Best Margin Brokers 2026

Find the top brokers that offer trading on margin; providers who offer competitive rates, user-friendly platforms, and tools that make trading on margin less daunting and more rewarding.

-

1

In our tests, Interactive Brokers provided flexible leverage by asset class, up to 1:50 for forex and lower for others. Margin calls were accurate, with fast execution and promptly enforced stop-out levels. The Advanced Trader Workstation tools and strong regulation support advanced margin trading and risk management.

Leverage Trading

At Interactive Brokers the available trading leverage is 1:50. The margin rate is 1.55 - 2.59%

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 When testing NinjaTrader, we found it provided competitive leverage up to 1:100 on futures and forex. The platform efficiently managed margin calls and stop-outs. Advanced charting and risk tools supported traders in monitoring exposure, making it a strong choice for active margin users.

Leverage Trading

At NinjaTrader the available trading leverage is 1:50.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Plus500US, a reputable broker since 2021, is authorized by the CFTC and NFA. It offers futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a quick 10-minute signup, a $100 minimum deposit, and an easy-to-use web platform, Plus500 is enhancing its services for traders in the US.Leverage Trading

At Plus500US the available trading leverage is Variable.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 OANDA is a well-known broker that excels in quick trade executions, a low deposit requirement, and impressive charting and trading platform functions. The highly-regarded brand has over 25 years of expertise and is overseen by reliable authorities like the NFA/CFTC. It provides 24/7 support for traders and offers flexible contract sizes with automated trade executions.Leverage Trading

At OANDA US the available trading leverage is 1:50. The margin rate is 2%

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 With FOREX.com, margin usage was clearly shown with updates, and stop-out levels were around 50%. Leverage was up to 1:200 (lower in some areas). The platform managed margin calls effectively. Strong regulation and solid risk tools made it ideal for traders focused on margin.

Leverage Trading

At FOREX.com the available trading leverage is 1:50.

Top Margin Brokers Comparison

Safety Comparison

Compare how safe the Best Margin Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Margin Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Margin Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Margin Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Margin Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Margin Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Margin Brokers 2026.

Broker Popularity

See how popular the Best Margin Brokers 2026 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Plus500US |

|

| Interactive Brokers |

|

| NinjaTrader |

|

| FOREX.com |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- Interactive Brokers has introduced ForecastTrader, a zero-commission service allowing users to trade yes/no Forecast Contracts on political, economic, and climate events. Contracts offer fixed $1 payouts, 24/6 market access, and a 3.83% APY on held positions.

- The TWS platform is designed for intermediate to advanced traders. It includes over 100 order types and a dependable real-time market data feed that rarely experiences downtime.

- IBKR, primarily designed for skilled traders, has expanded its appeal recently by eliminating its initial $10,000 deposit requirement.

Cons

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- NinjaTrader is a well-regarded and acclaimed futures broker, approved by the NFA and CFTC.

- You can access thousands of applications and add-ons from developers worldwide for trading.

- Low costs, with $50 trading margins and commissions starting at $.09 per micro contract.

Cons

- You need to register with partner brokers to trade in securities other than forex and futures.

- The advanced trading tools require an additional fee.

- Some payment methods require a withdrawal fee.

Why Trade With Plus500US?

Plus500US is an excellent choice for beginners, offering a user-friendly platform, low trading margins, and access to the Futures Academy to improve trading skills. Its powerful tools and reliable service earned it second place in DayTrading.com's annual 'Best US Broker' award.

Pros

- Plus500US stands out for its low fees, competitive trading margins, and no charges for inactivity, live data, routing, or platform use.

- The account setup, pricing structure, and web platform make futures trading simpler than competitors like NinjaTrader.

- Plus500 included prediction markets in its 'Plus500 Futures' platform in February 2026. This addition offers event-based trades in 10 categories, such as financials and politics, and includes short-term intraday contracts expiring in 15 minutes.

Cons

- Testing showed fast response times for support, but phone aid is not available.

- Plus500US is expanding its investment options, but it currently only offers around 50+ futures and no stocks.

- The private trading platform is easy to use, but doesn't have the advanced analysis tools that platforms like MetaTrader 4 do.

Why Trade With OANDA US?

OANDA is a reputable broker for US traders. It offers user-friendly tools for analysis and a simple sign-up process. It is very trustworthy due to heavy regulation.

Pros

- There's a robust selection of 68 currency pairs for committed forex traders focusing on short-term trades.

- The OANDA web platform offers an exceptional charting environment with over 65 technical indicators provided by TradingView.

- The broker provides clear pricing without any concealed fees.

Cons

- Customer support is not accessible during weekends.

- Few payment options are available and e-wallets are not supported.

- The trading markets are limited to only forex and cryptocurrencies.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

Cons

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

Filters

Methodology

We reviewed a diverse selection of margin brokers, evaluating their features, leverage options, and performance.

After assessing each, we assigned a total score to compile a definitive ranking of the best margin brokers available in 2026.

What To Look For in a Margin Broker

When trading on margin, selecting the right broker isn’t just important – it’s critical. Here’s what to look for:

Margin Rates (Interest Costs)

Margin trading comes with borrowing costs, and brokers charge interest on the amount borrowed. Compare these rates carefully:

- Low Margin Rates: Look for brokers offering competitive rates, especially if you plan on holding positions for a while.

- Tiered Rates: Some brokers offer lower rates for higher borrowing amounts – ideal for traders with larger accounts.

Leverage Offered

Leverage determines how much buying power you can access. While more leverage can amplify gains, it also increases risks. Consider:

- Maximum Leverage: Some brokers cap leverage based on the asset class for retail investors (eg 1:5 for stocks and 1:30 for forex in the EU, UK and Australia).

- Customizable Leverage: Choose brokers that allow you to adjust leverage to suit your risk tolerance.

Margin Requirements and Maintenance Calls

These determine how much capital you need to maintain your positions:

- Initial Margin: The amount required to open a leveraged position.

- Maintenance Margin: The minimum account balance needed to keep your position open.

- Margin Calls: Look for brokers that provide clear notifications if your account approaches a margin call, so you’re never caught off guard.

Risk Management Tools

Since margin trading can magnify losses, risk management tools are essential. Features to prioritize include:

- Stop-Loss Orders: Automatically close a position if the market moves against you.

- Real-Time Margin Monitoring: Keep an eye on your margin balance to avoid liquidation.

- Negative Balance Protection: Ensure your losses don’t exceed your account balance (some brokers offer this).

Asset Range and Compatibility

Ensure the broker supports the assets you plan to trade:

- Margin Trading for Stocks: Access to US European, or global markets.

- CFDs or Forex: For high-leverage opportunities.

- Cryptocurrency: Specialized platforms often offer unique features for crypto trading.

Education and Support

Margin trading can be complex, especially for beginners. A broker that supports your learning curve is invaluable:

- Margin Calculators: Tools to estimate costs and risks.

- Educational Resources: Tutorials, webinars, and guides focused on margin trading.

- Responsive Customer Support: 24/7 assistance to help resolve issues quickly.

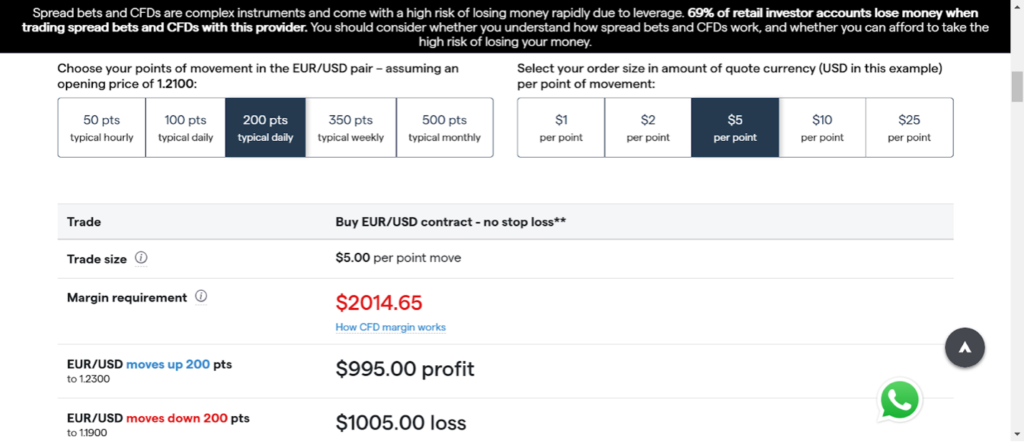

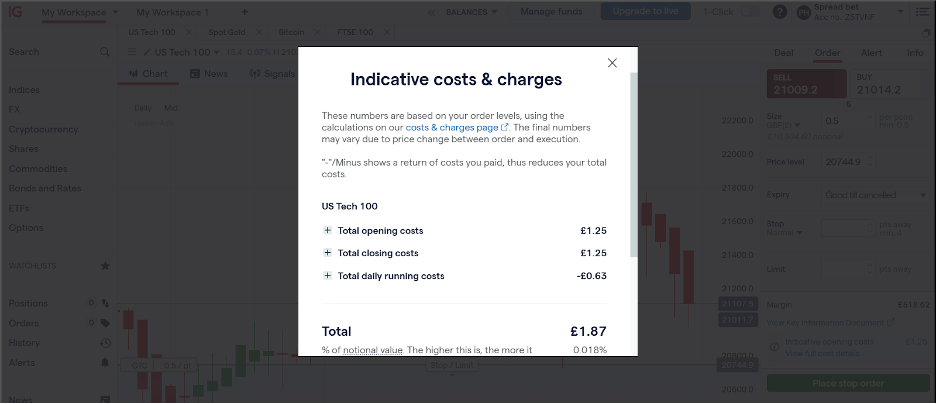

IG – Margin Requirements

Platform Features and User Experience

Margin trading requires a robust, intuitive platform with features like:

- Advanced Charting Tools: To analyze trends and make informed decisions.

- Ease of Executing Trades: Quick, hassle-free order placements are essential.

- Mobile Compatibility: A seamless mobile app for trading on the go.

Regulation and Security

Trading on margin introduces additional risks, so trustworthiness is non-negotiable:

- Regulated Brokers: Make sure reputable authorities like FINRA (US), FCA (UK), ASIC (Australia), or CySEC (Cyprus) license them.

- Segregated Accounts: Brokers that separate your funds from operational accounts offer added security.

Account Requirements and Additional Costs

Understand the fine print before committing:

- Minimum Deposits: Check if the broker has high account balance requirements for margin accounts.

- Hidden Fees: Watch for fees like account maintenance or inactivity charges that could eat into your returns.

IG – Margin Costs

Choosing the right broker for margin trading isn’t just about finding the lowest rates or the highest leverage; it’s about finding a partner that supports your trading journey.

A good broker combines competitive costs, robust risk management tools, a user-friendly platform, and reliable customer support.

FAQ

What Is Margin Trading?

At its core, margin trading is borrowing money from your broker to increase your buying power.

Instead of being limited to the funds in your account, margin lets you trade with leverage, magnifying both potential profits and risks.

Here’s a quick example: If you have $1,000 in your trading account and a broker offers 1:5 leverage, you could control a $5,000 position.

That’s the allure of margin trading – it amplifies opportunities. But remember, it’s a double-edged sword; losses can be equally magnified.

Who Is Margin Trading Suitable For?

Margin trading is popular among experienced traders who have strategies in place and understand the mechanics of managing risk.

Whether you’re trading stocks, CFDs, or other assets, choosing the right broker can make or break your experience.

Why Do Brokers Offer Margin Trading?

Brokers provide margin services for profit through interest rates and fees, and because it enables traders to engage with larger market positions.

Which Brokers Offer the Best Margin?

While offshore brokers might offer higher margins, they come with increased risk due to lower regulatory oversight. Look for brokers that balance leverage with safe trading practices.