Best Options Brokers 2026

We’ve tested and ranked the top options brokers, selected for their excellent trading conditions, from fees and commissions to platform usability and trust.

-

1

IBKR’s platform impressed with low commissions, starting at $0.25 per contract for high-volume traders, and no extra spreads or platform fees. It provides vast global options markets and advanced tools. The Trader Workstation (TWS) interface can be complex, requiring new traders to learn. Real-time data access needs extra subscriptions.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 In our tests, NinjaTrader stood out for its advanced charting, automated options trading, and low commissions beginning at $0.09 per micro contract. The platform includes a free version with basic features and paid plans for advanced tools. It provides strong tools for experienced options traders, but beginners may find it challenging to learn.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 eToro USA's options platform offers a user-friendly interface with no commission or contract fees on U.S. equity options. Regulatory fees include a $0.02645 per contract Options Regulatory Fee (ORF) and a $0.00279 per contract FINRA Trading Activity Fee. It provides access to various U.S.-listed stocks and options, with a $50 minimum deposit required to begin.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 During our tests, FOREX.com provided fast, reliable options execution with user-friendly tools on both desktop and mobile. The platform offers a wide variety of currency and index options with competitive pricing, typically $0.50–$0.80 per contract. It is regulated in multiple areas and allows small trade sizes and low deposits for flexible access.

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.3 When we tested Moomoo’s US options, the platform impressed with $0 commission on equity options and only $0.50 per index contract. It supports 13 strategies, offers real-time Level 2 data (with $100 average balance), and provides fast execution. FCA/SEC regulated, low deposits, but note: options positions cannot be transferred out once opened, which users found restrictive in our live trades.

Best Options Brokers Comparison

Safety Comparison

Compare how safe the Best Options Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Options Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Options Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Options Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Options Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Options Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Options Brokers 2026.

Broker Popularity

See how popular the Best Options Brokers [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Moomoo |

|

| Interactive Brokers |

|

| eToro USA |

|

| NinjaTrader |

|

| FOREX.com |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- IBKR provides a cost-effective platform for traders by offering low fees, narrow spreads, and clear pricing.

- The TWS platform is designed for intermediate to advanced traders. It includes over 100 order types and a dependable real-time market data feed that rarely experiences downtime.

- There's a large selection of free or paid research subscriptions available to all traders. If you subscribe to Toggle AI, you will also receive commission refunds from IBKR.

Cons

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- You can access thousands of applications and add-ons from developers worldwide for trading.

- NinjaTrader provides detailed charting software for active traders, complete with custom technical indicators and widgets.

- NinjaTrader is a well-regarded and acclaimed futures broker, approved by the NFA and CFTC.

Cons

- The advanced trading tools require an additional fee.

- Some payment methods require a withdrawal fee.

- You need to register with partner brokers to trade in securities other than forex and futures.

Why Trade With eToro USA?

eToro is a top choice for traders due to its top-notch social investing and copy trading services. The broker caters well to new traders with its low deposit requirement, commission-free trading, and user-friendly platform.

Pros

- eToro USA Securities is a reliable broker that's regulated by the SEC, part of FINRA, and a member of SIPC.

- The online broker provides a user-friendly social investment network for easy crypto trading replication.

- A free demo account enables new users and potential traders to test the broker without risk.

Cons

- Traders used to third-party charting tools won't find MetaTrader 4 platform integration.

- Average fees can reduce the profits of traders.

- The exclusive terminal does not accommodate trading bots and lacks extra equity market analysis tools.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

Cons

- FOREX.com has expanded their trading offerings, but these remain limited to forex and CFDs. Unfortunately, they don't provide options to invest in actual stocks, ETFs, or cryptocurrencies.

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

- The funding options are not as extensive as those of top competitors such as IC Markets and lack several widely-used e-wallets, particularly UnionPay and POLi.

Why Trade With Moomoo?

Moomoo is a great option for beginner and intermediate traders aiming to diversify their investment portfolio. The brokerage's app is easily navigable and the trading fees are significantly low.

Pros

- Moomoo is a FINRA and SIPC member, providing additional security for potential clients interested in trading.

- The broker requires no minimum deposit, making it suitable for beginner traders.

- The fees for options contracts have been lowered from $0.65 to $0.

Cons

- The broker doesn't offer phone or live chat support, options typically provided by other brokers.

- Regrettably, even with its existing security features, this platform still lacks 2 factor authentication (2FA).

- The protection against negative balance, a standard security measure at highly regulated brokers, is not available here.

Filters

How We Chose the Best Options Brokers

We conducted an in-depth evaluation to pinpoint the best options brokers, assigning ratings based on their overall trading experience.

Here’s how we determined the top choices:

- Data-Driven Assessment – We analyzed over 200 key factors, focusing on key factors like the availability of options contracts and pricing.

- Hands-On Testing – We went beyond raw data, actively using each broker’s platform to assess trading tools, support, and user experience.

What to Look for in a Broker for Trading Options

Whether you’re just dipping your toes into the world of trading options or you’ve already got some experience under your belt, finding the right broker can make all the difference.

A good broker can make your trading experience seamless, educational, and profitable, while a poor one can leave you frustrated and out of pocket.

Here’s a detailed breakdown of what to look for when choosing a broker for trading options:

Low Fees and Commissions

Let’s face it — fees can eat into your profits faster than you can say “call option.” When trading options, you’ll encounter costs like:

- Per-contract fees: Some brokers charge a flat rate per options contract (e.g., 0.50 to 1.50 per contract).

- Base commission: A fee charged per trade, regardless of the number of contracts.

- Exercise and assignment fees: Charged when an option is exercised or assigned.

Expert take: I’d look for brokers with competitive pricing, especially if you plan to trade frequently. Some brokers even offer $0 commissions on options trading, though they might make up for it in other ways (like wider spreads).

User-Friendly Platforms and Tools

If you’re new to options trading, a clunky or overly complex platform can feel like trying to fly a spaceship without a manual.

Look for brokers that offer:

- Intuitive interfaces: Easy-to-navigate platforms that don’t require a PhD to understand.

- Customizable dashboards: The ability to set up your workspace to track the metrics that matter most to you.

- One-click trading: Quick execution is crucial in fast-moving markets.

- Paper trading: A risk-free way to practice trading options before putting real money on the line.

Expert take: I’ve discovered platforms like Interactive Brokers are great examples of user-friendly yet powerful tools for options traders. You can trade options on US and international markets for $0.65 per contract (with volume discounts available).

Educational Resources for Beginners

Options trading has its own language – calls, puts, strikes, spreads, Greeks (no, not the ancient kind). If you’re new to this, you’ll want a broker that offers:

- Tutorials and webinars: Step-by-step guides to help you understand the basics and advanced strategies.

- Glossaries and FAQs: Quick references for all those confusing terms.

- Demo accounts: Practice trading options with virtual money to build confidence.

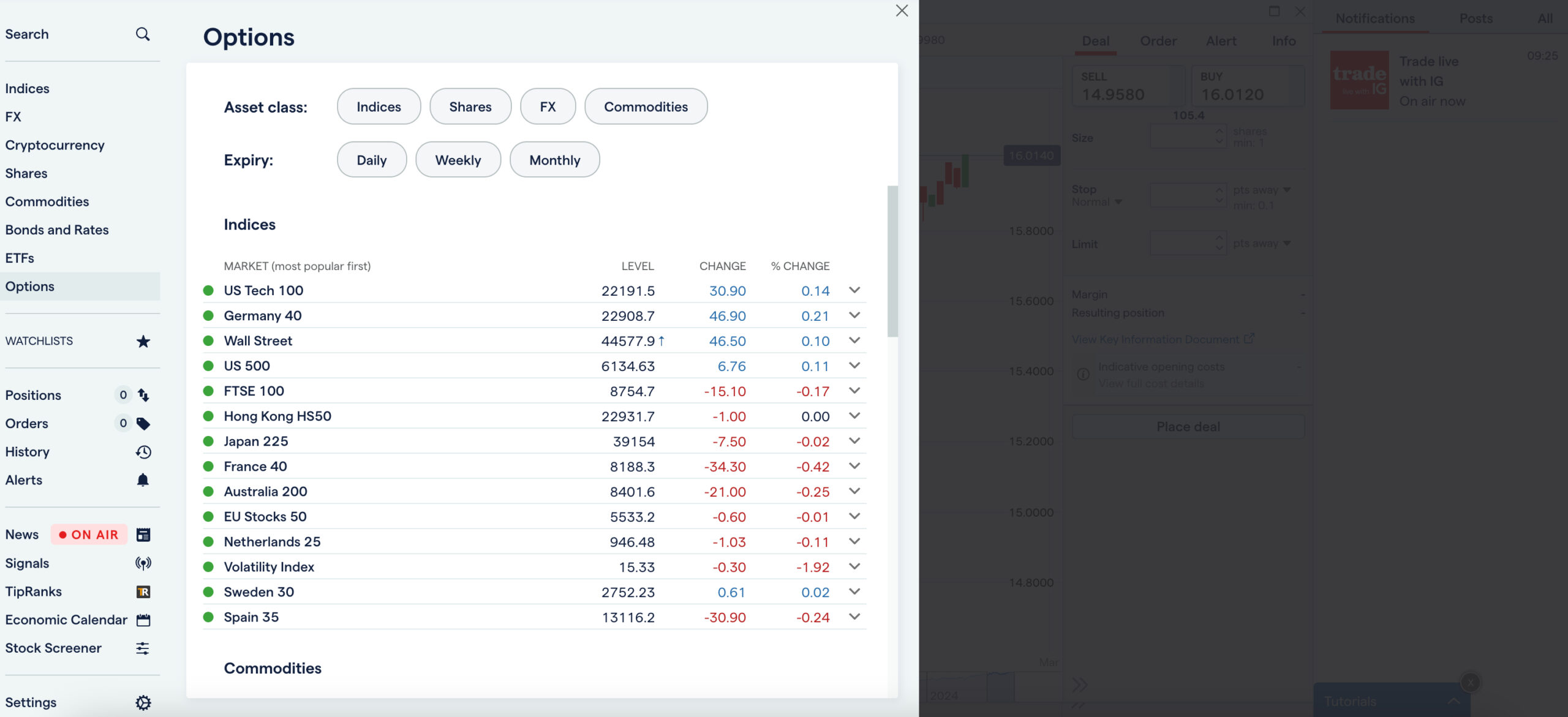

Expert take: In my opinion, brokers like IG are best for their extensive educational libraries, which make them excellent choices for beginners. IG is best for experienced traders who want a reliable, feature-rich platform and access to global options markets.

IG Platform

Robust Research and Analysis Tools

Successful options trading relies on solid research and analysis. Look for brokers that provide:

- Real-time data: Up-to-the-second pricing and market information.

- Options screeners: Tools to filter and find the best opportunities based on your criteria.

- Charting tools: Advanced charts with technical indicators to help you spot trends.

- Market news and insights: Stay informed about events that could impact your trades.

Expert take: Platforms like CMC Markets excel in this area, offering professional-grade tools for serious traders. You can trade options on indices, commodities, forex, and more with low spreads and no commission on CFD options trading.

Reliable Customer Support

When you’re in the middle of a trade, and something goes wrong, you don’t want to be stuck on hold for hours. Look for brokers that offer:

- 24/7 support: Because the market doesn’t sleep, and neither should your broker’s support team.

- Multiple contact options: Phone, email, live chat, and even social media support.

- Knowledgeable reps: Support staff who actually understand options trading and can help you resolve issues quickly.

Expert take: Brokers like Saxo Bank performed particularly well during our tests of its customer service. It offers access to options markets in the US, Europe, and Asia.

Mobile Trading Capabilities

In today’s fast-paced world, you must be able to trade options on the go. A good brokerage should offer:

- A fully functional mobile app: This allows you to monitor your positions, place trades, and access research tools from your phone.

- Push notifications: Alerts for price movements, order executions, and important news.

- Security features: Biometric login (fingerprint or face ID) to keep your account safe.

Expert take: easyMarkets is popular for its sleek, user-friendly mobile trading app, though it may lack some advanced features on desktop platforms.

Account Minimums and Margin Requirements

Some brokers require a hefty minimum deposit to start trading options, while others let you get started with just a few dollars. Consider:

- Account minimums: If you’re just starting out, you might prefer a broker with no minimum deposit.

- Margin accounts: If you plan to trade advanced options strategies like spreads or straddles, you’ll need a margin account. Check the broker’s margin requirements and interest rates.

Brokers like FOREX.com are great for beginners with smaller accounts, while platforms like Interactive Brokers cater to more experienced traders with larger balances.

Reputation and Regulation

Last but definitely not least, make sure your broker is reputable and regulated by a recognised authority like the SEC (US Securities and Exchange Commission), FINRA (Financial Industry Regulatory Authority), or the FCA (UK Financial Conduct Authority).

This will help safeguard your funds from bad actors and potential trading scams, while potentially ensuring measures like negative balance protection are in place so you can’t lose more than your balance.

Pro tip: Check our online reviews to see the scores our experts assigned each broker’s trustworthiness.