XTB Review 2026

Why Trade With XTB?

"XTB is an excellent option for new traders due to its xStation platform, low trading costs, no minimum deposit, and outstanding educational tools, many of which are integrated into the platform."

Detailed Ratings

Quick Facts

Pros

- XTB offers a wide range of instruments, including CFDs on stocks, indices, ETFs, raw materials, forex, crypto, real stocks, real ETFs, share dealing, and investment plans, catering to both short-term traders and long-term investors.

- Signing up for an XTB account is simple and entirely digital, taking only a short while. This enables a seamless transition into trading for new traders.

- The xStation platform stands out with its easy-to-use interface and intuitive features. These include personalized news feeds, sentiment heat maps, and a trading calculator, making it simpler for new traders.

- Great customer support 24/5, including a live chat service. During tests, responses were typically provided in less than two minutes.

- XTB provides withdrawals within 3 business days, depending on the method and amount.

Cons

- XTB's research tools are decent but could be improved by expanding beyond their own features to include top external tools like Autochartist, Trading Central, and TipRanks.

- Trading costs are fair with typical spreads of around 1 pip on the EUR/USD. However, they're not as low as those offered by the least expensive brokers, like IC Markets. Also, an inactivity fee applies after one year.

- XTB has stopped supporting MT4, making traders use its own platform, xStation. This could discourage advanced traders who are accustomed to the MetaTrader suite.

- The inability to modify the default leverage on XTB products is disappointing. Manual adjustment can greatly reduce trading risks, especially in forex and CFD trading.

- The demo account ends in four weeks. This is a limit for traders wanting to fully explore the xStation platform and try out strategies before using actual money.

Regulation & Trust

XTB is a trusted broker publicly listed on the Warsaw Stock Exchange. It ensures transparency through regular audits and public financials.

It holds licenses from five regulators, including the UK’s Financial Conduct Authority (FCA), the Cyprus Securities & Exchange Commission (CySEC), the Polish Financial Supervision Authority (KNF), the Dubai Financial Services Authority (DFSA), and the Belize Financial Services Commission (FSC).

Funds are kept in segregated accounts, adding an extra layer of security.

If you trade in the UK, you get protection up to £85,000 through the Financial Services Compensation Scheme (FSCS), and in Europe, up to €20,000 through the Cyprus Investor Compensation Fund (ICF). Unfortunately, clients outside these regions don’t have the same coverage.

XTB’s trust score dropped slightly after a $2.2 million fine for order execution issues in 2014-2015, but there haven’t been any significant breaches since.

While the broker is expanding in Asia and recently gained Dubai Financial Services Authority (DFSA) authorization, it still has fewer licenses than IG, which has been around for over 50 years compared to XTB’s 2002 launch.

Regulation & Trust Details

- Regulator: FCA, CySEC, KNF, DFSA, FSC

- Guaranteed Stop Loss: Yes

- Negative Balance Protection: Yes

- Segregated Accounts: Yes

Awards

- Best Forex Broker for Beginners 2022

- Best Customer Service 2021

- Best Forex Broker for Low Costs 2021

- Best Mobile App for Investing 2020

- #1 EMEA Bloomberg spot for FX accuracy in Q2 of 2020 and Q3 of 2018

- Best Polish Forex Broker 2019

- Best Execution Broker 2019

Accounts & Banking

Trading Accounts

XTB gives you a choice of three account types, depending on where you’re trading.

The Standard account works well if you want simple pricing, with floating spreads starting at 0.5 pips and no commissions.

The Professional account offers tighter spreads from 0.1 pips with market execution, but you have to pay a small commission.

XTB provides negative balance protection, which is rare for professional clients.

If you need a swap-free option, the Islamic account removes interest fees in certain regions.

One drawback is that XTB doesn’t offer a raw spread account for retail traders.

Other brokers, like Pepperstone, provide commission-free and raw-spread options, giving traders more flexibility.

You can test the platform with a demo account with €100k in virtual funds, but unlike IC Markets’ non-expiring demo accounts, it only lasts four weeks.

That feels too short since I like to get familiar with a platform before committing real money.

Thankfully, opening an account is quick and entirely online, taking just a few minutes.

XTB offers interest on uninvested cash (subject to change). Rates vary by deposit size and currency. Unlike eToro, which requires a $50,000 deposit for a high rate, XTB has no minimum balance condition.

Deposits & Withdrawals

XTB lets you fund your account using secure payment methods like credit card, debit card, e-wallet (Skrill, Paysafe, Neteller), and wire transfer, but only if available in your registered country.

For example, you can’t use PayPal unless you’re in the European Union.

One thing I like is that there’s no minimum deposit, which makes it accessible if I’m starting with a smaller balance.

XTB supports deposits in EUR, USD, GBP, and HUF—better than eToro but not as flexible as Interactive Brokers, which offers 12 currency options.

Deposits via bank wire or card don’t have fees, but if you’re in the UK and use Skrill, you must pay a 2% fee. EU residents don’t have that issue.

Withdrawals are free if they exceed £60, €80, or $100. That minimum is a downside since many top brokers don’t require one.

You have to withdraw to a verified bank account, which is frustrating if you want to use the same method for deposits and withdrawals.

The process is smooth as long as you have the right documentation. Most withdrawals are free, but if you withdraw a small amount, you might be charged a fee.

Accounts & Banking Details

- Minimum Deposit: $0

- Account Types: STP

- Payment Methods: Credit Card, Debit Card, Maestro, Mastercard, Neteller, PayPal, Paysafecard, Skrill, Visa, Wire Transfer

- Account Currencies: USD, EUR, GBP

- Islamic Account: Yes

Assets & Markets

XTB gives you access to over 6,400 instruments across eight categories, including CFDs on stocks, indices, ETFs, commodities, forex, cryptocurrencies, and real stocks and ETFs, depending on where you’re located.

Trade forex with 71 currency pairs, covering majors, minors, and exotics. Navigating XTB’s platform is easy, especially when trading CFDs on over 2,000 stocks and 33 global indices.

The indices are well-organized by region—Americas, Asia-Pacific, and Europe—so you can quickly find what you need.

You can also trade 50 major cryptocurrencies like Bitcoin, Litecoin, Ripple, and Ethereum, but you can’t if you’re in the UK because of regulations.

In 2023, XTB launched commission-free direct stock trading in the UK for trades up to €100,000 per month, making it a solid option for British investors.

In 2024, XTB added ‘Investment Plans,’ which let you build a hands-off ETF portfolio with 494 options.

The mobile app automates fund distribution based on your chosen allocations, making investing easier.

The downside is that XTB doesn’t offer futures, options, share baskets, treasuries, bonds, or mutual funds, which limits investment choices.

Leverage at XTB depends on where you’re located and the regulations in place.

Since I trade under FCA regulation in the UK, I can access leverage up to 1:30. EU residents under CySEC regulation have the same limit.

If you’re outside the EU or qualify as a professional trader, you can access high leverage up to 1:500.

One thing that frustrates me is the fixed leverage levels. I can’t manually adjust them, which would help me manage risk better.

In forex and CFD trading, preset leverage can sometimes feel too high, making risk management trickier than necessary.

Assets & Markets Details

- Instruments: CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs

- Leverage: 1:30 (EU) 1:500 (Global)

- Margin Trading: Yes | Margin rate: 4.5%

- Stock Exchanges: Australian Securities Exchange (ASX), Bombay Stock Exchange, CAC 40 Index France, DAX GER 40 Index, Deutsche Boerse, Dow Jones, Euronext, FTSE UK Index, Hang Seng, Hong Kong Stock Exchange, IBEX 35, Japan Exchange Group, Nasdaq, New York Stock Exchange, Russell 2000, S&P 500, SIX Swiss Exchange

- Commodities: Aluminium, Cattle, Cocoa, Coffee, Copper, Corn, Cotton, Gasoline, Gold, Lean Hogs, Livestock, Natural Gas, Nickel, Oil, Palladium, Platinum, Precious Metals, Silver, Soybeans, Sugar, Wheat, Zinc

- Crypto Coins: ADA, BTC, BCH, DSH, EOS, ETH, IOTA, LTC, NEO, XRP, XLM, TRX, XEM, XLM, XMR, DOGE, BNB, LINK, UNI, DOT, XTZ

Fees & Costs

XTB gives competitive pricing, but it’s not the cheapest option. Brokers like IC Markets and IG offer lower costs.

When you trade forex, the fees are reasonable, with EUR/USD spreads averaging around 1.0 pip during peak hours. Still, IC Markets does better, with spreads as low as 0.1 pips. For indices, the S&P 500 CFD averages 0.6 points, but the Europe 50 CFD is less competitive at 2.4 points.

Stocks and ETFs are commission-free if you trade under €100,000 per month, but this isn’t as good as eToro, which has no limits. If you go over that amount, XTB charges a 0.2% fee with a €10 minimum.

Currency conversion fees are a drawback. If you trade stocks or ETFs in a different currency than your account’s base, you pay a 0.5% fee.

XTB also has an inactivity fee. If you don’t trade for 12 months, it deducts $10 monthly until your balance hits zero. To avoid this, make sure to place a trade or withdraw funds entirely.

Fees & Costs Details

- Inactivity Fee: €10 per 365 days

- Crypto Spread: 0.22%

Forex Spreads

- GBP/USD: 1.4

- EUR/USD: 1.0

- GBP/EUR: 1.4

CFD Spreads

- FTSE: 1.8

- GBP/USD: 1.4

- Oil: 0.03

- Stocks: 0.2%

Platforms & Tools

XTB’s proprietary xStation 5 platform is one of my favorites because of its impressive features and easy-to-use interface. It’s an excellent starting point for new traders.

You can access it as a web or desktop version on both Windows and Mac, and it has identical functionality. There’s also a mobile app for iOS, Android, and even smartwatches, a rare convenience among brokers.

The platform perfectly suits my needs, especially with its great search function that lets me find instruments quickly.

XTB has thought of everything: I can customize my news feed, use the stock screener, check sentiment heatmaps, and rely on the detailed economic calendar to stay on top of things.

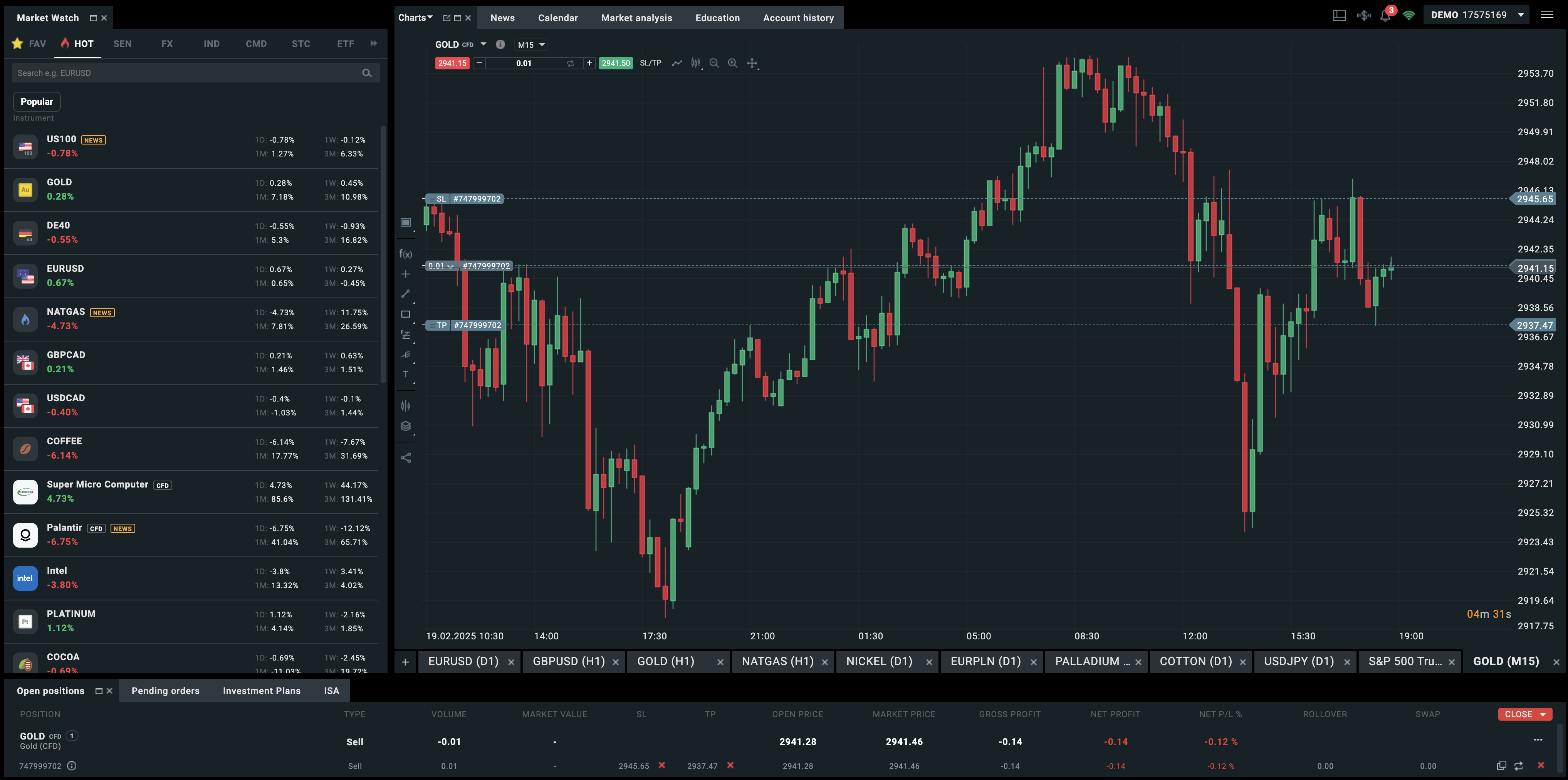

Trading feels intuitive, with various order types available, such as Market, Limit/Stop, Stop-loss/Take-profit, and Trailing stop orders. The trader calculator makes calculating parameters like margin and commission for each trade easy.

xStation 5 is user-friendly and includes a customizable news feed and economic calendar

I appreciate the order time limits like Good ’til’ time (GTT) and Good-til-Canceled (GTC), which give me more control over my trades. Plus, you get free market audio commentary, usually a paid feature with other brokers.

Setting up alerts for margin calls, deposits, and changes in open or closed positions is simple. You can receive notifications through email, SMS, or push notifications, which keeps you updated on important developments.

While xStation 5 is packed with useful tools for fundamental and technical analysis, XTB no longer supports external platforms after discontinuing MetaTrader 4 (MT4) in 2022.

This might be a downside for advanced traders who prefer using third-party platforms like MetaTrader, cTrader, or TradingView.

Other brokers like AvaTrade offer their own software in addition to third-party solutions, which I miss.

Platforms & Tools Details

- Platforms: xStation

- Android App Rating:

- iOS App Rating:

- Copy Trading: No

- VPS: No

- Automated Trading:

- AI Trading: No

Research

XTB offers a solid range of research tools through the xStation 5 platform and some resources on its website.

These tools are available in multiple languages, such as English, Arabic, and Chinese.

The platform includes a mix of fundamental and technical analysis, along with market insights.

XTB’s stock screener filters stocks based on personalized criteria

The news streams and economic calendars, complete with ‘market impact’ meters, are helpful. However, I wish XTB included third-party analysis, like Autochartist or Trading Central, as that would add another layer of value.

The economic calendar and market analysis stand out, especially the detailed event summaries and essential stock data like market cap, EPS, and P/E ratios.

This information is really useful when refining trading strategies. I also like using the ‘Stocks Scanner’ and ‘Heatmap’ tools.

The scanner helps you find stocks that fit your criteria, and the heatmap lets you spot market trends quickly, making it easier to identify opportunities.

Education

XTB offers a solid range of educational resources, including training videos, articles on trading strategies, and platform tutorials.

I appreciate that the educational videos are built into the platform—it saves me from hunting through the website or YouTube when I want to learn something new.

XTB’s educational videos provide easy access to valuable trading insights directly on the platform

The beginner guides are well-structured, covering key trading concepts, account management, and the xStation 5 platform.

That said, I wish I could filter articles by experience level to find the most relevant to me. Also, some videos feel outdated—the last “Live Workshop” video is still from 2021.

Unlike IG, XTB doesn’t provide regular live market analysis videos, which is disappointing since these can be valuable for learning from seasoned traders and spotting market opportunities.

While XTB’s educational content is valuable, I sometimes need to look elsewhere to fill in the gaps.

Customer Support

XTB’s customer support is available 24/5 through phone, email, and live chat, but I’d like to see support extended to 24/7, like IC Markets.

You can also reach its team on social media, including Facebook, X, Instagram, and YouTube.

Live chat is available during business hours Monday through Friday, and responses are quick and professional in my experience.

Having a dedicated account manager is helpful for any account-related questions.

Should You Trade With XTB?

XTB is a solid choice if you want a beginner-friendly platform with zero commissions and a broad range of assets, especially CFDs.

The broker’s recent shift toward longer-term products like investment plans and direct share dealing also makes it an excellent choice for investors and hands-off traders.

Article Sources

- XTB Website

- XTB Investment Plans

- XTB – FCA License

- XTB – CySEC License

- XTB – KNF License

- XTB – DFSA License

- XTB – FSC License

- Financial Services Compensation Scheme (FSCS)

- Cyprus Investor Compensation Fund (ICF)

- Finance Magnates – XTB’s $2.2M Fine

Alternatives To XTB

These similar brokers are the highest rated alternatives to XTB.

-

1

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.3 Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading. -

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.6 Founded in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage offering trading on over 1,200 instruments, including binary options. It provides various accounts (JForex, MT4/5, Binary Options) and advanced platforms (JForex, MT4/MT5) with strong tools and market data for active traders. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms.