Best MetaTrader 5 Brokers 2026

After extensive hands-on testing, these MetaTrader 5 brokers offer the best trading conditions.

-

1

In our testing, FOREX.com's MT5 provided reliable execution with spreads around 0.8 pips on EUR/USD and competitive commissions on RAW accounts ($5 per side). MT5 offers a range of assets, including forex, indices, commodities, and cryptocurrencies, with strong platform stability.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 When we tested RoboForex’s MT5, execution was fast, with spreads starting at 0.0 pips on Pro accounts and $3 commissions per side. The platform offers many assets, including forex, indices, commodities, and cryptocurrencies, and provides advanced charting and risk management tools for active traders.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 Trading on XM's MT5 had fast execution. Spreads averaged 0.6 to 1.0 pips on major pairs, varying by account type, with Ultra Low accounts offering tighter spreads. Most trades had no commission, low deposit minimums, and no early inactivity fee. The platform provided strong asset variety and reliable performance across forex, indices, and stocks.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.9 During our test of AvaTrade’s MT5 platform, its zero-commission model and consistent spreads of about 0.9 pips on major currencies were notable. The platform offers a good range of assets in forex, crypto, indices, and commodities, but its execution speed and slippage control were not as advanced as some other top MT5 brokers.

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.4 In tests, Exness' MT5 had tight spreads from 0.0 pips on Raw accounts with $3.50 per side commissions. Execution was fast, even in high volatility, with full access to expert advisors for automated trading.

MT5 Brokers Comparison

Broker Details Comparison

Safety Comparison

Compare how safe the Best MetaTrader 5 Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best MetaTrader 5 Brokers 2026.

Comparison for Beginners

Compare how suitable the Best MetaTrader 5 Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best MetaTrader 5 Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best MetaTrader 5 Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best MetaTrader 5 Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best MetaTrader 5 Brokers 2026.

Broker Popularity

See how popular the Best MetaTrader 5 Brokers 2026 are in terms of number of clients.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

- The in-house Web Trader is a top platform for new traders, featuring a sleek design and over 80 technical indicators for market analysis.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

Cons

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

Why Trade With RoboForex?

RoboForex offers a broad selection of over 12,000 trading markets along with ECN accounts, impressive charting, and loyalty incentives. It is also advantageous for stock traders due to its intuitive R StocksTrader platform, which provides access to over 3,000 shares, lower fees starting at $0.01, and advanced watchlists.

Pros

- The broker provides up to 1:2000 leverage for some accounts, a peak level in the industry. This high leverage lets traders increase their potential gains, but also increases risk.

- The R Stocks Trader platform competes with top platforms like MT4, offering netting and hedging abilities, thorough backtesting, Level II pricing, and a versatile workspace.

- RoboForex won the 'Best Forex Broker 2025' award from DayTrading.com for expanding their FX services, reducing spreads, and increasing availability in multiple countries.

Cons

- RoboForex, despite having many platforms, does not yet support the commonly used cTrader. This can dissuade traders who favor this platform for trading, which is accessible with firms such as Fusion Markets.

- RoboForex offers many account types which, although flexible, can be daunting for new traders to select the most appropriate for their trading preferences. Other platforms like eToro simplify the process with a single retail account option.

- RoboForex now only allows USD and EUR as base currencies. This could lead to conversion fees and inconvenience for traders who prefer managing their accounts in other currencies.

Why Trade With XM?

With a $5 minimum deposit, advanced charting on MT4 and MT5, a growing range of markets, and a Zero account with spreads from 0.0, XM offers what traders need. They have even won our 'Best MT4/MT5 Broker' award recently.

Pros

- In late 2025, XM received a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates, enhancing its regulatory standing and positioning it as a strong choice for traders in the Middle East.

- XM excels in trader education by providing well-organized resources like webinars, tutorials, and live trading sessions via XM Live.

- XM’s Zero account is ideal for trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, without requotes or rejections.

Cons

- XM is lagging because it doesn’t offer cTrader and TradingView, which are now preferred over MetaTrader for their better user interface and charting tools.

- XM is generally trusted and well-regulated but is registered with weak regulators such as FSC Belize. It no longer accepts UK clients, limiting its market reach.

- XM only uses the MetaTrader platforms for desktop trading, offering no in-house downloadable or web-based solutions with unique features for beginners.

Why Trade With AvaTrade?

AvaTrade provides traders with essential tools: an intuitive WebTrader, strong AvaProtect risk management, a quick 5-minute sign-up, and reliable support for fast-paced markets.

Pros

- AvaTrade's support team did well in tests, responding within 3 minutes and providing local support in major regions like the UK, Europe, and the Middle East.

- Years later, AvaTrade is still among the few brokers with a custom risk management tool, AvaProtect, which insures losses up to $1M for a fee and is simple to use on the platform.

- The WebTrader performed well in our tests, featuring an easy-to-use interface for beginners and strong charting tools, including 6 chart layouts and over 60 technical indicators.

Cons

- The AvaSocial app is satisfactory but could be better. Its design, usability, and navigation between strategy providers and account management need improvement to compete with top platforms like eToro.

- While the deposit process is smooth, AvaTrade doesn't support crypto payments, unlike TopFX, which caters to crypto-focused traders.

- Signing up is easy, but AvaTrade doesn't offer an ECN account like Pepperstone or IC Markets, which provides raw spreads and fast execution that many traders want.

Why Trade With Exness?

Exness is an excellent choice for active forex traders aiming to reduce costs after lowering spreads, enhancing execution speeds, and offering trading on over 100 currency pairs with more than 40 account currencies.

Pros

- Competitive spreads for USOIL and BTCUSD in 2024 start from 0 pips, with low commissions from $2 per side.

- Wide variety of account types for all experience levels, including Cent, Pro, and the new Raw Spread, ideal for traders.

- Execution speeds now average under 25ms, providing ideal conditions for short-term traders.

Cons

- Besides a mediocre blog, educational resources are lacking, especially compared to category leaders like IG, which offer a more comprehensive trading journey for new traders.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader are not available yet, despite increasing demand from traders and their integration with other platforms like Pepperstone.

- Exness has increased its variety of CFDs and introduced a copy trading feature, but it still lacks real assets like ETFs, cryptocurrencies, or bonds.

Filters

Methodology

We reviewed a wide range of brokers offering MetaTrader 5 (MT5) across desktop, web, and mobile.

Using hands-on testing and hundreds of data points, we ranked these brokers based on features, functionality, and user experience.

The MT5 brokers listed here represent the top-rated choices from our comprehensive analysis.

What To Look For in an MT5 Broker

Drawing on our team’s years of evaluating MT5 brokers and my personal experience using the platform, these are the key factors to consider:

Trading Costs: Low Spreads and Commissions

Trading costs can eat into your profits, so look for brokers that offer competitive spreads and low commissions.

Pepperstone and Fusion Markets both stood out during testing for their excellent pricing for active traders.

The best brokers for MT5 will also have transparent fee structures, so you know exactly what you’re paying for every trade.

Variety of Tradable Assets

A good MT5 broker offers a wide range of tradable assets.

While its predecessor, MT4, primarily focused on forex, MT5 was built for multi-asset trading. So whether you’re into forex, stocks, precious metals, or cryptocurrencies, having multiple options under one roof is super convenient.

It’s all about giving you flexibility and diversification in your trading.

Regulation and Trustworthiness

You want a broker regulated by a reputable authority, such as ASIC, the FCA, CySEC, or a similar organization.

Regulation ensures your funds are safe and that the broker operates transparently. Always check a broker’s credentials before committing.

I know that top brokers take extra measures to ensure the security of your funds. So, I always look for MT5 brokers that offer segregated accounts, which means your money is kept separate from the broker’s operational funds, reducing the risk in case of financial difficulties.

Execution Speed and Reliability

MT5 is known for its speed, but it’s only as good as the broker’s execution.

Look for brokers with fast execution speeds and minimal slippage, especially if you’re into scalping or high-frequency trading. Nobody wants to miss out on a good trade because of delays.

Leverage Options

Leverage can be a double-edged sword, but it can also amplify your trading power when used wisely.

I’ve discovered that the best MT5 brokers, like Interactive Brokers, IC Markets and IG, offer flexible leverage options tailored to different trading strategies and risk levels.

Just be sure to understand the risks involved – your losses are also amplified.

Customer Support

Even experienced traders hit a snag sometimes. Responsive customer support is key, whether it’s a platform issue or a question about your account.

The best MT5 brokers offer 24/7 support via multiple channels – live chat, email, and phone. AvaTrade excelled during testing here, with average response times of less than three minutes via live chat.

Educational Resources and Tools

Knowledge is power, especially in trading.

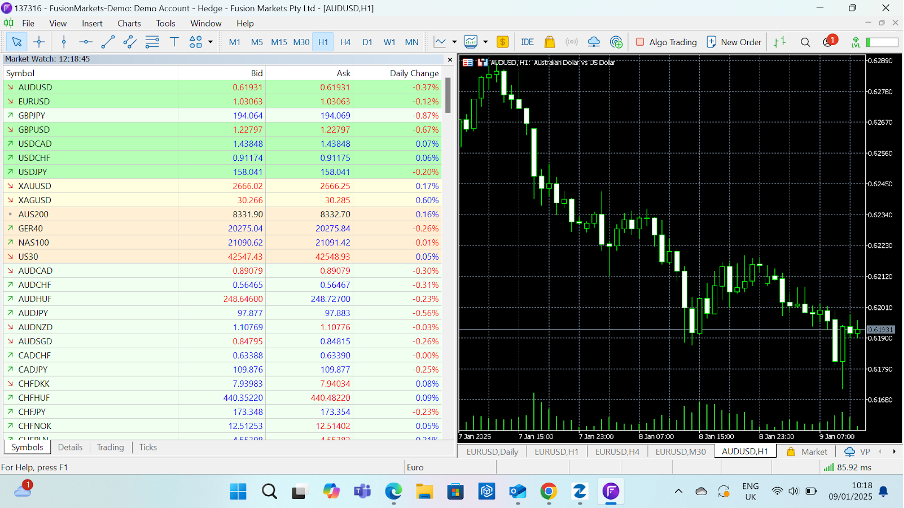

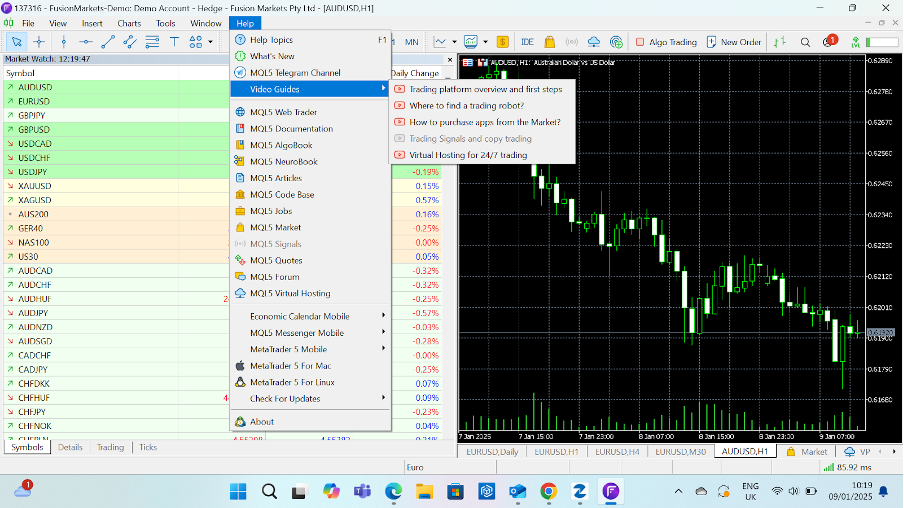

Top MT5 brokers like Fusion Markets often provide a wealth of educational resources like webinars, tutorials, market analysis and even guides and tips to getting the most out of MT5.

These tools can help you sharpen your skills and make informed trading decisions.

Deposit and Withdrawal Flexibility

It is crucial to have a seamless deposit and withdrawal experience. Look for brokers that support multiple payment methods and offer quick processing times.

You’ll find debit cards and wire transfers at most MT5 brokerages, but firms are increasingly offering e-wallets like PayPal and even crypto solutions like Bitcoin transactions.

You want to spend more time trading, not waiting for funds to clear.

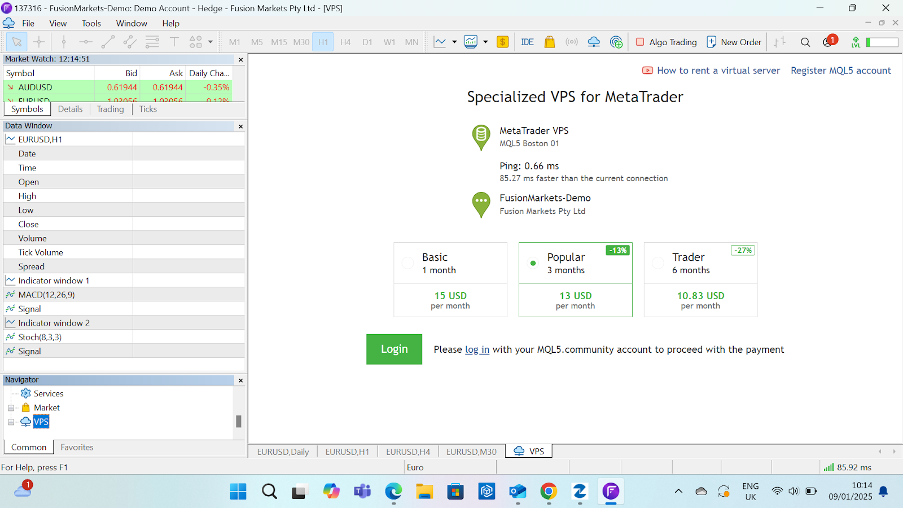

Bonus Features: VPS and Copy Trading

Some MT5 brokers like IC Markets go the extra mile with features like Virtual Private Servers (VPS) for uninterrupted trading or copy trading options where you can mimic the strategies of successful traders.

These extras can enhance your trading experience significantly.

Platform Customization and Add-Ons

MT5 is highly customizable, but some brokers take it a step further by offering tailored plugins or proprietary add-ons.

Admirals enhanced the core MT5 platform with its Supreme Edition package, introducing advanced tools such as the Mini Terminal for seamless trade execution and management, and the Tick Chart Trader, which enables pinpoint accuracy by tracking real-time price fluctuations.

These extras can enhance your trading with better analytics, advanced charting tools, or even bespoke trading signals.

Account Types and Minimum Deposits

Different traders have different needs. The best MT5 brokers offer a variety of account types, catering to beginners, intermediates, and pros.

Look for brokers with flexible minimum deposits, with a growing number of providers we’ve tested having no minimum deposit, so you can start small and scale up as your confidence grows.

Broker Reputation

A broker’s reputation can speak volumes. So, I always suggest traders check out online reviews, forums, and social media for real user feedback.

I know that an MT5 broker who consistently receives praise for reliability, transparency, and customer service is usually a good bet.

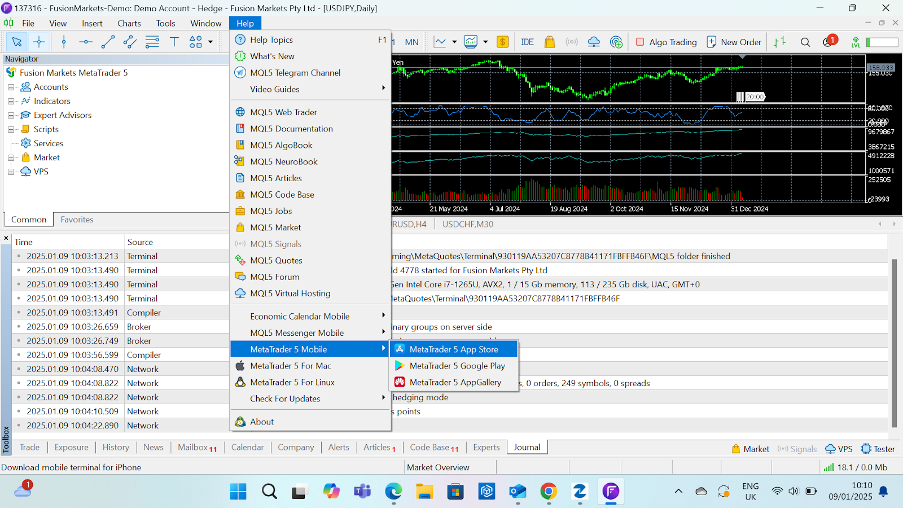

Mobile Trading Experience

In today’s fast-paced world, it is essential to trade on the go. The best MT5 brokers make sure their mobile apps are as robust as their desktop platforms.

Look for a broker that offers a seamless, intuitive mobile trading experience without sacrificing crucial features.

Social Trading Features

Some MT5 brokers integrate social trading into their platforms, allowing you to connect with other traders, share strategies, or follow experienced traders.

This can be particularly beneficial for beginners looking to learn from pros.

Demo Accounts

I’d suggest always testing the waters before committing real money. The top MT5 brokers provide demo accounts with virtual funds, letting you practice and get comfortable with the platform. This is a great way to test your strategies without risking capital.

Most of our recommendations, like Vantage, Trade Nation, and Fusion Markets, offer demos which can be renewed if required.

Risk Management Tools

Managing risk is crucial in trading.

Leading MT5 brokers offer advanced risk management tools, such as stop-loss orders, take-profit orders, and negative balance protection, to help you stay in control and protect your investments.

Market Research and Analysis

Access to top-notch market research and analysis can give you an edge.

Look for brokers that provide daily market updates, expert insights, and comprehensive analysis. These resources can help you make more informed trading decisions.

Bonus Offers

While not a deciding factor, I’ve discovered that promotional offers and bonuses can be a nice perk. Some brokers offer deposit bonuses, cashback, or loyalty programs, which can add value to your trading experience.

Make sure you read the terms and conditions carefully as many, such as those offered by FXCC, IC Markets and OANDA, are time and region-limited.

Multilingual Support

If English isn’t your first language, consider MT5 brokers that offer support in multiple languages. XM is a frontrunner here with multilingual assistance in over 25 languages.

Having customer service and platform information in your native language can make a big difference in your overall experience.

Innovation and Tech Updates

The trading world is constantly evolving, and so should your broker.

The best MT5 brokers stay ahead of the curve by regularly updating their technology, introducing new features, and adapting to market trends. This ensures you always have the latest tools at your disposal.

Consider these factors, and you can find an MT5 broker that aligns with your trading needs and helps you make the most of this powerful platform.

FAQ

Are All MT5 Brokers the Same?

No, our research and direct experience shows MT5 brokers can differ significantly in terms of execution models (STP, ECN, or market maker), trading fees, customer support, and additional tools.

Some brokers offer unique enhancements, such as custom indicators, advanced analytics, or integrated trading tools, which can make a big difference in your trading experience.

Always compare MT5 brokers to find the one that best suits your trading style and needs.