Best Demo Trading Accounts 2026

Dig into the best demo trading accounts based on our years and countless hours of personal use.

-

1

When we tried Interactive Brokers' demo, it closely matched the live TWS platform with access to global markets and advanced order types. Execution speed seemed realistic, but fast-moving assets showed some slippage. Setup needed basic details. The virtual balance was $1M, but trading was enabled only after account approval.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 During testing, NinjaTrader's demo offered quick execution and low slippage, perfect for futures and active traders. The platform accurately reflected the live environment, including depth-of-market tools. Setup needed only an email, providing users with a $50,000 virtual balance. The demo had no time limit, ideal for long-term strategy testing.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 When testing eToro USA's demo, execution speeds were slower than ECN brokers but were acceptable for social and crypto trading. The demo closely resembled live trading, offering a $100K virtual balance with full access to stocks, crypto, and ETFs. No KYC was required. Slippage was moderate during volatile times. The demo has no expiration.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 During testing, Plus500’s demo was immediately accessible without personal details or expiration. It closely resembled the live platform, offering CFDs on forex, stocks, crypto, and indices. Execution was quick, but spreads were wider, with EUR/USD averaging 0.8–1.2 pips. The $40,000 virtual balance automatically refilled when used up.

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 OANDA is a well-known broker that excels in quick trade executions, a low deposit requirement, and impressive charting and trading platform functions. The highly-regarded brand has over 25 years of expertise and is overseen by reliable authorities like the NFA/CFTC. It provides 24/7 support for traders and offers flexible contract sizes with automated trade executions.

Compare The Best Demo Account Providers Across Key Features

We thoroughly tested the top demo trading platforms - here’s how they stack up across core features:

How Secure Are The Top Demo Account Platforms?

Even for practice trading, platform security matters. Here’s how the best demo providers protect your data:

Top Mobile Apps With Demo Trading

Prefer to paper trade on your phone or tablet? Here’s how the top demo trading apps performed in our mobile testing:

Are These Demo Accounts Good For Beginners?

New to trading? Here's which demo platforms offer user-friendly tools and learning features to help you get started:

Are These Demo Accounts Suitable For Advanced Traders?

Looking to test pro strategies before going live? Here’s how the top demo accounts support advanced traders:

Accounts Comparison

Compare the trading accounts offered by Best Demo Trading Accounts 2026.

Detailed Ratings: Best Demo Account Brokers

See how each demo provider scored in our data-backed ratings system:

Fees & Account Terms Comparison

While demo accounts are free, account structure when you move to live trading can vary. Here’s what you need to know about costs when switching to a funded account with these providers:

Which Demo Account Providers Are Most Popular?

Want to see where most traders are heading? These demo account providers are attracting the highest sign-ups:

| Broker | Popularity |

|---|---|

| Interactive Brokers |

|

| eToro USA |

|

| NinjaTrader |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- The TWS platform is designed for intermediate to advanced traders. It includes over 100 order types and a dependable real-time market data feed that rarely experiences downtime.

- IBKR provides a cost-effective platform for traders by offering low fees, narrow spreads, and clear pricing.

- IBKR, primarily designed for skilled traders, has expanded its appeal recently by eliminating its initial $10,000 deposit requirement.

Cons

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- NinjaTrader provides detailed charting software for active traders, complete with custom technical indicators and widgets.

- NinjaTrader is a well-regarded and acclaimed futures broker, approved by the NFA and CFTC.

- You can access thousands of applications and add-ons from developers worldwide for trading.

Cons

- You need to register with partner brokers to trade in securities other than forex and futures.

- Some payment methods require a withdrawal fee.

- The advanced trading tools require an additional fee.

Why Trade With eToro USA?

eToro is a top choice for traders due to its top-notch social investing and copy trading services. The broker caters well to new traders with its low deposit requirement, commission-free trading, and user-friendly platform.

Pros

- eToro USA Securities is a reliable broker that's regulated by the SEC, part of FINRA, and a member of SIPC.

- A free demo account enables new users and potential traders to test the broker without risk.

- The online broker provides a user-friendly social investment network for easy crypto trading replication.

Cons

- Traders used to third-party charting tools won't find MetaTrader 4 platform integration.

- There are fewer trading options available, including only stocks, ETFs, and cryptos, compared to competitors.

- The exclusive terminal does not accommodate trading bots and lacks extra equity market analysis tools.

Why Trade With Plus500US?

Plus500US is an excellent choice for beginners, offering a user-friendly platform, low trading margins, and access to the Futures Academy to improve trading skills. Its powerful tools and reliable service earned it second place in DayTrading.com's annual 'Best US Broker' award.

Pros

- Plus500 is a reputable publicly traded company with over 24 million traders and sponsors the Chicago Bulls.

- The account setup, pricing structure, and web platform make futures trading simpler than competitors like NinjaTrader.

- The trading app offers an excellent user interface with an updated design, straightforward layout, and charts optimized for mobile use.

Cons

- Plus500US lacks social trading features, unlike competitors such as eToro US, which might enhance its appeal to aspiring traders.

- Plus500US offers competitive pricing but does not have a discount program for high-volume traders, unlike brokers like Interactive Brokers.

- The private trading platform is easy to use, but doesn't have the advanced analysis tools that platforms like MetaTrader 4 do.

Why Trade With OANDA US?

OANDA is a reputable broker for US traders. It offers user-friendly tools for analysis and a simple sign-up process. It is very trustworthy due to heavy regulation.

Pros

- The broker's API provides access to extensive historical data from the past 25 years and rates from over 200 currencies for traders.

- There's a robust selection of 68 currency pairs for committed forex traders focusing on short-term trades.

- You can start trading as a beginner with no minimum initial deposit required.

Cons

- The trading markets are limited to only forex and cryptocurrencies.

- Few payment options are available and e-wallets are not supported.

- Customer support is not accessible during weekends.

Filters

How BrokerListings.com Chose The Top Demo Accounts For Trading

We ranked the top demo account providers based on their overall ratings, combining 200+ data points with the hands-on observations of our testers spanning platform performance, features, ease of use, and more.

What To Look For In a Demo Account

Over the years, we’ve opened hundreds of demo accounts and spent countless hours testing them, so we know what makes a demo account genuinely useful for traders:

No Time Limits, No Hassles

One of the most important things to check when choosing a trading demo account is whether it offers free and unlimited access, and we’re not just talking about signing up without a credit card. We mean true, unrestricted access with no expiry dates, no forced re-registration every 30 days, and no limitations on platform features.

When we test brokers ourselves, we run into too many demo accounts that cut you off just when you’re getting into a groove. That’s not just frustrating – it’s disruptive to your learning curve.

Top Pick for Unlimited Demo Trading: FXCC is our top pick for traders who want genuinely unlimited and hassle-free demo access. What we liked most during our own testing is that FXCC gives you unlimited use of their demo account – no time caps, no reset requirements, and no annoying prompts to upgrade every time you log in.

The demo lets you trade using MetaTrader 4 (MT4), which is still one of the most popular and reliable trading platforms in the world. You’ll have access to all the key tools, charts, indicators, and order types that FXCC offers on their live accounts. That means you can practice with real-time market conditions and build skills that directly translate to live trading.

Fast and Friction-Free: How Quickly Can You Start Demo Trading?

When you’re excited to start testing a trading strategy or just want to explore a new platform, the last thing you want is a slow, paperwork-heavy signup process. We’ve seen demo account registrations that feel like you’re applying for a mortgage. Long forms, verification hoops, email confirmations, phone calls – you name it.

That kind of friction just doesn’t make sense for a demo trading account. You’re not investing real money yet, so why do some brokers act like you are?

When we tested the process across multiple brokers ourselves, we paid close attention to how quickly we could go from landing on the website to placing a virtual trade.

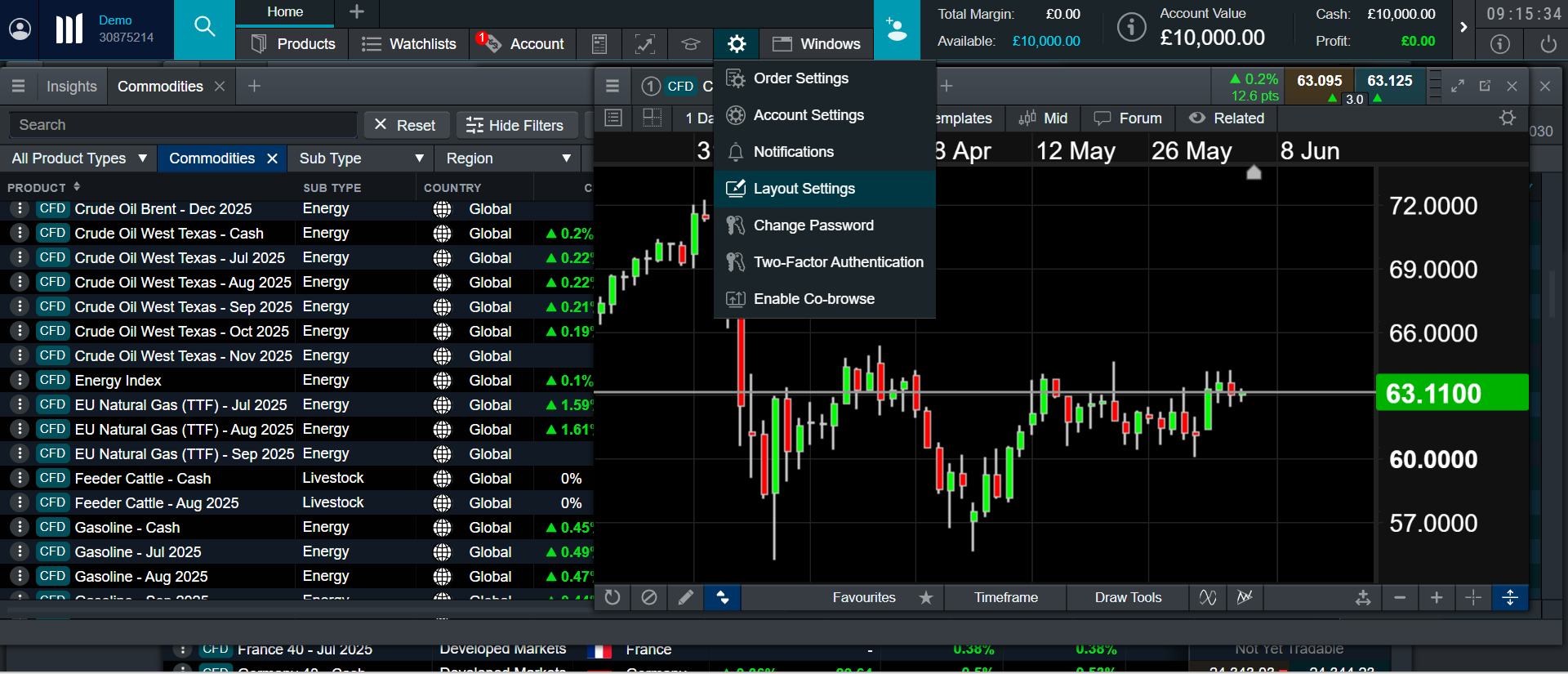

Top Pick for Quick and Easy Demo Access: If you’re looking for a broker that gets you into a demo account fast, CMC Markets nailed it in our tests. We were genuinely impressed by how little info they asked for – just the bare essentials: name, email, and a few quick preferences about platform type and region. That’s it. No ID uploads, no phone verification, no surprise follow-up forms.

In under two minutes, we were in and actively demo trading on their Next Generation platform, which is packed with professional-grade tools, real-time pricing, and an intuitive layout. You can also choose MetaTrader 4 (MT4) if you prefer a more classic setup, and switching between platforms is seamless.

CMC Markets platform demo account chart of WTI oil

Trade Like It’s Real: How Realistic Is the Demo Experience?

A demo account isn’t much use if it doesn’t reflect real trading conditions. You want a sandbox, not a fantasy. That means real-time pricing, tight spreads, fast execution speeds, and ideally, the option to customize your starting balance so you can practice under realistic risk conditions.

When evaluating demo accounts, this is one of the key factors we look for. We want the experience to be as close to live trading as possible – because that’s where the real learning happens. If the fills are too fast, the spreads are artificially tight, or the account is loaded with an unrealistic $1 million in fake cash, you’re not getting a true sense of what trading will feel like.

We personally tested several brokers for this, placing trades on both major and minor forex pairs at different times of day and under varying market conditions. One broker outperformed the rest when it came to real-world simulation.

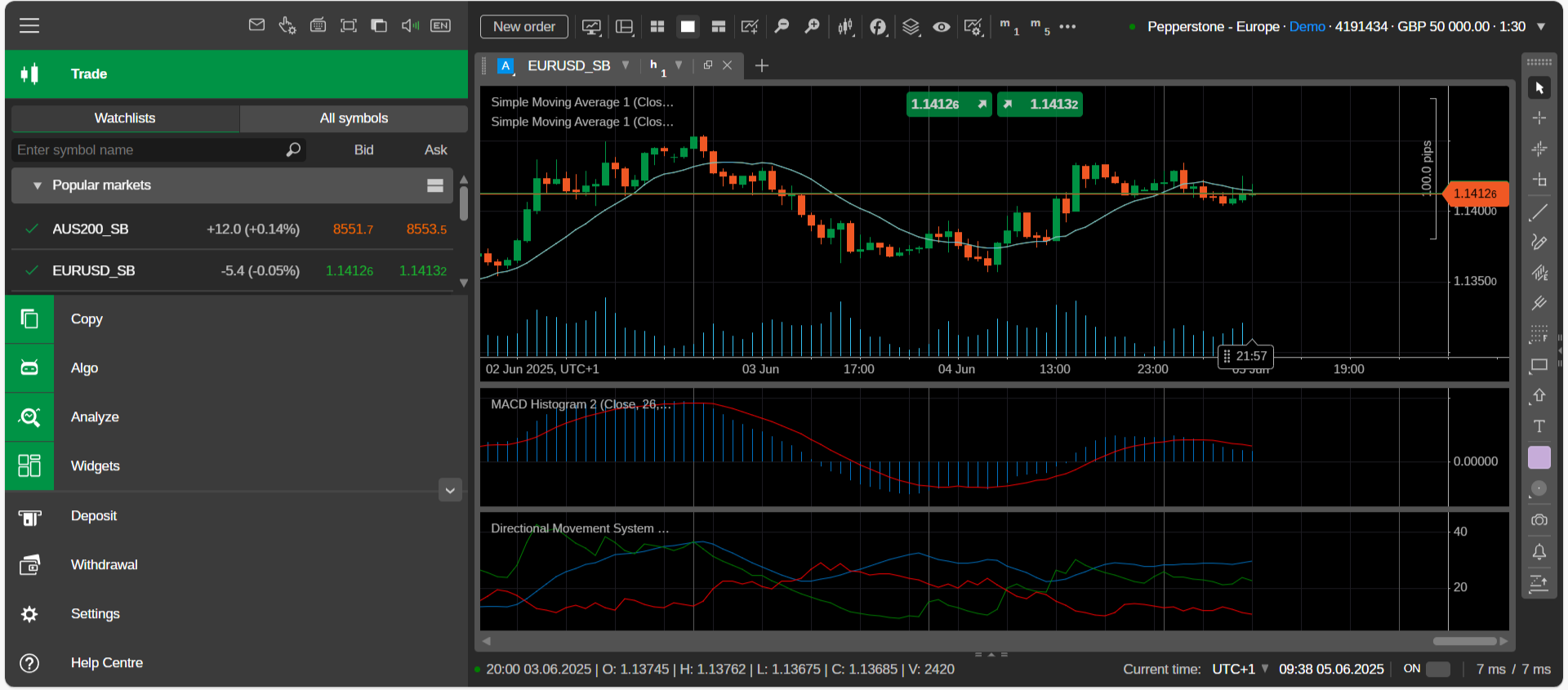

Top Pick for Realistic Demo Trading: When it comes to realism, Pepperstone is a standout. We’ve used their demo account extensively and were impressed with how closely it mirrors their live environment – real-time pricing, live market spreads, and execution speeds that feel nearly identical to the real thing.

One of our favorite features? You can customize your starting demo balance, which is a big plus if you want to test a strategy using the same capital you plan to trade with later. Whether you’re testing conservative risk management with $1,000 or trying higher-stakes setups with $50,000, you can tailor the environment to your goals.

Pepperstone offers demo access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as cTrader, and we tested all three. Across the board, trade execution was snappy, charts updated in real time, and order types executed as expected. There were no artificial buffers or delays, which can be a huge issue with some demo accounts.

Pepperstone cTrader demo platform EUR/USD chart

From Practice to Real Money: How Easy Is It to Go Live?

Once you’ve spent some time on a demo account and feel ready to trade real money, the last thing you want is a clunky, complicated upgrade process. We’ve seen some brokers turn this into a full-on paperwork marathon – documents, delays, new logins, and a complete reset of your settings.

That’s a huge red flag in our book. A good trading platform should make switching from a demo account to a live account as smooth and seamless as possible. Ideally, it should be as simple as verifying your ID, making a small initial deposit, and continuing right where you left off, with your settings, platform layout, and preferences all intact.

Top Pick for Easy Transition to Live Trading: Vantage makes the transition from demo to live almost frictionless. We tested it ourselves and were able to go live in less than 10 minutes. All they required was a basic ID upload, a few quick compliance questions, and a low minimum deposit – just $50 USD to get started.

The best part? Our platform settings from the demo account carried over automatically. That meant saved charts, indicators, watchlists, and even custom layouts were all still there when we logged into the live account. No need to redo anything.

Trade It All: Does the Demo Include a Full Range of Markets?

A lot of traders – especially those new to the game – assume that all demo accounts offer the full product range a broker has. But that’s not always true. Some limit you to just foreign exchange (FX), or offer only a few popular indices and commodities, while hiding the rest behind a live account paywall.

We’ve personally run into this during testing – signing up for what we thought was a fully featured demo, only to find out we couldn’t access stocks, crypto, or even basic indices like the S&P 500. That’s not great if you’re trying to explore your options or build a strategy across different asset classes.

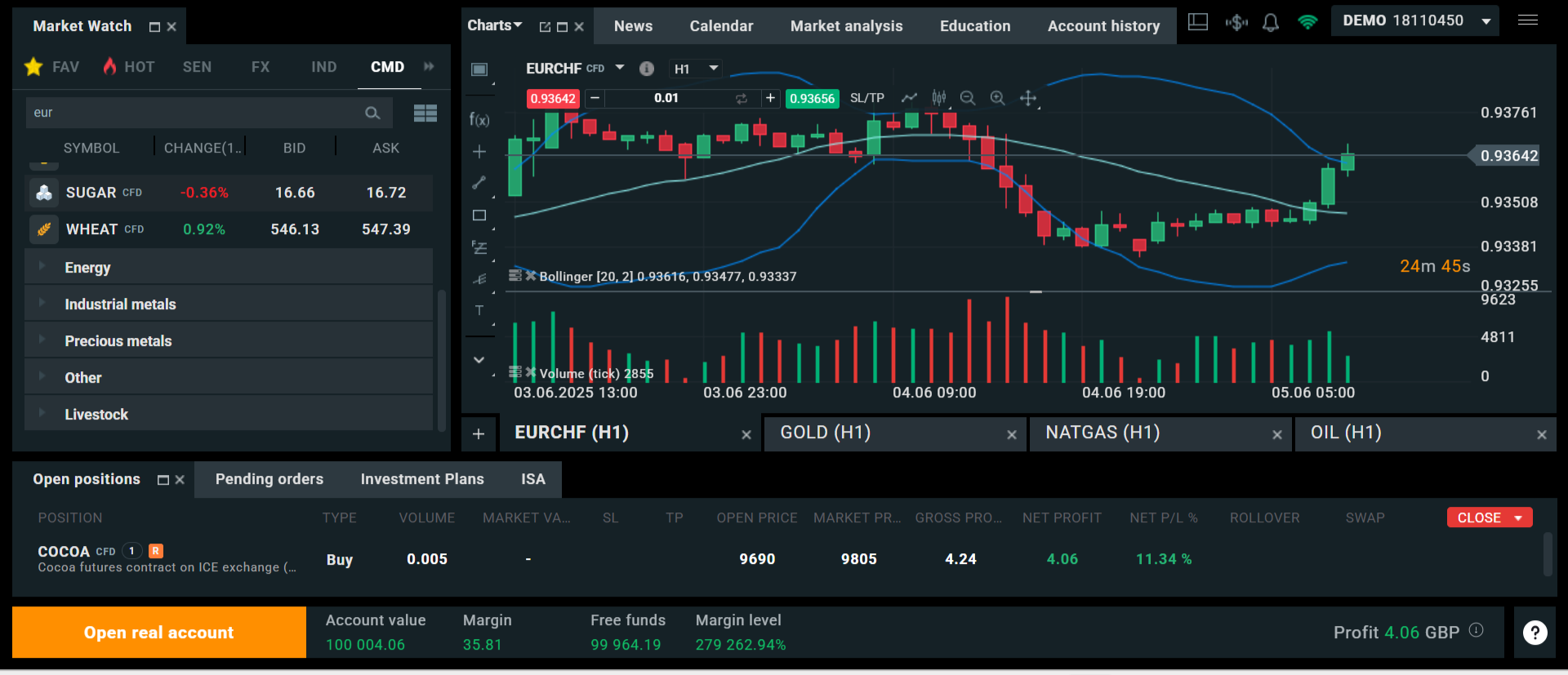

Top Pick for Full Market Access in Demo: If you want to explore every corner of the markets without restrictions, XTB is our go-to recommendation. We tested their demo account and were impressed by the wide range of tradable assets available from the outset.

On the demo platform, you can trade:

- Over 50 currency pairs (FX)

- Major and minor global indices

- A wide range of commodities, including gold, oil, and silver

- Popular cryptocurrencies like Bitcoin, Ethereum, and Ripple

- Hundreds of global stocks and ETFs

All of this is accessible on xStation 5, XTB’s proprietary platform, which we found fast, modern, and intuitive. Everything updates in real time, and the layout is highly customizable. You get advanced charting, integrated market sentiment tools, and one-click trading – all available in the demo.

XTB xStation platform demo account EUR/CHF chart

Learn While You Trade: Are Education and Research Tools Included in Demo?

A good demo account should do more than just simulate trades – it should help you grow as a trader. That means giving you access to market research, analyst insights, training videos, and a full library of educational materials – not locking them behind a live account paywall.

We’ve tested numerous platforms, and it’s disappointing how many treat demo users as second-class citizens. Sure, you can place a fake trade – but good luck accessing any real guidance or up-to-date market commentary unless you fund your account first.

In our evaluations, we looked specifically at whether demo users had full access to the same tools, research, and learning resources as live traders. And one broker consistently overdelivered.

Top Pick for Research and Education in Demo: CMC Markets sets the bar high when it comes to supporting demo traders with top-tier learning and market insight tools.

Even without depositing a cent, you get full access to:

- Professional-grade market analysis and news feeds

- Daily insights from CMC’s in-house analysts

- Video tutorials and platform walkthroughs

- Trading strategy guides for beginner to advanced levels

- Webinars and market outlooks updated regularly

We personally browsed through their education hub while testing the demo, and were impressed with the depth and clarity of the materials. It’s not just fluff or beginner basics – they cover serious topics like risk management, multi-timeframe analysis, and how to interpret economic data.

Real Help, Even in Demo: Is Customer Support Available Before You Go Live?

If you can’t get help when something’s not working in demo mode, it doesn’t give you much confidence for live trading. We’ve come across demo accounts where support is nonexistent until you fund a real account. That’s not good enough.

When we test demo accounts, we reach out to live chat, email, and phone channels to see how fast and helpful the support is for non-funded users. Some brokers ignore you. Others? Surprisingly helpful, even before you deposit a dime.

Top Pick for Customer Support in Demo: Pepperstone impressed us with how seriously they take demo users. We reached out via live chat as a demo-only user and got through to a knowledgeable support agent in under a minute – no account number or live login required.

Whether it was questions about MetaTrader 4, demo funding levels, or how to transition to a live account, the responses were clear, friendly, and accurate. They also offer email and phone support, and their FAQ section is one of the more detailed ones we’ve seen.

Trade Anywhere: Can You Access the Demo on Mobile?

You shouldn’t have to sit in front of a desktop to try a strategy or check your trades. Like many of the best trading accounts, a good demo account needs to work just as well on your phone or tablet, especially if you’re planning to trade on the go in the future.

We downloaded and tested mobile apps for the brokers we reviewed where practical, checking for feature parity with desktop, speed, design, and ease of placing and managing trades.

Top Pick for Mobile Demo Trading: Vantage gives you a demo trading experience that works beautifully on mobile. We tested both their MetaTrader apps (MT4 and MT5) as well as the Vantage mobile app, and in both cases, we were able to trade, chart, and manage settings smoothly.

What we liked most? The demo apps include:

- Real-time pricing and full asset access

- Advanced charting with drawing tools and indicators

- One-click trading and fast order execution

- Seamless syncing with desktop versions

It doesn’t feel like a stripped-down version of the platform – it’s the full trading experience in your pocket. If you’re someone who wants to trade from your phone, Vantage’s mobile-friendly demo is the ideal starting point.