Best Forex Brokers 2026

We’ve rigorously tested and ranked the top forex brokers, analyzing their platforms, spreads, and tools. Find the right broker to enhance your forex trading journey.

-

1

IBKR offers more than 100 varieties of major, minor, and exotic forex pairs, exceeding the options provided by most competitors, except for CMC Markets. Forex trading happens across numerous platforms and features spreads from 0.1 pips, which are of institutional quality. It supports 20 types of complex orders like brackets, scale, and one-cancels-all (OCA) orders.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 NinjaTraders allows traders to deal in widely traded currencies like EUR/USD. The platform provides sophisticated features geared towards enhancing trading practices, including specialized order options such as market if touched (MIT) and one cancels other (OCO).

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Plus500 US provides futures trading for 13 currencies, including well-known pairs such as EUR/USD and GBP/USD. Trading margins start at $40, which are competitive. The educational materials they offer effectively explain the fundamental aspects of forex futures for novice traders.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 remains a top FX broker, offering 80 currency pairs with very competitive fees. With EUR/USD spreads as low as 0.0 and a $7 commission per $100k, it excels in the industry.

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 OANDA provides an impressive assortment of 68 currency pairs. Their custom trading platform features robust trading tools through advanced TradingView charts. It includes over 65 technical indicators and 11 adjustable chart types, superior to many other options.

Compare Forex Brokers

Safety Comparison

Compare how safe the Best Forex Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Forex Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Forex Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Forex Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Forex Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Forex Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Forex Brokers 2026.

Broker Popularity

See how popular the Best Forex Brokers [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Interactive Brokers |

|

| NinjaTrader |

|

| FOREX.com |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- The TWS platform is designed for intermediate to advanced traders. It includes over 100 order types and a dependable real-time market data feed that rarely experiences downtime.

- IBKR offers exceptional access to global stocks, with thousands of equities available from over 100 market centers in 24 countries, including the recent addition of the Saudi Stock Exchange.

- IBKR, primarily designed for skilled traders, has expanded its appeal recently by eliminating its initial $10,000 deposit requirement.

Cons

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- Traders can access a free platform and trade simulation capabilities with the unlimited demo.

- You can access thousands of applications and add-ons from developers worldwide for trading.

- Low costs, with $50 trading margins and commissions starting at $.09 per micro contract.

Cons

- Some payment methods require a withdrawal fee.

- You need to register with partner brokers to trade in securities other than forex and futures.

- The advanced trading tools require an additional fee.

Why Trade With Plus500US?

Plus500US is an excellent choice for beginners, offering a user-friendly platform, low trading margins, and access to the Futures Academy to improve trading skills. Its powerful tools and reliable service earned it second place in DayTrading.com's annual 'Best US Broker' award.

Pros

- Plus500 is a reputable publicly traded company with over 24 million traders and sponsors the Chicago Bulls.

- The account setup, pricing structure, and web platform make futures trading simpler than competitors like NinjaTrader.

- The trading app offers an excellent user interface with an updated design, straightforward layout, and charts optimized for mobile use.

Cons

- Plus500US lacks social trading features, unlike competitors such as eToro US, which might enhance its appeal to aspiring traders.

- The private trading platform is easy to use, but doesn't have the advanced analysis tools that platforms like MetaTrader 4 do.

- Plus500US offers competitive pricing but does not have a discount program for high-volume traders, unlike brokers like Interactive Brokers.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

Cons

- The funding options are not as extensive as those of top competitors such as IC Markets and lack several widely-used e-wallets, particularly UnionPay and POLi.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

Why Trade With OANDA US?

OANDA is a reputable broker for US traders. It offers user-friendly tools for analysis and a simple sign-up process. It is very trustworthy due to heavy regulation.

Pros

- OANDA is a credible and safe trading brand, approved by top regulators such as the CFTC.

- Traders can experience quick and dependable order execution.

- Experienced traders can use top-notch tools like an MT4 premium upgrade and advanced charting from MotiveWave.

Cons

- Few payment options are available and e-wallets are not supported.

- Customer support is not accessible during weekends.

- The trading markets are limited to only forex and cryptocurrencies.

Filters

Methodology

We tested many platforms to bring you a list of the best forex brokers with outstanding features:

- A wide selection of currency pairs

- Excellent fees for active traders

- User-friendly tools and forex research

- Quick and dependable order execution

- Strong regulation for trust and safety

- Affordable and convenient account transfers

- Reliable, timely customer support

What To Look For in a Forex Broker

Your broker isn’t just a service to execute trades; they’re your partner in navigating the forex market. These are the most critical aspects to look for when choosing the right provider for your needs:

Range of Currency Pairs

Forex trading revolves around currency pairs, so a broker’s selection directly impacts your trading opportunities.

Most brokers we’ve evaluated offer the major pairs – like EUR/USD, GBP/USD, and USD/JPY – since these are the most liquid and widely traded.

However, access to minor pairs (such as NZD/CAD or AUD/CHF) and exotic pairs (like USD/ZAR or EUR/TRY) can open doors to more diverse strategies.

A broker offering a wide range of currency pairs enables you to diversify your portfolio and access less competitive markets. Exotic pairs often have higher volatility, presenting opportunities for experienced traders to capitalzse on price swings.

We still haven’t found a broker offering more currency pairs than CMC Markets, with a market-leading 330 forex assets, providing a huge range of trading opportunities.

CMC Markets – Currency Pairs

Trading Fees

Trading costs are a critical factor when choosing a forex broker. Fees can vary widely, so it’s essential to understand how they’re structured.

The primary types of costs include:

- Spreads: This is the difference between the bid (sell) and ask (buy) price. Tight spreads are particularly important for scalpers or day traders who open multiple trades daily. Brokers may offer fixed or variable spreads, so choose based on your strategy.

- Commissions: Some brokers charge a commission per trade, especially on accounts with tighter spreads. For traders handling large volumes, low-commission structures can save substantial amounts.

- Overnight Fees (Swap Fees): These apply if you hold positions overnight. Depending on the currency pair and interest rate differential, you may pay or earn interest on your position.

- Other Charges: Watch for hidden fees, such as inactivity fees, deposit/withdrawal charges, or platform subscription costs.

Pepperstone stood out in our latest tests for its ultra-competitive spreads, reduced in 2021, that start from 0.0 pips on EUR/USD in the Razor account, alongside rebates of 25%+ through the Active Trader scheme.

Platforms and Tools

A broker’s trading platform is your primary tool for navigating the forex market, so it needs to align with your skill level and trading requirements.

Most forex brokers we’ve assessed offer one or more of these platforms:

- MetaTrader 4 (MT4): Perfect for beginners and seasoned traders alike, MT4 was specifically built for forex trading and impresses with its intuitive interface, customizable charts, and access to thousands of indicators and automated strategies (Expert Advisors).

- MetaTrader 5 (MT5): A more advanced version of MT4, this platform supports additional asset classes, a broader range of order types, and improved analytics. It’s a good step up for experienced traders.

- TradingView: A very modern and increasingly popular alternative to MetaTrader, featuring a vast global trader community, plus serious tools for technical analysis, including 21 chart types and over 100 indicators.

- Proprietary Platforms: Many brokers create proprietary platforms tailored to their clients. These platforms often feature unique tools like integrated market news, sentiment analysis, or advanced risk management options. In my experience, they’re also better designed for newer traders.

MT4 Web Platform – USD/JPY Chart

The availability of robust charting tools and indicators is essential for technical traders, while fundamental traders may value platforms with integrated news and analysis.

Vantage stood out in this category during our hands-on tests, offering not just MT4, MT5 and TradingView, but also its own ProTrader, packed with advanced tools for active forex traders, and accessible in a user-friendly platform.

Execution Speed and Reliability

The forex market moves quickly, so execution speed can directly impact your trading success.

I know from first-hand experience that slow execution times or frequent server delays can lead to missed opportunities or slippage, which occurs when your trade executes at a price different from what you expected.

Look for forex brokers offering:

- Low Latency: Ensure trades are executed instantly, especially during volatile market conditions.

- Minimal Slippage: The difference between the expected and actual execution price should be minimal, particularly in fast-moving markets.

- Order Types: Advanced order types like stop-loss, take-profit, and trailing stops can help manage risk effectively.

Pepperstone stands out from the crowd with its incredibly fast execution speeds, with most forex orders processed in less than 30 ms, making it ideal for day traders and scalpers.

Regulation and Trust

The forex market is decentralized, making broker regulation a vital safeguard for traders. Regulated brokers adhere to strict operational standards designed to protect client funds and ensure fair trading conditions.

Top regulatory bodies include:

- FCA (UK): Highly reputable and offers extensive client protections.

- ASIC (Australia): Enforces strict compliance and fund segregation rules.

- CySEC (Cyprus): Popular with brokers serving European traders.

- CFTC (US): Known for stringent requirements but ensures maximum security for clients.

Trading currencies with an unregulated broker can expose you to risks such as unfair trading practices, fund mismanagement, or outright scams.

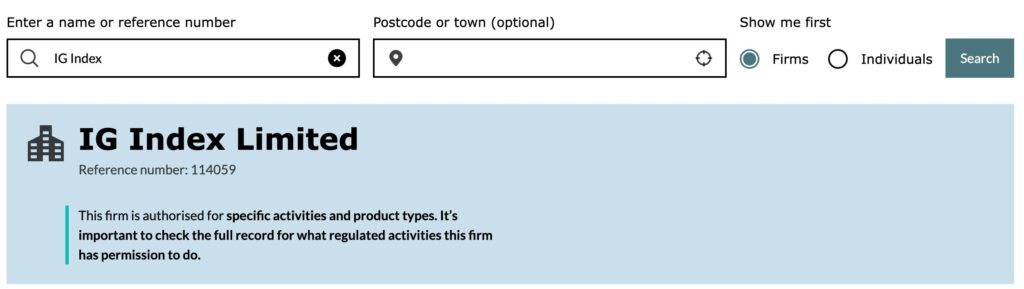

IG takes our crown as the ‘safest forex broker’. It’s authorized by 11 regulators at our last count and is personally used by several of our team for real-money trading.

IG Index – FCA License

Deposits and Withdrawals

A reliable broker ensures smooth and fast transactions regarding deposits and withdrawals. Look for forex brokers that support various payment methods, including:

- Credit/debit cards

- Bank wire transfers

- E-wallets (e.g., PayPal, Skrill, Neteller)

- Local payment solutions

Key considerations:

- Processing Times: Deposits are typically instant, but withdrawals may take 1 – 5 business days in my experience, depending on the broker and method. Fast withdrawal processing is a sign of a trustworthy broker.

- Transaction Fees: Some brokers offer free deposits and withdrawals, while others charge a fee. Consider this if you plan to trade frequently or in smaller amounts.

FXCC shone in our latest evaluations with its growing selection of 10+ payment methods, including increasingly popular options like Bitcoin transfers, all with zero fees at the deposit stage.

Customer Support

Even the most seasoned traders encounter issues, whether it’s a technical glitch, a question about a trade, or account-related concerns.

Trust me – exceptional customer support can save you a lot of headaches.

Top forex brokers provide:

- 24/7 Availability: Forex is a global market that operates 24/5, so support should match.

- Multiple Channels: Live chat, email, and phone support give you options to reach out.

- Fast Response Times: Nobody wants to wait hours for help during a critical moment.

- Educational Resources: Many providers enhance their support by offering tutorials, webinars, and FAQ sections to help traders navigate challenges independently.

After interacting with its support department many times over the years, IC Markets continues to prove itself a dependable option if you need fast, professional assistance to deal with technical issues or questions about forex trading conditions.

FAQs

What Is A Forex Broker?

A forex broker is a financial service provider that facilitates currency trading by connecting retail or institutional traders with the foreign exchange market.

They offer platforms for buying and selling currency pairs, provide leverage to amplify trading positions, and often supply tools like charts, market analysis, and educational resources.

Forex brokers act as intermediaries, enabling traders to speculate on currency price movements without owning the underlying assets.

How Does A Forex Broker Make Money?

Forex brokers make money primarily through:

- Spreads: The difference between the bid (buy) and ask (sell) price of a currency pair, which traders pay when entering a trade.

- Commissions: A fixed fee charged per trade, typically on top of the spread in ECN-style accounts.

- Swap Fees: Charges for holding positions overnight, which reflect interest rate differentials between traded currencies.

- Markups: Increasing the spread or adding fees on trades to profit indirectly.

- Other Services: Offering premium features like VPS hosting, copy trading, or educational courses for a fee.

Forex brokerages may also profit from losing trades when operating as market makers, as they take the opposing side of client trades.