Best cTrader Brokers 2026

After hands-on tests of countless cTrader brokers by our experts, which includes experienced users of the platform, these stand out as the very best.

Paul Holmes

With over 15 years of trading experience, including developing algorithmic strategies on MetaTrader and evaluating brokers, he brings deep expertise in market analysis and trader education, helping traders choose the right platform for their requirements.

Paul Holmes Profile PageTobias Robinson

Tobias is head of BrokerListing.com's testing panel and after more than 25 years of trading, turns his expertise to helping investors find the best trading platforms for their needs.

Tobias Robinson Profile PageJames Barra

James is an experienced investment writer with a background in financial services, specializing in assessing brokerages to help traders find reliable options.

James Barra Profile PageFebruary 22, 2026

-

1

IC Markets' cTrader offers very low spreads starting at 0.0 pips and a $7 commission per standard lot. In our tests, execution was consistently fast with ample liquidity. It has advanced features like customizable algorithms and one-click trading, making it suitable for scalpers and professionals.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.2 IC Trading's cTrader offers tight spreads from around 0.1 pips and low commissions starting at $6 per lot. Our test of the cTrader software showed reliable, fast execution with strong liquidity support. The platform excels in advanced risk management tools and automated trading features for active traders.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 Pepperstone's cTrader offers fast execution and tight spreads, often 0.0-0.2 pips on major currencies, with low commissions starting at $7 per round turn. While using it, we experienced seamless order routing, no minimum deposit requirements, and advanced charting and algorithmic trading tools that benefit active traders.

-

4

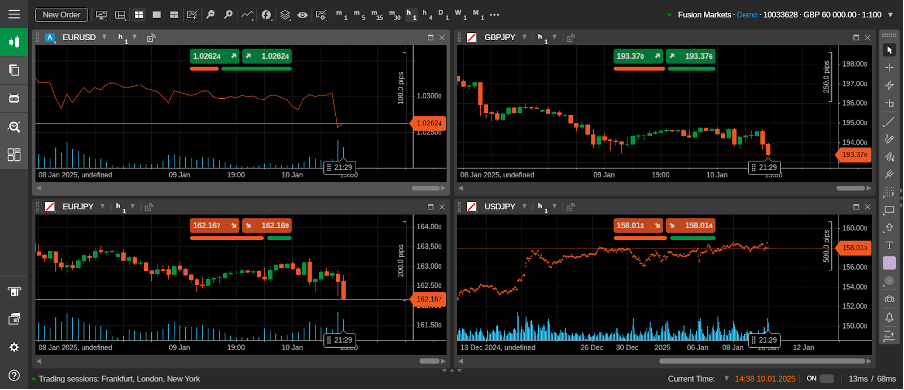

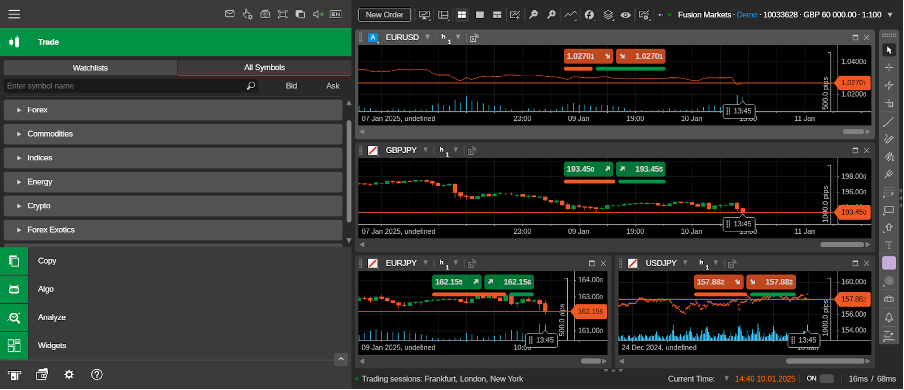

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 Fusion Markets’ cTrader impressed with ultra-low spreads from 0.0 pips and a $7 commission per round turn. During our testing, execution was quick and stable. Advanced features like customizable indicators and smart order types enhance trading for all skill levels.

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.7 BlackBull Markets' cTrader offers tight spreads from 0.0 pips and competitive commissions around $6–$7 per lot. Testing showed consistently fast execution speeds, helped by deep liquidity. Features like automated trading and a customizable interface make it a solid choice for active and professional traders.

Top cTrader Brokers Comparison

Safety Comparison

Compare how safe the Best cTrader Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best cTrader Brokers 2026.

Comparison for Beginners

Compare how suitable the Best cTrader Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best cTrader Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best cTrader Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best cTrader Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best cTrader Brokers 2026.

Broker Popularity

See how popular the Best cTrader Brokers 2026 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Pepperstone |

|

| IC Markets |

|

| IC Trading |

|

| Fusion Markets |

|

Why Trade With IC Markets?

IC Markets provides excellent prices, quick execution, and smooth deposits. The utilization of sophisticated charting platforms such as TradingView and the Raw Trader Plus account makes it a preferred choice for intermediate to advanced traders.

Pros

- You can trade more than 2,250 CFDs in various markets, such as forex, commodities, indices, stocks, bonds, and cryptocurrencies. This range enables varied trading strategies.

- IC Markets provides some of the smallest spreads in the industry, offering 0.0-pip spreads on major currency pairs. This makes trading particularly cost-efficient for traders.

- IC Markets won DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its top-notch MetaTrader integration, perfected over years to enhance the platform experience.

Cons

- IC Markets have a selection of metals and cryptos for trading through CFDs, but their range is not as wide as brokers such as eToro. This may limit options for traders who are interested in these asset types.

- Despite having four top-tier third-party platforms, there is no in-house software or trading app specifically designed for new traders.

- The range and quality of educational materials, such as tutorials and webinars, require improvement. This lag falls behind competitors like CMC Markets and reduces its suitability for novice traders.

Why Trade With IC Trading?

IC Trading's fast execution speeds, strong liquidity, and advanced charting software provide an ideal environment for scalpers, traders, and algorithmic traders.

Pros

- The digital account opening process is efficient, enabling traders to quickly start trading without a lot of paperwork. The process takes only a few minutes in testing.

- IC Trading provides great flexibility with its accounts. Traders can operate up to 10 live and 20 demo accounts, allowing them to have distinct profiles for varied activities like manual and algo trading.

- Trading Central and Autochartist are useful for technical summaries and practical trading ideas. You can access them from your account area or the cTrader platform.

Cons

- During testing, customer support was disappointing. Multiple attempts to reach out through live chat were unsuccessful and emails went unanswered. This raises concerns about their capacity to handle urgent trading issues.

- IC Trading, unlike IC Markets, doesn't offer social trading options via its IC Social app or the ZuluTrade third-party platform.

- The educational resources need enhancement, particularly for beginners who seek a thorough learning experience, contrasted to top-ranking platforms like eToro. This issue is lessened if you visit the IC Markets website, but it can present a challenge for traders.

Why Trade With Pepperstone?

Pepperstone is a leading choice for trading with low spreads, quick execution, and advanced charting for experienced traders. New traders benefit from no minimum deposit, a wealth of educational resources, and 24/7 support. Operating under ASIC regulation, Pepperstone is a top option for Australian traders and won DayTrading.com's 'Best Aus Broker' award for 2025.

Pros

- Support for numerous top-charting platforms such as MT4, MT5, TradingView, and cTrader. These cater to different short-term trading styles, including algorithmic trading.

- Pepperstone has simplified deposits and withdrawals, adding Apple Pay and Google Pay in 2025, and PIX and SPEI for Brazilian and Mexican clients in 2024.

- Pepperstone provides impressive transaction completion speeds, averaging about 30ms. This allows for quick order processing and execution, making it suitable for traders.

Cons

- Pepperstone's demo accounts are available for 60 days, which might not be sufficient to fully learn the platforms and test trading strategies.

- Despite expanding its market range, crypto options are limited compared to other brokers in this area, and there is no option to invest in actual coins.

- Pepperstone does not support cTrader Copy, a popular feature in the cTrader platform available at alternatives like IC Markets, though it has launched an intuitive copy trading app.

Why Trade With Fusion Markets?

Fusion Markets is a top choice for forex traders seeking competitive prices with near zero spreads, minimal commissions, and new TradingView integration. The company, based and regulated in Australia by the ASIC, is especially suitable for Australian traders.

Pros

- Fusion Markets stands out for its competitive pricing, offering narrow spreads and lower-than-average commissions attractive to active traders.

- Execution speeds averaging 37 milliseconds significantly outpace many competitors, assisting traders in obtaining the best prices in quickly changing markets.

- Fusion Markets offers a supported VPS solution for algorithmic traders, including a 25% discount if they choose the NYC Servers VPS for their MT4 or cTrader platforms.

Cons

- The lack of a beginner-friendly trading platform or app is a significant disadvantage compared to AvaTrade.

- Non-Australian traders need to register with global entities that have less regulation, limited safety measures, and no protection against negative balances.

- The demo account lasts for 30 days, reducing its usefulness as a trading tool together with a real-money account.

Why Trade With BlackBull?

After upgrading its trading infrastructure with Equinix servers in New York, London, and Tokyo to reduce latency for traders, BlackBull is a top choice for trading stock CFDs with ECN pricing.

Pros

- BlackBull's updated ECN Prime account is now better suited for new traders. It offers improved spreads averaging 0.16 on EUR/USD and has removed the previous $2,000 minimum deposit, making it more accessible with a $0 deposit.

- BlackBull offers three ECN-powered accounts—Standard, Prime, and Institutional—catering to beginners, experienced traders, and professionals with flexibility for trading needs and capital requirements.

- BlackBulls’s research is excellent, particularly the daily ‘Trading Opportunities’ articles, which make complex market movements easy to understand and help traders capitalize on new trends.

Cons

- BlackBull doesn't have its own platform and uses MetaTrader, cTrader, and TradingView. Though these are excellent, other brokers' platforms, like eToro’s, often offer unique features for beginner traders.

- Unlike most top brokers, BlackBull charges a $5 withdrawal fee, which can reduce cost-effectiveness, especially for active traders who often transfer funds.

- Despite having over 26,000 assets, including new Asia Pacific indices, the selection primarily consists of stocks, with an average range of currency pairs and indices.

Filters

Methodology

To rank the best brokers for cTrader, we:

- Reviewed our directory of online brokers,

- Identified those offering cTrader on desktop, web, or mobile,

- Ranked them based on their overall rating which considers over 200 data points and tester feedback.

What To Look For in a Broker With cTrader

I rate cTrader highly as a powerful trading platform with a user-friendly interface, advanced charting tools, and lightning-fast execution.

It’s a favorite among traders like me who crave a blend of simplicity and sophisticated features, making it ideal for both newbies and pros.

However, not all brokers offering cTrader are created equal. The best cTrader brokers enhance the platform’s strengths while ensuring traders have a smooth, rewarding experience.

Here’s what you should keep an eye on:

Regulation and Security

Trust is paramount. Always choose a broker regulated by reputable authorities like the FCA, CySEC, or ASIC.

Regulation ensures your funds are protected and the broker operates transparently.

Pepperstone is a highly trusted cTrader broker – it’s regulated by seven top-tier bodies and we’ve tested it for years with peace of mind.

Low Spreads and Commissions

The cost of trading can reduce your profits.

If you plan on frequent trading, look for cTrader brokers offering competitive spreads and low commissions. Some providers offer commission-free trading but with wider spreads, so balancing the two is essential.

IC Markets has long stood out in our tests for its terrific pricing on cTrader, with spreads from 0.0 pips.

Fast Execution Speeds

Speed matters in trading, especially if you’re into scalping or trading during volatile markets.

The best cTrader brokers offer lightning-fast execution, minimizing slippage and ensuring you get the best possible prices. Brokers with servers located near major financial hubs tend to offer quicker execution.

FxPro is one of the fastest cTrader brokers we’ve evaluated, sporting fast and reliable execution with speeds averaging 13ms.

Range of Tradable Instruments

A diverse range of tradable assets is a must. Whether you’re into forex, stocks, or commodities, the best cTrader brokers provide a broad selection to diversify your portfolio.

Also check if the broker offers exotic currency pairs or niche markets like cryptocurrencies, adding more opportunities to your trading strategy.

Customer Support

Excellent customer service can make a world of difference.

Choose brokers that offer 24/5 or even 24/7 support through multiple channels like live chat, email, and phone. When you encounter a problem, having a reliable support team to turn to can save you time and stress.

Fusion Markets consistently impresses in the support department – we’ve tested it multiple times and generally get responses in less than two minutes.

Educational Resources and Tools

Continuous learning is key to successful trading. Brokers that offer rich educational content, such as webinars and trading tutorials, help you sharpen your skills and stay ahead of the curve.

FP Markets is a terrific option here, offering a comprehensive video tutorial on using cTrader, which is perfect for new users of the platform.

Demo Accounts

A demo account is an invaluable tool for testing strategies without risking real money.

Top cTrader brokers offer free demo accounts with virtual funds, allowing you to practice and familiarize yourself with the platform.

Even experienced traders use demo accounts to test new strategies before going live.

Deposit and Withdrawal Options

Look for cTrader brokers like Skilling that offer reliable deposit and withdrawal methods, including bank transfers, debit cards, and e-wallets like PayPal or Skrill. Fast processing times and low fees are a plus.

Hassle-free transactions mean you can focus on trading without worrying about delays or excessive charges.

Multi-Device Support

Ensure your broker supports you in trading on the go with cTrader’s mobile and web versions, ensuring you never miss a trading opportunity.

BlackBull, for instance, provides a reliable trading environment for the cTrader desktop client, web solution, and iOS and Android devices.

Expert take: Choosing the right broker for cTrader isn’t just about picking the one with the best platform.

In my experience, it’s about finding a broker that aligns with your trading style, offers competitive costs, and provides the support and tools you need to succeed.

FAQ

What Is cTrader?

cTrader is a popular online platform for trading currencies and CFDs, created by Spotware Systems Group.

Since launching in 2011 with FxPro, it has gained wide popularity, especially with traders seeking advanced features after MetaTrader was removed from app stores in 2022.

Its growth can be attributed to strong charting tools and fast trade execution, which are key for active trading strategies.

Spotware also regularly updates cTrader to enhance its features, making it suitable for all levels of traders. Notable improvements in recent years include new overlay indicators and the Market Replay feature.