Best Trading Accounts 2026

Open the best trading account for your needs following our hands-on tests.

-

1CloseOption, based in Georgia, has over ten years in the trading industry. It provides high/low binary options trading on forex and crypto markets, offering good payouts, 24/7 customer support, and user-friendly trading software.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 NinjaTrader is a US-based brokerage regulated for trading futures. It offers three different pricing plans for varied needs and budgets, along with extremely low margins on popular contracts. The company's renowned charting software and trading platform provides extensive customization options and excellent technical analysis features. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.0 InstaTrade, located in the British Virgin Islands, is an online broker that focuses on structured fixed income products and active trading via CFDs. Its no-spread accounts, outstanding research primarily from InstaTrade TV, and access to the well-known MT4 and InstaTrade Gear make it a good choice for traders of all levels. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 eToro is a platform for social investing that provides options for both short and long-term trading on stocks, ETFs, options, and crypto. The platform is recognized for its easy-to-use, community-oriented interface and reasonable fees. With oversight from FINRA and SIPC, and used by millions globally, eToro is a reputed name in the industry. Trading on eToro is facilitated by eToro USA Securities, Inc. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 Pionex is a platform for cryptocurrency trading. It focuses on trading robots and offers many pre-built bots and strategies. It also features integrated Artificial Intelligence to assist in customizing strategies. Both spot crypto markets and crypto futures can utilize these services.

Compare The Best Brokers Offering Trading Accounts

We reviewed the top trading accounts - here’s how they stack up across key features:

How Safe Are the Top Trading Accounts?

Safety matters when choosing a trading account. Here’s how the top accounts protect client funds:

Trading on the Go: Mobile Account Access

We tested each broker’s mobile trading platforms to see which ones deliver full account access on the move:

Are the Top Trading Accounts Good for Beginners?

New to trading? Here’s how these brokers support beginners with easy onboarding, intuitive platforms, and educational content:

Do These Trading Accounts Suit Experienced Traders?

For seasoned traders, we looked at pro-level features across the best accounts:

Accounts Comparison

Compare the trading accounts offered by Best Trading Accounts 2026.

Detailed Ratings: Best Trading Accounts

Explore how each trading account provider scored across our independent scoring criteria:

Compare Fees at the Best Trading Accounts

We analyzed spreads, commissions, and hidden costs to identify the most cost-effective trading accounts:

Which Brokers with Trading Accounts Are Most Popular?

These brokerage accounts are the most trusted and widely used by active traders around the world:

| Broker | Popularity |

|---|---|

| InstaTrade |

|

| Pionex |

|

| CloseOption |

|

| eToro USA |

|

| NinjaTrader |

|

Why Trade With CloseOption?

CloseOption is the easiest binary broker for beginners. Sign-up takes under 5 minutes, with a $5 minimum deposit and $1 minimum stake. CloseOption also hosts weekly binary trading competitions with cash prizes up to $1,300.

Pros

- CloseOption hosts weekly cash-prize trading competitions.

- The platform works with most internet browsers and is easy to use.

- Free demo account

Cons

- CloseOption is not overseen by a reputable trading body.

- Binary options can be traded on both traditional (“fiat”) and digital currencies.

- Customers must deposit over $50,000 to be eligible for the maximum payouts.

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- Traders can access a free platform and trade simulation capabilities with the unlimited demo.

- Low costs, with $50 trading margins and commissions starting at $.09 per micro contract.

- You can access thousands of applications and add-ons from developers worldwide for trading.

Cons

- Some payment methods require a withdrawal fee.

- The advanced trading tools require an additional fee.

- You need to register with partner brokers to trade in securities other than forex and futures.

Why Trade With InstaTrade?

InstaTrade provides active trading on an extensive platform. It has a unique offering known as Fixed Income Structured Product (FISP), which allows for passive investment. Investors can potentially earn up to a 50% return within 6 months, provided certain conditions are fulfilled.

Pros

- VPS hosting is suitable for algorithmic trading strategies. It uses a dedicated server to offer quick execution speeds, potentially as fast as 9 milliseconds.

- InstaTrade promises returns using its structured passive trading solution (FISP), with applications processed within 24 hours.

- InstaTrade provides a high-quality range of charting tools for traders. Its web trader includes over 250 indicators, 11 types of charts and a design that's easy to use.

Cons

- The advertising of FISP, specifically about its "profit guarantee" and "risk-free trading," creates unease.

- Profits in the FISP are guaranteed only if investors do not make over 50% profit and recruit other users, earning $4 for each dollar in compensation.

- InstaTrade's website and client interfaces are quite complex which can be confusing for new traders. On the other hand, XTB offers a more straightforward and user-friendly trading experience.

Why Trade With eToro USA?

eToro is a top choice for traders due to its top-notch social investing and copy trading services. The broker caters well to new traders with its low deposit requirement, commission-free trading, and user-friendly platform.

Pros

- eToro USA Securities is a reliable broker that's regulated by the SEC, part of FINRA, and a member of SIPC.

- The online broker provides a user-friendly social investment network for easy crypto trading replication.

- Traders can use Smart Portfolios for a simpler approach, covering multiple sectors and markets like renewable energy and artificial intelligence.

Cons

- Average fees can reduce the profits of traders.

- Traders used to third-party charting tools won't find MetaTrader 4 platform integration.

- The exclusive terminal does not accommodate trading bots and lacks extra equity market analysis tools.

Why Trade With Pionex?

Pionex is a great choice for crypto traders interested in advanced AI and automated trading.

Pros

- Top-quality liquidity solutions, sourced from Binance and Huobi, have been refined and improved.

- Over 40 types of cryptocurrencies are accepted for trading.

- 12 free, user-friendly trading bots that require no coding skills.

Cons

- Does not accept fiat deposits

- No demo account

- Trading may involve withdrawal fees and limits.

Filters

How BrokerListings.com Selected the Best Trading Accounts

To find the top trading accounts, we took the following steps:

- Gathered data from our extensive list of brokers, examining over 10 types of accounts.

- Rated each broker based on the selection and quality of their online trading accounts.

- Ranked brokers by their “Accounts & Banking Rating” to highlight the best options for different traders.

We also performed hands-on tests with many of our team going through the live and demo account opening process, so we know what makes for a smooth onboarding process and what can make it a painful experience to start trading.

List Of Different Account Types

Find the right account type for your needs with our list of all the main types of trading accounts:

- Demo Account: A demo account lets you practice trading with virtual funds in real market conditions, it’s ideal for testing strategies without financial risk.

- Islamic Account: An Islamic account is a swap-free trading account structured to comply with Sharia law, avoiding interest charges on overnight positions.

- DMA Account: A DMA account (short for Direct Market Access) provides traders with direct access to the order books of liquidity providers, enabling faster execution and greater transparency.

- Demat Account: A Demat (short for dematerialized) account holds shares electronically, allowing seamless buying, selling, and holding of securities in digital form. They are particularly popular in India.

- ECN Account: An ECN account (short for Electronic Communications Network) connects you directly with other market participants for tighter spreads and minimal broker intervention.

- STP Account: An STP account (short for Straight Through Processing) routes your orders directly to liquidity providers without dealer desk interference, helping avoid requotes and slippage.

- LAMM Account: A LAMM account (shore for Lot Allocation Management Module) allows investors to copy trades from a master account with fixed lot sizes, regardless of their individual account balance.

- MAM Account: A MAM account (short for Multi-Account Manager) lets fund managers execute bulk orders across multiple accounts with customizable allocation methods per investor.

- PAMM Account: A PAMM account (short for Percentage Allocation Management Module) pools investor capital under a single trading strategy, with profits and losses distributed based on individual contribution percentages.

- Managed Account: A managed account is fully overseen by a professional trader or asset manager, who makes all trading decisions on the investor’s behalf.

- Micro Account: A micro account allows you to trade very small lot sizes (typically 1,000 units), making it ideal for low-capital or risk-conscious traders.

- Custodial Account: A custodial account is controlled by a guardian on behalf of a minor or dependent, typically used for long-term investing or saving.

- Segregated Account: A segregated account ensures your trading funds are held separately from the broker’s operational funds, offering extra protection in case of insolvency.

- Joint Account: A joint account is shared between two or more people, such as spouses or business partners, who have equal access to trading and fund management.

- Pro Account: A pro (professional) account offers lower margin requirements, higher leverage, and raw spreads, typically available to experienced traders meeting eligibility criteria.

- Cent Accounts: A cent account displays balances and trades in cents instead of dollars, letting beginners trade real money at ultra-low risk and scale.

List of Different Account Currencies

Choose an account based in a convenient currency for a smooth trading experience and to minimize conversion fees:

- USD account: A trading account based in US Dollars.

- EUR account: A trading account based in Euros.

- GBP account: A trading account based in British Pounds.

- CAD account: A trading account based in Canadian Dollars.

- AUD account: A trading account based in Australian Dollars.

- NZD account: A trading account based in New Zealand Dollars.

- INR account: A trading account based in Indian Rupees.

- JPY account: A trading account based in Japanese Yen.

- ZAR account: A trading account based in South African Rand.

- MYR account: A trading account based in Malaysian Ringgit.

- IDR account: A trading account based in Indonesian Rupiah.

- TRY account: A trading account based in Turkish Lira.

- SEK account: A trading account based in Swedish Krona.

- NOK account: A trading account based in Norwegian Krone.

- DKK account: A trading account based in Danish Krone.

- CHF account: A trading account based in Swiss Francs.

- HKD account: A trading account based in Hong Kong Dollars.

- SGD account: A trading account based in Singaporean Dollars.

- RUB account: A trading account based in Russian Rubles.

- PLN account: A trading account based in Polish Zloty.

- CZK account: A trading account based in Czech Koruna.

- AED account: A trading account based in UAE Dirhams.

- SAR account: A trading account based in Saudi Riyals.

- HUF account: A trading account based in Hungarian Forint.

- BRL account: A trading account based in Brazilian Real.

- NGN account: A trading account based in Nigerian Naira.

- THB account: A trading account based in Thai Baht.

- VND account: A trading account based in Vietnamese Dong.

- UAH account: A trading account based in Ukrainian Hryvnia.

- KWD account: A trading account based in Kuwaiti Dinar.

- QAR account: A trading account based in Qatari Riyal.

- KRW account: A trading account based in South Korean Won.

- MXN account: A trading account based in Mexican Peso.

- KES account: A trading account based in Kenyan Shilling.

- CNY account: A trading account based in Chinese Yuan.

What To Look For In A Trading Account

Account Type & Purpose

Before anything else, clarify what you need the account for. Are you testing the waters with a demo account, starting small with a cent or micro account, or trading professionally with a DMA or pro account?

Different account types serve different goals, so match the structure of the account with your strategy, capital, and level of experience.

Minimum Deposit Requirements

Some accounts, like micro or cent accounts, let you start with as little as $1–$10, while DMA or professional accounts may require higher deposits.

Make sure the broker’s minimum aligns with your risk tolerance and budget. Don’t overextend yourself just to access features you may not use yet. You can also check out our top low deposit brokers.

Execution Model

Understanding how your trades are executed is crucial. Do you want direct market access (DMA), ECN execution with tight spreads, or STP routing that sends your order straight to the market?

Traders who scalp or trade on news events often benefit from faster, less manipulated execution models.

Spreads, Fees & Swaps

Different accounts come with different pricing models. ECN accounts often charge raw spreads plus commission, while standard accounts may have wider spreads but no fees.

Consider overnight swap charges if you plan to hold positions – unless you’re using an Islamic (swap-free) account.

Risk Management Features

Accounts should offer flexible lot sizing, margin control, and stop-loss functionality.

For beginners, micro or cent accounts help reduce exposure while still experiencing live trading.

More advanced traders may look for negative balance protection or segregated accounts for additional safety.

Platform Compatibility

Make sure the account integrates with your preferred trading platform (like MT4, MT5, cTrader, or a custom app).

Some managed or PAMM accounts require specific setups or broker-only platforms, so double-check compatibility before committing.

Access to Support & Resources

Good trading accounts come with good broker support. Look for brokers that offer responsive customer service, educational content, and community access, especially if you’re new or managing an account on behalf of someone else (like with custodial or joint accounts).

Regulatory Protection

Accounts with regulated brokers (e.g. SEC in the US, FCA in the UK, ASIC in Australia, CySEC in Europe) offer higher transparency and fund safety.

Segregated accounts, custodial controls, and capital adequacy rules ensure your money isn’t mixed with the broker’s operating funds.

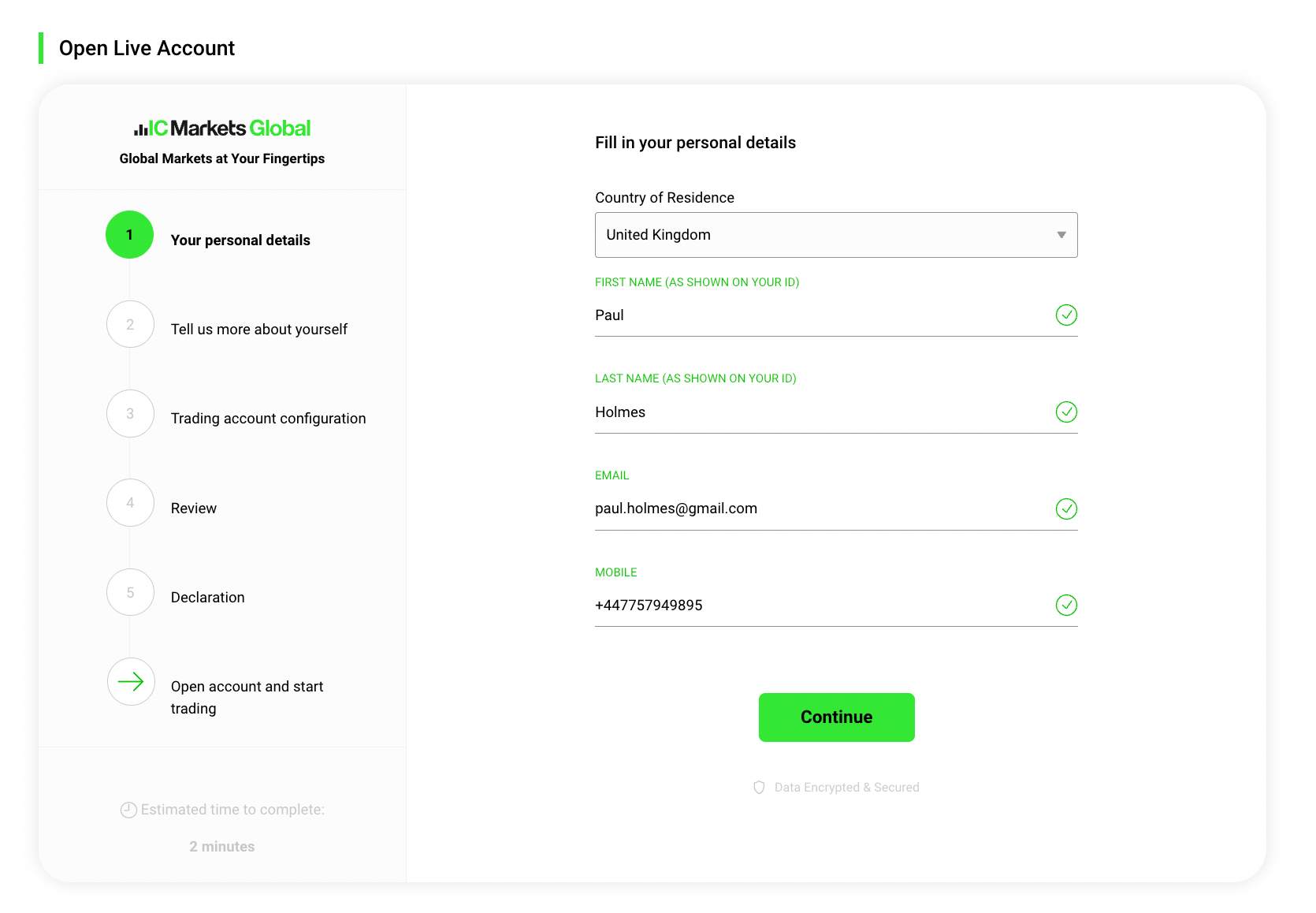

How To Open A Trading Account

Opening a trading account requires three simple steps:

- Fill out a sign-up form with basic information. This typically includes your name, email, phone number and location.

- Choose your account type and settings. This includes the sort of trading account and details like your account currency.

- Verify your identity with requested documents. This often includes copies of documents that show your identity and address, and is part of legal and compliance requirements.

I’ve opened many trading accounts over the years. It can take just half an hour or a few days depending on the documentation required and the time it takes for the broker to verify your details and set up the account.

IC Markets has one of the smoothes account sign-up processes in the industry that several of our expert team have been through