Best Natural Gas Brokers 2026

Explore our expert-driven ranking of the best natural gas brokers, backed by in-depth analysis and hands-on testing by seasoned traders and industry specialists.

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Plus500US, a reputable broker since 2021, is authorized by the CFTC and NFA. It offers futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a quick 10-minute signup, a $100 minimum deposit, and an easy-to-use web platform, Plus500 is enhancing its services for traders in the US. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.0 InstaTrade, located in the British Virgin Islands, is an online broker that focuses on structured fixed income products and active trading via CFDs. Its no-spread accounts, outstanding research primarily from InstaTrade TV, and access to the well-known MT4 and InstaTrade Gear make it a good choice for traders of all levels. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 Established in 2008, Exness is a respected broker known for offering over 40 account currencies, a wide choice of CFD instruments, and an intuitive web platform with features like currency converters and trading calculators.

Best Natural Gas Brokers Comparison

Safety Comparison

Compare how safe the Best Natural Gas Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Natural Gas Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Natural Gas Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Natural Gas Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Natural Gas Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Natural Gas Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Natural Gas Brokers 2026.

Broker Popularity

See how popular the Best Natural Gas Brokers [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| InstaTrade |

|

| Interactive Brokers |

|

| Exness |

|

| FOREX.com |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- The new IBKR Desktop platform combines the advantages of TWS and adds unique tools like Option Lattice and Screeners with MultiSort to make trading accessible and impressive for traders of all levels.

- Interactive Brokers was named Best US Broker for 2025 by DayTrading.com for its dedication to US traders, ultra-low margin rates, and affordable global market access.

- The TWS platform is designed for intermediate to advanced traders. It includes over 100 order types and a dependable real-time market data feed that rarely experiences downtime.

Cons

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

Why Trade With Plus500US?

Plus500US is an excellent choice for beginners, offering a user-friendly platform, low trading margins, and access to the Futures Academy to improve trading skills. Its powerful tools and reliable service earned it second place in DayTrading.com's annual 'Best US Broker' award.

Pros

- The account setup, pricing structure, and web platform make futures trading simpler than competitors like NinjaTrader.

- The Futures Academy is a useful resource for beginner traders due to its captivating videos and simple articles. Its unrestricted demo account is also beneficial for practicing trading strategies.

- Plus500 is a reputable publicly traded company with over 24 million traders and sponsors the Chicago Bulls.

Cons

- Plus500US offers competitive pricing but does not have a discount program for high-volume traders, unlike brokers like Interactive Brokers.

- The private trading platform is easy to use, but doesn't have the advanced analysis tools that platforms like MetaTrader 4 do.

- Plus500US is expanding its investment options, but it currently only offers around 50+ futures and no stocks.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

Cons

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

Why Trade With InstaTrade?

InstaTrade provides active trading on an extensive platform. It has a unique offering known as Fixed Income Structured Product (FISP), which allows for passive investment. Investors can potentially earn up to a 50% return within 6 months, provided certain conditions are fulfilled.

Pros

- InstaTrade provides approximately 300 assets for investment. It particularly shines in the area of currency pairs, making it an excellent platform for experienced traders interested in volatile exotics.

- InstaTrade TV provides video interviews and insightful market information about stocks, cryptocurrencies, and more. It assists in identifying opportunities for quick trading.

- VPS hosting is suitable for algorithmic trading strategies. It uses a dedicated server to offer quick execution speeds, potentially as fast as 9 milliseconds.

Cons

- Profits in the FISP are guaranteed only if investors do not make over 50% profit and recruit other users, earning $4 for each dollar in compensation.

- InstaTrade is registered in the British Virgin Islands, providing minimal regulatory protections for retail traders.

- InstaTrade's learning resources are helpful for new traders but are not as organized or comprehensive as those provided by top companies such as eToro.

Why Trade With Exness?

Exness is an excellent choice for active forex traders aiming to reduce costs after lowering spreads, enhancing execution speeds, and offering trading on over 100 currency pairs with more than 40 account currencies.

Pros

- Wide variety of account types for all experience levels, including Cent, Pro, and the new Raw Spread, ideal for traders.

- Fast and reliable 24/7 multilingual customer support through phone, email, and live chat, validated by practical tests.

- Competitive spreads for USOIL and BTCUSD in 2024 start from 0 pips, with low commissions from $2 per side.

Cons

- Exness has increased its variety of CFDs and introduced a copy trading feature, but it still lacks real assets like ETFs, cryptocurrencies, or bonds.

- Besides a mediocre blog, educational resources are lacking, especially compared to category leaders like IG, which offer a more comprehensive trading journey for new traders.

- Retail trading services are not available in some areas, including the US, UK, and EU, making them less accessible compared to leading brokers like Interactive Brokers.

Filters

How We Chose the Best Natural Gas Brokers

To identify the top brokers for trading natural gas, we ranked providers from our evolving database by their overall ratings, assigned by our experts.

Our evaluation process:

- Comprehensive Data Analysis – We examined over 200 critical factors for each broker, from the availability of natural gas trading instruments, to contract spreads and trading tools.

- Hands-On Testing – Beyond the data, we personally used each broker’s platform to assess trading tools, user experience, and key features like risk management options and advanced charting capabilities.

What to Look for in a Natural Gas Trading Broker

Choosing the right broker is the foundation of successful natural gas trading; the brokerage you pick can make or break your trading experience.

Natural gas is a unique commodity, and not all brokers are equipped to handle its complexities.

Here’s a detailed breakdown of what to look for:

Commodity Trading Availability

Not all brokers offer natural gas trading. Look for brokers that provide natural gas CFDs (Contracts for Difference) or futures.

CFDs are particularly popular among retail traders because they allow you to speculate on price movements without owning the physical commodity.

Ensure the broker offers competitive pricing and liquidity for natural gas markets. Pepperstone is a good option here, with natural gas CFDs featuring tight spreads (Razor) and no commission on standard accounts.

User-Friendly Trading Platform

A good platform should be intuitive, even for beginners. Look for platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which are widely used and offer advanced charting tools.

Some brokers have proprietary platforms with features tailored for commodity trading. I recommend always testing these platforms with a demo trading account before committing.

For example, CMC Markets has an excellent proprietary platform with advanced charting and risk management tools that we enjoyed using during testing.

Regulation and Security

Always choose a broker regulated by a reputable authority. This includes:

- CFTC (Commodities Futures Trading Commission) in the US

- FCA (Financial Conduct Authority) in the UK

- CySEC (Cyprus Securities and Exchange Commission) in Cyprus

- BaFin (Federal Financial Supervisory Authority) in Germany

Regulation ensures the broker follows strict financial standards and protects your funds.

For example, IG is heavily regulated by the FCA (UK) and other top-tier authorities. It also offers tight spreads and no commission on natural gas CFDs

Also check if the broker keeps client funds in segregated accounts. This means your money is kept separate from the broker’s operating funds, reducing the risk of misuse.

Expert take: When I’m trading, I always look for brokers that offer negative balance protection; this ensures you can’t lose more than your account balance.

A trustworthy broker will disclose all fees, terms, and conditions on their website. Avoid brokers with vague or hard-to-find information.

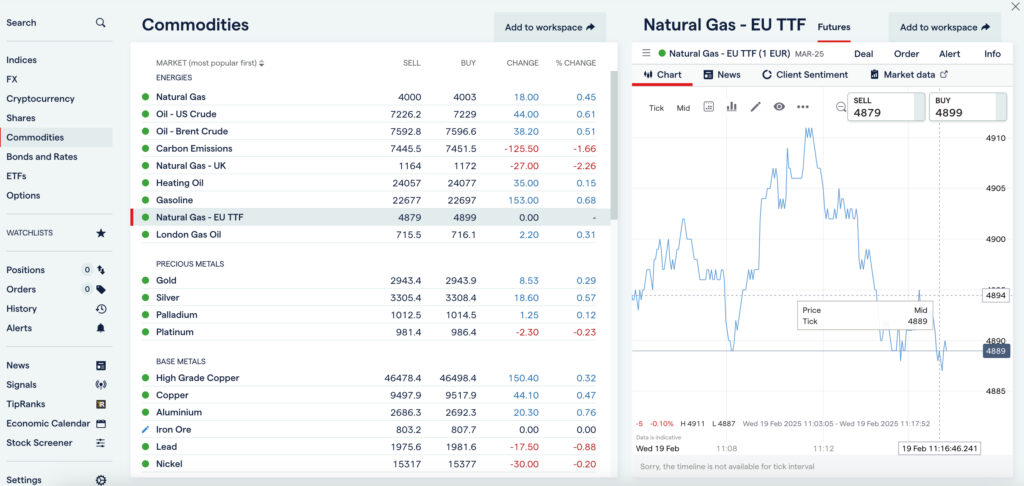

IG Web Platform

Leverage Options

Leverage allows you to trade larger positions with a smaller amount of capital. For example, with 1:10 leverage, you can control 10,000 worth of natural gas with just 1,000.

However, leverage amplifies profits and losses, so choose a broker offering flexible leverage options to suit your risk tolerance.

Note: Due to regulatory restrictions, EU, UK and Australian-regulated brokers cap leverage at 1:30 for retail traders.

Educational Resources

If you’re new to natural gas trading, look for brokers that offer educational resources like tutorials, webinars, eBooks, and market analysis.

Some brokers provide demo accounts where you can practice trading natural gas with virtual money. This is a great way to build confidence before trading with real funds.

XTB offers an easy-access demo account that we’ve used to test natural gas trading conditions. It also provides excellent education, including a guide covering how to trade natural gas.

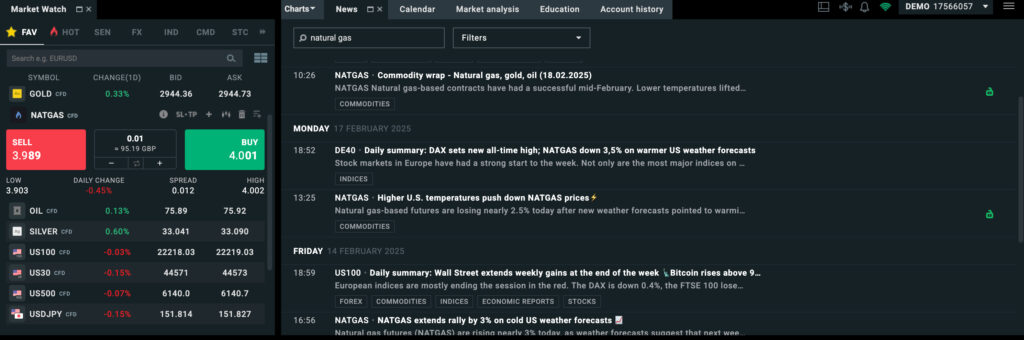

Market Analysis Tools

Weather patterns, supply and demand, and geopolitical events influence natural gas prices.

A good brokerage will provide real-time news feeds, economic calendars, and technical analysis tools to help you make informed decisions about when to enter and exit natural gas trades.

XTB xStation Platform

Customer Support

- Availability: Natural gas markets can move quickly, so you need a broker with 24/7 customer support. Look for brokers that offer multiple contact methods, such as live chat, email, and phone support.

- Responsiveness: Before opening an account, test the broker’s customer support. Are they quick to respond? Are they knowledgeable and helpful?

- Multilingual Support: If English isn’t your first language, check if the broker offers support in your preferred language.

Interactive Brokers scored high during our tests of its customer support. It also offers great flexibility with natural gas futures and options, in addition to CFDs.

Fees and Spreads

The spread is the difference between the bid (buy) and ask (sell) price. For natural gas, spreads can vary significantly between brokers. Look for brokers with tight spreads, especially if you’re a frequent trader.

- Commissions: Some brokers charge a commission per trade, while others build their costs into the spread. Compare both options to see which is more cost-effective for your trading style.

- Overnight Financing Costs: If you hold a position open overnight, you may incur swap fees or rollover charges. These can add up, so check the broker’s fee structure.

- Deposit and Withdrawal Fees: Some brokers charge fees for depositing or withdrawing funds. Look for brokers that offer free deposits and low withdrawal fees.

Years on and IC Markets still offers some of the lowest spreads on natural gas (averaging 0.004) and the fastest execution that we’ve seen.

Peppertone Natural Gas Spreads

How to Trade Natural Gas with the Best Brokers

Now you’ve chosen a reliable broker, this section will walk you through the process step-by-step, from opening your account to placing your first trade.

Open and Fund Your Account

Visit the broker’s website and click the “Sign Up” or “Open Account” button. Fill in your details, including your name, email address, and phone number.

Most brokers require you to verify your identity and address. This is a standard procedure to comply with anti-money laundering (AML) regulations.

Once your account is verified, deposit funds using a secure payment method. Most brokers we’ve evaluated accept:

- Bank transfers

- Credit cards/debit cards

- E-wallets (e.g., PayPal, Skrill, Neteller)

Pro tip: Check if the broker offers new clients a welcome bonus or deposit match (not available in all regions).

Choose Your Trading Platform

- MetaTrader 4/5 (MT4/MT5): MT4 and MT5 are the most popular trading platforms for natural gas. They offer advanced charting tools, technical indicators, and automated trading options. You can download the platform from your broker’s website or use the web-based version.

- Proprietary Platforms: Some brokers we’ve tested offer their own trading platforms, which may have unique features tailored for commodity trading. Try the platform with a demo account to ensure it meets your needs.

- Mobile Trading Apps: If you prefer trading on the go, check if the broker offers a mobile app. Most apps allow you to monitor the market, place natural gas trades, and manage your account from your smartphone.

Pro tip: IC Markets offers natural gas CFDs on MetaTrader4/5, TradingView and cTrader – providing among the best range of trading platforms we’ve seen.

Tips for Successful Natural Gas Trading

- Start Small: If you’re new to natural gas trading, start with a small position size and gradually increase as you gain experience.

- Stay Disciplined: Stick to your trading plan and avoid impulsive decisions. Emotional trading is one of the biggest reasons traders lose money.

- Diversify Your Portfolio: Don’t put all your capital into natural gas. Consider trading other commodities, forex, or stocks to spread your risk.

Expert take: Natural gas trading is complex, and the market is constantly changing. That’s why I stay updated on market trends and continue developing and adjusting my trading strategies.

Example Trade: Trading Natural Gas with a Top Broker

Let’s say you’re using IG, a popular global broker, to trade natural gas. Here’s how it might look:

- Account Setup: You open an account, verify your identity, and deposit $10,000.

- Market Analysis: You notice that a cold winter is forecasted, which could increase demand for natural gas.

- Placing the Trade: You decide to go long on natural gas CFDs at 3,600.

- Stop Loss Order: You set the stop loss order at 3,500 and a take-profit at $100.

- Monitoring: Over the following sessions, natural gas prices rise due to increased demand.

- Closing the Trade: Your take-profit order is triggered, and you close the trade with a $100 profit.

What Are the Pros and Cons of Trading Natural Gas?

Whether you’re a beginner or an experienced trader, it’s important to understand this commodity’s unique advantages and risks.

Pros:

- High Volatility: Natural gas prices can fluctuate significantly due to factors like weather, supply disruptions, and geopolitical events. This creates opportunities for traders to profit from short-term and long-term price movements.

- Liquidity: Natural gas is one of the most actively traded commodities, ensuring you can enter and exit positions quickly without significant price slippage.

- Diversification: Adding natural gas to your portfolio can help diversify your investments, reducing overall risk.

- Leverage Opportunities: Most brokers we’ve evaluated offer leverage, allowing you to control larger positions with less capital. This can amplify profits (but also losses).

- Global Demand: Natural gas is a key energy source worldwide, used for heating, electricity, and industrial processes. This ensures consistent market activity.

- Multiple Trading Instruments: You can trade natural gas through CFDs, futures, options, or ETFs, giving you flexibility in how you approach the market.

- Seasonal Trends: Natural gas prices often follow predictable seasonal patterns (e.g., higher demand in winter for heating), making it easier to plan trades.

Cons:

- High Volatility: While volatility can be a pro, it also increases risk. Prices can swing dramatically quickly, leading to significant losses if not managed properly.

- Complex Market Drivers: Natural gas prices are influenced by a wide range of factors, including weather, storage levels, geopolitical events, and economic data. Keeping up with these can be overwhelming for beginners.

- Leverage Risks: While leverage can amplify profits, it can also magnify losses. Over-leveraging is a common pitfall for inexperienced traders.

- Storage and Transportation Costs: Unlike stocks or forex, natural gas is a physical commodity with storage and transportation costs, which can impact prices and trading strategies.

- Regulatory Changes: Government policies, environmental regulations, and energy transitions (e.g., toward renewables) can significantly impact natural gas prices.

- Limited Trading Hours: Natural gas futures have specific trading hours, unlike forex markets, which operate 24/5. This can limit your ability to react to market-moving events.

- Weather Dependency: Prices are heavily influenced by unpredictable weather patterns. A mild winter, for example, can lead to oversupply and falling prices.