Best Autochartist Brokers 2026

Drawing on our latest tests, these Autochartist brokers stand out for their access to the platform’s real-time scanning, automated pattern recognition, and comprehensive analytics.

-

1OANDA is a well-known broker that excels in quick trade executions, a low deposit requirement, and impressive charting and trading platform functions. The highly-regarded brand has over 25 years of expertise and is overseen by reliable authorities like the NFA/CFTC. It provides 24/7 support for traders and offers flexible contract sizes with automated trade executions.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.2 IC Trading, a component of the larger IC Markets group, is designed for high-level traders. It offers favorable spreads, dependable order execution, and sophisticated trading instruments. However, it's registered in Mauritius, an offshore financial center with limited regulation, which allows it to provide high leverage. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 Pepperstone, established in Australia in 2010, is a highly-regarded forex and CFD broker serving more than 400,000 international clients. It provides access to over 1,300 instruments through leading trading platforms such as MT4, MT5, cTrader, and TradingView, while keeping fees relatively low and transparent. The company is regulated by known authorities including FCA, ASIC, and CySEC, offering a safe trading environment for all. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.7 BlackBull, based in New Zealand, is a CFD broker offering trading on over 26,000 instruments. After a 2023 rebrand, it now features a modern design with advanced trading tools and execution speeds averaging 20ms. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.8 Spreadex is a broker regulated by the FCA which provides opportunities for spread betting on more than 10,000 CFD instruments. This includes 60 forex pairs. Traders can also take short-term positions on sports events. With over 20 years of experience, the brand has earned several awards.

Top Brokers With Autochartist Comparison

Safety Comparison

Compare how safe the Best Autochartist Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Autochartist Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Autochartist Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Autochartist Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Autochartist Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Autochartist Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Autochartist Brokers 2026.

Broker Popularity

See how popular the Best Autochartist Brokers [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Pepperstone |

|

| IC Trading |

|

| Spreadex |

|

Why Trade With OANDA US?

OANDA is a reputable broker for US traders. It offers user-friendly tools for analysis and a simple sign-up process. It is very trustworthy due to heavy regulation.

Pros

- The broker provides clear pricing without any concealed fees.

- The OANDA web platform offers an exceptional charting environment with over 65 technical indicators provided by TradingView.

- You can start trading as a beginner with no minimum initial deposit required.

Cons

- Few payment options are available and e-wallets are not supported.

- Customer support is not accessible during weekends.

- The trading markets are limited to only forex and cryptocurrencies.

Why Trade With IC Trading?

IC Trading's fast execution speeds, strong liquidity, and advanced charting software provide an ideal environment for scalpers, traders, and algorithmic traders.

Pros

- The digital account opening process is efficient, enabling traders to quickly start trading without a lot of paperwork. The process takes only a few minutes in testing.

- IC Trading offers leading spreads, such as 0.0-pip spreads on major currencies like EUR/USD. This makes it suitable for traders.

- IC Trading provides great flexibility with its accounts. Traders can operate up to 10 live and 20 demo accounts, allowing them to have distinct profiles for varied activities like manual and algo trading.

Cons

- The educational resources need enhancement, particularly for beginners who seek a thorough learning experience, contrasted to top-ranking platforms like eToro. This issue is lessened if you visit the IC Markets website, but it can present a challenge for traders.

- During testing, customer support was disappointing. Multiple attempts to reach out through live chat were unsuccessful and emails went unanswered. This raises concerns about their capacity to handle urgent trading issues.

- IC Trading, unlike IC Markets, doesn't offer social trading options via its IC Social app or the ZuluTrade third-party platform.

Why Trade With Pepperstone?

Pepperstone is a leading choice for trading with low spreads, quick execution, and advanced charting for experienced traders. New traders benefit from no minimum deposit, a wealth of educational resources, and 24/7 support. Operating under ASIC regulation, Pepperstone is a top option for Australian traders and won DayTrading.com's 'Best Aus Broker' award for 2025.

Pros

- Pepperstone is a low-cost broker, ideal for serious traders. The Razor account offers spreads from 0.0, with rebates up to 30% for indices and commodities, and $3 per lot for forex through the Active Trader program.

- Pepperstone provides impressive transaction completion speeds, averaging about 30ms. This allows for quick order processing and execution, making it suitable for traders.

- Pepperstone now offers spread betting via TradingView, enabling tax-efficient trading with sophisticated analysis tools.

Cons

- Pepperstone does not support cTrader Copy, a popular feature in the cTrader platform available at alternatives like IC Markets, though it has launched an intuitive copy trading app.

- Pepperstone's demo accounts last for 30 days. This might be insufficient for learning the various platforms and testing trading strategies.

- Despite expanding its market range, crypto options are limited compared to other brokers in this area, and there is no option to invest in actual coins.

Why Trade With BlackBull?

After upgrading its trading infrastructure with Equinix servers in New York, London, and Tokyo to reduce latency for traders, BlackBull is a top choice for trading stock CFDs with ECN pricing.

Pros

- BlackBull offers three ECN-powered accounts—Standard, Prime, and Institutional—catering to beginners, experienced traders, and professionals with flexibility for trading needs and capital requirements.

- BlackBull's updated ECN Prime account is now better suited for new traders. It offers improved spreads averaging 0.16 on EUR/USD and has removed the previous $2,000 minimum deposit, making it more accessible with a $0 deposit.

- BlackBull has partnered with ZuluTrade and Myfxbook, enhanced its own CopyTrader, and enabled cTrader Copy, offering a comprehensive trading experience.

Cons

- Unlike most top brokers, BlackBull charges a $5 withdrawal fee, which can reduce cost-effectiveness, especially for active traders who often transfer funds.

- Despite having over 26,000 assets, including new Asia Pacific indices, the selection primarily consists of stocks, with an average range of currency pairs and indices.

- BlackBull doesn't have its own platform and uses MetaTrader, cTrader, and TradingView. Though these are excellent, other brokers' platforms, like eToro’s, often offer unique features for beginner traders.

Why Trade With Spreadex?

Spreadex is fitting for UK traders intrigued by spread betting on financial markets and placing conventional sports bets. Charges are minimal for short trades and gains from spread bets are tax-exempt. There's an effective proprietary charting platform available, and no deposit is needed to begin.

Pros

- Spreadex allows US traders to earn tax-free earnings from spread betting.

- There's a great variety of tools and methods available for short-term traders.

- The broker provides a user-friendly, self-developed charting platform and mobile application for trading.

Cons

- Potential clients may be disappointed by the absence of a demo account to try out Spreadex's trading services.

- Third-party digital wallets are not accepted for transactions.

- The proprietary terminal doesn't have the extensive charting features found in platforms such as MT4 and MT5.

Filters

Methodology

We conducted an in-depth analysis of online brokers offering access to Autochartist’s advanced market scanning and analysis tools.

By evaluating 200+ data points and performing hands-on tests, we rated these brokers based on key factors, from the integration of Autochartist to trading conditions and user experience.

The brokers listed here are ranked by their highest overall scores from our comprehensive review.

What To Look For in a Broker With Autochartist

Looking for the top brokers for Autochartist involves looking beyond the tool’s availability. It’s about how well the broker integrates into the trading platform, the range of features provided, the quality of support, and the educational resources offered.

Let’s explore the critical features that make some brokers stand out:

Seamless Integration

A top-tier broker integrates Autochartist directly into their trading platform (like MT4, MT5, or proprietary platforms), eliminating the need for external logins or separate software.

Benefits:

- Convenience: Access Autochartist tools within the trading platform.

- Efficiency: No need to switch between different applications, which can save time and streamline trading.

Expert take: I always look for brokers like Pepperstone that offer Autochartist alerts as part of their platform rather than a separate service. This ensures a smoother, more efficient trading experience.

Customizable Alerts

Custom alerts are vital for tailoring the Autochartist experience to your trading style. The best brokers let you set up alerts based on your specific criteria, whether it’s certain chart patterns, volatility levels, or price movements.

Benefits:

- Personalisation: Receive alerts that match your trading preferences.

- Timely Opportunities: Never miss out on potential trades aligned with your strategy.

Expert take: Customizable alerts are a lifesaver. They help me stay on top of potential trades without constantly monitoring the market.

For example, Autochartist alerts on FOREX.com notify you via email, push, or platform messages about specific price levels or patterns.

Full Feature Access

The best brokers don’t limit your access to Autochartist’s tools. They provide the complete package, from chart pattern recognition to volatility analysis and risk management tools.

Benefits:

- Comprehensive Analysis: Utilize all Autochartist tools for a well-rounded market analysis.

- Advanced Insights: Gain deeper market insights with features like volatility analysis and key level identification.

Expert take: I make sure the broker doesn’t skimp on Autochartist’s features. Full access means more tools at my disposal for smarter trading.

Take Axi, for instance, during testing we appreciated the breadth of Autochartist tools available: automated analysis of support, resistance, chart patterns, and volatility, real-time market insights, and customizable alerts.

Educational Resources

Trading with tools like Autochartist can be more effective if you understand how to leverage them fully. The best brokers offer tutorials, webinars, and guides to help you master Autochartist.

Benefits:

- Enhanced Learning: Learn how to maximize Autochartist’s potential.

- Improved Strategy: Apply your knowledge to develop more effective trading strategies.

Tip: A broker that offers educational resources alongside Autochartist is investing in your success. Knowledge is power in trading.

Blackbull impressed in this department during testing, featuring a collection of articles with tips on setting up Autochartist.

Dedicated Support

Technical support can be crucial, especially when dealing with advanced tools like Autochartist. The top providers have dedicated support teams to assist you with any issues or questions related to Autochartist.

Benefits:

- Quick Resolutions: Get timely help with any problems, reducing downtime.

- Expert Advice: Access to experts who can provide insights and tips on using Autochartist effectively.

The customer support at OANDA stands above most brokers with Autochartist. We’ve personally used it various times stretching back to 2018 and always get fast, reliable assistance with response times on live chat coming in under three minutes.

FAQ

What is Autochartist?

Autochartist is a tool that helps traders by providing signals based on financial data.

Typically provided through plugins for brokers’ trading platforms, it offers several features, notably:

- Automated Chart Pattern Recognition: Automatically identifies trading patterns like triangles, wedges, and Fibonacci patterns.

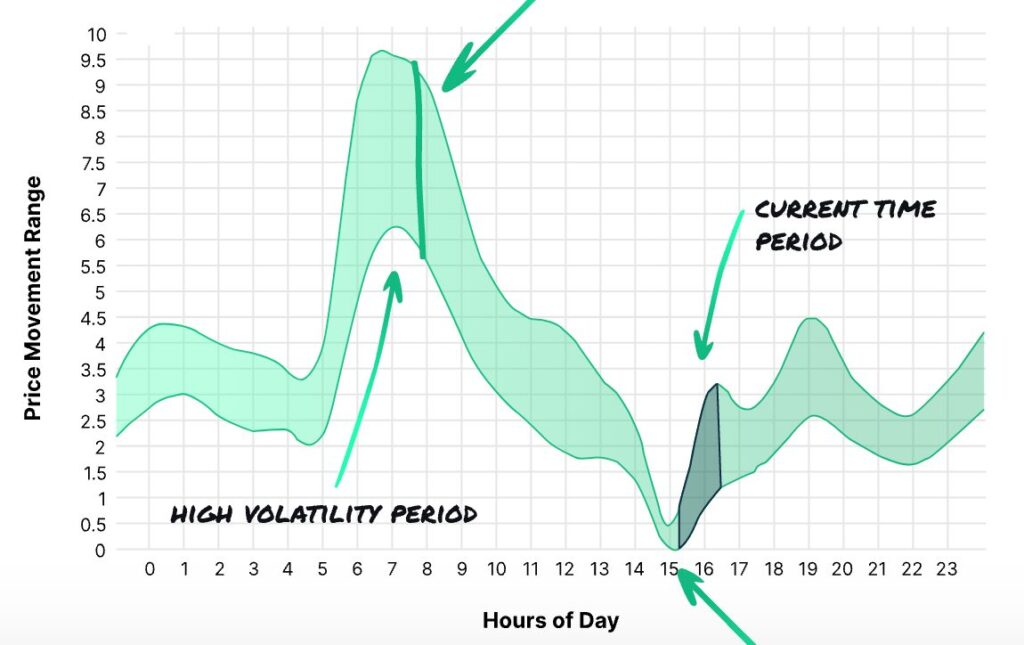

- Volatility Analysis: Offers insights into market volatility, helping you anticipate price movements.

- Customizable Trade Alerts: Notify you when potential trade opportunities align with your predefined parameters.

- Risk Management Tools: Assists in assessing risk-reward scenarios before executing trades.

Do I Need Autochartist?

Autochartist could elevate your trading experience if you’re looking for a tool that filters out noise to help focus on high-probability trading setups.

Its core benefits include:

- Increased Trade Accuracy: With Autochartist’s precise pattern recognition and a broker offering real-time data, your trade entries and exits can become more accurate, potentially boosting your profitability.

- Time-Saving Automation: Autochartist automates market scanning, saving traders countless hours of manual analysis.

- Enhanced Risk Management: Brokers using Autochartist help traders manage their risk better by providing risk management tools like projected price ranges and volatility analysis.

- Reduced Emotional Trading: Automated pattern recognition helps reduce the emotional aspect of trading, leading to more disciplined decision-making.