Saxo Bank Review 2026

Why Trade With Saxo?

"Saxo is ideal for frequent traders and large-scale investors due to its extraordinary range of tools, high-quality market research, and fee discounts. Moreover, its offering of 190 currency pairs with narrow spreads makes it suitable for forex traders."

Detailed Ratings

Quick Facts

Pros

- The ISA account is easily available and adaptable, without any charges for initiating or concluding transactions.

- High-quality learning materials like podcasts, webinars, and expert videos are available for traders.

- You can use thorough analysis tools like TradingView and Updata for trading.

- A reputable and strictly regulated brand from Switzerland.

- A top-tier research center providing market analysis and unique insights, including 'Outrageous Predictions' for traders.

Cons

- To view Level 2 pricing, a subscription is necessary.

- Do not accept clients from certain regions, specifically the US and Belgium, for trading activities.

- The trading accounts require substantial funding.

Regulation & Trust

Saxo Bank, headquartered in Copenhagen, was established in 1992 as a private company and has since become a leading innovator in retail brokerage across Europe and globally.

Its commitment to secure and compliant trading is reflected in its regulation by over 10 financial authorities worldwide.

The UK’s Financial Conduct Authority (FCA) and the Danish Financial Supervisory Authority (FSA) are among the most notable regulatory bodies overseeing Saxo Bank’s operations.

Additionally, Saxo holds a Capital Market Services (CMS) license in Singapore, is regulated by the Financial Market Supervisory Authority (FINMA) in Switzerland, and operates under ASIC oversight in Australia.

These licenses highlight Saxo’s strong global regulatory framework and commitment to investor protection.

Regulation & Trust Details

- Regulator: DFSA, MAS, FCA, SFC, FINMA, AMF, CONSOB

- Guaranteed Stop Loss: No

- Negative Balance Protection: No

- Segregated Accounts: Yes

Accounts & Banking

Live Accounts

Saxo Bank’s platform’s account structure is transparent and flexible. It offers three main account types: Classic, Platinum and VIP.

I started with a Classic account, which requires a standard minimum deposit that varies depending on the country.

Suppose you upgrade to the Platinum account by depositing at least $200,000, customer service should become more personal, you’ll get access to IP-secured logins, and the spreads tighten significantly.

The VIP account, which requires a minimum of $1,000,000, offers even more personalized services.

Saxo Bank uses a tiered margin system that allows for leverage up to 1:30, which is standard among EU-regulated brokers.

This system is particularly effective for managing risk, especially during periods of high market volatility driven by political or economic events. It gives more control over trades and risk exposure.

Funding and withdrawals with Saxo Bank work smoothly. I typically transfer funds via bank wire transfer, which takes one to five business days.

As a European client, I receive money through Saxo’s Danish account, which means it’s processed as an international transfer. When I need faster access, I use a debit card for instant deposits, though I factor in the 0.5 to 2.5 percent fee charged by the card provider.

Minimum deposit requirements vary depending on the region. I need £500 in the UK to open an account, which is much more than most regular brokers like AvaTrade’s $100 minimum deposit.

In other regions, the amount ranges — some places like Belgium, Denmark, Norway, and Singapore have no minimum, while others, like Central Eastern Europe (non-EU countries), require up to €10,000.

Even though Saxo Bank doesn’t offer trading bonuses, we see that as a positive. Regulatory bodies often discourage bonuses because they can lead to excessive trading.

Instead, Saxo focuses on offering competitive spreads, especially in forex, where commission-based pricing is common. Its trading costs feel fair and align well with those of other top-tier brokers we’ve tested.

Demo Accounts

Right after registering, you are given instant access to a demo account. This account lets you explore the platform immediately—no delays, no extra steps. Before committing real money, I could click around freely, try different tools, and get a feel for the interface.

It closely mirrors live market conditions, making the transition from testing to execution seamless.

Even now, with real positions running in my live account, I still use the demo as a safe space to experiment.

It’s an essential part of my workflow — especially when I want to practice during volatile market periods or before major economic events.

Accounts & Banking Details

- Minimum Deposit:

- Account Types: ECN

- Payment Methods: Credit Card, Mastercard, PayNow, Visa, Wire Transfer

- Account Currencies: USD, EUR, GBP, CAD, AUD, JPY, SEK, DKK, CHF

- Islamic Account: Yes

Assets & Markets

The broad access it provides across global markets makes Saxo Bank stand out.

You can trade forex, bonds, equities, ETFs, mutual funds, options, futures, warrants, commodities, and region-dependent products like CFDs and crypto derivatives through a single platform.

It’s a comprehensive setup that allows you to diversify your trading without juggling multiple platforms.

In the forex market, Saxo Bank offers over 100 currency pairs, giving plenty of options to explore major and minor pair strategies.

Execution has been reliable during testing, and spreads are generally competitive. For someone who trades during news events or volatile sessions, stability during peak times is key, and Saxo Bank handles this well, in my experience.

Crypto trading is available as derivatives tied to major coins like Bitcoin, Ethereum, and Litecoin. These are offered as FX-style pairs linked to USD, EUR and JPY currencies.

While it doesn’t offer spot crypto trading, unlike eToro, this approach provides a regulated, streamlined way to gain exposure without dealing with wallets or unregulated exchanges.

Saxo Bank’s bond offering is more extensive than we initially expected. There are over 5,000 bonds, including about 3,400 from developed markets and 1,600 from emerging ones.

Access to government bonds in more than 40 countries is useful when adjusting for risk or diversifying income sources.

Corporate bonds are also available, though limited to seven countries, which may be a consideration depending on your strategy.

Assets & Markets Details

- Instruments: Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs

- Leverage: 1:30

- Margin Trading: No

- Stock Exchanges: London Stock Exchange, Nasdaq Dubai, New York Stock Exchange, S&P 500, Shenzhen Stock Exchange, Toronto Stock Exchange

- Commodities: Copper, Corn, Gold, Natural Gas, Oil, Silver

- Crypto Coins: BTC, ETH, LTC, XRP, XTZ, SOL, ADA, DOT

Fees & Costs

Since joining Saxo Bank, we’ve noticed significant improvements in its pricing, which help to make trading more affordable.

Commissions for US stocks now start at just $1, and UK stocks begin at £3. US options are priced at $0.75 per contract, which is also competitive.

Currency conversion fees have dropped to 0.25%, which applies to automated conversions, sub-account transfers, and FX options — a welcome change for frequent traders.

Futures are priced at $3 for Classic accounts, $2 for Platinum, and $1 for VIP accounts. However, the high minimum deposit requirements of $200,000 for Platinum and $1,000,000 for VIP accounts will be a barrier for most retail traders.

Spreads for forex and metals start at 0.4 pips, which is excellent. The removal of inactivity fees and lower custody fees also benefit casual traders.

Fees & Costs Details

- Crypto Spread: Variable

Forex Spreads

- GBP/USD: 0.7 (varies by region)

- EUR/USD: 0.2 (varies by region)

- GBP/EUR: 0.6 (varies by region)

CFD Spreads

- FTSE: 1.2 pts (Variable)

- GBP/USD: 0.7 (var)

- Oil: 0.03

- Stocks: 0.10% (subject to min commission)

Platforms & Tools

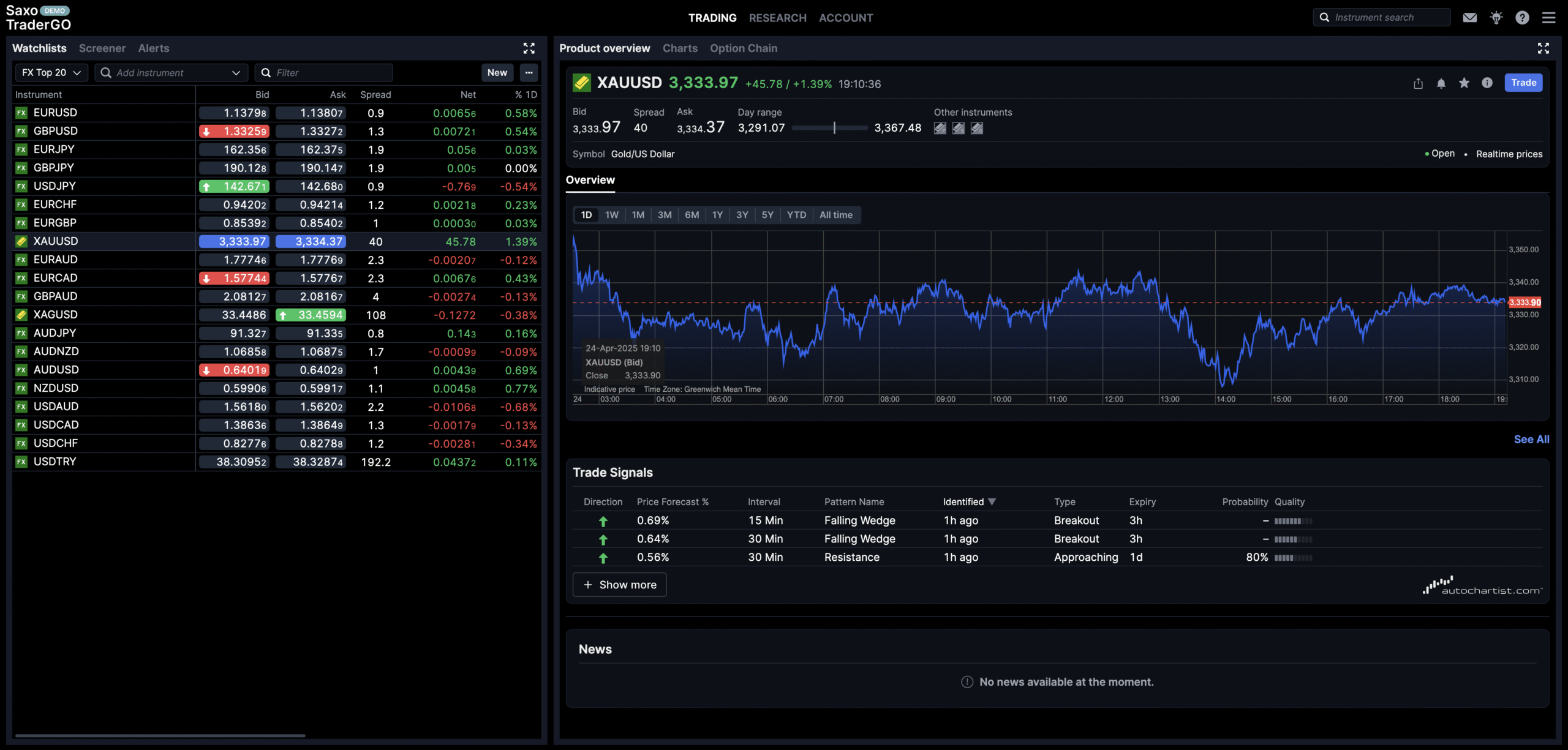

I mainly use the SaxoTraderGO platform from a browser and on my mobile devices, especially when I need to trade or monitor positions while traveling or during short breaks throughout my day.

The app is quick, responsive, and generally easy to use. It offers most of the core features I need, like charting tools and order entry, and the interface is well-organized.

It’s not perfect, though. I sometimes find it challenging to manage more complex trades or view multiple assets at once on a mobile screen.

SaxoTraderGO offers a user-friendly interface on web and mobile devices

When I’m at my desk, I prefer using the SaxoTraderPRO platform, which is more feature-rich and suitable for managing larger positions. It’s compatible with Windows and macOS, and while it’s powerful, it can initially feel overwhelming. Also, it’s available for download only and can’t be used from a browser.

There’s a learning curve to fully understand all the tools and functionalities, especially regarding advanced charting and market analysis. But once you got the hang of it, you’ll appreciate how customizable the platform is.

You can arrange the interface however you want, add various indicators, and even set up multiple screens. It’s a trader’s dream for anyone who enjoys detailed, in-depth market analysis. However, the complexity might not be ideal for beginners, as it can be much for someone just starting.

On the security side, Saxo takes security seriously, which I really appreciate. Platinum and VIP account holders have access to an IP-linked login, which adds an extra protection layer.

Sadly, those on lower-tier accounts may not have the same level of security, which could be a downside if you’re trading with large amounts of capital.

Overall, my experience with Saxo Bank’s trading platforms has been positive. The wide selection of markets, flexibility across devices, and strong security measures give it a competitive edge.

A few areas could use some refinement, especially in terms of customization options and the learning curve for some of the more advanced features.

The only noticeable downside is that it does not support popular third-party trading platforms like MetaTrader or cTrader, although we’ve been pleased to see support for TradingView and MultiCharts.

Platforms & Tools Details

- Platforms: TradingView, ProRealTime

- Android App Rating:

- iOS App Rating:

- Copy Trading: No

- VPS: No

- Automated Trading:

- AI Trading: No

Research

Saxo Bank’s live market news helps you keep up with real-time developments and stay informed about key market events that might impact your trades.

Equity analysis is another feature I frequently use. It provides detailed insights into stock movements, and I’ve found it helpful for making informed decisions about my equity trades.

The strategists’ opinions are also a great resource, and I often turn to them for a broader perspective on market trends. These expert insights help you see beyond the day-to-day fluctuations and think more strategically about long-term positioning.

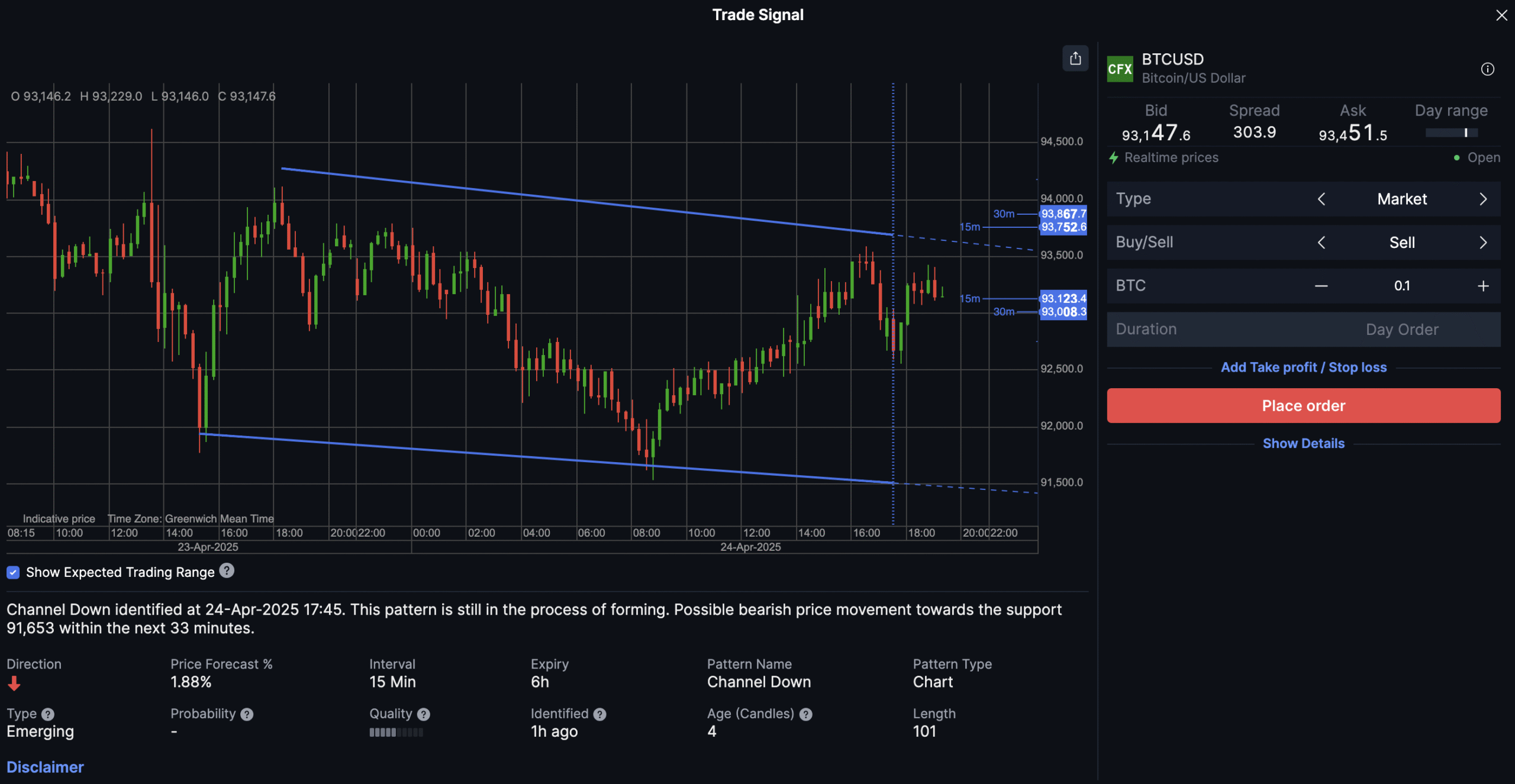

SaxoTraderGO’s trading signals provide useful insights and potential trade ideas

Also check out the trade signals and macroeconomic calendar. The Autochartist trade signals give actionable ideas that you can use to enter or exit trades, and the economic calendar is vital for keeping track of upcoming events that could move markets, like central bank meetings or economic reports.

While the research tools are robust, they can sometimes feel overwhelming, especially for newer traders. The sheer amount of information available can be hard to digest all at once, and it takes time to figure out which tools and features are most useful for your trading style.

Education

Saxo Bank stands out when it comes to educating traders. As someone always looking to improve my trading knowledge, I’ve found its platform to be a great resource.

It offers webinars led by experts covering a wide range of asset classes, which have helped me deepen my understanding of different markets. It also provides articles, interview videos and podcasts.

Saxo Bank offers a solid range of educational resources, including webinars and tutorials

While the educational tools are solid, they require some effort to fully explore and use, especially for newer traders. There are no structured trading courses, either.

While some content can be overwhelming and navigating the various platforms takes time, Saxo Bank’s educational resources are excellent.

Customer Support

I’ve used Saxo Bank’s support quite a bit, and overall, it’s been a positive experience.

While there’s no live chat, the phone and email support is helpful and provides a more personal touch for more complex issues.

However, I’ve occasionally faced long wait times during busy periods, and some responses from agents have felt a bit generic.

The Help Center is comprehensive and covers many topics, but navigating it can be tricky when I’m looking for specific information.

Overall, Saxo’s support is solid, but response times and the depth of assistance could be improved.

Should You Trade With Saxo Bank?

Saxo Bank stands out as a top brokerage with its powerful trading platform, which offers access to global markets and a wide variety of asset classes.

The research and customer service teams are always available to assist traders, ensuring a strong support system.

While the high minimum trading fees may be a challenge for some, the exceptional service and features solidify Saxo’s reputation as a leading global player.

Article Sources

Alternatives To Saxo

These similar brokers are the highest rated alternatives to Saxo.

-

1

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.3 Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading. -

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.6 Founded in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage offering trading on over 1,200 instruments, including binary options. It provides various accounts (JForex, MT4/5, Binary Options) and advanced platforms (JForex, MT4/MT5) with strong tools and market data for active traders. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms.