Best Trading Central Brokers 2026

Based on our hands-on tests, these Trading Central brokers are a cut above the rest if you want the software’s comprehensive toolkit complete with automated analysis, pattern recognition and fundamental insights.

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Firstrade is a US-based discount broker-dealer authorized by the SEC and a member of FINRA/SIPC. It offers welcome bonuses, advanced tools and apps, and commission-free trading. Firstrade Securities is a popular top online brokerage, and opening a new account is fast and simple. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 Established in 2008, Exness is a respected broker known for offering over 40 account currencies, a wide choice of CFD instruments, and an intuitive web platform with features like currency converters and trading calculators. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 IC Markets is a renowned forex and CFD broker recognized for its high-quality pricing, extensive range of trading tools, and superior trading technology. Established in 2007 in Australia, it operates under the oversight of ASIC, CySEC, and FSA. It has drawn in over 180,000 traders from across 200 countries. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 XM is a global forex and CFD broker with over 15 million clients in more than 190 countries. Since 2009, it has offered low trading fees on over 1000 instruments. The broker is well-regulated by authorities such as ASIC, CySEC, DFSA, and SCA in the UAE, and provides a full MetaTrader experience.

Top Brokers With Trading Central Comparison

Safety Comparison

Compare how safe the Best Trading Central Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Trading Central Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Trading Central Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Trading Central Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Trading Central Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Trading Central Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Trading Central Brokers 2026.

Broker Popularity

See how popular the Best Trading Central Brokers 2026 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| XM |

|

| Interactive Brokers |

|

| Exness |

|

| IC Markets |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- The TWS platform is designed for intermediate to advanced traders. It includes over 100 order types and a dependable real-time market data feed that rarely experiences downtime.

- Interactive Brokers was named Best US Broker for 2025 by DayTrading.com for its dedication to US traders, ultra-low margin rates, and affordable global market access.

- There's a large selection of free or paid research subscriptions available to all traders. If you subscribe to Toggle AI, you will also receive commission refunds from IBKR.

Cons

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

Why Trade With Firstrade?

Firstrade is ideal for beginners wanting to trade US stocks without commission fees. It offers plenty of free educational resources and high-quality research, including its new FirstradeGPT tool. Users also get trading ideas from Morningstar, Briefing.com, Zacks, and Benzinga.

Pros

- FirstradeGPT ranks among the initial brokers to offer AI-powered analysis.

- Improved stock trading features now include overnight trading and fractional shares.

- In 2025, Firstrade Invest 3.0 will enhance the platform with a cleaner interface and faster order entry, benefiting active traders in key areas such as watchlists and options chains.

Cons

- Firstrade emphasizes stocks and lacks forex options, reducing diversification opportunities.

- Visa card deposits and withdrawals are not accepted.

- Customer support needs improvement after testing, with no 24/7 help available.

Why Trade With Exness?

Exness is an excellent choice for active forex traders aiming to reduce costs after lowering spreads, enhancing execution speeds, and offering trading on over 100 currency pairs with more than 40 account currencies.

Pros

- Competitive spreads for USOIL and BTCUSD in 2024 start from 0 pips, with low commissions from $2 per side.

- Fast and reliable 24/7 multilingual customer support through phone, email, and live chat, validated by practical tests.

- Wide variety of account types for all experience levels, including Cent, Pro, and the new Raw Spread, ideal for traders.

Cons

- Besides a mediocre blog, educational resources are lacking, especially compared to category leaders like IG, which offer a more comprehensive trading journey for new traders.

- Retail trading services are not available in some areas, including the US, UK, and EU, making them less accessible compared to leading brokers like Interactive Brokers.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader are not available yet, despite increasing demand from traders and their integration with other platforms like Pepperstone.

Why Trade With IC Markets?

IC Markets provides excellent prices, quick execution, and smooth deposits. The utilization of sophisticated charting platforms such as TradingView and the Raw Trader Plus account makes it a preferred choice for intermediate to advanced traders.

Pros

- IC Markets won DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its top-notch MetaTrader integration, perfected over years to enhance the platform experience.

- You can trade more than 2,250 CFDs in various markets, such as forex, commodities, indices, stocks, bonds, and cryptocurrencies. This range enables varied trading strategies.

- IC Markets, a well-regulated and respected broker, emphasizes client security and transparency for a trustworthy global trading experience.

Cons

- IC Markets have a selection of metals and cryptos for trading through CFDs, but their range is not as wide as brokers such as eToro. This may limit options for traders who are interested in these asset types.

- Some withdrawal methods require fees such as a $20 wire charge. This can reduce profits, particularly for traders who withdraw frequently.

- Despite having four top-tier third-party platforms, there is no in-house software or trading app specifically designed for new traders.

Why Trade With XM?

With a $5 minimum deposit, advanced charting on MT4 and MT5, a growing range of markets, and a Zero account with spreads from 0.0, XM offers what traders need. They have even won our 'Best MT4/MT5 Broker' award recently.

Pros

- XM’s Zero account is ideal for trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, without requotes or rejections.

- XM excels in trader education by providing well-organized resources like webinars, tutorials, and live trading sessions via XM Live.

- In late 2025, XM received a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates, enhancing its regulatory standing and positioning it as a strong choice for traders in the Middle East.

Cons

- The XM app is user-friendly and offers unique copy trading products, but its technical analysis tools need enhancement for advanced traders.

- XM is lagging because it doesn’t offer cTrader and TradingView, which are now preferred over MetaTrader for their better user interface and charting tools.

- XM only uses the MetaTrader platforms for desktop trading, offering no in-house downloadable or web-based solutions with unique features for beginners.

Filters

Methodology

We analyzed our evolving directory of online brokers that offer access to Trading Central’s research and analysis tools.

Through hands-on testing and evaluating key data points, we scored these brokers based on their performance, user experience, and overall trading conditions.

The Trading Central brokers listed here are sorted by the highest overall ratings from our in-depth analysis.

What To Look For in a Broker With Trading Central

Choosing a broker that excels in the areas below will help set you up for a rewarding trading experience with Trading Central.

Let’s explore what sets the best brokers apart when offering Trading Central to help you find the right fit for your needs:

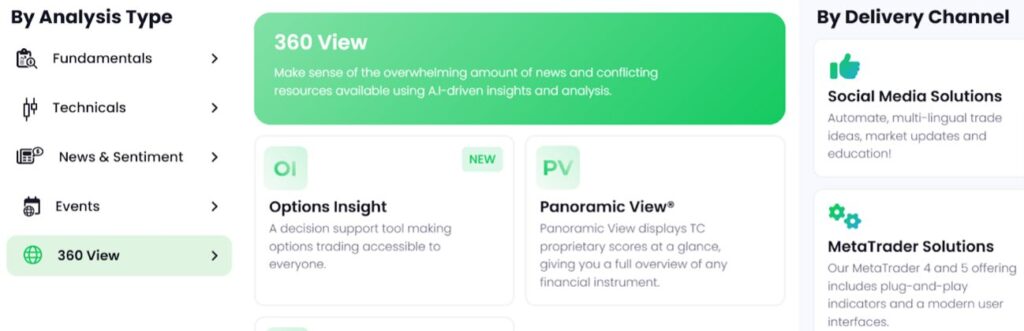

Comprehensive Access to Trading Central Features

When choosing a broker, ensure they provide full access to Trading Central’s suite of tools. This includes everything from:

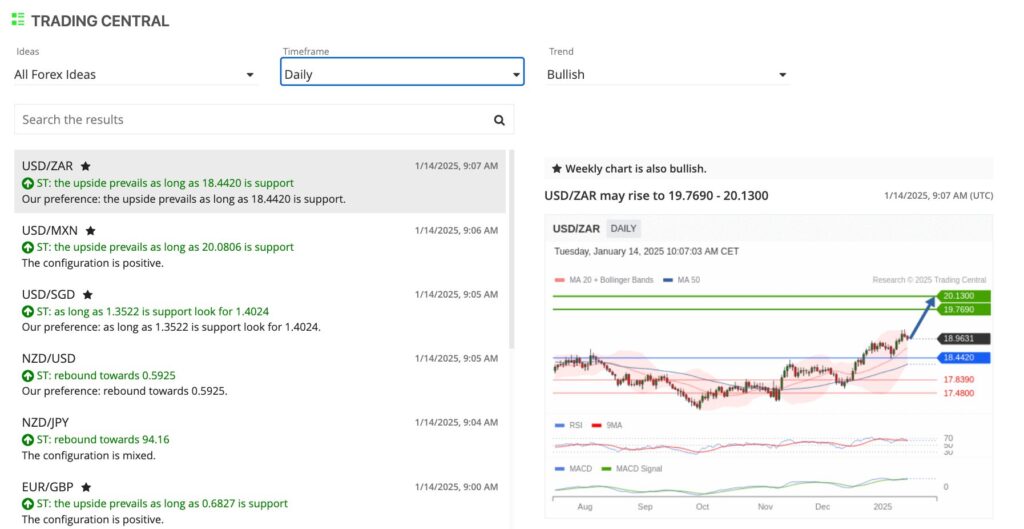

- Technical Analysis: Look for brokers that offer detailed technical insights, complete with charts and trend lines.

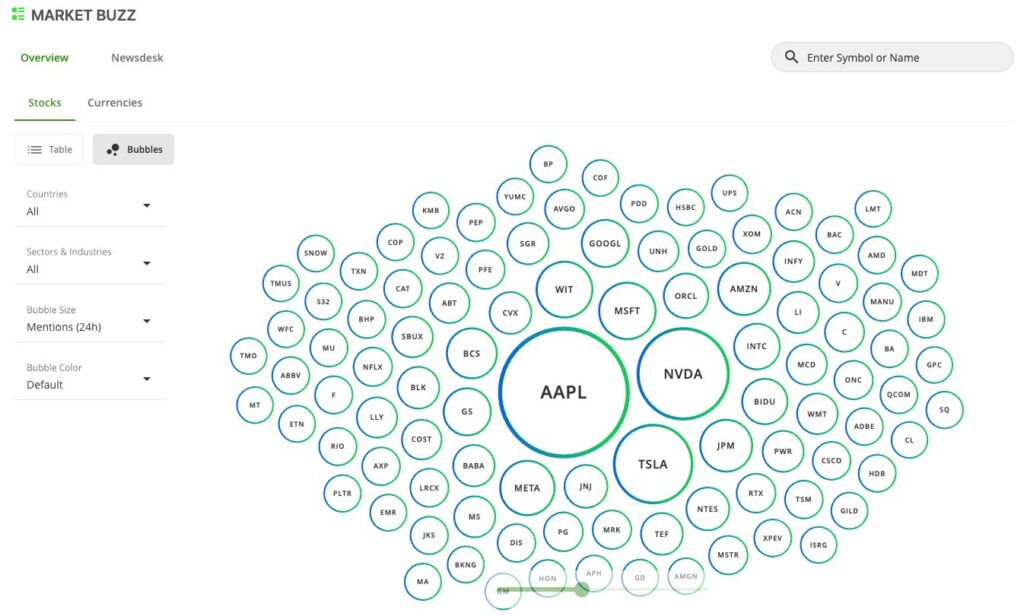

- Sentiment Analysis: Access to market sentiment tools is crucial for understanding broader market trends.

- Automated Trade Ideas: Brokers should offer a seamless integration of trade ideas that align with your trading strategy.

Ease of Integration and User Experience

A seamless user experience is key. The best brokers will offer a smooth integration of Trading Central directly into their platforms. Look for:

- User-Friendly Interface: Platforms should simplify accessing Trading Central’s tools without unnecessary steps.

- Mobile Access: Top brokers ensure Trading Central is just as accessible on mobile apps as on desktops.

Expert take: I’ve discovered that brokers prioritizing ease of use help us traders focus more on strategy and less on navigating the platform.

For example, you can navigate to Trading Central through IC Markets in three clicks on the left-hand menu once logged in to your account.

Educational Resources and Support

Trading Central is packed with features, but it can be overwhelming for beginners. That’s why educational resources are crucial. The top providers offer:

- Tutorials and Guides: Detailed walkthroughs on how to use Trading Central effectively.

- Webinars and Support: Regular webinars and responsive customer support to help you get the most out of the tools.

Cost and Value for Money

While some brokers offer Trading Central for free, others may charge a premium. It’s essential to weigh the costs against the value provided. Consider:

- Free Access or Premium Add-Ons: Most brokers we’ve tested include Trading Central in their standard packages, while others may offer it as a premium service.

- Value-Added Features: Look for brokers that provide additional benefits, such as exclusive insights or enhanced customer support.

Expert take: I’d always choose a broker that offers Trading Central at no extra cost as it can significantly enhance your trading without breaking the bank.

FOREX.com is one of the cheapest brokers for Trading Central that we’ve evaluated, featuring spreads from 0.0 pips on the EUR/USD with a low $5 commission per $100k if you opt for their Raw Spread account.

Regulation and Trustworthiness

Never compromise on regulation. The best brokers are regulated by top-tier financial authorities like the FCA in the UK, ASIC in Australia, and SEC in the US, and have a strong reputation. This ensures:

- Security of Funds: Your investments are protected in the event of brokerage insolvency.

- Reliable Market Access: Trustworthy brokers provide accurate and timely market data.

Interactive Brokers is the most trusted Trading Central broker based on our assessments. It’s 100% legit with 20+ years of industry experience and authorization from seven tier-one regulators, including the FCA and SEC.

Customizable Trading Strategies

Top brokers often allow traders to customize and implement their own strategies using Trading Central’s tools. This includes:

- Strategy Builders: Tools to create and backtest your trading strategies.

- Custom Indicators: Develop indicators tailored to your trading style.

- Automated Execution: Some brokers offer automated trading based on Trading Central’s signals.

Expert take: Over the years, the ability to customize strategies and automate trades through Trading Central has significantly enhanced my efficiency and effectiveness.

Real-Time Alerts and Notifications

Staying updated with the latest market movements is crucial for successful trading. The best brokers integrate Trading Central’s real-time alerts and notifications to keep you informed.

- Customizable Alerts: Set alerts for specific market conditions or price movements.

- Push Notifications: Get instant updates on your mobile or desktop so you never miss an opportunity.

Multi-Asset Coverage

Trading Central isn’t limited to just one market or asset class. Top brokers provide extensive coverage across multiple assets, including:

- Forex: Comprehensive analysis of major and minor currency pairs.

- Equities: Insights into stocks and indices across global markets.

- Commodities and Cryptocurrencies: Detailed analysis and trade ideas for commodities like gold, oil, and popular cryptocurrencies.

Tip: Multi-asset coverage allows you to diversify portfolios and capitalize on opportunities across various markets. eToro scores well here, with a growing suite of 6,000+ instruments catering to active traders through to passive investors.

Advanced Charting Tools

Advanced charting tools are a must for traders who rely on technical analysis, such as many short-term traders.

The best brokers enhance Trading Central’s offerings with robust charting capabilities, such as:

- Interactive Charts: Zoom in on specific timeframes and customize indicators.

- Multiple Chart Types: Access to candlesticks, bars, line charts, and more.

- Overlay Indicators: Use multiple indicators simultaneously for deeper insights.

Sentiment Indicators

Understanding market sentiment can be a game-changer. The best brokers ensure you have access to sentiment indicators from Trading Central, which show:

- Bullish or Bearish Trends: Gauge the general mood of the market.

- Volume Trends: Analyse trading volumes to confirm market sentiment.

Expert take: Sentiment indicators give traders like us a psychological edge, helping us to anticipate market reactions and adjust our positions accordingly.

FAQ

What is Trading Central?

Trading Central is a leading provider of investment research and financial market insights. It combines human expertise with advanced algorithms to offer:

- Technical Analysis: Real-time analysis of market trends.

- Market Sentiment: Insights into market movements.

- Trade Ideas: Actionable recommendations based on technical data.

With the sheer volume of financial information available publicly available increasing over the years, we’ve observed a growing demand for tools like Trading Central which help digest complex data to inform trading decisions.

Do You Have to Pay to Use Trading Central?

Individual investors can’t buy Trading Central tools directly. However, most of the global brokers featured in this guide offer these services at no extra cost.