Best Silver Brokers 2026

Explore our expert-ranked list of the best silver trading brokers, backed by in-depth testing and analysis from industry professionals and seasoned traders.

-

1NinjaTrader is a US-based brokerage regulated for trading futures. It offers three different pricing plans for varied needs and budgets, along with extremely low margins on popular contracts. The company's renowned charting software and trading platform provides extensive customization options and excellent technical analysis features.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Plus500US, a reputable broker since 2021, is authorized by the CFTC and NFA. It offers futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a quick 10-minute signup, a $100 minimum deposit, and an easy-to-use web platform, Plus500 is enhancing its services for traders in the US. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.0 InstaTrade, located in the British Virgin Islands, is an online broker that focuses on structured fixed income products and active trading via CFDs. Its no-spread accounts, outstanding research primarily from InstaTrade TV, and access to the well-known MT4 and InstaTrade Gear make it a good choice for traders of all levels. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 Established in 2008, Exness is a respected broker known for offering over 40 account currencies, a wide choice of CFD instruments, and an intuitive web platform with features like currency converters and trading calculators.

Best Silver Brokers Comparison

Safety Comparison

Compare how safe the Best Silver Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Silver Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Silver Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Silver Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Silver Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Silver Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Silver Brokers 2026.

Broker Popularity

See how popular the Best Silver Brokers 2026 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Plus500US |

|

| InstaTrade |

|

| NinjaTrader |

|

| Exness |

|

| FOREX.com |

|

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- Low costs, with $50 trading margins and commissions starting at $.09 per micro contract.

- NinjaTrader is a well-regarded and acclaimed futures broker, approved by the NFA and CFTC.

- You can access thousands of applications and add-ons from developers worldwide for trading.

Cons

- You need to register with partner brokers to trade in securities other than forex and futures.

- The advanced trading tools require an additional fee.

- Some payment methods require a withdrawal fee.

Why Trade With Plus500US?

Plus500US is an excellent choice for beginners, offering a user-friendly platform, low trading margins, and access to the Futures Academy to improve trading skills. Its powerful tools and reliable service earned it second place in DayTrading.com's annual 'Best US Broker' award.

Pros

- Plus500US stands out for its low fees, competitive trading margins, and no charges for inactivity, live data, routing, or platform use.

- The account setup, pricing structure, and web platform make futures trading simpler than competitors like NinjaTrader.

- Plus500 included prediction markets in its 'Plus500 Futures' platform in February 2026. This addition offers event-based trades in 10 categories, such as financials and politics, and includes short-term intraday contracts expiring in 15 minutes.

Cons

- Plus500US offers competitive pricing but does not have a discount program for high-volume traders, unlike brokers like Interactive Brokers.

- Testing showed fast response times for support, but phone aid is not available.

- Plus500US lacks social trading features, unlike competitors such as eToro US, which might enhance its appeal to aspiring traders.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

- The in-house Web Trader is a top platform for new traders, featuring a sleek design and over 80 technical indicators for market analysis.

Cons

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

Why Trade With InstaTrade?

InstaTrade provides active trading on an extensive platform. It has a unique offering known as Fixed Income Structured Product (FISP), which allows for passive investment. Investors can potentially earn up to a 50% return within 6 months, provided certain conditions are fulfilled.

Pros

- InstaTrade provides approximately 300 assets for investment. It particularly shines in the area of currency pairs, making it an excellent platform for experienced traders interested in volatile exotics.

- VPS hosting is suitable for algorithmic trading strategies. It uses a dedicated server to offer quick execution speeds, potentially as fast as 9 milliseconds.

- InstaTrade provides a high-quality range of charting tools for traders. Its web trader includes over 250 indicators, 11 types of charts and a design that's easy to use.

Cons

- The advertising of FISP, specifically about its "profit guarantee" and "risk-free trading," creates unease.

- InstaTrade's website and client interfaces are quite complex which can be confusing for new traders. On the other hand, XTB offers a more straightforward and user-friendly trading experience.

- InstaTrade's learning resources are helpful for new traders but are not as organized or comprehensive as those provided by top companies such as eToro.

Why Trade With Exness?

Exness is an excellent choice for active forex traders aiming to reduce costs after lowering spreads, enhancing execution speeds, and offering trading on over 100 currency pairs with more than 40 account currencies.

Pros

- Exness Terminal provides an easy experience for beginners with interactive charts, and creating watchlists is simple.

- Wide variety of account types for all experience levels, including Cent, Pro, and the new Raw Spread, ideal for traders.

- Execution speeds now average under 25ms, providing ideal conditions for short-term traders.

Cons

- MetaTrader 4 and 5 are supported, but TradingView and cTrader are not available yet, despite increasing demand from traders and their integration with other platforms like Pepperstone.

- Exness has increased its variety of CFDs and introduced a copy trading feature, but it still lacks real assets like ETFs, cryptocurrencies, or bonds.

- Besides a mediocre blog, educational resources are lacking, especially compared to category leaders like IG, which offer a more comprehensive trading journey for new traders.

Filters

How We Chose the Best Silver Brokers

Our comprehensive review assessed and ranked the top brokers for trading silver based on our overall ratings.

Our evaluation process:

- Data-Driven Analysis – We examined 200+ key factors across multiple categories for each provider, including available silver trading instruments and spreads on contracts.

- Hands-On Testing – We personally tested each broker’s platform to evaluate trading tools, user experience, and unique features such as social trading access.

What to Look for in a Top Broker for Trading Silver

Market Access and Product Offerings

Whether you’re looking to trade silver futures, options, or CFDs, choosing a broker that provides multiple avenues for exposure is crucial.

Plus, access to major exchanges like the Intercontinental Exchange (ICE) and Chicago Mercantile Exchange (CME) can open up better pricing, deeper liquidity, and more trading opportunities.

Consider brokers that provide:

- Silver Futures: Ideal for long-term positioning or hedging strategies.

- Silver Options: Great for risk management and strategic trading.

- Silver CFDs: Flexible for short-term trades with lower capital requirements.

Having access to multiple instruments gives you the flexibility to adapt to different market conditions and trading goals.

Top pick for market access: Interactive Brokers excels in providing broad market access with a wide range of silver trading products. You can trade silver futures directly on major exchanges like ICE and CME for transparent pricing and strong liquidity. If you prefer more flexible, short-term positions without ownership obligations, IBKR’s silver CFDs are a solid choice.

Fees and Commission Structure

Understanding the true cost of each trade is vital. Even small fees can chip away at your returns, especially if you’re an active trader or prefer holding positions overnight.

The best brokers for silver trading provide transparent, competitive pricing with minimal hidden costs.

Here’s what to keep an eye on:

Spreads and Commissions

Tighter spreads mean lower costs when opening and closing silver trades. Some brokers charge a separate commission per trade, while others bundle their fees into the spread.

- Low Spread Brokers: Ideal for frequent traders seeking minimal trading costs.

- Commission-Based Brokers: Often better for high-volume traders, as they may offer tighter spreads with fixed fees.

Overnight Financing (Swap) Rates

You’ll encounter swap fees if you plan to hold silver positions overnight. These rates vary between brokers, significantly affecting your profits on longer trades.

Tip: Brokers with transparent swap rate calculators help you better estimate costs.

Hidden Charges

While some brokers promote low trading fees, extra costs may appear in the form of:

- Withdrawal Fees: Charges for transferring funds out of your account.

- Inactivity Fees: Penalties for leaving your account dormant for a specified period.

- Currency Conversion Fees: Important if you’re funding your account in a currency different from your trading instrument.

Top pick for low fees: With its transparent pricing and commission-free structure, XTB is a solid choice for both beginner and experienced silver traders who want to keep costs low. XTB offers zero-commission silver CFD trades, with costs built directly into the spread. XTB’s silver spreads are highly competitive, often starting as low as 0.03 points.

Research and Market Insights

The best silver brokers provide powerful research tools, market insights, and educational content to help traders make smarter decisions.

Here’s what to look for in a broker’s research offering:

Market Reports and Analysis

Since silver prices are influenced by industrial demand, geopolitical events, and economic shifts, access to in-depth analysis is crucial. Top brokers provide:

- Daily & Weekly Silver Market Reports: Covering price trends, economic data releases, and technical analysis.

- Supply & Demand Analysis: Insights into mining output, global demand trends, and major industrial buyers.

- Geopolitical & Economic Forecasts: Since silver is a key industrial metal, economic shifts often impact its price.

For example, a broker highlighting silver’s role in solar panel production or electronics manufacturing may give traders an edge.

Trading Signals and AI-Based Predictions

Advanced tools like trading signals and AI-powered forecasts can help traders identify entry and exit points. Look for:

- Real-Time Trading Alerts: Highlighting potential trade setups based on technical indicators.

- AI-Driven Forecast Models: Predictive tools that analyze historical data to suggest trade ideas.

- Sentiment Analysis Tools: Helping traders gauge market mood and potential price movements.

Top pick for research and market insights: IG excels in providing high-quality silver market insights, trading signals, and educational content from our tests. IG offers daily silver reports, technical analysis, and insights into supply-demand trends. Their coverage includes major economic events that may impact silver prices. IG’s platform also integrates AI-driven trade ideas, real-time alerts, and technical pattern recognition tools — perfect for identifying silver price movements.

Trading Platform and Tools

Whether you’re analyzing silver price trends, setting alerts, or executing trades, having the right tools at your fingertips is essential. The top providers offer feature-rich platforms that combine flexibility, speed, and advanced analytics.

Here’s what to look for in a silver trading platform:

Platform Options

Top brokers typically offer a mix of popular third-party platforms and their proprietary solutions. Each has unique strengths:

- MetaTrader 4 (MT4): Ideal for silver CFD traders, featuring automated trading with Expert Advisors (EAs).

- MetaTrader 5 (MT5): Great for multi-asset trading with enhanced charting tools and depth of market (DOM) insights.

- TradingView: A web-based platform with powerful charting, social trading features, and extensive indicator support.

- Proprietary Platforms: Some brokers develop their platforms with custom features tailored for silver traders.

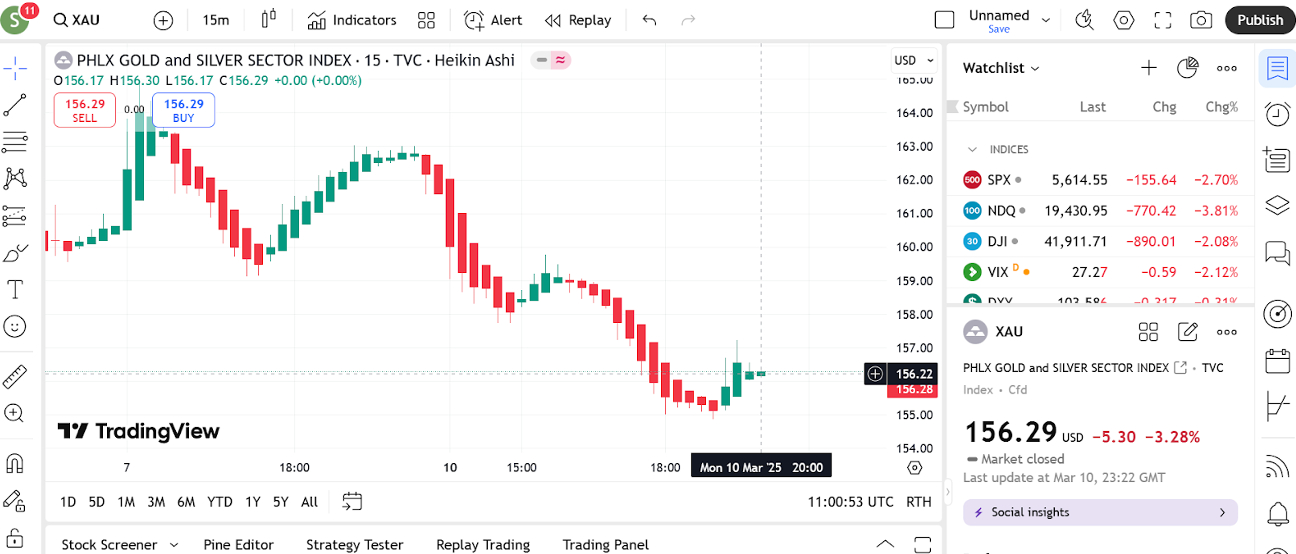

A growing number of brokers offer the modern, intuitive TradingView platform for trading silver

Advanced Charting Tools and Indicators

You’ll need access to robust technical tools to effectively track silver’s price movements. Key features to look for include:

- Multiple Timeframes: Ideal for analyzing both short- and long-term silver trends.

- Custom Indicators: Tools like RSI, MACD, and Bollinger Bands can help spot entry and exit points.

- Drawing Tools: For marking support, resistance, and trend lines.

- Price Alerts: Real-time notifications when silver hits key levels, helping you stay informed without constantly monitoring charts.

Mobile Trading Capability

A responsive trading app is key for traders like me who want to stay active on the go. Look for:

- User-Friendly Interface: Clear navigation with fast order execution.

- Full Charting Features: Ensure mobile apps offer technical analysis tools, not just basic trade execution.

- Push Notifications: To alert you of price changes, news updates, or trade opportunities.

Top pick for trading platforms: With its platform variety, advanced tools, and mobile convenience, Pepperstone is an excellent choice for silver traders prioritizing flexibility and powerful analytics. Both MetaTrader platforms are available, with Expert Advisors (EAs) for automated silver trading. Pepperstone also links directly with TradingView, giving you access to over 100+ indicators, custom charting tools, and community-driven trade ideas.

Regulation and Security

When trading silver, choosing a broker with strong regulatory oversight is essential. Regulated brokers follow strict financial standards, ensuring your funds are protected, and your trades are fair.

Key things to look for:

- Top-Tier Regulators: Trusted brokers are licensed by authorities like the CFTC (U.S.), FCA (UK), ASIC (Australia), or CySEC (EU).

- Segregated Client Funds: Ensures your trading funds are kept separate from the broker’s operating capital, adding a layer of protection.

- Transparency & Compliance: Reputable brokers disclose their fees, risks, and trading policies clearly.

Top pick for regulation and security: With its robust regulatory framework and focus on fund security, Saxo is a reliable choice for traders seeking peace of mind while trading silver. Saxo is licensed by multiple top-tier authorities, including the FCA, ASIC, and FINMA. Saxo Bank is also known for its transparent practices, detailed reporting, and commitment to client safety.

Leverage and Margin Requirements

Leverage can boost your silver trading potential, but managing risk is key. A good broker should offer flexible leverage options with clear margin policies.

Key points to consider:

- Maximum Leverage: Retail traders generally may access leverage up to 1:30 in tightly regulated regions like Europe, while professional accounts can go as high as 1:500 and beyond.

- Margin Call & Stop-Out Levels: Lower stop-out thresholds reduce the risk of sudden position closures.

- Trader Suitability: Higher leverage suits experienced traders, while beginners may prefer safer, lower ratios.

Top pick for leverage and margin: With its competitive leverage options and precise risk controls, Axi is a strong choice for silver traders seeking flexibility in their trading approach. Axi offers leverage up to 1:500, transparent margin call and stop-out levels to help manage exposure, plus flexible account types designed for both conservative and aggressive trading strategies.

Execution Speed and Order Types

When trading silver, speed and precision can make all the difference. Fast order execution with minimal slippage ensures you enter and exit trades at the expected prices.

Key features to look for:

- Fast Order Execution – A broker that offers fast order execution reduces the chances of slippage (where your trade is filled at a different price than expected). This is especially important in volatile markets like silver.

- Minimal Slippage – Good brokers aim to minimize slippage, ensuring your silver trade fills at or near your desired price. This is vital during high volatility periods, which can happen frequently in commodity markets.

- Advanced Order Types – Stop-loss orders automatically close your position at a specified loss level to protect your capital. Take-profit orders lock in your profits by closing your position when it hits your target. Trailing stops move your stop-loss order along with the price, locking in profits as the price moves in your favour.

- Liquidity Access – Trading large positions requires access to sufficient liquidity to ensure that large orders can be executed without causing significant price movement or slippage. A broker with solid liquidity sources makes it easier to execute bigger trades efficiently.

Top broker excelling in execution speed and order types: Whether you’re trading on silver CFDs or futures, CMC Markets‘ proprietary Next Gen platform easily handles large trades, providing reliable execution every time. Minimal slippage makes it a solid choice for silver traders who need precision, plus there’s a variety of advanced order types, including stop-loss, take-profit, and trailing stop orders,

Customer Support

A good broker should offer 24/5 or 24/7 support to ensure you’re never left in the lurch, no matter when you need assistance.

Key aspects to look for in customer support:

- 24/5 or 24/7 Availability – A broker with around-the-clock support ensures you’re covered regardless of your time zone or the market’s activity.

- Multiple Support Channels – Whether you prefer phone, email, or live chat, it’s great to have options to resolve any issues quickly.

- Multilingual Support – If you’re trading from a non-English-speaking region, it’s essential to have support in your preferred language to avoid misunderstandings.

Top broker excelling in customer support: Whether you’re facing an issue with your silver trades or need guidance on platform features, FOREX.com’s dedicated customer service is quick, helpful, and professional based on our tests. You get 24/5 support via phone, email, and live chat, making it easy for traders to get help whenever needed.

Deposit and Withdrawal Options

Look for brokers that offer multiple funding options, such as bank transfers, credit cards/debit cards, and e-wallets, ensuring flexibility for different preferences.

Fast withdrawal processing times are essential, as you don’t want to be left waiting for your funds when you need them.

Additionally, brokers with low or no withdrawal fees will save you from unnecessary charges when accessing your profits.

Top broker excelling in deposit and withdrawal options: Payment flexibility and quick processing make FXTM an excellent choice for silver traders who value smooth financial transactions. There is a wide range of deposit options: bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller and fast withdrawal processing times, often within 24 hours for e-wallets.