Best Brokers With AUD Accounts 2026

Dig into our top brokers offering AUD accounts based on thorough tests, reducing conversion fees and optimizing the experience for traders dealing in Australian Dollars.

James Barra

Tobias Robinson

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 OANDA is a well-known broker that excels in quick trade executions, a low deposit requirement, and impressive charting and trading platform functions. The highly-regarded brand has over 25 years of expertise and is overseen by reliable authorities like the NFA/CFTC. It provides 24/7 support for traders and offers flexible contract sizes with automated trade executions. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.9 Kraken is a major cryptocurrency exchange that offers a unique trading terminal and over 220 cryptocurrencies for trading. It provides up to 1:5 leverage for spot crypto trading with consistent rollover fees, and up to 1:50 leverage on futures. Additionally, it offers crypto staking services and features an interactive NFT marketplace. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.5 Crypto.com is a major name in cryptocurrency trading, designed to speed up the global shift to DeFi technologies. The exchange provides token lending, prepaid cards, NFTs, and more. Founded in Germany in 2016, it serves 150 million users.

Compare Brokers With AUD Accounts

Broker Details Comparison

Safety Comparison

Compare how safe the Best Brokers With AUD Accounts 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Brokers With AUD Accounts 2026.

Comparison for Beginners

Compare how suitable the Best Brokers With AUD Accounts 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Brokers With AUD Accounts 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Brokers With AUD Accounts 2026.

Detailed Rating Comparison

Compare how we rated the Best Brokers With AUD Accounts 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Brokers With AUD Accounts 2026.

Broker Popularity

See how popular the Best Brokers With AUD Accounts [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Crypto.com |

|

| Kraken |

|

| Interactive Brokers |

|

| FOREX.com |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- The new IBKR Desktop platform combines the advantages of TWS and adds unique tools like Option Lattice and Screeners with MultiSort to make trading accessible and impressive for traders of all levels.

- The TWS platform is designed for intermediate to advanced traders. It includes over 100 order types and a dependable real-time market data feed that rarely experiences downtime.

- IBKR offers exceptional access to global stocks, with thousands of equities available from over 100 market centers in 24 countries, including the recent addition of the Saudi Stock Exchange.

Cons

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

Why Trade With OANDA US?

OANDA is a reputable broker for US traders. It offers user-friendly tools for analysis and a simple sign-up process. It is very trustworthy due to heavy regulation.

Pros

- There's a robust selection of 68 currency pairs for committed forex traders focusing on short-term trades.

- You can start trading as a beginner with no minimum initial deposit required.

- The broker's API provides access to extensive historical data from the past 25 years and rates from over 200 currencies for traders.

Cons

- Customer support is not accessible during weekends.

- Few payment options are available and e-wallets are not supported.

- The trading markets are limited to only forex and cryptocurrencies.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

Cons

- The funding options are not as extensive as those of top competitors such as IC Markets and lack several widely-used e-wallets, particularly UnionPay and POLi.

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

Why Trade With Kraken?

Kraken is suitable for traders seeking a variety of cryptocurrencies, including Bitcoin, and a strong history of security.

Pros

- A highly safe and secure service, with no recorded breaches in the ten years since it was established.

- Excellent trading platform and mobile application.

- 3D secure required

Cons

- Does not accept fiat deposits

- Pro account's verification process is slow.

- Low leverage on spot trading

Why Trade With Crypto.com?

Crypto.com is ideal for new crypto traders looking to buy, sell, and trade over 400 digital tokens. Its strike options and prediction markets cover financial, economic, election, sport, and cultural events. As a CFTC-regulated platform, it provides a secure choice for US traders interested in binary-style contracts using an easy-to-use app.

Pros

- Crypto.com has expanded in some regions, now offering over 5000 stocks and ETFs for traders seeking diverse portfolios and opportunities in various sectors.

- The platform offers unified tracking for cryptocurrencies, stocks, ETFs, and prediction markets within one interface, making multi-asset management simpler and providing combined insights.

- The Crypto.com Exchange platform provides advanced bots like Dollar Cost Averaging (DCA), Time-Weighted Average Price (TWAP), and Grid Trading bots. Traders can automate strategies, including leveraged perpetual trades, reducing manual work and slippage.

Cons

- Customer support mainly uses chatbots and email, with limited reliable phone support from our testing. This may cause delays in solving urgent issues like account access or transaction problems, which can be frustrating for crypto traders needing quick help.

- The app has high bid-ask spreads on many coins, which can be expensive for traders using market orders. Wide spreads mean the buying price is significantly higher than the selling price, reducing profits, especially in low-volume trades.

- Fees apply to crypto and fiat withdrawals, which can be significant for active traders making smaller transfers. The minimum withdrawal limits are also high, limiting flexibility in managing smaller portfolios or immediate liquidity needs.

Filters

Methodology

To determine the best brokers offering AUD-denominated accounts, we leveraged our robust database of global online brokers.

We identified platforms that allow clients to deposit, trade, and withdraw funds in Australian Dollars (AUD).

Our rankings are based on overall scores derived from a comprehensive analysis of 200+ metrics, including fees, platform usability, AUD support, and regulatory compliance, all backed-up by hands-on tests.

What Is an AUD Account?

An AUD account is a trading account where all transactions, profits, and losses are recorded in Australian Dollars.

This type of account is ideal for traders in Australia as it eliminates the need for currency conversion when funding or withdrawing in AUD.

However, less than 50% of brokers we’ve evaluated offer AUD accounts.

After evaluating the best trading accounts, we found that the key benefits of an AUD account are:

- Avoid Currency Conversion Costs: Depositing and withdrawing funds in AUD means no conversion fees, reducing costs for Australian traders.

- Hedging Against FX Volatility: An AUD account minimizes the impact of unfavorable AUD/USD or AUD/EUR fluctuations on your trading capital.

- Simplified Local Transactions: It enables seamless transactions with Australian banks, potentially making deposits and withdrawals faster and more affordable.

- Alignment with Local Investments: An AUD account suits those trading Australian-listed stocks, commodities, or assets linked to the Australian economy, like ASX equities or AUD-based forex pairs.

How Do I Open an AUD Account?

Opening an AUD trading account is a breeze. Follow these five steps:

- Choose a Broker: Select a broker that offers AUD as a base currency. Focus on fees, platform features, access to Australian and global markets, and local regulatory compliance (we recommend ASIC-regulated brokers for Aussie traders).

- Register an Account: Complete the broker’s sign-up process, including providing identification and proof of residency if required.

- Select AUD as Your Base Currency: During account setup, choose AUD as your preferred account currency.

- Fund Your Account: Deposit funds in AUD directly through bank transfers or popular payment methods with Aussie traders like PayID or BPAY for minimal fees and fast processing.

- Start Trading: Once funded, you can trade Australian and global markets while avoiding the friction of currency conversions.

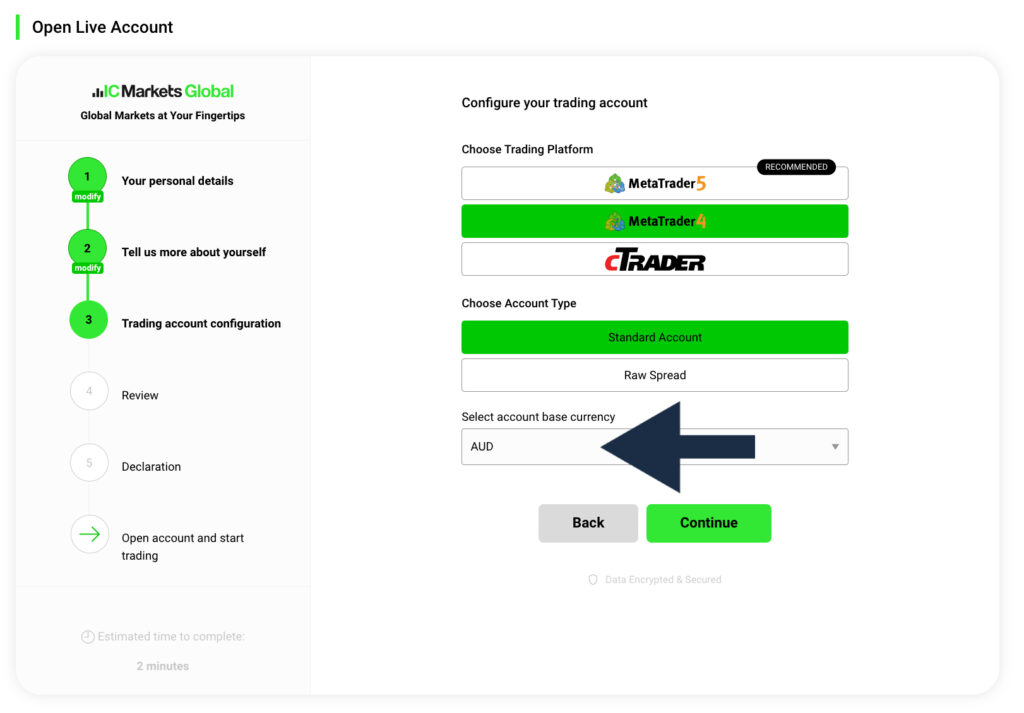

For instance, below you can see where I opened an AUD account at IC Markets in a snap.

Configuring an AUD trading account at IC Markets

Should I Use an AUD Trading Account?

An AUD trading account is an excellent choice if the following apply to you:

- You Live in Australia: An AUD account aligns with your local currency, simplifying tax reporting and reducing banking costs.

- You Actively Trade Australian Assets: If your portfolio includes ASX-listed stocks, Australian ETFs, or AUD-denominated forex pairs, an AUD account can eliminate exchange rate costs and delays.

- You Want to Hedge Against AUD Volatility: For Australian traders earning and spending in AUD, this account minimizes the risk of losing value due to unfavorable exchange rate movements.

- You Prefer Local Payment Methods: From our investigations, Australian-based brokers offering AUD accounts often support local payment options like POLi Payments, making deposits and withdrawals fast and convenient.

What Are the Limitations of Opening an AUD Account?

- Expensive Access to USD-Assets: Trading US-based stocks or popular forex pairs like EUR/USD in an AUD account may involve higher spreads or require conversions.

- Exposure to AUD Weakness: If the AUD weakens against major currencies like USD, the value of your holdings may decline when converted.

- Fewer Global Broker Options: Although a growing number of brokers support AUD accounts, most international platforms we’ve tested focus on USD accounts or EUR accounts, limiting your choices somewhat.