Best Brokers With Expert Advisors (EAs) 2026

After extensive testing, we’ve selected the best brokers offering Expert Advisors (EAs) that automate strategies, saving you time while ensuring efficient trades.

-

1OANDA is a well-known broker that excels in quick trade executions, a low deposit requirement, and impressive charting and trading platform functions. The highly-regarded brand has over 25 years of expertise and is overseen by reliable authorities like the NFA/CFTC. It provides 24/7 support for traders and offers flexible contract sizes with automated trade executions.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.0 InstaTrade, located in the British Virgin Islands, is an online broker that focuses on structured fixed income products and active trading via CFDs. Its no-spread accounts, outstanding research primarily from InstaTrade TV, and access to the well-known MT4 and InstaTrade Gear make it a good choice for traders of all levels. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 Established in 2008, Exness is a respected broker known for offering over 40 account currencies, a wide choice of CFD instruments, and an intuitive web platform with features like currency converters and trading calculators. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 IC Markets is a renowned forex and CFD broker recognized for its high-quality pricing, extensive range of trading tools, and superior trading technology. Established in 2007 in Australia, it operates under the oversight of ASIC, CySEC, and FSA. It has drawn in over 180,000 traders from across 200 countries.

Top Brokers For EAs Comparison

Safety Comparison

Compare how safe the Best Brokers With Expert Advisors (EAs) 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Brokers With Expert Advisors (EAs) 2026.

Comparison for Beginners

Compare how suitable the Best Brokers With Expert Advisors (EAs) 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Brokers With Expert Advisors (EAs) 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Brokers With Expert Advisors (EAs) 2026.

Detailed Rating Comparison

Compare how we rated the Best Brokers With Expert Advisors (EAs) 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Brokers With Expert Advisors (EAs) 2026.

Broker Popularity

See how popular the Best Brokers With Expert Advisors (EAs) 2026 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| InstaTrade |

|

| Exness |

|

| FOREX.com |

|

| IC Markets |

|

Why Trade With OANDA US?

OANDA is a reputable broker for US traders. It offers user-friendly tools for analysis and a simple sign-up process. It is very trustworthy due to heavy regulation.

Pros

- Traders can experience quick and dependable order execution.

- The OANDA web platform offers an exceptional charting environment with over 65 technical indicators provided by TradingView.

- Experienced traders can use top-notch tools like an MT4 premium upgrade and advanced charting from MotiveWave.

Cons

- The trading markets are limited to only forex and cryptocurrencies.

- Customer support is not accessible during weekends.

- Few payment options are available and e-wallets are not supported.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- The in-house Web Trader is a top platform for new traders, featuring a sleek design and over 80 technical indicators for market analysis.

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

Cons

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

Why Trade With InstaTrade?

InstaTrade provides active trading on an extensive platform. It has a unique offering known as Fixed Income Structured Product (FISP), which allows for passive investment. Investors can potentially earn up to a 50% return within 6 months, provided certain conditions are fulfilled.

Pros

- VPS hosting is suitable for algorithmic trading strategies. It uses a dedicated server to offer quick execution speeds, potentially as fast as 9 milliseconds.

- InstaTrade promises returns using its structured passive trading solution (FISP), with applications processed within 24 hours.

- InstaTrade provides a high-quality range of charting tools for traders. Its web trader includes over 250 indicators, 11 types of charts and a design that's easy to use.

Cons

- The advertising of FISP, specifically about its "profit guarantee" and "risk-free trading," creates unease.

- InstaTrade's learning resources are helpful for new traders but are not as organized or comprehensive as those provided by top companies such as eToro.

- InstaTrade is registered in the British Virgin Islands, providing minimal regulatory protections for retail traders.

Why Trade With Exness?

Exness is an excellent choice for active forex traders aiming to reduce costs after lowering spreads, enhancing execution speeds, and offering trading on over 100 currency pairs with more than 40 account currencies.

Pros

- Wide variety of account types for all experience levels, including Cent, Pro, and the new Raw Spread, ideal for traders.

- Fast and reliable 24/7 multilingual customer support through phone, email, and live chat, validated by practical tests.

- Execution speeds now average under 25ms, providing ideal conditions for short-term traders.

Cons

- Retail trading services are not available in some areas, including the US, UK, and EU, making them less accessible compared to leading brokers like Interactive Brokers.

- Besides a mediocre blog, educational resources are lacking, especially compared to category leaders like IG, which offer a more comprehensive trading journey for new traders.

- Exness has increased its variety of CFDs and introduced a copy trading feature, but it still lacks real assets like ETFs, cryptocurrencies, or bonds.

Why Trade With IC Markets?

IC Markets provides excellent prices, quick execution, and smooth deposits. The utilization of sophisticated charting platforms such as TradingView and the Raw Trader Plus account makes it a preferred choice for intermediate to advanced traders.

Pros

- IC Markets provides some of the smallest spreads in the industry, offering 0.0-pip spreads on major currency pairs. This makes trading particularly cost-efficient for traders.

- IC Markets provides fast and reliable 24/5 support for account and funding issues.

- IC Markets won DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its top-notch MetaTrader integration, perfected over years to enhance the platform experience.

Cons

- Some withdrawal methods require fees such as a $20 wire charge. This can reduce profits, particularly for traders who withdraw frequently.

- IC Markets have a selection of metals and cryptos for trading through CFDs, but their range is not as wide as brokers such as eToro. This may limit options for traders who are interested in these asset types.

- The range and quality of educational materials, such as tutorials and webinars, require improvement. This lag falls behind competitors like CMC Markets and reduces its suitability for novice traders.

Filters

How We Chose The Best Brokers For EAs

We ranked the top brokers for Expert Advisors (EAs) using our data-driven rating system, combining hands-on testing with an in-depth analysis of 200+ metrics per provider.

Since EAs rely on automation, execution speed, and strategy flexibility, we’ve considered brokers that offer an optimal environment for algo trading, assessing:

- Platform & EA Compatibility – Testing broker support for MetaTrader (MT4/MT5), and proprietary platforms with robust automation features.

- Execution Speed & Stability – Ensuring low-latency, fast order execution with minimal slippage to optimize EA performance.

- Spreads & Trading Costs – Evaluating spreads, commission structures, and overall cost efficiency for frequent automated trades.

- Order Execution Policies – Reviewing whether brokers allow scalping and high-frequency trading, key for EA strategies.

- VPS & Hosting Services – Assessing access to free or discounted VPS hosting for uninterrupted 24/7 EA operation.

What To Look For In A Top Broker With EAs

Not all brokers are created equal when it comes to supporting Expert Advisors (EAs). Some fully embrace automated trading with fast execution, low spreads, and minimal restrictions, while others limit EA use through high slippage, delayed order execution, or outright bans on specific strategies.

To get the best out of your EA, here are the most important factors to consider when choosing a broker:

Execution Speed & Latency – The Faster, The Better

EAs rely on fast order execution to take advantage of market movements, especially for scalping and high-frequency strategies.

If a broker has slow execution speeds or high latency, your trades may suffer from slippage, where orders are filled at worse prices than expected.

- Look for ECN or STP brokers with low-latency trading infrastructure

- Check if the broker offers VPS (Virtual Private Server) hosting for even faster execution

- Prefer brokers with data centres close to major liquidity providers

Avoid brokers with:

- Market-making models that delay execution to widen spreads

- Frequent system freezes or order rejections

Top pick for execution speed and latency: IC Markets impressed during testing with its ultra-fast execution speeds of around 35 milliseconds. Traders looking for an all-in-one broker with low costs and high-speed execution for EA trading will get the best out of IC Markets.

Spread and Commission Costs – Keep It Cheap

Since EAs often execute multiple trades daily (especially scalping EAs), tight spreads and low commissions are crucial. High trading costs can eat into your profits over time.

- Look for RAW or ECN accounts with tight spreads (0.0 – 0.2 pips on EUR/USD)

- Prioritize brokers that charge commissions instead of widening spreads

- Check if the broker offers rebates or cashback on trading volume

Avoid brokers with:

- Excessive markups on spreads

- Hidden fees on deposits/withdrawals

Top pick for spreads and commissions: Pepperstone offers razor-sharp spreads from 0.0 pips and a commission-based ECN model from $6/lot, making it ideal for EAs focused on cost efficiency. It’s one of the best brokers for scalping EAs, offering razor-sharp pricing and minimal slippage.

Platform Compatibility – MT4, MT5, or cTrader?

EAs need a compatible trading platform to function. The most popular platforms for automated trading are:

- MetaTrader 4 (MT4) – The most widely used EA platform, ideal for forex trading.

- MetaTrader 5 (MT5) – Supports more asset classes, better backtesting, and multi-threaded optimization.

- cTrader – Less common but offers advanced automation features via cAlgo.

Choose a broker that fully supports EA trading on your preferred platform.

- Ensure the broker offers dedicated EA-friendly features like backtesting tools and optimization settings.

- If using custom EAs, check if the broker allows API trading for advanced automation

Avoid brokers with:

- Limited or outdated platform support

- Restrictions on third-party EAs

Top pick for platform compatibility: FXPro supports MT4, MT5, and cTrader, making it one of the most flexible brokers for EA traders.

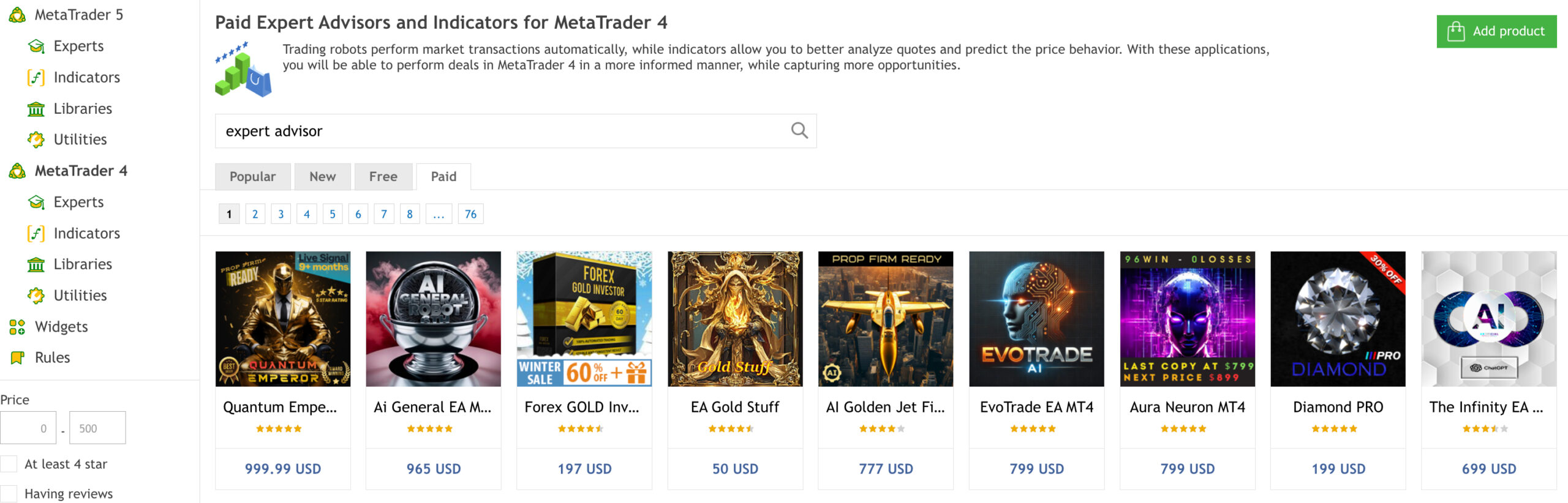

MetaTrader has a budding marketplace where you can find free or pay for expert advisors

Broker’s Policy on EA Trading – Are There Any Restrictions?

Some brokers claim to support EAs but impose hidden restrictions that can hinder performance. Be sure to check:

- Does the broker allow scalping EAs? Some brokers ban high-frequency trading.

- Are there limits on lot sizes or trade frequency?

- Does the broker manipulate spreads or delay execution on EA accounts?

Avoid brokers that:

- Ban high-frequency trading (HFT) or scalping EAs

- Use dealing desk models that interfere with automated orders

Top pick for clear EA policy: FXCC has a true ECN model, ensuring no intervention or restrictions on EA strategies.

VPS Hosting & Server Stability – Run Your EA 24/7

A Virtual Private Server (VPS) is essential if you’re serious about EA trading. A VPS lets you run your EA without needing to keep your computer on, reducing downtime and improving execution speeds.

- Look for brokers that offer free or discounted VPS hosting

- Check the broker’s uptime and server reliability

- Ensure the VPS is close to liquidity providers for low-latency execution

Avoid brokers with:

- Unstable servers that disconnect frequently.

- No VPS options, forcing you to rely on your personal device

Top pick for VPS hosting and server stability: Eightcap offers free VPS hosting for high-volume EA traders.

Regulation & Security – Trust Matters

Since EA trading involves high-frequency transactions, you want a regulated and trustworthy broker. A regulated broker ensures:

- Funds are kept in segregated accounts

- Strict oversight to prevent price manipulation

- Fair order execution policies

Avoid brokers that:

- Operate under weak or offshore regulation

- Have a history of unfair trade rejections or complaints

Top pick for regulation and security: Exness is a long-standing, multi-regulated broker (CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC), making it a reputable choice for EA traders.

FAQ

What Are Expert Advisors (EAs)?

Expert Advisors (EAs) are automated trading programmes that execute trades based on pre-set rules and strategies.

They run on trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), scanning the markets, identifying trade opportunities, and placing trades without human intervention.

Traders use EAs to eliminate emotions from trading, optimize execution speed, and take advantage of market movements 24/7.

Whether you’re a beginner looking for a hands-off approach or a seasoned trader testing complex strategies, EAs can significantly improve efficiency.

How Do EAs Work In Trading?

An EA operates using algorithms and trading rules coded in a programming language like MQL4 (for MT4) or MQL5 (for MT5). Here’s how it works:

- Market Analysis: The EA continuously monitors price movements, indicators, and market conditions.

- Trade Execution: When the EA detects a signal that matches its programmed strategy, it automatically places a trade.

- Risk Management: Many EAs come with built-in risk controls, such as stop-loss and take-profit settings.

- Trade Monitoring & Adjustments: Some advanced EAs can modify trade parameters based on changing conditions.

Why Do Traders Use EAs?

- Speed & Efficiency: EAs can execute trades faster than any human.

- 24/7 Trading: They don’t need sleep, so they keep trading even when you’re away.

- Emotion-Free Trading: No second-guessing, fear, or greed, just pure strategy.

- Backtesting Capabilities: Traders can test strategies on historical data before risking real money.

- Multi-Asset Trading: Run multiple EAs simultaneously across forex, indices, crypto, and more.

What Different Types of Expert Advisors Are There?

- Trend-Following EAs: Designed to capitalize on market trends.

- Scalping EAs: Execute high-frequency trades for small profits.

- Hedging EAs: Open opposing trades to manage risk.

- Grid EAs: Place multiple buy/sell orders at predefined levels to exploit price fluctuations.

- News Trading EAs: React to economic events for high-impact trades.

Some traders buy pre-made EAs, while others develop their own to fit specific strategies. Either way, choosing the right broker is crucial; some brokers limit EA use or impose high slippage and slow execution, which can affect performance.