Best Brokers For Trading Commodities 2026

We’ve listed the top commodity brokers after personally evaluating platforms in every area that’s important when trading commodities.

-

1

Interactive Brokers offers exceptional market access and high-quality execution for commodities. The spreads are very tight, especially for gold and energy futures, with commissions starting at $0.85 per contract. Slippage is minimal, and the Trader Workstation platform provides excellent control, analytics, and real-time data.

Interactive Brokers Commodity Trading

Interactive Brokers offers trading of 8 commodities:

Aluminium, Gold, Lead, Lean Hogs, Natural Gas, Precious Metals, Soybeans, Zinc

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 When we tested NinjaTrader for commodities, it provided nearly unmatched execution speed and transparency with direct futures market access. Spreads vary with the underlying futures, but commission rates were competitive at about $0.09 per side. The platform performs well on desktop, offering detailed market views and advanced order flow tools, ideal for precision trading.

NinjaTrader Commodity Trading

NinjaTrader offers trading of 4 commodities:

Copper, Gold, Oil, Silver

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 In our test of Plus500 US, we found its commodities trading very user-friendly, especially on mobile. Execution was quick and reliable, with no slippage on assets like gold and oil. Spreads began at 0.06, and the platform's clear interface, built-in sentiment tools, and 24/7 alerts provided a smooth, beginner-friendly experience.

Plus500US Commodity Trading

Plus500US offers trading of 10 commodities:

Copper, Corn, Gold, Livestock, Natural Gas, Oil, Platinum, Silver, Soybeans, Wheat

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 In our tests, FOREX.com provided a variety of commodities with quick execution and spreads starting at 0.04 on gold. With leverage limited to 1:200, we were impressed by fill reliability and minimal slippage during active U.S. session hours. The web and mobile platforms were strong, and the built-in research tools for energy and metal markets were valuable for short-term traders.

FOREX.com Commodity Trading

FOREX.com offers trading of 13 commodities:

Cattle, Coffee, Cotton, Gold, Lean Hogs, Livestock, Natural Gas, Oil, Orange Juice, Silver, Soybeans, Sugar, Wheat

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.0 InstaTrade provides a strong offering in metals and commodities with zero-spread accounts and low commissions. Execution was fast, with no hidden fees for active traders.

InstaTrade Commodity Trading

InstaTrade offers trading of 16 commodities:

Cocoa, Copper, Corn, Cotton, Gasoline, Gold, Livestock, Natural Gas, Oil, Orange Juice, Palladium, Platinum, Silver, Soybeans, Sugar, Wheat

Compare The Best Brokers For Trading Commodities Across Key Features

We thoroughly reviewed top-rated commodity trading platforms - here’s how they stack up on the features that matter most:

How Secure Are The Top Commodity Brokers?

Security is crucial when trading hard and soft commodities. Here’s how the best brokers protect your funds:

Top Mobile Apps For Commodity Trading

Prefer trading commodity markets on the go? Here's how the top providers performed in our hands-on mobile tests:

Are The Top Commodity Brokers Good For Beginners?

Just getting into commodities? These brokers offer the tools and support to help you start:

Are The Top Commodity Brokers Good For Advanced Traders?

Here's how the top brokers serve professional-level commodity traders:

Accounts Comparison

Compare the trading accounts offered by Best Brokers For Trading Commodities 2026.

Detailed Ratings: Best Brokers For Commodities

See how each commodity broker scored in our detailed ratings system:

Fees & Spreads Comparison

We compared pricing structures to highlight which brokers offer competitive spreads and low trading fees:

Which Top Commodity Trading Brokers Are Most Popular?

Looking for where most commodity traders go? These brokers are attracting the most clients:

| Broker | Popularity |

|---|---|

| Plus500US |

|

| InstaTrade |

|

| Interactive Brokers |

|

| NinjaTrader |

|

| FOREX.com |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- There's a large selection of free or paid research subscriptions available to all traders. If you subscribe to Toggle AI, you will also receive commission refunds from IBKR.

- The TWS platform is designed for intermediate to advanced traders. It includes over 100 order types and a dependable real-time market data feed that rarely experiences downtime.

- The new IBKR Desktop platform combines the advantages of TWS and adds unique tools like Option Lattice and Screeners with MultiSort to make trading accessible and impressive for traders of all levels.

Cons

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- Low costs, with $50 trading margins and commissions starting at $.09 per micro contract.

- NinjaTrader is a well-regarded and acclaimed futures broker, approved by the NFA and CFTC.

- NinjaTrader provides detailed charting software for active traders, complete with custom technical indicators and widgets.

Cons

- Some payment methods require a withdrawal fee.

- The advanced trading tools require an additional fee.

- You need to register with partner brokers to trade in securities other than forex and futures.

Why Trade With Plus500US?

Plus500US is an excellent choice for beginners, offering a user-friendly platform, low trading margins, and access to the Futures Academy to improve trading skills. Its powerful tools and reliable service earned it second place in DayTrading.com's annual 'Best US Broker' award.

Pros

- The account setup, pricing structure, and web platform make futures trading simpler than competitors like NinjaTrader.

- The Futures Academy is a useful resource for beginner traders due to its captivating videos and simple articles. Its unrestricted demo account is also beneficial for practicing trading strategies.

- Plus500 included prediction markets in its 'Plus500 Futures' platform in February 2026. This addition offers event-based trades in 10 categories, such as financials and politics, and includes short-term intraday contracts expiring in 15 minutes.

Cons

- Plus500US is expanding its investment options, but it currently only offers around 50+ futures and no stocks.

- Plus500US lacks social trading features, unlike competitors such as eToro US, which might enhance its appeal to aspiring traders.

- Plus500US offers competitive pricing but does not have a discount program for high-volume traders, unlike brokers like Interactive Brokers.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

- The in-house Web Trader is a top platform for new traders, featuring a sleek design and over 80 technical indicators for market analysis.

Cons

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

Why Trade With InstaTrade?

InstaTrade provides active trading on an extensive platform. It has a unique offering known as Fixed Income Structured Product (FISP), which allows for passive investment. Investors can potentially earn up to a 50% return within 6 months, provided certain conditions are fulfilled.

Pros

- VPS hosting is suitable for algorithmic trading strategies. It uses a dedicated server to offer quick execution speeds, potentially as fast as 9 milliseconds.

- InstaTrade provides approximately 300 assets for investment. It particularly shines in the area of currency pairs, making it an excellent platform for experienced traders interested in volatile exotics.

- InstaTrade provides a high-quality range of charting tools for traders. Its web trader includes over 250 indicators, 11 types of charts and a design that's easy to use.

Cons

- InstaTrade's website and client interfaces are quite complex which can be confusing for new traders. On the other hand, XTB offers a more straightforward and user-friendly trading experience.

- The advertising of FISP, specifically about its "profit guarantee" and "risk-free trading," creates unease.

- InstaTrade is registered in the British Virgin Islands, providing minimal regulatory protections for retail traders.

Filters

How We Selected the Best Commodity Brokers

To create these rankings, we focused on brokers offering reliable access to a wide range of commodities — including energies, metals, and agricultural markets — via instruments like CFDs, futures, and spot contracts.

We used our in-house methodology to assess each broker across 200+ data points, including trading costs, regulation, usability, platform features, and execution.

Crucially, we also tested each platform ourselves to assess how they perform for commodity traders.

Find The Top Brokers By Specific Commodities

Explore the best online brokers by individual commodities below.

Precious Metals

Gold

Silver

Platinum

Palladium

Precious Metals

Industrial Metals

Aluminium

Copper

Iron

Lead

Lithium

Nickel

Steel

Zinc

Energy

Soft Commodities

Cocoa

Coffee

Cotton

Orange Juice

Sugar

Agricultural Commodities

Livestock

Other

What To Look For In a Commodities Broker

The top commodities brokers share key traits:

Market Access: How Far Can Your Broker Take You?

When you’re trading commodities, the first and most important question is: where can your broker get you access to trade? It sounds basic, but it’s not something to gloss over.

Ideally, you want a broker that gives you direct access to major commodity exchanges like the London Metal Exchange (LME), the Chicago Mercantile Exchange (CME), and Intercontinental Exchange (ICE). These are the global heavyweights – if you’re trading things like copper, oil, gold, or agricultural futures, this is where the action happens.

But not every broker offers direct market access. Some only offer synthetic trading products like Contracts for Difference (CFDs) or Exchange-Traded Funds (ETFs). That’s fine if you’re looking for convenience, leverage, or simplicity, but it’s crucial to know what you’re signing up for.

On top of that, make sure the broker clearly outlines what markets you’re getting. Are they just offering a few softs or metals CFDs? Or do they go deep, covering energy, livestock, grains, and precious metals across global exchanges?

Top Pick: When it comes to giving traders access to a truly wide range of commodity markets, CMC Markets stood out in our testing.

They offer a comprehensive selection of commodity CFDs, covering energy sources like crude oil and natural gas, metals such as gold, silver, and copper, as well as agricultural products like cocoa and sugar.

And while it’s true that they don’t offer direct futures trading via the LME or CME, their CFD range closely mirrors these markets, and their pricing and liquidity are among the best we’ve seen for retail access.

CMC Markets platform crude oil cash CFD chart

Specific Research and Insights: More Than Just a Price Chart

If you’re serious about trading commodities, you already know that it’s not just about the ticker price – it’s about the bigger story behind that price.

Whether you’re trading copper, coffee, or crude oil, what moves the market isn’t just supply and demand on paper – it’s real-world stuff like electric vehicle battery demand, mining disruptions, bad weather in Brazil, or political instability in major producing countries.

That’s why we always look for brokers that go beyond the basics and offer genuinely helpful, commodity-specific research and insights. We’re talking about analysis that dives into supply chain dynamics, like new lithium mine approvals, weather patterns that could impact wheat harvests, or geopolitical tensions that affect oil exports from the Middle East or metal output from South America.

Top Pick: When it comes to quality research that’s relevant to commodity traders, XTB impressed us the most. Their in-house team consistently puts out detailed market commentary, with a sharp focus on real-world factors that drive commodity prices.

For example, during our testing, we found updates that explored the impact of drought conditions on soybean futures, as well as the influence of surging electric vehicle demand on lithium and cobalt markets. That’s precisely the kind of contextual insight that gives traders an edge.

XTB’s x-Station platform also features video updates, technical analysis, and macroeconomic breakdowns that tie directly into commodity markets. Whether it’s mining activity in Chile or OPEC’s latest move, they don’t just report it – they explain why it matters to traders like us.

Execution Speed and Reliability: When Every Second Counts

Commodity markets can be ruthless. Prices can spike or drop in seconds – whether it’s a surprise inventory report from the United States Department of Agriculture (USDA), unexpected weather damage to a major crop, or a geopolitical headline out of the Middle East. In those moments, fast, stable execution isn’t a luxury – it’s all about survival.

That’s why execution speed and platform reliability are dealbreakers for us. We’ve tested platforms during real market events – like crude oil inventory releases or copper reacting to Federal Reserve minutes – and the gap between a fast, dependable broker and a laggy one is night and day.

In short: if your broker freezes or slips during volatility, you’re paying the price. And not just in frustration, potentially in real cash.

We always look for brokers with low latency, minimal slippage, and zero platform downtime when markets get hot. Whether you’re scalping short-term oil moves or holding a position through a key economic release, you need to know your trades will go through cleanly.

Top Pick: Among all the brokers we tested, IC Markets provided the most consistent and lightning-fast execution, particularly during periods of peak volatility.

Their infrastructure is built for speed. IC Markets uses low-latency data centres, Equinix servers, and straight-through processing (STP) execution – all of which help ensure that your trades hit the market fast and with minimal interference.

During our tests – specifically during a big gold price move triggered by U.S. inflation data – we were impressed by how stable and snappy the execution was, with no re-quotes or lag.

Data Feeds and Charts: The Tools Behind Smart Trades

If you’re trading commodities without access to real-time pricing, live inventory updates, and serious charting tools, you’re behind the curve.

Whether you’re tracking gold futures, crude oil, or soybeans, you need accurate and up-to-the-second pricing from real exchanges like the London Metal Exchange (LME), Chicago Mercantile Exchange (CME), and Intercontinental Exchange (ICE). Add to that inventory data—like crude oil stockpiles or copper warehouse levels—and you’re starting to get the complete picture.

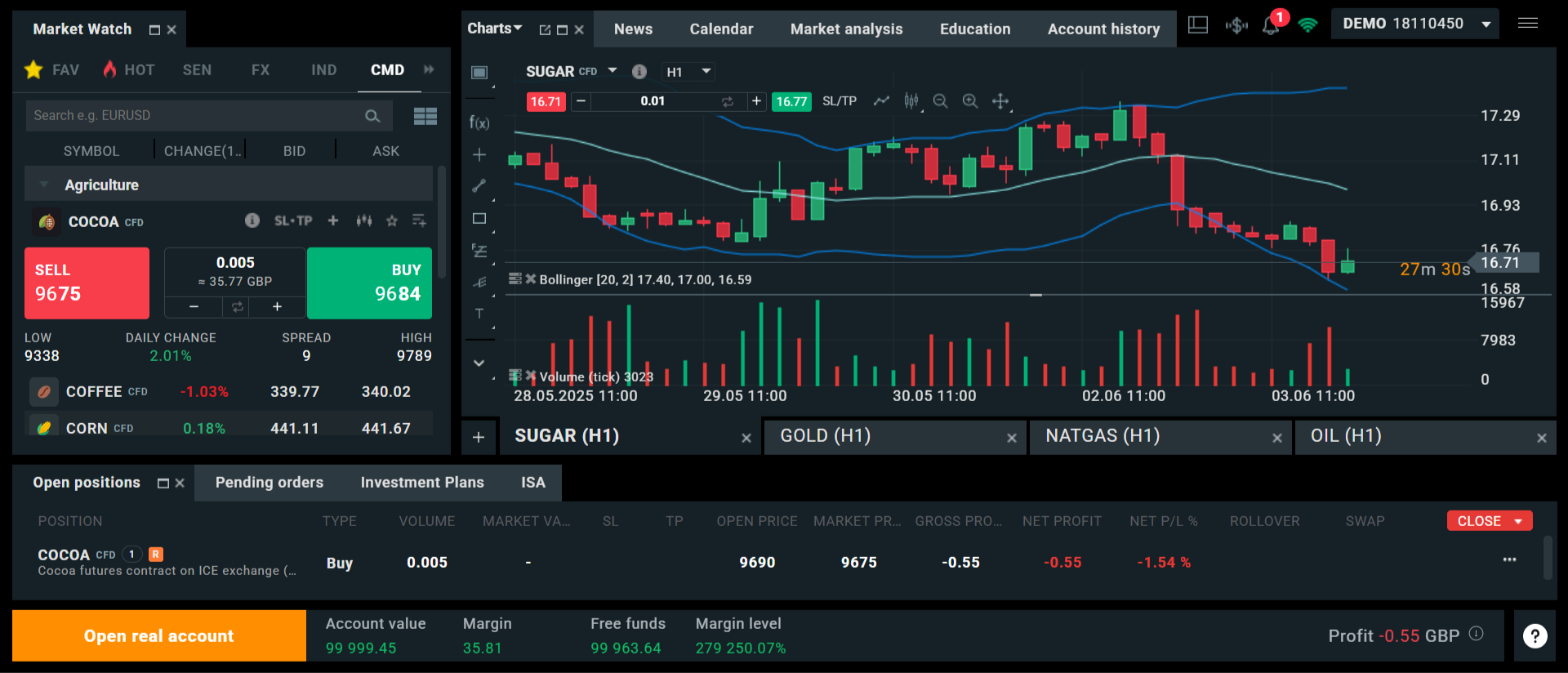

Charts aren’t just something nice to look at, either. We rely heavily on technical indicators that are tailored for commodity behavior, like Bollinger Bands during oil volatility, or the Relative Strength Index (RSI) when gold’s making big moves. The right platform should enable you to chart commodity-specific timeframes, compare seasonal trends, and overlay fundamentals as needed.

During our testing, some brokers gave us little more than laggy candles and generic indicators. Others stood out for delivering a toolkit that provides serious traders with everything they need to analyse and act decisively.

Top Pick: Pepperstone gave us one of the most complete and professional-grade data and charting experiences of any broker we tested, especially for commodities.

They offer real-time pricing via CFD mirrors of major exchanges like LME, CME, and ICE, and their integration with TradingView, MetaTrader 4/5, and cTrader means you’re not locked into one limited charting setup.

We tested their platforms during active sessions and found the feeds to be responsive, the overlays smooth, and the indicator library rich, with everything a commodity trader needs—from MACD to volume profile.

What did we appreciate most? The ability to track live price action alongside key fundamentals like inventory levels or economic releases. That’s where Pepperstone sets itself apart. Whether you’re zooming in on short-term WTI crude patterns or tracking long-term agricultural cycles, the tools are precise, flexible, and built for serious analysis.

Pepperstone cTrader Spotware platform aluminium CFD

Margin and Leverage Options: Know What You’re Risking, and What You’re Getting

One of the big appeals of commodities trading – especially via futures or Contracts for Difference (CFDs) – is the leverage. You can control a much larger position than your initial outlay. But that also means your margin terms matter—a lot.

If the broker’s margin requirements are too high, you’re tying up unnecessary capital. If they’re too low (without risk controls), you could be walking into volatility without protection. And let’s not forget transparency—nothing kills confidence like hidden overnight financing charges or unclear margin call policies.

In our experience, a good broker strikes the right balance: competitive leverage, clear risk management tools, and margin terms that adjust appropriately across asset classes.

We put these to the test, checking leverage flexibility across commodities such as oil, gold, and even more volatile softs like coffee and cocoa. Some brokers offer fixed leverage. Others provide a dynamic margin that adapts to market conditions, which is a significant advantage.

Top Pick: Out of all the brokers we reviewed, FXCC gave us a standout experience when it comes to flexible, trader-friendly margin and leverage terms, especially for leveraged CFD trading.

During our evaluation, we found that FXCC offers leverage up to 1:500, depending on your account type and the asset class. That’s among the highest retail leverage available – but more importantly, they clearly explain how it applies to commodity CFDs, which many brokers gloss over.

Their margin requirements are transparent, with detailed breakdowns on each instrument. We didn’t encounter any hidden costs or confusing overnight charges – something we always watch for. You can also manage your exposure in real-time with built-in tools like margin calculators and stop-out level alerts, which helped us stay in control even during big moves in energy or metal markets.

Regulatory Oversight and Broker Credibility: Trust Matters in This Game

Commodities trading can be risky enough without wondering whether your broker is playing by the rules.

When we review brokers, one of the first things we check is their regulatory status. Are they licensed by a serious authority like the Commodity Futures Trading Commission (CFTC) in the US, the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) in the UK, or the Cyprus Securities and Exchange Commission (CySEC)? If not, that’s an immediate red flag.

But it’s not just about a badge. We also look for a solid track record in commodities trading, particularly in metals, energy, and agricultural markets. You want a broker with experience – one that’s weathered volatility, handled client funds responsibly, and hasn’t popped up on any regulatory watchlists.

Top Pick: CMC Markets came out on top here, not just for its strong regulatory credentials, but for its long-standing reputation in commodities and metals trading.

They’re regulated by the FCA in the UK, ASIC in Australia, and several other top-tier authorities. That means strong client fund protections, regular audits, and strict capital requirements. You’re not dealing with a fly-by-night operation.

More importantly, CMC has decades of experience offering commodity products, from precious metals like gold and silver to energies and agricultural CFDs. During our tests, everything from account setup ran smoothly, and we found no history of major regulatory issues – a good sign in an industry where that’s unfortunately not always the case.

Fees and Commissions: Keep More of What You Earn

Here’s something a lot of traders underestimate: fees and spreads can quietly eat into your profits, especially when you’re working with tight margins, like you often do in commodities.

Whether you’re trading gold CFDs or Brent crude futures, the tighter the spread and the lower the commission, the more of your edge you keep. That’s why we take fees seriously in every broker test we run – factoring in spread width, overnight swap rates, and hidden platform fees.

Some brokers advertise low costs but tack on fees elsewhere. Others are refreshingly upfront – and those are the ones we recommend.

Top Pick: IC Markets is our pick for low-cost commodity trading. In our testing, IC consistently delivered tight spreads on commodity CFDs, especially on major instruments like gold, silver, and oil.

For example, we saw spreads on gold as low as 0.2 points during active market hours, paired with raw pricing on their ECN-style accounts, which can be a major edge for high-frequency or short-term traders.

They also keep commissions transparent and reasonable, and we didn’t run into any unpleasant surprises when holding positions overnight. Plus, with their deep liquidity and fast execution (see our earlier section), those low costs translate into real-world savings, not just flashy marketing.

Risk Management Tools: Stay in the Game When Markets Get Wild

Commodities don’t just move; they can occasionally experience whipsaws. One moment gold’s calm, the next it’s reacting to inflation data. Wheat can spike on a single weather forecast. That’s why risk management tools are absolutely essential.

We’re talking about features like stop-loss orders, price alerts, guaranteed stop-outs, and even volatility warnings that flag potential market-moving events before they hit. These aren’t just “nice to have” – they’re critical for anyone trading leveraged commodities, especially during macro releases, inventory reports, or unexpected geopolitical shocks.

When we tested brokers, we didn’t just check for tool availability – we used them to see how well they worked. Do the alerts hit in time? Are stops honoured at your level, or do they slip wildly in fast markets? That’s the kind of difference that protects your capital.

Top Pick: XTB stood out when it came to risk control and trader support during volatile conditions. They offer an excellent suite of built-in tools, including standard stop-loss and take-profit options, trailing stops, and price alerts that can be set across web, mobile, and desktop platforms.

We especially liked their volatility alerts, which proactively warn traders of upcoming market-moving events – ideal for commodities, where surprises are the norm, not the exception.

One thing that really impressed us during our testing: stop-loss orders were executed reliably, even during sudden moves in oil and natural gas markets. That kind of performance builds confidence. And for newer traders, XTB’s risk calculator is a fantastic feature – it lets you see your potential loss or gain before placing the trade, based on real margin and pip values.

XTB x-Station platform sugar CFD chart