Best Financial Industry Regulatory Authority (FINRA) Regulated Brokers 2026

We’ve personally tested and ranked the top brokers regulated by the US Financial Industry Regulatory Authority (FINRA), ensuring high standards of trust and reliability.

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 eToro is a platform for social investing that provides options for both short and long-term trading on stocks, ETFs, options, and crypto. The platform is recognized for its easy-to-use, community-oriented interface and reasonable fees. With oversight from FINRA and SIPC, and used by millions globally, eToro is a reputed name in the industry. Trading on eToro is facilitated by eToro USA Securities, Inc. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.3 Moomoo is a regulated trading platform which is controlled by SEC. It provides a simple, cost-effective method to trade in stocks, ETFs, and various assets from China, Hong Kong, Singapore, the US, and Australia. They provide the option for margin trading, along with no deposit account and several bonus options. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Firstrade is a US-based discount broker-dealer authorized by the SEC and a member of FINRA/SIPC. It offers welcome bonuses, advanced tools and apps, and commission-free trading. Firstrade Securities is a popular top online brokerage, and opening a new account is fast and simple.

Compare the Best FINRA-Regulated Brokers

Safety Comparison

Compare how safe the Best Financial Industry Regulatory Authority (FINRA) Regulated Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Financial Industry Regulatory Authority (FINRA) Regulated Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Financial Industry Regulatory Authority (FINRA) Regulated Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Financial Industry Regulatory Authority (FINRA) Regulated Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Financial Industry Regulatory Authority (FINRA) Regulated Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Financial Industry Regulatory Authority (FINRA) Regulated Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Financial Industry Regulatory Authority (FINRA) Regulated Brokers 2026.

Broker Popularity

See how popular the Best Financial Industry Regulatory Authority (FINRA) Regulated Brokers 2026 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Moomoo |

|

| Interactive Brokers |

|

| eToro USA |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- IBKR, primarily designed for skilled traders, has expanded its appeal recently by eliminating its initial $10,000 deposit requirement.

- Interactive Brokers was named Best US Broker for 2025 by DayTrading.com for its dedication to US traders, ultra-low margin rates, and affordable global market access.

- IBKR is a highly regarded brokerage, regulated by prime authorities. This ensures the safety and reliability of your trading account.

Cons

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

Why Trade With eToro USA?

eToro is a top choice for traders due to its top-notch social investing and copy trading services. The broker caters well to new traders with its low deposit requirement, commission-free trading, and user-friendly platform.

Pros

- The low minimum deposit and simple account setup allow beginners to start trading quickly.

- eToro USA Securities is a reliable broker that's regulated by the SEC, part of FINRA, and a member of SIPC.

- The online broker provides a user-friendly social investment network for easy crypto trading replication.

Cons

- There are fewer trading options available, including only stocks, ETFs, and cryptos, compared to competitors.

- Traders used to third-party charting tools won't find MetaTrader 4 platform integration.

- Average fees can reduce the profits of traders.

Why Trade With Moomoo?

Moomoo is a great option for beginner and intermediate traders aiming to diversify their investment portfolio. The brokerage's app is easily navigable and the trading fees are significantly low.

Pros

- Moomoo's insights and analytics are more comprehensive and detailed than other brands.

- The 'Moomoo Token' produces changing passwords to enhance transaction security - a distinctive and practical safety measure for traders.

- Moomoo is a FINRA and SIPC member, providing additional security for potential clients interested in trading.

Cons

- Regrettably, even with its existing security features, this platform still lacks 2 factor authentication (2FA).

- The broker doesn't offer phone or live chat support, options typically provided by other brokers.

- The protection against negative balance, a standard security measure at highly regulated brokers, is not available here.

Why Trade With Firstrade?

Firstrade is ideal for beginners wanting to trade US stocks without commission fees. It offers plenty of free educational resources and high-quality research, including its new FirstradeGPT tool. Users also get trading ideas from Morningstar, Briefing.com, Zacks, and Benzinga.

Pros

- In 2025, Firstrade Invest 3.0 will enhance the platform with a cleaner interface and faster order entry, benefiting active traders in key areas such as watchlists and options chains.

- Improved stock trading features now include overnight trading and fractional shares.

- FirstradeGPT ranks among the initial brokers to offer AI-powered analysis.

Cons

- Over 90% of the evaluated options lack a demo or paper trading account.

- Customer support needs improvement after testing, with no 24/7 help available.

- Visa card deposits and withdrawals are not accepted.

Filters

How BrokerListings.com Selected the Top FINRA-Regulated Brokers

To find the most trustworthy brokers overseen by FINRA (the Financial Industry Regulatory Authority):

- Regulatory Verification: Each broker’s registration and disciplinary record were verified through FINRA’s BrokerCheck database. This ensured that all firms should operate under FINRA’s strict standards for investor protection, market integrity, and fair dealing.

- Comprehensive Broker Evaluation: Using our proprietary scoring framework, we reviewed over 200 data points per broker, including platform reliability, pricing transparency, investment options, and customer service responsiveness.

- Hands-On Testing: Our team opened accounts to test providers. This allowed us to assess not only regulatory compliance but also execution, ease of use, and the overall trading experience from a trader’s perspective.

What Is FINRA?

The Financial Industry Regulatory Authority (FINRA) is one of several bodies that oversees the smooth and orderly running of financial services and markets in the US.

Established in 2007, the organization’s mission statement is “to protect investors and safeguard the integrity of our vibrant capital markets to ensure that everyone can invest with confidence.”

It is a self-regulatory body that operates under the umbrella of the US Securities and Exchange Commission (SEC), which is responsible for the broader regulation and oversight of the country’s securities markets.

FINRA issues licenses to brokers, supervises their conduct, and carries out enforcement action when it considers rules have been breached. It has been designated Category A status by BrokerListings.com under our broker regulator rating system.

As a consequence, traders who use a FINRA-registered broker can expect an excellent level of service.

Pro tip: More than 3,250 companies and 625,000 financial services representatives are licensed by FINRA.

What Powers Does FINRA Have?

FINRA is charged with regulating three types of entity:

- Broker-dealers, which buy and sell securities for customers as well as themselves.

- Capital acquisition brokers, which offer a more limited range of services (such as advising companies on capital raising and corporate restructuring).

- Funding portals, which facilitate crowdfunding campaigns through online platforms.

All registered broker-dealers and brokers that trade securities in the US must adhere to rules that FINRA has written. The regulator closely supervises their activities to ensure compliance, and undertakes enforcement measures when appropriate.

It has established four key objectives for its regulatory activities. These are:

- “obtaining restitution for harmed customers.”

- “ridding the industry of brokers engaged in fraud or other egregious misconduct.”

- “protecting seniors and vulnerable investors.”

- “ensuring the integrity of the markets.”

FINRA has a range of tools it can use to penalize rulebreakers. It can impose informal disciplinary actions like Cautionary Actions for minor infractions. For more serious cases it can impose sanctions that include financial penalties, suspending and barring firms from undertaking certain activities, and striking companies from its register.

In March 2025, the regulator ordered Robinhood to pay a total of $29.75 million “for violating numerous FINRA rules.”

These breaches included providing customers with inaccurate or incomplete disclosures; failing to implement reasonable anti-money laundering systems; failing to reasonably supervise its clearing technology system; and failing to comply with reporting requirements.

The $29.75 million sum comprised a $26 million fine and $3.75 million in restitution for customers.

What Rules Must A FINRA Broker Follow?

The FINRA Rulebook provides a comprehensive list of obligations entities must meet. These include:

- Observing “high standards of commercial honor and just and equitable principles of trade.”

- Ensuring that transactions are “as favorable as possible under prevailing market conditions” for the customer, based on factors like the asset price, market liquidity, and the size and type of the transaction.

- Using “reasonable diligence, in regard to the opening and maintenance of every account, to know (and retain) the essential facts concerning every customer.”

- Making sure that “a recommended transaction or investment strategy involving a security or securities is suitable for the customer.”

- Confirming that all communications are “based on principles of fair dealing and good faith, must be fair and balanced, and must provide a sound basis for evaluating the facts.”

- Ensuring that retail communications that compare investments and services “must disclose all material differences between them,” including on costs, potential returns and tax features.

- Guaranteeing that “securities that are held on margin for a customer and that are eligible to be pledged or loaned” are not done so without prior client authorization.

- Taking care to “establish and maintain a system to supervise the activities of each associated person” so that FINRA rules are followed.

How Can I Check If A Brokerage Is FINRA Regulated?

Traders and investors can simply and quickly check a broker’s regulatory status using FINRA’s BrokerCheck search facility. This can be used to search for both companies and individuals.

Let’s say I wish to check that eToro USA is FINRA-authorized. I click over to the ‘Firm’ tab, type the broker’s name into the ‘Firm Name’ field and hit the ‘Search’ button:

Searching for eToro USA using FINRA’s BrokerCheck facility. Source: FINRA

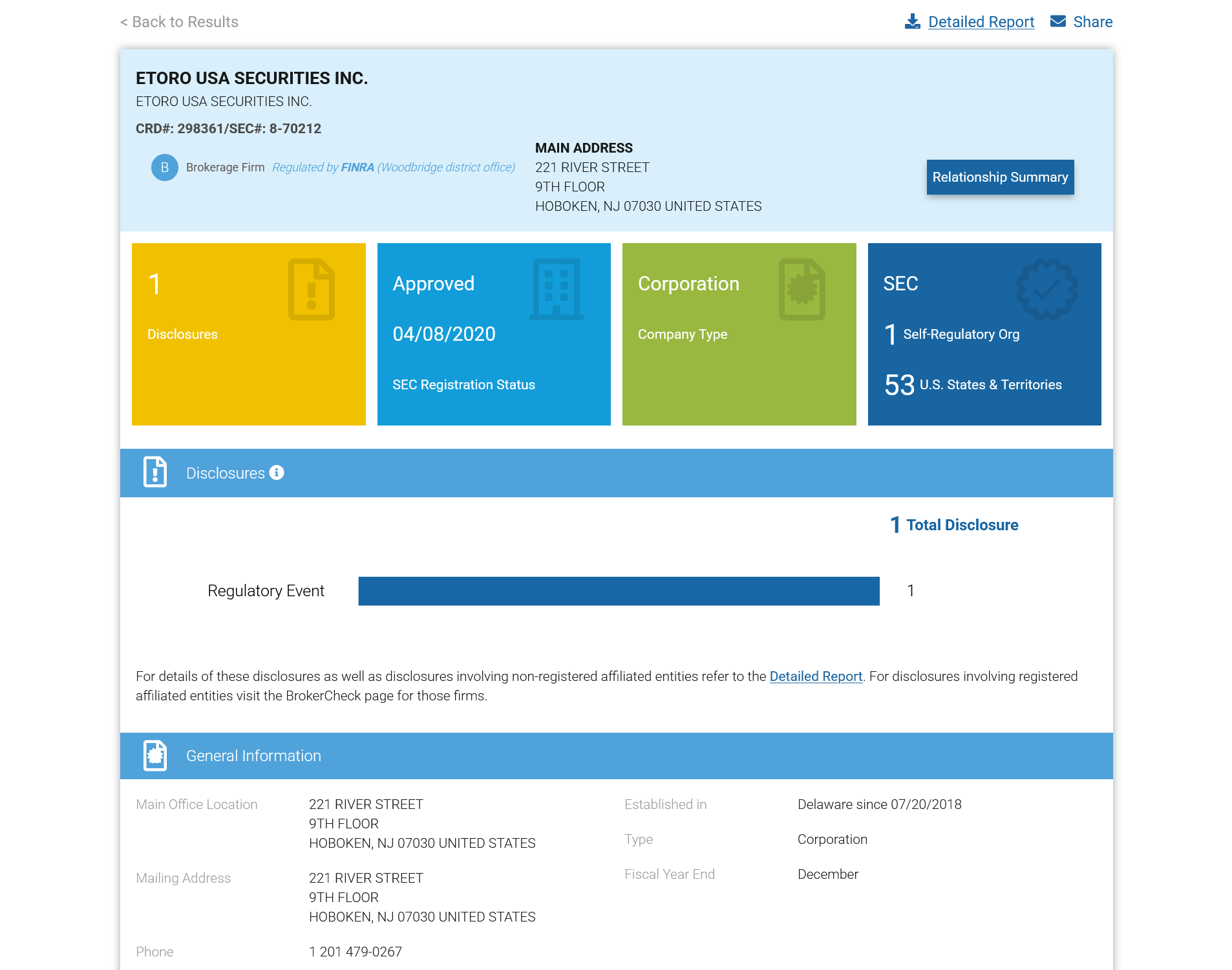

My search generates one result, confirming that eToro USA is licensed and revealing basic information like the company’s Central Registration Depository (CRD) registration number and registered address.

Locating eToro USA using FINRA’s BrokerCheck facility. Source: FINRA

Clicking on the information box gives me even more details like the type of business it conducts, categories of registrations with FINRA and SEC, and disclosures on items like regulatory events and criminal matters.

I can also download a ‘Detailed Report’ from this page. This document provides a more comprehensive picture of the broker and its activities.

eToro USA’s detailed profile on FINRA’s BrokerCheck. Source: FINRA

FINRA set up the BrokerCheck Help Line to help individuals navigate the search facility and understand the information provided. It can be reached on (800) 289-9999.

FINRA also maintains a list of people it has barred from working for any entity that it oversees. On top of this, traders can view a database of companies and individuals against whom it has taken disciplinary action since 2005.

Pro tip: Consider using a broker with a USD account if you actively trade in the US. These accounts can save you a wedge of cash by avoiding currency conversion fees.

Bottom Line

Verifying that the broker you use is licensed and supervised by FINRA is an essential step for all traders. Individuals using FINRA-authorized brokers can expect an excellent level of protection from bad business practices and fraudulent activity.

Bad actors still operate in the US, like any other territory. So it’s critical to keep your eyes peeled for potential threats.

Article Sources

Financial Industry Regulatory Authority (FINRA)

How FINRA Serves Investors and Members – FINRA

On the Front Lines of Investor Protection – FINRA