Best Lead Brokers 2026

We’ve researched, tested, and ranked the best brokers for trading lead in 2026, helping you access reliable platforms with competitive pricing, robust tools, and exposure to global lead markets.

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 Established in 2008, Exness is a respected broker known for offering over 40 account currencies, a wide choice of CFD instruments, and an intuitive web platform with features like currency converters and trading calculators. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 Fusion Markets, an online broker since 2017, is regulated by the ASIC, VFSC and FSA. Known for its low-cost forex and CFD trading, it offers a variety of accounts and copy trading options for all types of traders. New traders can register and begin trading in three easy steps. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.7 BlackBull, based in New Zealand, is a CFD broker offering trading on over 26,000 instruments. After a 2023 rebrand, it now features a modern design with advanced trading tools and execution speeds averaging 20ms. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 is a leading multi-asset platform offering trading in thousands of CFDs, stocks, and cryptoassets. Established in 2007, it has millions of active global traders and is regulated by top authorities like the FCA and CySEC. It is well-known for its social trading platform. Crypto trading is provided through eToro USA LLC. Investments are subject to market risk, including potential loss of principal. CFDs are not available in the US. Crypto investments carry risk and may not be suitable for retail investors, with a possibility of losing your entire investment. Understand the risks here. 61% of retail CFD accounts lose money.

Compare The Best Brokers For Trading Lead Across Key Features

We’ve analyzed and compared the top platforms for lead trading—see how they stack up in critical areas:

How Secure Are The Top Lead Trading Platforms?

Security matters when trading lead. See how each broker protects your capital:

Mobile Platforms For Lead Trading – Compared

We tested mobile apps with lead trading. Here’s how the leading platforms perform on the go:

Are The Best Lead Trading Brokers Suitable For Beginners?

Just getting started with lead trading? These brokers offer easy-to-use platforms, solid education, and low entry barriers:

Are The Best Lead Trading Brokers Good For Advanced Traders?

Advanced lead traders need precision, speed, and extra features. See which brokers deliver for seasoned traders:

Accounts Comparison

Compare the trading accounts offered by Best Lead Brokers 2026.

Expert Ratings: Best Brokers For Trading Lead

Explore our detailed ratings on the top lead trading brokers—covering every core category in our tests:

Lead Brokers Compared On Trading Costs

We broke down spreads, commissions, and other fees to reveal the true cost of trading with each top lead trading platform:

Which Top Lead Trading Brokers Are Most Popular?

Discover which brokers attract the highest number of lead traders—highlighting the most trusted names in the industry:

| Broker | Popularity |

|---|---|

| eToro |

|

| Interactive Brokers |

|

| Exness |

|

| Fusion Markets |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- Interactive Brokers has introduced ForecastTrader, a zero-commission service allowing users to trade yes/no Forecast Contracts on political, economic, and climate events. Contracts offer fixed $1 payouts, 24/6 market access, and a 3.83% APY on held positions.

- The new IBKR Desktop platform combines the advantages of TWS and adds unique tools like Option Lattice and Screeners with MultiSort to make trading accessible and impressive for traders of all levels.

- IBKR, primarily designed for skilled traders, has expanded its appeal recently by eliminating its initial $10,000 deposit requirement.

Cons

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

Why Trade With Exness?

Exness is an excellent choice for active forex traders aiming to reduce costs after lowering spreads, enhancing execution speeds, and offering trading on over 100 currency pairs with more than 40 account currencies.

Pros

- Execution speeds now average under 25ms, providing ideal conditions for short-term traders.

- Wide variety of account types for all experience levels, including Cent, Pro, and the new Raw Spread, ideal for traders.

- Exness Terminal provides an easy experience for beginners with interactive charts, and creating watchlists is simple.

Cons

- Exness has increased its variety of CFDs and introduced a copy trading feature, but it still lacks real assets like ETFs, cryptocurrencies, or bonds.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader are not available yet, despite increasing demand from traders and their integration with other platforms like Pepperstone.

- Retail trading services are not available in some areas, including the US, UK, and EU, making them less accessible compared to leading brokers like Interactive Brokers.

Why Trade With Fusion Markets?

Fusion Markets is a top choice for forex traders seeking competitive prices with near zero spreads, minimal commissions, and new TradingView integration. The company, based and regulated in Australia by the ASIC, is especially suitable for Australian traders.

Pros

- Execution speeds averaging 37 milliseconds significantly outpace many competitors, assisting traders in obtaining the best prices in quickly changing markets.

- Fusion Markets provides superior support with quick and friendly responses during evaluations. There is no need to deal with annoying automated chatbots.

- Fusion Markets offers a supported VPS solution for algorithmic traders, including a 25% discount if they choose the NYC Servers VPS for their MT4 or cTrader platforms.

Cons

- The demo account lasts for 30 days, reducing its usefulness as a trading tool together with a real-money account.

- Non-Australian traders need to register with global entities that have less regulation, limited safety measures, and no protection against negative balances.

- The lack of a beginner-friendly trading platform or app is a significant disadvantage compared to AvaTrade.

Why Trade With BlackBull?

After upgrading its trading infrastructure with Equinix servers in New York, London, and Tokyo to reduce latency for traders, BlackBull is a top choice for trading stock CFDs with ECN pricing.

Pros

- BlackBulls’s research is excellent, particularly the daily ‘Trading Opportunities’ articles, which make complex market movements easy to understand and help traders capitalize on new trends.

- BlackBull provides essential features for traders: execution speeds of less than 100ms, leverage up to 1:500, and tight spreads starting at 0.0 pips.

- BlackBull has partnered with ZuluTrade and Myfxbook, enhanced its own CopyTrader, and enabled cTrader Copy, offering a comprehensive trading experience.

Cons

- Unlike most top brokers, BlackBull charges a $5 withdrawal fee, which can reduce cost-effectiveness, especially for active traders who often transfer funds.

- BlackBull doesn't have its own platform and uses MetaTrader, cTrader, and TradingView. Though these are excellent, other brokers' platforms, like eToro’s, often offer unique features for beginner traders.

- The Education Hub now includes webinars and tutorials, but the courses still need to better explain the broader economic factors that affect prices.

Why Trade With eToro?

eToro's social trading platform ranks highly due to its excellent user experience and active community chat, useful for beginners seeking trading opportunities. The platform also offers competitive fees on a vast selection of CFDs and actual stocks, alongside beneficial rewards for skilled strategy contributors.

Pros

- The copy trading app provides an excellent social platform with an engaging feed and community chat.

- Charts use TradingView, providing strong technical analysis features with 9 chart types and 100+ indicators.

- eToro enhanced social trading in 2025 by incorporating insights from over 10 million Stocktwits users to assess market sentiment.

Cons

- The minimum withdrawal amount is $30 with a $5 fee, impacting beginners with little capital.

- There are no guaranteed stop-loss orders, which would be a helpful risk management feature for beginners.

- The absence of extra charting platforms like MT4 may reduce the appeal for experienced traders used to third-party software.

Filters

How We Selected The Top Lead Trading Brokers

To find the best brokers for trading lead, we reviewed our dynamic database of global brokerages, focusing on those offering access to lead through CFDs, futures, or spot markets.

We ranked each lead broker using a proprietary scoring system that evaluates over 200 data points across 8 categories, including pricing, regulation, and trading tools.

Our team also conducted hands-on testing of each platform’s performance for lead trading, from charting features and risk management tools to mobile usability.

What To Look For In a Broker To Trade Lead

After years of hands-on testing, we know exactly what sets an average lead broker apart from a truly elite platform – here’s what to focus on when choosing where to trade lead:

Market Access: Go Where the Lead Is

When you’re sizing up a lead broker, the first box to tick is market access. That sounds obvious, but you’d be surprised by how many brokers make it more complicated than it needs to be.

If you’re looking to trade lead directly via lead futures on major exchanges like the LME (London Metal Exchange) or CME (Chicago Mercantile Exchange), you’ll want a broker that offers real access to those markets.

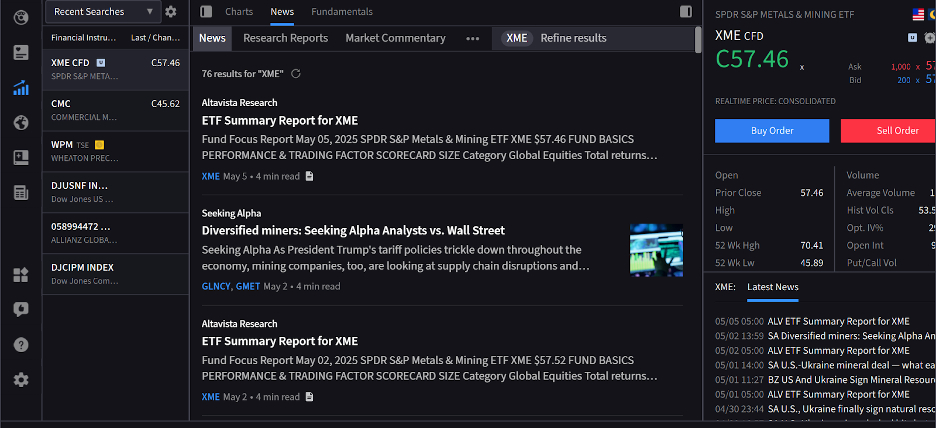

Now, if you’re more into synthetic instruments—like CFDs or ETFs that track lead—you’ll also need a broker with a solid range of products in that space.

Top Pick: We’ve tested and reviewed this across multiple platforms, and when it comes to market access for lead, Interactive Brokers is hands-down our top pick. They offer direct trading access to lead futures on global exchanges like the LME and CME and a respectable lineup of lead-linked ETFs, stocks and funds for those of us who prefer a less leveraged or longer-term position.

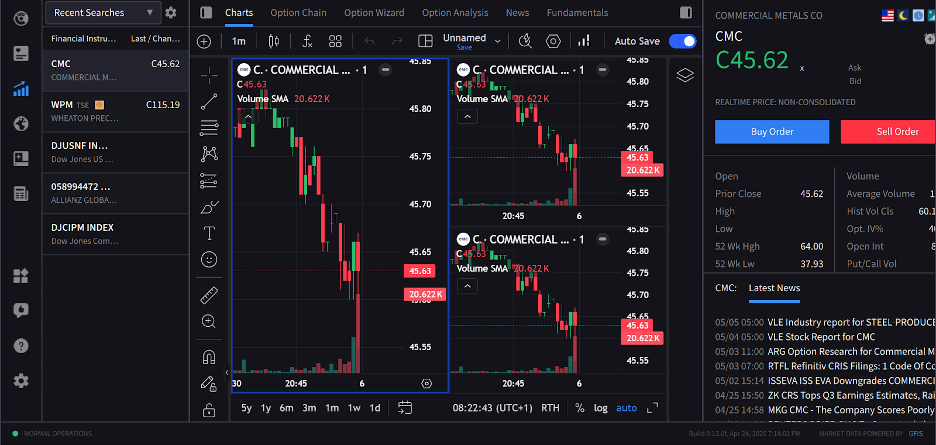

IBKR offers a range of lead trading instruments catering to diverse strategies

Lead-Specific Research and Insights

If you’re serious about trading lead, you’ll need more than just a decent charting tool and a news feed. Lead prices don’t move in a vacuum; they’re tied into complex global supply chains, mining outputs, industrial demand (especially batteries), and the broader commodities ecosystem.

That means any broker worth your time should offer more than generic “market sentiment” updates. You want actual, in-depth commodities research.

Lead is often influenced by what’s happening in other metals markets, especially iron and zinc, and by shifts in global manufacturing. Think changes in China’s industrial policy, mining regulations in Mexico, or labor strikes in Australia.

You’ll want research that pulls these threads together; not every broker delivers on that front.

Top Pick: Out of all the brokers we reviewed, FxPro stood out here. While they’re more well-known for forex and CFDs, we’ve been pleasantly surprised by the quality of their commodities commentary. Their insights often touch on the broader industrial metals complex, including mentions of China’s demand cycles, mining policy updates, and industrial output, all of which have knock-on effects for lead. It’s not deep-dive academic research, but it’s way ahead of the pack for daily usability and relevance for traders like us.

Execution Speed and Reliability

Lead might not be as flashy as gold or crude oil, but this metal can move, and fast. Whether it’s a surprise inventory report, a geopolitical twist, or a shift in China’s industrial policy, lead prices can spike (or drop) hard in a matter of seconds.

That’s why a broker’s execution speed and platform reliability aren’t just “nice to have”; they’re essential.

We’ve seen it firsthand during our testing. In volatile markets like this, even a brief delay in order execution can mean entering a trade at the wrong level or missing your target exit entirely. It’s not just frustrating, it’s expensive.

And if your broker’s platform freezes, lags, or disconnects at the wrong moment? You’re out of luck.

So here’s what we, and you, should look for:

- Low-latency order routing (especially important if you’re trading lead CFDs)

- Fast order fills even during high-volatility news events

- Platform stability across desktop, mobile, and web

- Minimal slippage and no annoying re-quotes

Top Pick: The broker that impressed in this area was BlackBull Markets. Their trade execution is consistently snappy, even during macro events when spreads widen and volatility surges. We ran tests placing CFD trades on lead-related products and found near-instant execution, plus zero disconnections or hiccups, something that sets them apart in this category.

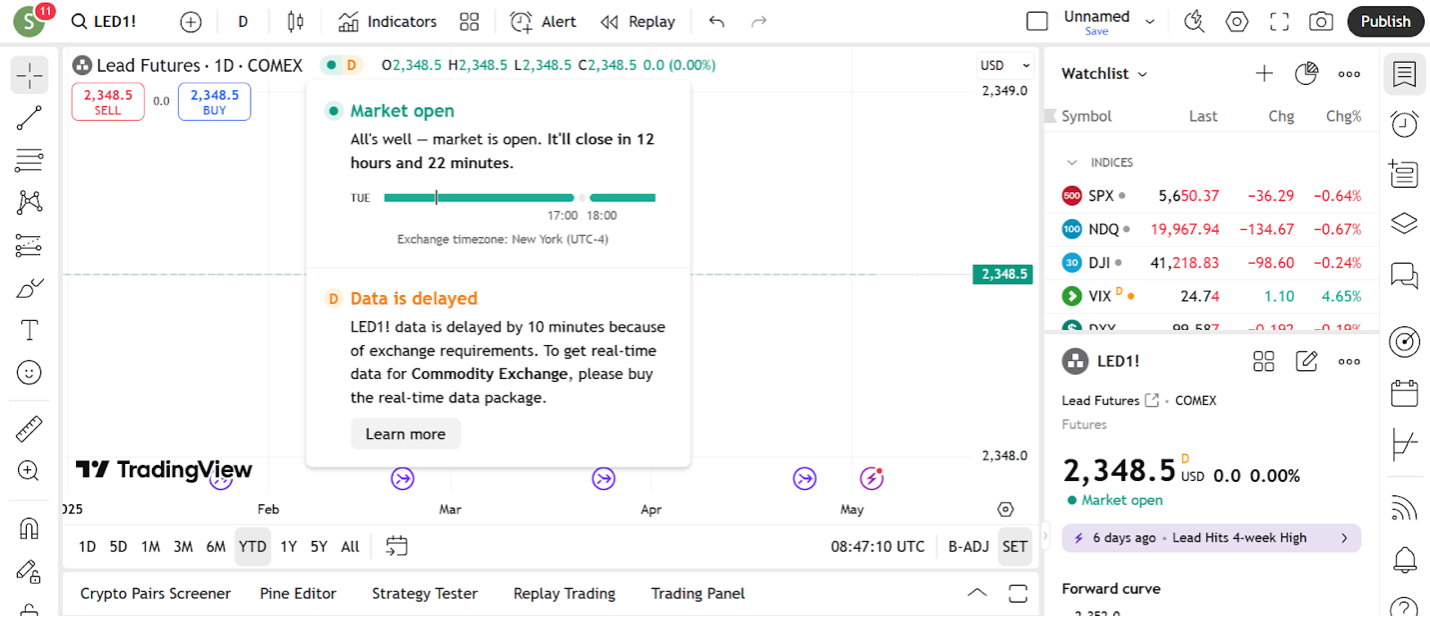

TradingView, available at BlackBull, offers some of the most user-friendly charts for trading lead

Data Feeds and Charts

When it comes to trading lead, real-time data is critical and delayed or limited info can cost you. Lead doesn’t always follow the crowd; shifting inventory levels, exchange warehouse data, or subtle moves in other base metals often drive its price.

That’s why having access to the correct data and the ability to analyze it quickly is non-negotiable.

We’ve worked with enough platforms to know that not all data feeds are created equal. Some brokers only provide delayed or generalized commodity prices. Others lump all metals into a single feed that doesn’t even mention lead.

If you’re trading lead futures or CFDs, what you want is:

- LME or CME lead pricing (not delayed by 10 or 15 minutes)

- Inventory data from warehouses, especially on the LME

- Professional-grade charts with technical indicators built for commodities

- The ability to overlay news events, volume changes, and macro data

Top Pick: We put this to the test, and Interactive Brokers came out ahead once again. Their data feed coverage for commodities is the real deal. Not only do they offer live pricing for lead futures from major exchanges like the LME and CME, but they also provide access to inventory levels and real-time news integration that matters to traders. When we pulled up metal ETF charts during our evaluations, we found dozens of custom indicators, solid drawing tools, and the ability to go deep with volume, open interest, and spread tracking.

Interactive Brokers offers deep research into metals like lead directly in its platform

Margin and Leverage Options

Trading lead—especially through futures or leveraged CFDs—isn’t for the faint of heart. Price swings can be sharp, and if you’re using leverage, your gains (and losses) get magnified fast.

That’s why understanding your broker’s margin and leverage terms isn’t just smart—it’s essential to surviving in the game.

We’ve tested plenty of lead brokers where the leverage might sound appealing at first, until you dig into the fine print. Some slap on sky-high overnight fees, others quietly hike margin requirements during volatile periods, and a few simply don’t disclose the terms clearly. That’s a recipe for nasty surprises.

Here’s what we looked for during our evaluation:

- Transparent leverage structures across lead CFDs and futures

- Brokers with competitive margin requirements that don’t force you to over-capitalize

- Clear communication on margin calls, rollover costs, and stop-out levels

- Risk management tools to help you stay in control (like guaranteed stop losses)

Top Pick: After our evaluations, Fusion Markets looked especially strong in this area. Their approach to leverage is refreshingly straightforward: up to 1:500 for pro accounts and sensible limits for retail traders. What stood out to us was the clarity—they break down strictly what margin is required for each product, including lead and other base metals, right on the platform. There are no hidden conditions. There are no vague policies.

Regulatory Oversight and Broker Credibility

Credibility isn’t just a buzzword when trading something niche and potentially volatile as lead; it’s your first line of defence.

Because let’s face it: there’s no shortage of offshore brokers offering considerable leverage and flashy platforms, but if a top-tier authority does not regulate them, you’re taking a serious risk with your capital.

In the commodities space, that risk becomes even more significant. Lead trading isn’t just about catching price trends; it’s about working with a brokerage that understands the complexities of metals markets and can handle your trades with integrity and transparency.

So here’s what we focused on during our evaluation:

- Strong regulatory credentials (think CFTC, ASIC, FCA, CySEC—not just some unknown offshore body)

- A proven history of handling commodities and metals, not just forex or crypto

- Transparent terms of service, fair pricing, and clean withdrawal processes

- A reputation for reliability in fast-moving, high-margin markets

Top Pick: When we tested these criteria, eToro stood out as a top-tier choice for trader protection. eToro is regulated by multiple authorities, including the FCA (UK), CySEC (EU), and ASIC (Australia), and it offers a secure and well-established trading environment. Although they’re well known for their social trading features, what impressed us was their growing focus on commodities, paired with a user-friendly interface and robust compliance structure.

Fees and Commissions

With metals like lead, your edge is often slim. You’re not always riding huge multi-dollar moves like in oil or gold.

That means trading costs matter—a lot. High spreads or hidden fees can quietly eat away your profits before your trade gets off the ground.

So if you’re trading lead via CFDs or futures, keeping an eye on spreads, commissions, and overnight charges is crucial. During our broker testing, we saw firsthand how those slight differences—half a pip here, a dollar there—can really stack up if you’re an active trader.

Here’s what we specifically looked for:

- Tight spreads on lead CFDs or related base metal products

- Low or zero commissions, especially on standard accounts

- Transparent swap/rollover fees for multi-day trades

- No hidden platform or inactivity fees lurking in the fine print

Top Pick: After reviewing the numbers, FxPro earned our vote for top pick in the cost-efficiency department. Their spreads on commodities, including lead and its industrial cousins, were consistently low in our tests, even during active market hours. And they’re upfront about it: no shady “variable markup” models or surprise commissions.

We also appreciated that FxPro offers different account types depending on how you trade. Want raw spreads with a small commission? They’ve got that. Prefer an all-in spread with no separate charge? They offer that too.