Best Trading Apps 2026

After rigorously testing a wide range of Android and iOS trading apps, we’ve identified the brokers with the best mobile platforms in February 2026.

-

1

The IBKR Mobile app for iOS and Android allows you to access your IBKR accounts, monitor portfolios, execute trades, and view real-time quotes and charts. Its user-friendly design is ideal for new traders, offering a simpler experience compared to the more complex TWS platform.

Interactive Brokers Trading Apps

Interactive Brokers has apps for iOS & Android.

iOS App Rating:

Android App Rating:

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 OANDA's app excels with its customizable interface, allowing you to tailor the trading experience to your strategy by setting custom notifications and adjusting chart sizes and overlays. This personalization, along with quick response to market changes, risk management, and alerts on significant market events, makes it a market leader.

OANDA US Trading Apps

OANDA US has apps for iOS & Android.

iOS App Rating:

Android App Rating:

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Available with MT4 and Web Trader platforms, the FOREX.com app provides full trading features on an easy-to-use compact platform. Integrated news, analysis, and real-time trade alerts are mobile-specific features that make this app stand out. It surpasses MT4 in mobile charting tools, offering over 80 indicators, 11 chart types, and a sleeker design.

FOREX.com Trading Apps

FOREX.com has apps for iOS & Android.

iOS App Rating:

Android App Rating:

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.0 InstaTrade's app, downloaded over 2 million times, lets you trade its 300+ instruments easily. With a fast, modern interface, it offers real-time quotes, various orders, and analysis tools. Notably, it includes 'hot' ideas and trading signals to help investors spot opportunities.

InstaTrade Trading Apps

InstaTrade has apps for iOS & Android.

iOS App Rating:

Android App Rating:

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.5 Coinbase provides a user-friendly and regularly updated app, consistent with the desktop experience, known for its speed and reliability. It offers strong tools for crypto investors, including advanced trading features, real-time market analysis, staking rewards, secure portfolio management, and educational resources, all supported by high-level security and regulatory compliance. However, Android user ratings suggest the interface lags behind the Apple version, with concerns about user experience and notifications.

Coinbase Trading Apps

Coinbase has apps for iOS & Android.

iOS App Rating:

Android App Rating:

Compare Trading Apps

Safety Comparison

Compare how safe the Best Trading Apps 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Trading Apps 2026.

Comparison for Beginners

Compare how suitable the Best Trading Apps 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Trading Apps 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Trading Apps 2026.

Detailed Rating Comparison

Compare how we rated the Best Trading Apps 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Trading Apps 2026.

Broker Popularity

See how popular the Best Trading Apps [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Coinbase |

|

| InstaTrade |

|

| Interactive Brokers |

|

| FOREX.com |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- There's a large selection of free or paid research subscriptions available to all traders. If you subscribe to Toggle AI, you will also receive commission refunds from IBKR.

- Interactive Brokers has introduced ForecastTrader, a zero-commission service allowing users to trade yes/no Forecast Contracts on political, economic, and climate events. Contracts offer fixed $1 payouts, 24/6 market access, and a 3.83% APY on held positions.

- IBKR provides a cost-effective platform for traders by offering low fees, narrow spreads, and clear pricing.

Cons

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

Why Trade With OANDA US?

OANDA is a reputable broker for US traders. It offers user-friendly tools for analysis and a simple sign-up process. It is very trustworthy due to heavy regulation.

Pros

- The OANDA web platform offers an exceptional charting environment with over 65 technical indicators provided by TradingView.

- Traders can experience quick and dependable order execution.

- Experienced traders can use top-notch tools like an MT4 premium upgrade and advanced charting from MotiveWave.

Cons

- The trading markets are limited to only forex and cryptocurrencies.

- Customer support is not accessible during weekends.

- Few payment options are available and e-wallets are not supported.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

Cons

- FOREX.com has expanded their trading offerings, but these remain limited to forex and CFDs. Unfortunately, they don't provide options to invest in actual stocks, ETFs, or cryptocurrencies.

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

Why Trade With InstaTrade?

InstaTrade provides active trading on an extensive platform. It has a unique offering known as Fixed Income Structured Product (FISP), which allows for passive investment. Investors can potentially earn up to a 50% return within 6 months, provided certain conditions are fulfilled.

Pros

- InstaTrade provides a high-quality range of charting tools for traders. Its web trader includes over 250 indicators, 11 types of charts and a design that's easy to use.

- VPS hosting is suitable for algorithmic trading strategies. It uses a dedicated server to offer quick execution speeds, potentially as fast as 9 milliseconds.

- InstaTrade promises returns using its structured passive trading solution (FISP), with applications processed within 24 hours.

Cons

- The advertising of FISP, specifically about its "profit guarantee" and "risk-free trading," creates unease.

- Profits in the FISP are guaranteed only if investors do not make over 50% profit and recruit other users, earning $4 for each dollar in compensation.

- InstaTrade's learning resources are helpful for new traders but are not as organized or comprehensive as those provided by top companies such as eToro.

Why Trade With Coinbase?

Coinbase is great for beginners who want an easy-to-use platform to buy and sell various cryptocurrencies, with strong security and regulatory compliance. However, its fees are higher than competitors in our tests, and it’s less suited for short-term traders.

Pros

- Coinbase Advanced now integrates TradingView, a rare feature for crypto exchanges, enabling users to trade spot and futures markets directly from real-time charts with advanced technical analysis tools.

- Coinbase offers over 240 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and new altcoins like $Trump, providing early access to emerging tokens.

- Coinbase, listed on Nasdaq, complies with strict financial regulations and is licensed in the US, UK, and Europe. It offers security features like FDIC insurance for USD balances (up to $250,000) and two-factor authentication (2FA).

Cons

- Crypto fees are high based on tests, especially when compared to competitors like Kraken and BitMEX, particularly on the regular trading platform.

- Advanced Trade provides TradingView charts but lacks research tools like news feeds, economic calendars, and AI market insights.

- Customer support is frustrating during testing because most help options require login, making it difficult for locked-out users or those without accounts to get assistance.

Filters

Methodology

Our process to find the top trading apps was hands-on.

We personally tested each mobile platform, focusing on ease of use, built-in tools, trading costs, and performance.

We also recorded and analyzed user ratings from the Apple App Store and Google Play Store to capture additional trader experiences.

By combining our expert testing with real user opinions, we’ve been able to rate and rank the best apps for seamless mobile trading.

What to Look for in a Trading App

Trading apps have made buying and selling assets easier than ever. They let you trade anytime, anywhere.

Yet we know from our hands-on tests and own experience using trading apps for personal investments that not all are created equal. Some offer a seamless, feature-packed experience, while others can feel clunky or lack essential tools.

Here are the key things to look for:

User-Friendly Interface and Navigation

An excellent trading app should be easy to use right from the start. When the market is moving quickly, the last thing you want is to waste time hunting for the buy or sell button.

Look for an app with a clean design, intuitive navigation, and customizable layouts so you can quickly access everything you need.

Pro tip: Avoid apps that have gamification features that distract you from trading and encourage excessive trading. Robinhood was a serious culprit of this, though it’s since made strides to remove these features.

Testing highlight: If you’re just starting out, the app from City Index is a fantastic choice. The app is super intuitive, and it’s a platform that helps you build your skills while giving you access to powerful features, including real-time price alerts, performance analytics, and one-swipe trading.

Speed and Execution Reliability

Speed matters – a lot. Whether you’re trading forex, stocks, or crypto, the price you see on your screen can change instantly.

The best trading apps offer lightning-fast execution speeds, ensuring you enter and exit trades exactly when you want.

Avoid apps that lag or frequently crash, as a delay of even a few seconds can affect your results, especially if you’re a short-term trader.

Testing highlight: The Pepperstone app delivers ultra-fast order execution of around 30 milliseconds, which is critical for day traders and scalpers. The added bonus of algorithmic trading support ensures you can trade smarter, not harder.

Real-Time Market Data and Charting Tools

Access to live price feeds, real-time charts, and advanced indicators is crucial.

The best trading apps provide interactive charts with multiple timeframes, technical indicators (like RSI, MACD, and Bollinger Bands), and drawing tools so you can analyze the market on the go.

If the app only offers basic charts, it may not be the best choice for serious traders.

Testing highlight: CMC Markets gives you the mobile tools to stay ahead with its advanced charting (40 indicators and drawing tools). The in-depth market insights and execution speeds make it an ideal app for those who want to make informed decisions quickly.

CMC App

Customization Options

Every trader has their own style, so an app must allow for customization.

Look for apps that let you set up personalized watchlists, adjust chart settings, and create custom alerts.

Being able to tailor your trading app to fit your needs can give you an edge.

Testing highlight: I love using the eToro app – its ‘watchlist’, ‘portfolio’ and ‘discover’ features, all available from the bottom menu, make finding instruments a breeze, while the active community makes for a unique and personal trading experience wherever you go.

Risk Management Features

Good trading apps don’t just let you place trades – they help you manage risk effectively.

The best applications allow you to set up stop-loss and take-profit levels easily, ensuring you lock in profits and minimize losses without constantly monitoring the market.

Additionally, features like price alerts and trailing stops can help you control your trades even when you’re away from the screen. Just imagine Elon Musk punches another wild post on X, sending crypto prices rocketing or spiralling – you don’t want to be caught off guard.

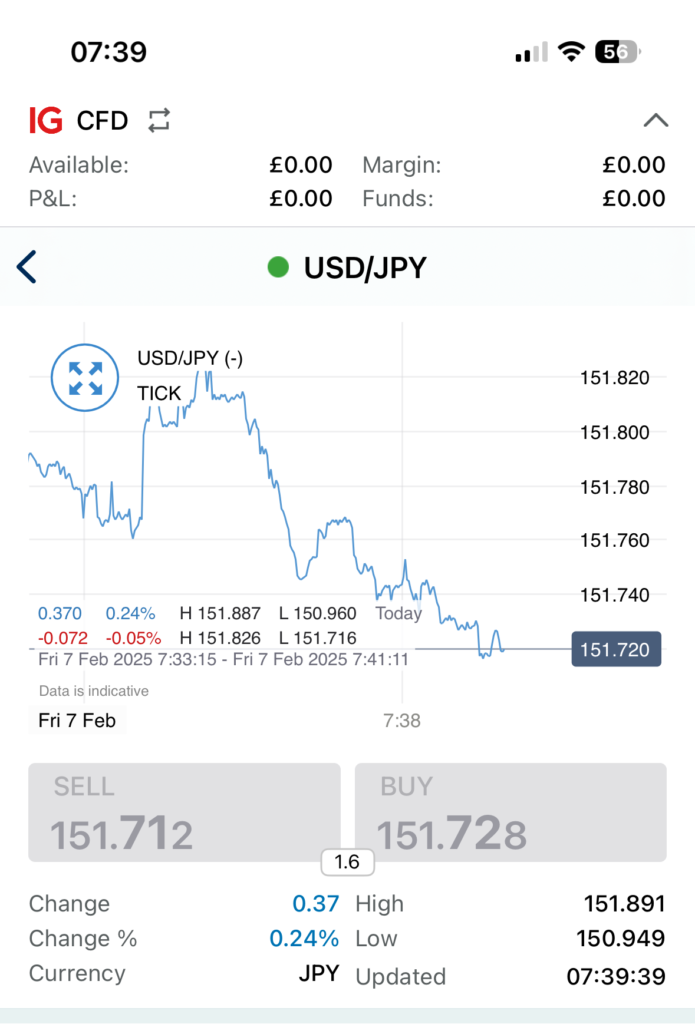

Testing highlight: For traders who value control, IG offers one of the best risk management systems out there. Their app gives you the power to protect your positions with precision, including guaranteed stops, making it great for managing your exposure.

IG App

Compatibility with Desktop and Web Versions

While mobile trading is convenient, many traders also use desktop platforms for in-depth analysis – myself included.

The ideal trading app should seamlessly sync with a web or desktop version so you can switch between devices without losing important data or settings. This ensures a smooth trading experience across all your devices.

Testing highlight: IC Markets provides smooth trading across all devices with their cTrader, MT4, MT5, and TradingView apps, optimized for both Android and iOS. What sets them apart is how effortlessly they sync the mobile experience with desktop and web solutions, ensuring consistent, professional-grade trading no matter where you are.

Access to Research, News, and Analysis

A good trading app should provide more than just trading functionality – it should also keep you informed. Look for apps offering market news, expert analysis, and sentiment indicators.

Brokers that integrate economic calendars and news updates within their apps make it easier to stay ahead of market-moving events.

Testing highlight: Forex traders looking for advanced research and flexibility will appreciate the app from OANDA. With its comprehensive forex insights through Dow Jones FX Select for expert analysis, plus MarketPulse for live news, it’s tailored for those who want to stay informed in the fast-paced forex market.

Tips for Setting Up a Trading App

Take some time to explore the app’s features and customize it to fit your trading style:

- Set up watchlists for your favourite assets.

- Adjust chart settings to display the indicators you use most.

- Enable price alerts so you never miss key market movements.

- Customize order execution settings to suit your trading strategy.

Most trading apps we’ve evaluated offer different types of orders to help you control how and when you enter trades:

- Market Orders: Instantly buy or sell at the best available price.

- Limit Orders: Set a specific price you want to buy or sell, ensuring you don’t get a worse price.

- Stop Orders: Automatically trigger a buy or sell order when the price reaches a predetermined level.

Expert take: In my opinion, understanding these order types can help you trade efficiently on the go while managing risk.

Once your trade opens, you can monitor its performance directly from the app. You should be able to:

- Modify stop-loss and take-profit levels.

- Add to or partially close positions.

- View real-time profit/loss updates.

Expert take: I always check if a broker allows one-click trading or fast execution modifications to help me react quickly to market changes.

Top-tier trading apps come with powerful tools that can also enhance your trading strategy:

- Technical Indicators: Use tools like moving averages, Fibonacci retracements, and Bollinger Bands to analyze price action.

- Sentiment Analysis: Some apps provide data on market sentiment, helping you gauge trader behaviour.

- Economic Calendars: Stay updated on key events that could impact the market.

- Trading Alerts: Set up push notifications for instant updates on price movements, trend changes, or news.

Expert take: By mastering these features, you can make more informed trading decisions and take full advantage of your broker’s trading app.

Bottom Line

Choosing the right trading app comes down to key features. Charting and analysis tools are essential for technical traders, while fast execution and reliability matter for high-volume trading. Risk management tools help control exposure and protect investments.

Beginners should look for intuitive apps with educational resources, while experienced traders may need advanced features like algorithmic trading or custom indicators.

Forex traders should focus on low spreads and flexible lot sizes, while stock and index traders may prefer in-depth market analysis.

Use free trials or demo accounts to test an app before committing. As your needs evolve, be open to switching.

The right app can elevate your trading – whether you’re a beginner or a pro.

FAQ

What Is A Trading App?

A trading app is a downloadable tool for your mobile or tablet that allows you to analyze financial markets, make trades, and manage your account, all on the go.

What Are the Pros and Cons of Trading From My Mobile?

Pros:

- Trade Anytime, Anywhere: Mobile trading apps let you access markets from anywhere, making staying on top of your positions easier.

- User-Friendly Interfaces: Many apps are designed for smooth navigation, ensuring even beginners can easily place trades.

- Fast Execution: Top trading apps provide near-instant trade execution, helping you quickly take advantage of market opportunities.

- Custom Alerts and Notifications: Get real-time price alerts and market news to stay informed.

- Access to Charts and Analysis Tools: Many apps offer advanced charting capabilities, helping traders make data-driven decisions.

Cons:

- Limited Screen Space: Mobile screens can make in-depth chart analysis and research more complex compared to desktop platforms.

- Connectivity Issues: A weak internet connection can cause execution delays or app crashes.

- Fewer Features: Some mobile apps lack the full functionality of their desktop counterparts, such as in-depth customization options.

- Distractions: Due to easy access, trading on a mobile device can sometimes lead to impulsive decisions.