Best Cannabis Brokers 2026

Looking to trade cannabis stocks or derivatives? We’ve researched, tested, and ranked the top cannabis brokers for 2026 through in-depth analysis.

-

1Founded in 2006, AvaTrade is a top forex and CFD broker trusted by over 400,000 traders. Regulated in 9 regions, it handles more than 2 million trades monthly. AvaTrade offers platforms like MT4, MT5, and WebTrader, with over 1,250 instruments. Traders of all levels can explore CFDs, AvaOptions, and AvaFutures for short-term trading. AvaTrade provides excellent education and 24/5 multilingual customer support for a complete trading experience.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 is a leading multi-asset platform offering trading in thousands of CFDs, stocks, and cryptoassets. Established in 2007, it has millions of active global traders and is regulated by top authorities like the FCA and CySEC. It is well-known for its social trading platform. Crypto trading is provided through eToro USA LLC. Investments are subject to market risk, including potential loss of principal. CFDs are not available in the US. Crypto investments carry risk and may not be suitable for retail investors, with a possibility of losing your entire investment. Understand the risks here. 61% of retail CFD accounts lose money. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 FXCM is a well-known forex and CFD broker that was set up in 1999. Its head office is in the UK, but it operates globally, including in places like Australia. FXCM offers trading without any commission fees, a selection of more than 400 assets, and a variety of analysis tools. Many traders prefer it, which is why it has received several awards. Major entities such as FCA, ASIC, CySEC, FSCA, and BaFin regulate FXCM. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.7 Established in 1989, CMC Markets is a reputable brokerage firm authorized by various top regulators such as the FCA, ASIC and CIRO, and is listed on the London Stock Exchange. They boast a global client base of over 1 million traders and have received numerous awards.

Compare the Best Cannabis Trading Brokers by Key Features

We evaluated the leading cannabis trading platforms side-by-side — here’s how they perform across the most important criteria:

How Safe Are the Top Cannabis Trading Brokers?

Security matters when trading in fast-moving sectors like cannabis. Here’s how top brokers protect your funds:

Best Mobile Apps for Cannabis Trading – Tested

Want to stay connected to the cannabis market on the go? We reviewed the top-rated mobile platforms for trading flexibility:

Are The Top Cannabis Brokers Good for Beginners?

Just starting with cannabis trading? Here's how the top platforms offer easy-to-use tools and great education for new traders:

Do The Top Cannabis Brokers Support Advanced Traders?

Experienced in the markets? Explore which cannabis brokers deliver the speed, tools and execution capabilities professionals demand:

Accounts Comparison

Compare the trading accounts offered by Best Cannabis Brokers 2026.

Complete Ratings: Best Cannabis Brokers

See how the leading brokers for cannabis trading ranked in our independent evaluations based on expert scoring:

Fees & Spreads: Which Cannabis Brokers Offer the Best Value?

We compared fees and spreads to highlight which cannabis trading platforms give you the most bang for your buck:

Which Top Cannabis Brokers Are Attracting the Most Traders?

Wondering which platforms cannabis traders are turning to? These brokers are earning serious traction in the market:

| Broker | Popularity |

|---|---|

| eToro |

|

| AvaTrade |

|

| CMC Markets |

|

| FXCM |

|

Why Trade With AvaTrade?

AvaTrade provides traders with essential tools: an intuitive WebTrader, strong AvaProtect risk management, a quick 5-minute sign-up, and reliable support for fast-paced markets.

Pros

- AvaTrade introduced AvaFutures for low-margin global market access and expanded in 2025 by adding CME’s Micro Grain Futures. Later that year, they integrated with TradingView.

- Years later, AvaTrade is still among the few brokers with a custom risk management tool, AvaProtect, which insures losses up to $1M for a fee and is simple to use on the platform.

- AvaTrade's support team did well in tests, responding within 3 minutes and providing local support in major regions like the UK, Europe, and the Middle East.

Cons

- The AvaSocial app is satisfactory but could be better. Its design, usability, and navigation between strategy providers and account management need improvement to compete with top platforms like eToro.

- AvaTrade’s WebTrader has improved, but it needs more customization as widgets like market watch and watchlists can't be hidden, moved, or resized.

- Signing up is easy, but AvaTrade doesn't offer an ECN account like Pepperstone or IC Markets, which provides raw spreads and fast execution that many traders want.

Why Trade With eToro?

eToro's social trading platform ranks highly due to its excellent user experience and active community chat, useful for beginners seeking trading opportunities. The platform also offers competitive fees on a vast selection of CFDs and actual stocks, alongside beneficial rewards for skilled strategy contributors.

Pros

- eToro secured second place in DayTrading.com's 'Best Crypto Broker' for 2025 due to its wide range of tokens, reliable service, and competitive fees.

- Investment portfolios are available, focusing on traditional markets, tech, crypto, and more.

- eToro launched accounts in EUR and GBP, and recently added BTC and ETH payments, reducing conversion fees and offering a localized trading experience.

Cons

- The absence of extra charting platforms like MT4 may reduce the appeal for experienced traders used to third-party software.

- The minimum withdrawal amount is $30 with a $5 fee, impacting beginners with little capital.

- Contact options are limited, except for the in-platform live chat.

Why Trade With FXCM?

FXCM is a top choice for traders using automated strategies because of its four strong platforms, strategy testing, and API trading. The company is also highly recommended for active traders due to its reduced spreads and minimal or zero commissions on frequently traded assets.

Pros

- The broker provides spread reductions and other great benefits for skilled traders using the Active Trader account.

- The Trading Station terminal is suitable for traders seeking a comprehensive solution for their short-term and automated trading approaches.

- FXCM has broadened its trading options with stock CFDs available on MetaTrader 4.

Cons

- The live chat support might not be as quick or dependable as that of leading competitors.

- FXCM primarily caters to proficient traders, but unfortunately, they do not provide managed accounts.

- Traders do not have the option to choose between different retail accounts, and there are no options for Cent/Micro accounts.

Why Trade With CMC Markets?

CMC Markets offers a great online platform for traders. It has advanced charting tools and a wide variety of CFDs to trade, including a large selection of currencies and customized indices. It caters to traders at all levels.

Pros

- The CMC web platform offers an excellent user experience, featuring advanced charting tools and customizable options for trading. It suits both beginners and experienced traders. It supports MT4 and will add TradingView in 2025.

- CMC provides great pricing, with narrow spreads and low fees for trading except for stock CFDs. The Alpha and Price+ programs also give benefits to active traders, including up to 40% spread discounts.

- We upgraded its 'Assets & Markets' rating due to frequent product additions in early 2025, including extended hours trading on US stocks and new share CFDs.

Cons

- Trading stock CFDs carries a comparatively high commission charge, particularly when contrasted with more affordable brokers such as IC Markets.

- A $10 monthly inactivity fee is charged after one year of no trading activity. This could discourage occasional traders.

- CMC provides a commendable range of assets, but lacks support for actual stock trading and UK customers are unable to trade cryptocurrencies.

Filters

How We Chose the Top Cannabis Trading Brokers

To compile our rankings, we looked at brokers offering access to cannabis-related markets – including cannabis stocks, ETFs, and derivatives – through regulated, transparent platforms.

Each broker was scored across 200+ metrics, including fees, tools for charting, trade execution speed, and market access to leading cannabis assets.

We didn’t just rely on data – we tested each platform for usability, reliability, and performance.

What To Look For In A Top Broker For Trading Cannabis

After analyzing dozens of platforms, we know what separates a decent broker from a top-tier cannabis trading experience. Here’s what really matters:

Market Access

When you’re trading cannabis, market access isn’t just a nice-to-have – it’s essential. The cannabis sector is still relatively young and developing fast, which means access to the right products can make a big difference in your strategy.

Whether you’re looking to get exposure through cannabis stocks, futures or prefer to trade synthetic instruments like cannabis-linked ETFs or CFDs, not every broker delivers equally.

One thing we always check when evaluating a broker is how broad and direct their access to the cannabis market is. Some platforms limit you to indirect exposure, while others might have an exhaustive product list but make it hard to locate and trade cannabis instruments efficiently.

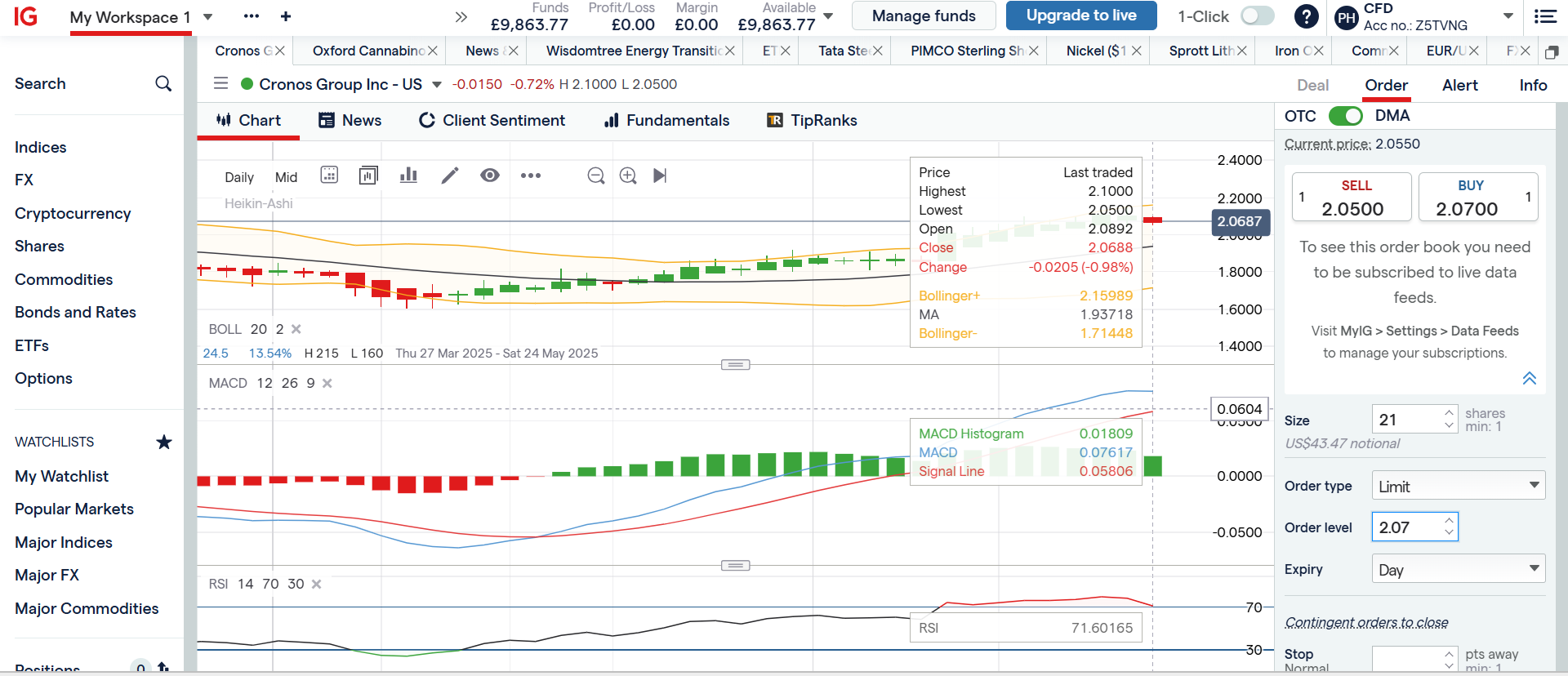

Top Pick: After testing several platforms ourselves, we see that IG stands out in this area. Their platform offers a clear and straightforward route into cannabis-related CFDs and ETFs, with good depth of market data, research, news and reliable execution.

For traders looking to get serious about cannabis exposure, IG makes it easy to see what’s available and get started. We found their product offering to be one of the most comprehensive, and the platform layout helped us compare cannabis-linked assets, especially stocks like Cronos Group, without digging through unrelated sectors.

IG Web Trader Platform, Cronos chart

Cannabis-Specific Research and Insights

When trading cannabis assets, price moves aren’t just about market sentiment or technical trends – they’re deeply tied to the real-world supply chain and evolving legal landscape.

From shifting regulations in North America to cultivation bottlenecks or oversupply in major producer regions, having timely, cannabis-focused research can give you a serious edge.

One key thing we evaluate in a broker is how much support they offer in understanding what’s driving the cannabis market. This isn’t a mature commodity like oil or gold; cannabis is affected by everything from policy changes in key U.S. states to international licensing delays.

Brokers who lump cannabis in with general market commentary often miss the mark.

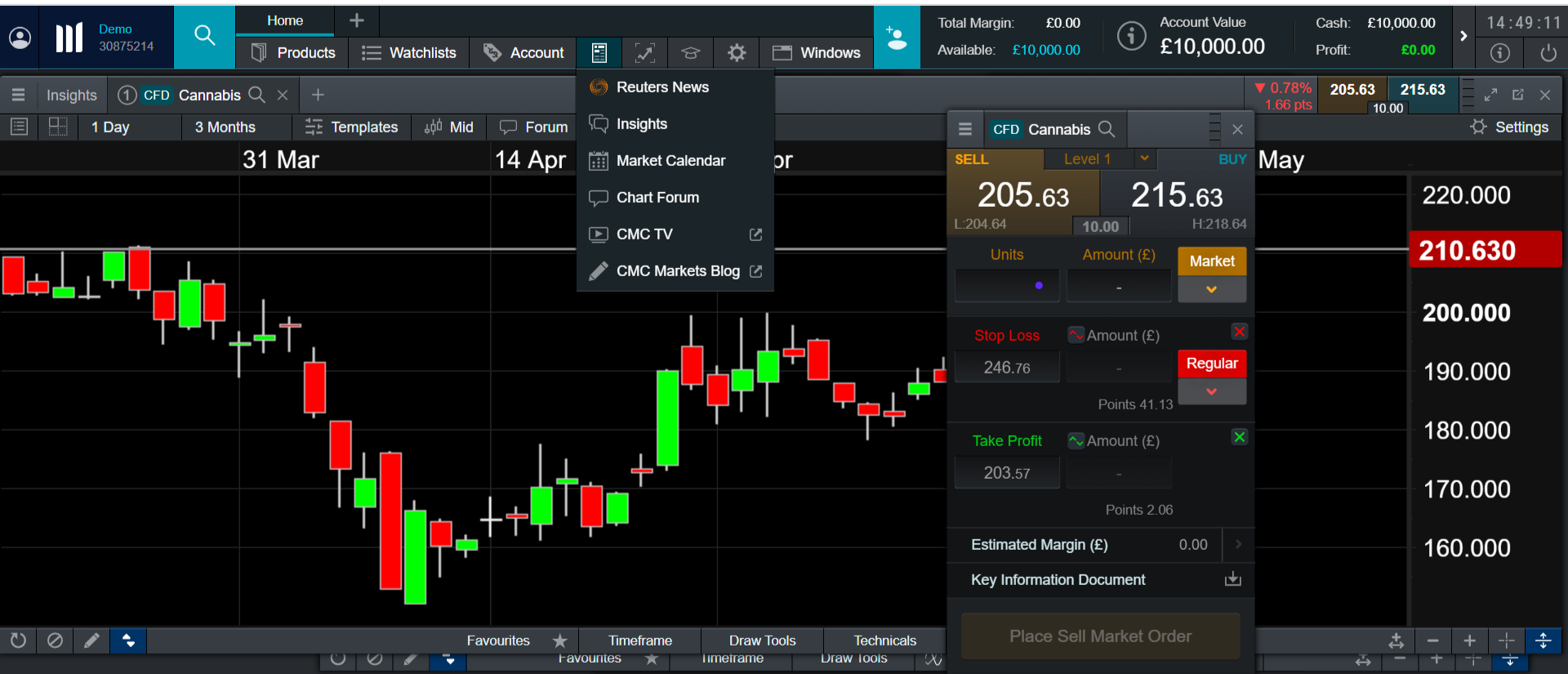

Top Pick: CMC Markets offers the most potent research tools from the platforms we tested in this space. While they’re known for their broader commodities coverage, we found their insights on cannabis particularly useful, especially regarding supply chain pressures and market-moving regulatory updates.

Their platform includes access to detailed market news and analyst commentary, helping us track developments, not just in the U.S. but also in emerging producer countries like Canada, Germany, and parts of Latin America.

What we like most is that the research wasn’t just surface-level. When policy proposals are floated in the U.S. Congress or supply issues hit Canadian producers, CMC covers the potential impact on cannabis-linked ETFs and related equities through its renowned Insights section and the Reuters news subscription service.

CMC Markets Next Gen Platform, Cannabis CFD

Execution Speed and Reliability

In the cannabis market, timing is everything. Prices can spike or drop suddenly due to regulatory announcements, macroeconomic shifts, or even a surprise inventory report from a major producer. That kind of volatility is exciting, but only if your trades go through exactly when and how you expect them to.

That’s why we put a lot of weight on execution speed and platform reliability when evaluating brokers. It’s not just about having a slick interface; it’s about how quickly orders are filled and whether the platform holds up during peak trading hours.

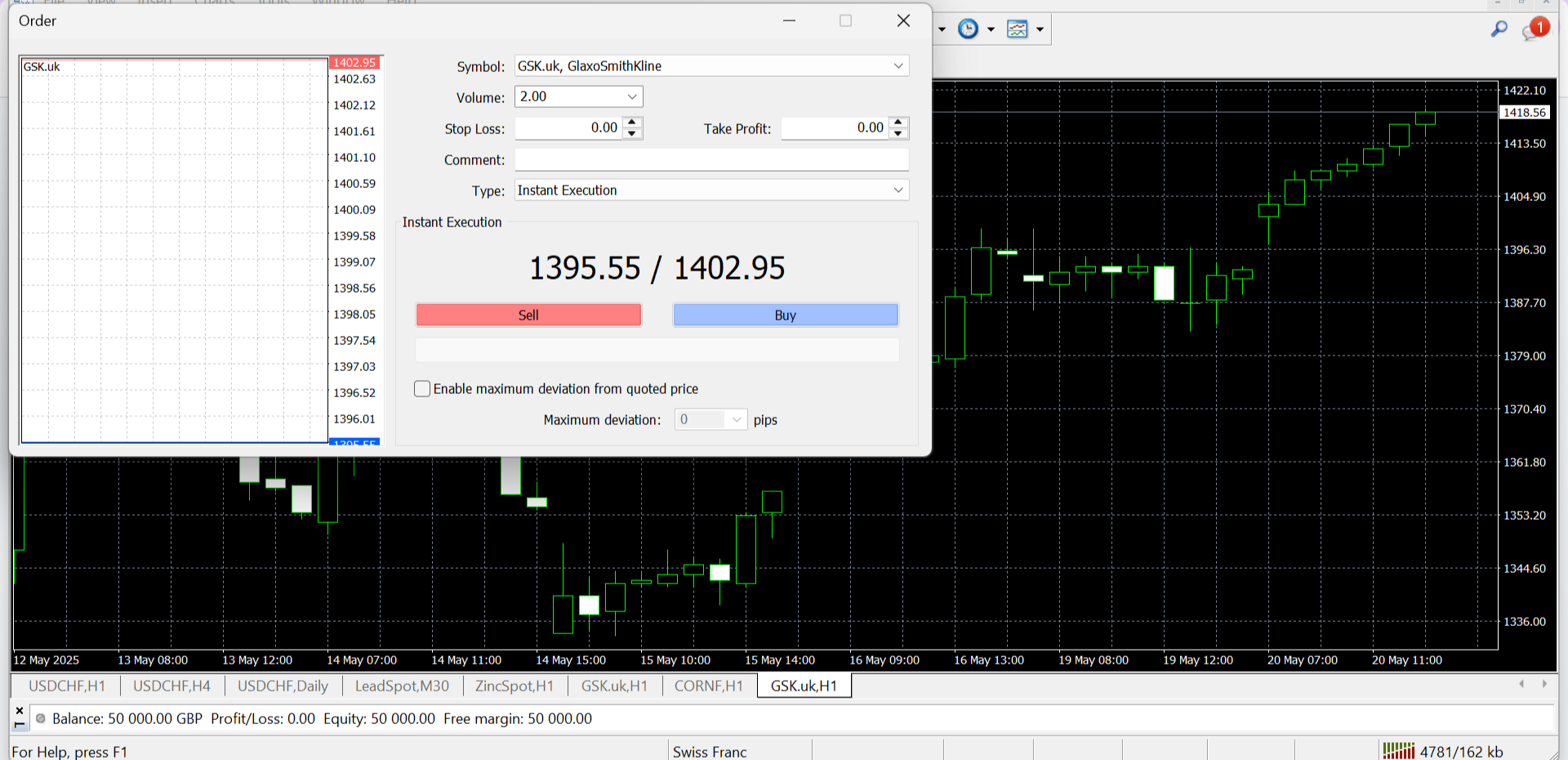

Slippage or delayed fills in this space can eat into your edge fast, especially if you’re trading leveraged cannabis ETFs, stocks like GSK (which has moved into cannabis related research and products) or CFDs.

Top Pick: From our experience, FXCM does a great job in this area. We ran several tests during market opens and around cannabis-related news events, and FXCM consistently delivered near-instant execution with minimal slippage on its MetaTrader platforms. The platform stayed responsive even when trading volumes spiked, and we didn’t encounter any frustrating freezes or order rejections.

What also stood out to us was the transparency in trade reporting. FXCM makes it easy to review execution quality after the fact, which helped us verify that fills were happening at expected prices, even in fast-moving markets.

MT4 FXCM Glaxo Chart

Data Feeds and Charts

If you’re trading cannabis seriously, you can’t rely on delayed data or basic charts. Real-time pricing and accurate market depth are non-negotiable, especially when sharp moves can be triggered by inventory shifts, earnings from major cannabis firms, or legal changes that hit wire services with little warning. Without live data, you’re essentially flying blindfolded.

When we evaluate brokers, we look for more than just real-time pricing. We want charting tools that support commodity-style analysis – things like volume overlays, volatility indicators, and the ability to compare cannabis assets against correlated instruments like biotech ETFs or broader market indices. That level of context matters when you’re trying to get in early or manage risk precisely.

Top Pick: After testing several platforms side-by-side, eToro stood out for us by offering a potent mix of accessible real-time data and powerful yet user-friendly charts through its relationship with TradingView.

While eToro is often seen as a social trading platform, we found their charting tools through TV surprisingly robust, especially for commodities like cannabis. You can pull up advanced technical indicators like Bollinger Bands, MACD, RSI, and Fibonacci retracements – all of which are useful when you’re trading volatile assets with unclear long-term price patterns.

What also impressed us was how easy it was to overlay and compare cannabis-related assets. This helped us see how, for example, a cannabis ETF was moving relative to a broader sector index or a currency impacted by cannabis exports. These kinds of small advantages help shape smarter entries and exits.

Margin and Leverage Options

Leverage can be a powerful tool in cannabis trading – but only if it’s managed carefully and offered under fair, transparent terms. Because cannabis is still an emerging and volatile commodity, leveraged positions can swing quickly.

That makes it essential to understand exactly what your broker is offering in terms of margin requirements and how much exposure you’re really taking on.

When we review brokers, we pay close attention to how margin is structured – are the terms clearly outlined? Are there tiered margin levels depending on position size? Just as importantly, does the platform provide tools to monitor and manage margin usage in real time?

Top Pick: In our experience, AvaTrade offers one of the more competitive and user-friendly setups when it comes to leverage and margin on cannabis CFDs. We found their margin terms to be both clear and consistent across different cannabis-linked assets.

AvaTrade offers leverage of up to 1:5 on major cannabis CFDs like their cannabis index, which provides room to amplify your exposure without taking on excessive risk – ideal for tactical short-term trades.

Regulatory Oversight and Broker Credibility

In a market as fast-evolving and sometimes unpredictable as cannabis, who you trade with matters just as much as what you trade.

Regulatory oversight isn’t just a formality; it’s a critical layer of protection that ensures your broker operates under strict financial standards, transparent practices, and real accountability.

We always consider a broker’s regulatory standing one of the first checks in our review process. Is the broker licensed in major jurisdictions like the US, UK, EU, or Australia? Are client funds segregated? Do they have a proven track record in commodities like cannabis, not just in equity or FX trading?

Top Pick: When it comes to trust and credibility, IG sets the benchmark. They’re regulated by top-tier authorities including the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and several others worldwide.

This gives us – and should give you – confidence that IG operates under some of the industry’s strictest compliance and capital requirements.

Beyond regulation, IG also brings deep experience in commodity trading. Over the years, we’ve seen their performance across different commodity markets, and they’ve consistently demonstrated stability, fair dealing, and platform integrity. This is a big reason we keep coming back to test and trade with them.

Fees and Commissions

In cannabis trading, where price swings can be sharp but margins are often thin, high trading costs can seriously erode your profit. Whether you’re scalping short-term moves or holding leveraged positions, spreads and commissions matter more than most traders realise.

That’s why we closely examine the whole cost structure – both the headline rates and the small print – before recommending a broker.

We look for tight spreads on cannabis-related CFDs and ETFs, low or zero commissions where possible, and no hidden fees tucked into overnight financing or account activity.

We’ve found that some brokers advertise low costs but then surprise you with charges once you’re already trading. So we always test for that ourselves.

Top Pick: CMC Markets consistently delivers one of the most competitive pricing setups for cannabis trading. In our testing, their spreads on cannabis-linked CFDs were among the tightest in the group, and there were no added commissions to worry about. That’s a big plus for traders making frequent trades or working within narrow risk-reward ratios.

What we appreciate most is the transparency. CMC clearly lays out all the costs on the trade ticket, including overnight holding costs, so you’re never guessing the true cost of a trade. This upfront clarity gives you better control over your position sizing and helps you plan trades more effectively.

Risk Management Tools

The cannabis market is known for its volatility. Prices can react quickly to regulatory news, earnings reports, or even supply chain updates; those swings can catch you off guard if you’re unprepared. That’s why effective risk management trading tools aren’t optional – they’re essential.

When evaluating cannabis brokers, we ensure they offer more than just the basics. Yes, a stop-loss is important, but we’re also looking for features like trailing stops, take-profit orders, customizable price alerts, and even volatility warnings. These tools can help you stay in control, even when the market isn’t.

Top Pick: In our hands-on testing, eToro offered one of the most user-friendly and complete risk management setups for cannabis trading. Every position you open includes built-in options for stop-loss and take-profit, and both are adjustable on the fly, even after the trade is live.

We also like that eToro prompts you to think about risk before you confirm a trade, rather than burying those options in a secondary menu.

Another standout was the price alert system. We were able to set instant alerts for specific cannabis assets and received real-time push notifications when our target levels were hit. That helped us react quickly, without needing to be glued to the screen.