Best Brokers For ETFs 2026

Explore our top ETF brokers identified through hands-on tests, offering a wide range of funds, excellent fees, and reliable platforms to help you invest in markets and sectors worldwide.

-

1

During testing, we accessed thousands of ETFs in major sectors like AI, utilities, and ESG on IBKR’s professional platforms. U.S. clients have $0 commissions, while others get very low fees (from $0.005/share). Globally regulated with no minimum deposit on IBKR Lite, it is nearly unparalleled for serious, high-volume ETF traders.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 When we tested eToro USA, we traded over 250 ETFs in sectors such as tech, clean energy, biotech, and defense, all without commissions. The user-friendly platform and social trading tools were impressive, although spreads were around 0.10%. Regulated by FINRA and SEC, it requires a $10 minimum deposit, making it accessible for beginners and offering sector variety.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.3 In our recent review, Moomoo provided commission-free trading for over 3,000 U.S.-listed ETFs in sectors such as technology, healthcare, energy, ESG, dividends, commodities, bonds, and international markets. Spreads are minimal, around $0.01 per share. Regulated by the SEC/FINRA, it has no deposit minimum, and its advanced Level II data and charting are notable for active ETF traders.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.5 Crypto.com is a major name in cryptocurrency trading, designed to speed up the global shift to DeFi technologies. The exchange provides token lending, prepaid cards, NFTs, and more. Founded in Germany in 2016, it serves 150 million users. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Our tests found that Firstrade provides commission-free trading on over 700 U.S. ETFs in sectors such as tech, emerging markets, healthcare, bonds, dividends, and ESG. Execution spreads were nearly zero per share. It's SEC/FINRA-regulated, has no minimum deposit or account fees, and allows short selling or margin trading without hidden costs, making it suitable for low-cost ETF traders.

Top ETF Brokers Comparison

Safety Comparison

Compare how safe the Best Brokers For ETFs 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Brokers For ETFs 2026.

Comparison for Beginners

Compare how suitable the Best Brokers For ETFs 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Brokers For ETFs 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Brokers For ETFs 2026.

Detailed Rating Comparison

Compare how we rated the Best Brokers For ETFs 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Brokers For ETFs 2026.

Broker Popularity

See how popular the Best Brokers For ETFs [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Crypto.com |

|

| Moomoo |

|

| Interactive Brokers |

|

| eToro USA |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- IBKR, primarily designed for skilled traders, has expanded its appeal recently by eliminating its initial $10,000 deposit requirement.

- The new IBKR Desktop platform combines the advantages of TWS and adds unique tools like Option Lattice and Screeners with MultiSort to make trading accessible and impressive for traders of all levels.

- IBKR is a highly regarded brokerage, regulated by prime authorities. This ensures the safety and reliability of your trading account.

Cons

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

Why Trade With eToro USA?

eToro is a top choice for traders due to its top-notch social investing and copy trading services. The broker caters well to new traders with its low deposit requirement, commission-free trading, and user-friendly platform.

Pros

- eToro USA Securities is a reliable broker that's regulated by the SEC, part of FINRA, and a member of SIPC.

- The online broker provides a user-friendly social investment network for easy crypto trading replication.

- The low minimum deposit and simple account setup allow beginners to start trading quickly.

Cons

- The exclusive terminal does not accommodate trading bots and lacks extra equity market analysis tools.

- There are fewer trading options available, including only stocks, ETFs, and cryptos, compared to competitors.

- Traders used to third-party charting tools won't find MetaTrader 4 platform integration.

Why Trade With Moomoo?

Moomoo is a great option for beginner and intermediate traders aiming to diversify their investment portfolio. The brokerage's app is easily navigable and the trading fees are significantly low.

Pros

- The broker requires no minimum deposit, making it suitable for beginner traders.

- Moomoo's insights and analytics are more comprehensive and detailed than other brands.

- The 'Moomoo Token' produces changing passwords to enhance transaction security - a distinctive and practical safety measure for traders.

Cons

- Regrettably, even with its existing security features, this platform still lacks 2 factor authentication (2FA).

- The protection against negative balance, a standard security measure at highly regulated brokers, is not available here.

- The broker doesn't offer phone or live chat support, options typically provided by other brokers.

Why Trade With Crypto.com?

Crypto.com is ideal for new crypto traders looking to buy, sell, and trade over 400 digital tokens. Its strike options and prediction markets cover financial, economic, election, sport, and cultural events. As a CFTC-regulated platform, it provides a secure choice for US traders interested in binary-style contracts using an easy-to-use app.

Pros

- The platform offers unified tracking for cryptocurrencies, stocks, ETFs, and prediction markets within one interface, making multi-asset management simpler and providing combined insights.

- Crypto.com has expanded in some regions, now offering over 5000 stocks and ETFs for traders seeking diverse portfolios and opportunities in various sectors.

- Crypto.com uses a cold wallet system with multi-signature technology and geographic distribution to improve security. This method ensures strong protection of user assets with secure offline storage.

Cons

- The app has high bid-ask spreads on many coins, which can be expensive for traders using market orders. Wide spreads mean the buying price is significantly higher than the selling price, reducing profits, especially in low-volume trades.

- Customer support mainly uses chatbots and email, with limited reliable phone support from our testing. This may cause delays in solving urgent issues like account access or transaction problems, which can be frustrating for crypto traders needing quick help.

- Fees apply to crypto and fiat withdrawals, which can be significant for active traders making smaller transfers. The minimum withdrawal limits are also high, limiting flexibility in managing smaller portfolios or immediate liquidity needs.

Why Trade With Firstrade?

Firstrade is ideal for beginners wanting to trade US stocks without commission fees. It offers plenty of free educational resources and high-quality research, including its new FirstradeGPT tool. Users also get trading ideas from Morningstar, Briefing.com, Zacks, and Benzinga.

Pros

- FirstradeGPT ranks among the initial brokers to offer AI-powered analysis.

- In 2025, Firstrade Invest 3.0 will enhance the platform with a cleaner interface and faster order entry, benefiting active traders in key areas such as watchlists and options chains.

- Trusted US-regulated broker, member of SIPC

Cons

- Customer support needs improvement after testing, with no 24/7 help available.

- Firstrade emphasizes stocks and lacks forex options, reducing diversification opportunities.

- Over 90% of the evaluated options lack a demo or paper trading account.

Filters

How We Chose the Best ETF Brokers

We evaluated numerous platforms to curate a list of the top ETF brokers with exceptional features:

- Diverse ETF selection to match your investment goals and strategies.

- Low fees like commission-free trading to minimize costs.

- User-friendly platforms with intuitive tools and mobile access.

- Robust research and education to support informed decision-making.

- Strong regulation and security for peace of mind.

- Flexible account options like retirement accounts and fractional trading.

- Responsive customer support for quick problem resolution.

- Extra perks and bonuses to enhance your overall experience.

What To Look For in an ETF Broker

Picking the right broker for ETFs can make a big difference in your investment experience. Whether you’re a first-time investor or a seasoned trader, here are the key factors to keep in mind:

ETF Selection

The cornerstone of any great ETF broker is the variety it offers. Look for brokers offering diverse ETFs, including those focused on different sectors, geographic regions, asset classes, and investment strategies.

Options like index ETFs, sector ETFs, and thematic ETFs give you the flexibility to tailor your portfolio to your goals.

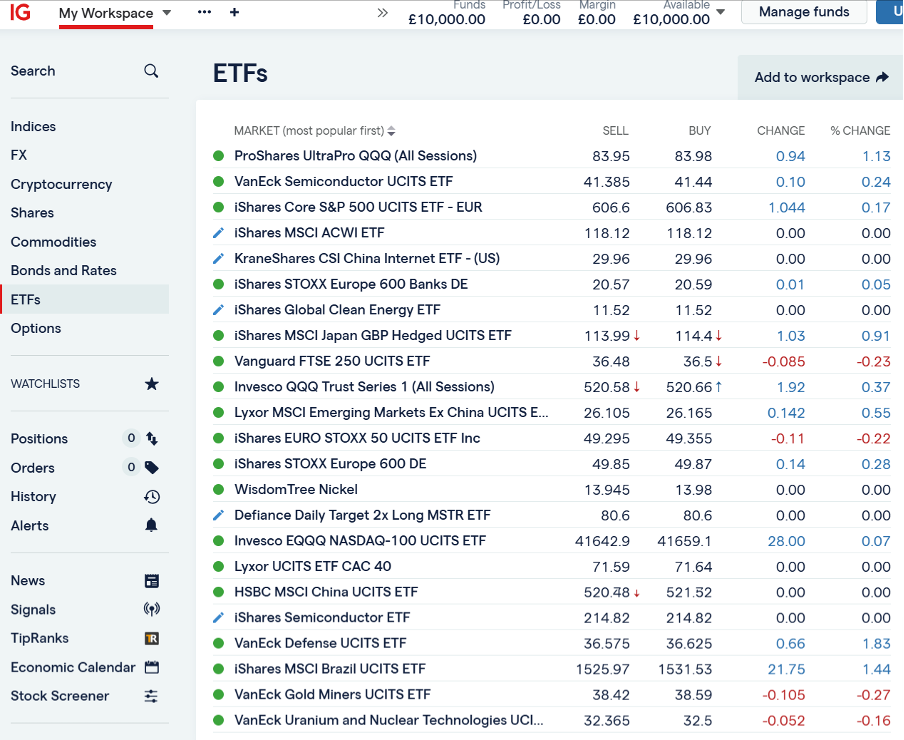

IG has the best selection of ETFs we’ve seen, featuring more than 5,400 funds spanning indices, commodities, and currencies.

Fees and Commissions

Costs matters. Pay attention to trading fees, account maintenance costs, and other charges.

Some brokers offer commission-free ETF trading, which can be a game-changer if you make frequent trades.

Keep an eye out for expense ratios too – these are the ongoing costs of owning an ETF. Lower is generally better.

XTB shined during testing for its tight spreads coupled with zero commissions on ETFs, appealing to budget-conscious traders.

User-Friendly Platforms

A user-friendly platform can simplify your trading experience, whether you’re a beginner or a pro.

Look for intuitive interfaces, responsive mobile apps, and tools that make ETF research and trading easy.

A demo account, offered by most ETF brokers we’ve evaluated, can also be a great way to test the waters before committing.

I love the web platform at eToro, which makes trading ETFs an intuitive and enjoyable experience.

It also features a best-in-class social trading network that enables you to copy the ETF trades of experienced investors.

Research and Educational Resources

Great brokers don’t just provide ETFs – they help you make informed decisions.

Brokers offering robust research tools, market analysis, and educational content can be tremendous assets, especially if you’re new to ETF investing.

Look for features like ETF screeners, market news, and detailed fund breakdowns.

IG tops our rankings for education, even offering videos on ‘how to choose the right ETF’.

Regulation and Security

Never compromise on security. Choose a broker regulated by a reputable financial authority to protect your investments.

Regulators like the SEC (US), FCA (UK), or ASIC (Australia) offer peace of mind that the broker operates under strict guidelines.

With authorization from five top-tier regulators (FCA, CySEC, KNF, DFSA, FSC), plus a listing on the Warsaw Stock Exchange, XTB is highly trusted.

Account Types and Features

Does the broker cater to your specific needs? Some platforms offer specialized accounts, such as retirement accounts (IRAs) or tax-advantaged accounts.

Features like fractional ETF trading, dividend reinvestment programs (DRIPs), and margin trading can add value depending on your strategy.

Pepperstone caters to a wide range of ETF traders through its Standard and Razor accounts, with the former offering commission-free trading and the latter suiting active traders looking for raw spreads.

Customer Support

I know from firsthand experience that when things don’t go as planned, reliable customer support is invaluable.

Look for brokers with multiple support channels, such as live chat, email, or phone, and check for availability during trading hours.

Highly rated customer service can save you time and frustration.

Webull earns a high support rating based on our latest tests, with 24/7 assistance to help traders around the clock.

Additional Perks

Finally, consider the extras. Some brokers offer perks like cash bonuses for new accounts, ETF promotions, or integrations with popular financial tools.

While not essential, these benefits can sweeten the deal.

IG is a great pick here, with its ETF screener that lets you narrow options by asset class, geographic region, and track the highest-performing funds over various periods, from one month to year-to-date.

5 Tips for Choosing the Best Broker for ETFs

1. Define Your Investment Goals

Are you planning to build a long-term portfolio or actively trade ETFs?

Understanding your goals will help you prioritize features like low fees for frequent trades or a wide selection of sector-specific ETFs for diversification.

2. Prioritize Research Tools

Top brokers often provide robust research features to help you make informed decisions.

Look for ETF comparison tools, detailed fund data, market news, and expert insights.

For beginners, educational resources like tutorials and guides are invaluable.

3. Look for Long-Term Value

Don’t get lured by short-term bonuses or promotions.

While perks like sign-up bonuses or free trades are attractive, they shouldn’t outweigh the long-term value of low fees, excellent tools, and reliable service.

4. Read Reviews and User Feedback

Take the time to read reviews and testimonials from other traders. User experiences can highlight a broker’s strengths and weaknesses, giving you a clearer picture of what to expect.

Our reviews and ratings, for example, are drawn from our firsthand assessments and direct experience testing brokers over many years.

5. Start Small and Scale Up

If unsure, start with a smaller investment to test the waters. ETF brokers increasingly accept retail investors with less than $100.

This approach allows you to evaluate the broker’s platform, tools, and overall service before fully committing.

FAQ

What Are ETFs?

ETFs, or Exchange-Traded Funds, are investment funds traded on stock exchanges, much like individual stocks.

Each ETF holds a collection of assets, such as stocks, bonds, or commodities, and is designed to track the performance of a specific index, sector, or theme.

Should I Trade ETFs?

ETFs combine the best features of mutual funds and stocks. They offer the diversification of a mutual fund but with the flexibility and ease of trading individual stocks.

This makes them an excellent choice for investors looking for a low-cost, transparent, and versatile investment vehicle.

Whether your goal is to invest in broad market indices, explore niche sectors, or gain exposure to international markets, there’s probably an ETF that matches your plan.

What Is An ETF Broker?

An ETF broker helps you buy and sell ETFs by providing an online platform and useful resources for managing your investments.