Best Copper Brokers 2026

We’ve investigated, tested, and ranked the best brokers for copper trading in 2026, helping you find platforms with sharp pricing, solid tools, and direct access to the copper markets.

-

1NinjaTrader is a US-based brokerage regulated for trading futures. It offers three different pricing plans for varied needs and budgets, along with extremely low margins on popular contracts. The company's renowned charting software and trading platform provides extensive customization options and excellent technical analysis features.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Plus500US, a reputable broker since 2021, is authorized by the CFTC and NFA. It offers futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a quick 10-minute signup, a $100 minimum deposit, and an easy-to-use web platform, Plus500 is enhancing its services for traders in the US. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.0 InstaTrade, located in the British Virgin Islands, is an online broker that focuses on structured fixed income products and active trading via CFDs. Its no-spread accounts, outstanding research primarily from InstaTrade TV, and access to the well-known MT4 and InstaTrade Gear make it a good choice for traders of all levels. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 Established in 2008, Exness is a respected broker known for offering over 40 account currencies, a wide choice of CFD instruments, and an intuitive web platform with features like currency converters and trading calculators. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 RoboForex is a registered online broker since 2009 under the IFSC in Belize. Traders can select from five different account types (Prime, ECN, R StocksTrader, ProCent, Pro). These accounts allow trades starting from 0.01 lots and offer spreads beginning from 0 pips. In addition to the original service, RoboForex has expanded its platform by introducing the trading of CFDs and by developing a stock trading platform, including the CopyFX system.

Compare The Best Brokers For Trading Copper Across Key Features

We’ve tested and compared the top platforms for copper trading—see how they perform across key areas:

How Safe Are The Top Copper Trading Platforms?

When trading copper, platform safety matters. See how these brokers protect your funds:

Mobile Copper Trading Platforms – Compared

We tested mobile apps that support copper trading. Here’s how the leading brokers perform on mobile devices:

Are The Top Copper Trading Brokers Beginner-Friendly?

New to copper trading? Here’s which brokers offer intuitive platforms, solid education, and low barriers to entry:

Are The Top Copper Trading Brokers Good For Advanced Traders?

Experienced traders need precision tools for trading copper. Here’s how top brokers support pro-level copper trading strategies:

Accounts Comparison

Compare the trading accounts offered by Best Copper Brokers 2026.

Detailed Ratings: Best Brokers For Trading Copper

Check out our expert ratings on the best copper brokers - covering every important category:

Copper Brokers Compared On Trading Costs

We analyzed fees and spreads to compare real trading costs across the top brokers for trading copper:

Which Copper Trading Brokers Are Most Popular?

Find out which brokers attract the most copper traders - revealing trusted providers:

| Broker | Popularity |

|---|---|

| InstaTrade |

|

| NinjaTrader |

|

| Exness |

|

| RoboForex |

|

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- Traders can access a free platform and trade simulation capabilities with the unlimited demo.

- NinjaTrader provides detailed charting software for active traders, complete with custom technical indicators and widgets.

- NinjaTrader is a well-regarded and acclaimed futures broker, approved by the NFA and CFTC.

Cons

- You need to register with partner brokers to trade in securities other than forex and futures.

- The advanced trading tools require an additional fee.

- Some payment methods require a withdrawal fee.

Why Trade With Plus500US?

Plus500US is an excellent choice for beginners, offering a user-friendly platform, low trading margins, and access to the Futures Academy to improve trading skills. Its powerful tools and reliable service earned it second place in DayTrading.com's annual 'Best US Broker' award.

Pros

- The account setup, pricing structure, and web platform make futures trading simpler than competitors like NinjaTrader.

- The Futures Academy is a useful resource for beginner traders due to its captivating videos and simple articles. Its unrestricted demo account is also beneficial for practicing trading strategies.

- Plus500US stands out for its low fees, competitive trading margins, and no charges for inactivity, live data, routing, or platform use.

Cons

- Plus500US offers competitive pricing but does not have a discount program for high-volume traders, unlike brokers like Interactive Brokers.

- The private trading platform is easy to use, but doesn't have the advanced analysis tools that platforms like MetaTrader 4 do.

- Plus500US is expanding its investment options, but it currently only offers around 50+ futures and no stocks.

Why Trade With InstaTrade?

InstaTrade provides active trading on an extensive platform. It has a unique offering known as Fixed Income Structured Product (FISP), which allows for passive investment. Investors can potentially earn up to a 50% return within 6 months, provided certain conditions are fulfilled.

Pros

- InstaTrade TV provides video interviews and insightful market information about stocks, cryptocurrencies, and more. It assists in identifying opportunities for quick trading.

- VPS hosting is suitable for algorithmic trading strategies. It uses a dedicated server to offer quick execution speeds, potentially as fast as 9 milliseconds.

- InstaTrade provides approximately 300 assets for investment. It particularly shines in the area of currency pairs, making it an excellent platform for experienced traders interested in volatile exotics.

Cons

- The advertising of FISP, specifically about its "profit guarantee" and "risk-free trading," creates unease.

- Profits in the FISP are guaranteed only if investors do not make over 50% profit and recruit other users, earning $4 for each dollar in compensation.

- InstaTrade is registered in the British Virgin Islands, providing minimal regulatory protections for retail traders.

Why Trade With Exness?

Exness is an excellent choice for active forex traders aiming to reduce costs after lowering spreads, enhancing execution speeds, and offering trading on over 100 currency pairs with more than 40 account currencies.

Pros

- Execution speeds now average under 25ms, providing ideal conditions for short-term traders.

- Fast and reliable 24/7 multilingual customer support through phone, email, and live chat, validated by practical tests.

- Competitive spreads for USOIL and BTCUSD in 2024 start from 0 pips, with low commissions from $2 per side.

Cons

- Besides a mediocre blog, educational resources are lacking, especially compared to category leaders like IG, which offer a more comprehensive trading journey for new traders.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader are not available yet, despite increasing demand from traders and their integration with other platforms like Pepperstone.

- Exness has increased its variety of CFDs and introduced a copy trading feature, but it still lacks real assets like ETFs, cryptocurrencies, or bonds.

Why Trade With RoboForex?

RoboForex offers a broad selection of over 12,000 trading markets along with ECN accounts, impressive charting, and loyalty incentives. It is also advantageous for stock traders due to its intuitive R StocksTrader platform, which provides access to over 3,000 shares, lower fees starting at $0.01, and advanced watchlists.

Pros

- The broker provides two free withdrawals each month in the Free Funds Withdrawal program, assisting traders in reducing transaction expenses.

- The R Stocks Trader platform competes with top platforms like MT4, offering netting and hedging abilities, thorough backtesting, Level II pricing, and a versatile workspace.

- RoboForex offers more than 12,000 instruments for trading. This includes forex, stocks, indices, ETFs, commodities, and futures. Comparatively, this surpasses the trading opportunities available from most online brokers.

Cons

- RoboForex now only allows USD and EUR as base currencies. This could lead to conversion fees and inconvenience for traders who prefer managing their accounts in other currencies.

- RoboForex provides fair spreads, but some of its account types have high trading commissions up to $20 per lot, which are more expensive compared to more affordable brokers like IC Markets.

- RoboForex, with more than 15 years in the industry, is authorized by the IFSC in Belize, a 'Red-Tier' regulator. This authorization provides a lower level of regulatory protection for traders.

Filters

How We Chose The Best Brokers For Trading Copper

We scoured our evolving database of online brokers to identify those offering the best platforms for trading copper, whether through spot markets, CFDs, or futures.

We then ranked these copper brokers using our proprietary scoring system, built from over 200 individual data points across 8 key categories – including pricing, platform tools, and research features.

Finally, our hands-on testing evaluated how effectively each broker supports copper trading – from charting tools and order execution to mobile usability – so you can choose a platform with confidence.

What to Look For in a Top Copper Broker

With years of hands-on testing, we know exactly what separates an average copper broker from a truly top-tier platform – here’s what to look for:

Market Access: Get the Right Exposure to Copper

When it comes to trading copper, not all brokers offer the same level of access, and that’s a big deal. If you’re serious about copper as a commodity play, you’ll want a broker that gives you a clean, reliable route to the major markets where copper is traded.

That usually means direct access to copper futures on exchanges like the Chicago Mercantile Exchange (CME) or London Metal Exchange (LME).

And if you’re trading synthetics like CFDs or ETFs, it’s even more important that the broker has solid pricing and a diverse product lineup, not just a token copper CFD with thin spreads and no depth.

Now, we’ve seen some brokers advertise copper access but then only deliver a barebones CFD with minimal support or liquidity. That’s not what you want when volatility kicks in or you’re trying to build a meaningful position.

We’ve tested many platforms over the past few months, and what we’re looking for here is range, reliability, and real tradability.

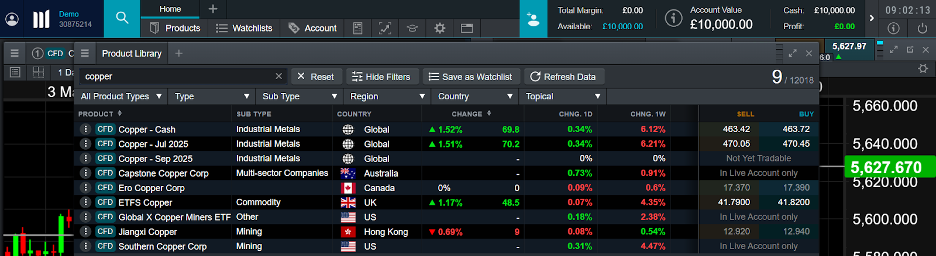

Top Pick: Out of the brokers we evaluated, CMC Markets clearly stands out when it comes to market access for copper. These guys offer both copper futures pricing (via CFDs) and exposure through ETFs — all from a single, unified, user-friendly platform; the advanced Next Gen platform. You can trade spot copper, copper-linked ETFs, and even broader industrial metals indices that track copper’s performance.

CMC NextGen Platform – Copper Instruments

Copper-Specific Research and Insights: Go Beyond the Headlines

If you’re going to trade copper seriously, you need more than just price charts — you need context.

Copper is one of those commodities that touches everything from power grids and electric vehicles to construction, consumer electronics, and even healthcare infrastructure.

That means price moves aren’t just about demand and supply; they’re also about geopolitics, infrastructure investment, mining activity, and even tech trends.

The best copper brokers don’t just show you the current market price — they help you understand why it’s moving. We’ve looked closely at how different platforms support traders with copper-specific insights.

We’re not talking about recycled headlines or generic market summaries here. We’re talking about fundamental research that digs into the copper supply chain, key global producers (Chile, Peru, and the DRC), and demand drivers like EVs and green energy rollouts.

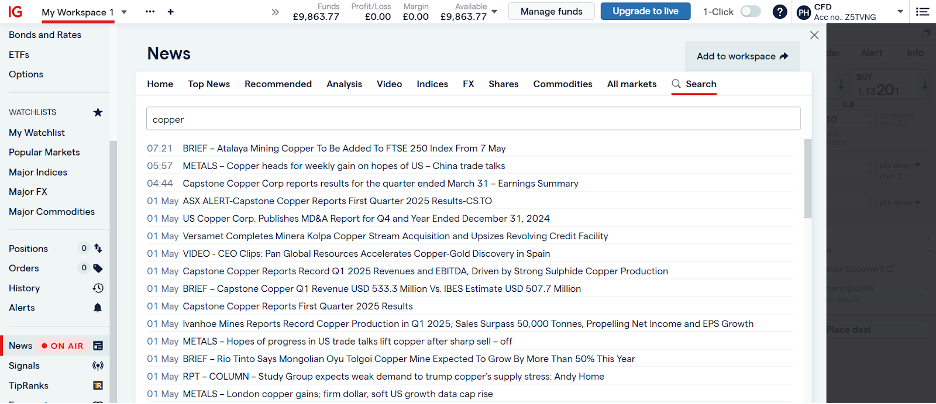

Top Pick: Out of all the brokers we tested, IG delivered the most comprehensive research experience when it comes to copper. Their in-house analysts regularly publish commodities-focused reports that drill down into the fundamentals, including copper mining output, export bottlenecks, and major buyers like China and the US.

During our investigations, we found dedicated content around copper’s role in the energy transition, battery tech, and geopolitical flashpoints involving key mining nations like Russia, Indonesia, and the DRC. IG also integrates live news feeds and macroeconomic calendars that flag copper-relevant events, like Chinese PMI data or supply disruptions in Latin America.

IG Web Platform – Copper News

Execution Speed and Reliability: Don’t Get Left Behind When Copper Moves

Copper doesn’t always move slowly. When macro data drops, like China’s industrial output or unexpected inventory figures from the LME, copper can spike or dip in seconds.

And if your broker is lagging when that happens, it can cost you, whether you’re scalping short-term price swings or locking in a longer-term position. That’s why execution speed and platform stability aren’t just nice-to-haves; they’re non-negotiables.

We’ve stress-tested execution across several brokers during high-volatility events — think major central bank announcements, Chinese trade data, and even mining strike news out of Latin America. We wanted to see how the platforms held up when it mattered most: no freezing, no slippage nightmares, and certainly no “requote” pop-ups mid-trade.

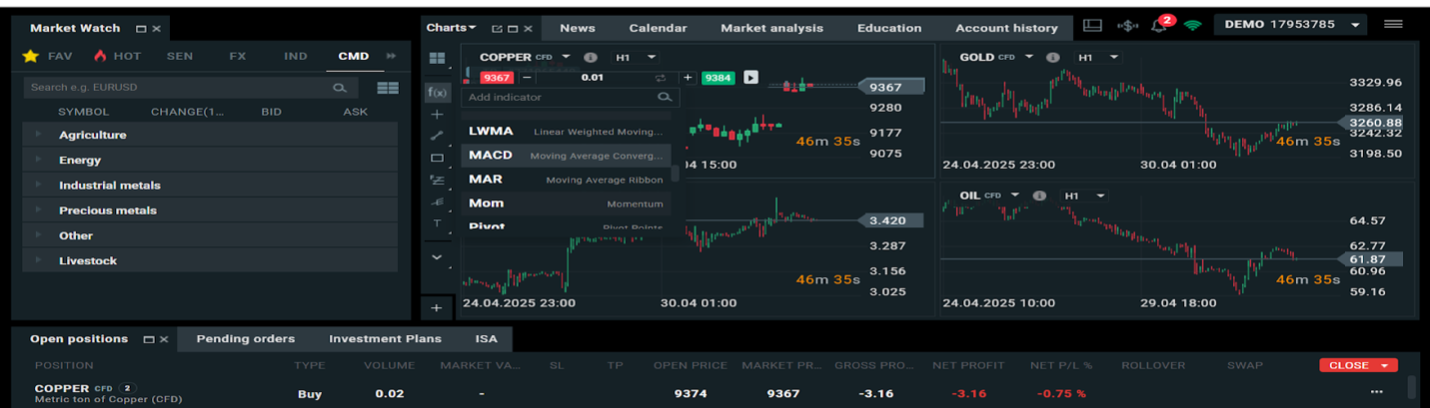

Top Pick: From our experience, Pepperstone nails execution for copper CFDs. We tested it during a week of choppy metals trading driven by US inflation prints and weak PMI data out of China, and it held firm. Orders went through fast, even when spreads widened briefly, and there were no annoying lags or platform crashes.

Pepperstone uses Equinix data centres and low-latency infrastructure, which means execution is fast and consistent, especially if you’re using MetaTrader 5, TradingView or cTrader. We were also impressed with how clean the trade flow felt on copper CFDs, even when we scaled in and out of positions.

Pepperstone cTrader – Copper Trade

Data Feeds and Charts: See the Copper Market Clearly

If you’re trading copper, having access to accurate data, not delayed, watered-down feeds, is a must. You need to know what’s happening on the LME and CME in real time, plus how inventories are moving and what the technical picture looks like.

Copper is a market that reacts fast to global changes, and even small shifts in warehouse stock levels or futures curve dynamics can trigger significant price action.

That’s why we always look for brokers that provide solid real-time pricing, live inventory insights, and professional-grade charting tools — not just something slapped together with a few moving averages and outdated candles.

In our testing, all brokers offered charting, but when we dug deeper, we found limited access to live LME/CME feeds, delayed or incomplete commodity data, and technical tools that felt more forex-oriented than commodity-savvy. For copper traders, that’s not going to cut it.

Top Pick: After comparing platforms side-by-side, XTB stood out when it comes to data and charting for copper. Their xStation 5 platform gives you crisp, real-time CFD pricing for copper that tracks closely with the futures markets, and the latency during testing was extremely low.

Even better, their charting tools felt purpose-built for commodities. You get access to advanced indicators like Bollinger Bands, MACD, and RSI, as well as volume overlays and commodity-relevant features like COT reports and sentiment tools.

We liked that you can customize layouts quickly and keep multiple copper-related charts open at once – spot copper, industrial metals indices, and even ETFs that track copper producers. This helped us analyze short-term momentum while keeping an eye on the bigger picture.

While they don’t offer a raw LME data feed (no retail broker does without an expensive add-on), XTB’s setup gives you more than enough detail to make smart, confident copper trades.

XTB xStation – Copper Trade

Margin and Leverage Options: Know What You’re Risking (and Gaining)

The margin terms can make or break your strategy when trading copper with leverage through futures or CFDs. Too low, and you’re overexposed to even minor price swings. Too high, and you can’t scale into positions efficiently.

So, finding a broker that offers competitive and transparent margin and leverage options is key if you want to keep your risk in check and your flexibility intact.

We’ve seen some brokers slap on high margin requirements for copper CFDs, even when their site promises “competitive leverage.” Others bury the accurate margin info behind menus or PDFs — not exactly helpful when you’re trying to plan a trade or manage open positions on the fly.

We want to see clear terms, easy-to-understand leverage caps, and tools that help you manage that leverage responsibly.

Top Pick: FxPro strikes the right balance between margin and leverage flexibility for copper trading from our tests. Their copper CFD product comes with leverage up to 1:20 (depending on your region and regulatory setup), which is solid for a commodity like copper—enough to amplify gains without exposing you to unnecessary blowout risk on normal daily price moves.

More importantly, FXPro clearly displays margin requirements on its platform and in its instrument specs—no digging through footnotes or outdated PDFs. During testing, we appreciated how margin levels updated in real time as prices moved and how easy it was to calculate exposure across multiple positions.

They also provide built-in risk management tools like guaranteed stop losses and negative balance protection (on most accounts). This is a huge plus if you’re trading with leverage during high-volatility periods, like when major economic reports or geopolitical headlines hit.

Regulatory Oversight and Broker Credibility: Trust Matters in the Copper Game

Let’s be honest — the copper market isn’t a place for guessing games or shady brokers. You’re trading a highly volatile, globally sensitive commodity, so you need a broker that’s not only licensed and regulated but also experienced in handling metals.

It’s not enough to be regulated in name — the broker should have a solid reputation for commodity execution and risk controls.

We’ve reviewed many brokers who talk the talk on regulation but don’t specialize in commodities like copper. Others tick the regulatory boxes but fall short when it comes to platform stability or dispute resolution. That’s why we always look at the complete picture—licenses, history, and actual trader experience.

Top Pick: If regulation and credibility are your top priorities (and they should be), CMC Markets is a standout. They’re regulated by top-tier authorities like the FCA (UK), ASIC (Australia), and BaFin (Germany), and they’ve been around for more than 30 years. That’s not something many brokers in the copper space can say.

More importantly, CMC has a deep history with commodities trading. In our own experience using their platform, we’ve seen strong execution on copper and other industrial metals, consistent pricing and tight risk controls.

Fees and Commissions: Every Tick Counts

Copper might trade in huge global volumes, but when you’re trading it via CFDs or futures, margins can get tight. That’s why every pip, every tick of spread, and every commission charge matters.

If your broker is quietly charging you wide spreads or hidden fees on copper trades, you’re losing money before the trade even starts.

We’ve tested brokers to see who delivers low-cost copper trading. Some looked good on paper but widened during active hours. Others charged fixed commissions but added markups anyway. Transparency is a huge issue here.

Top Pick: Once again, Pepperstone earns its spot for offering highly competitive spreads on copper CFDs, especially during the liquid parts of the trading day. We saw spreads as low as 2 points during peak hours, with no extra commission added. That kind of cost efficiency makes a big difference if you’re trading actively or scalping short-term copper moves.

Risk Management Tools: Copper Can Turn on a Dime

Let’s not sugar-coat it: copper is volatile. One headline about Chinese demand or a supply disruption in Chile, and prices can move hard and fast.

That makes risk management tools essential, not just “nice extras.” We want to see stop-loss orders, take-profit targets, price alerts, and even volatility warnings that help you stay in control when the market heats up.

We’ve seen too many platforms that give you access to leverage but don’t offer the tools to manage it. That’s a recipe for disaster in copper trading.

Top Pick: In our testing, IG offered one of the most complete risk management packages available — and it’s particularly strong for volatile markets like copper. You can set guaranteed stop-loss orders (yes, guaranteed even in gapping markets), attach trailing stops, and get automated price alerts across devices. A customizable volatility filter also flags sharp price moves — a lifesaver during unexpected macro news.

We personally used IG’s risk tools during a week when copper was reacting to a wave of economic data from China and the US, and they helped us avoid unnecessary losses. Having alerts pop up in real time and being able to move stops quickly made a massive difference.