Best Sugar Brokers 2026

We’ve reviewed, tested, and ranked the best sugar brokers for 2026, based on expert analysis and hands-on experience.

-

1Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.0 InstaTrade, located in the British Virgin Islands, is an online broker that focuses on structured fixed income products and active trading via CFDs. Its no-spread accounts, outstanding research primarily from InstaTrade TV, and access to the well-known MT4 and InstaTrade Gear make it a good choice for traders of all levels. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 IC Markets is a renowned forex and CFD broker recognized for its high-quality pricing, extensive range of trading tools, and superior trading technology. Established in 2007 in Australia, it operates under the oversight of ASIC, CySEC, and FSA. It has drawn in over 180,000 traders from across 200 countries. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 RoboForex is a registered online broker since 2009 under the IFSC in Belize. Traders can select from five different account types (Prime, ECN, R StocksTrader, ProCent, Pro). These accounts allow trades starting from 0.01 lots and offer spreads beginning from 0 pips. In addition to the original service, RoboForex has expanded its platform by introducing the trading of CFDs and by developing a stock trading platform, including the CopyFX system. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 XM is a global forex and CFD broker with over 15 million clients in more than 190 countries. Since 2009, it has offered low trading fees on over 1000 instruments. The broker is well-regulated by authorities such as ASIC, CySEC, DFSA, and SCA in the UAE, and provides a full MetaTrader experience.

Compare The Best Brokers For Trading Sugar Across Key Features

We carefully assessed leading sugar trading platforms – here’s how they compare on the factors that matter most:

How Safe Are The Top Sugar Trading Brokers?

Security is critical when trading softs like sugar. Here's how top brokers safeguard your funds:

Best Mobile Platforms For Sugar Trading

Prefer trading on the go? These mobile apps deliver fast, reliable access to sugar markets from anywhere:

Best Sugar Brokers For Beginners

Just starting out? Here’s how the top platforms make it easier to learn and trade sugar confidently:

Are These Sugar Brokers Built For Pros?

Advanced trader? Here’s how these brokers stack up on execution, analysis tools, and trading features:

Accounts Comparison

Compare the trading accounts offered by Best Sugar Brokers 2026.

Detailed Ratings: Top Brokers For Sugar Trading

Explore how the best sugar brokers scored across our comprehensive rating system:

Fees & Spreads Breakdown

We dug into pricing to reveal which sugar brokers offer tight spreads and low fees:

Which Sugar Trading Brokers Are Most Popular?

Curious where other sugar traders are going? These brokers are drawing the biggest crowds:

| Broker | Popularity |

|---|---|

| XM |

|

| InstaTrade |

|

| RoboForex |

|

| FOREX.com |

|

| IC Markets |

|

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

Cons

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

- FOREX.com has expanded their trading offerings, but these remain limited to forex and CFDs. Unfortunately, they don't provide options to invest in actual stocks, ETFs, or cryptocurrencies.

Why Trade With InstaTrade?

InstaTrade provides active trading on an extensive platform. It has a unique offering known as Fixed Income Structured Product (FISP), which allows for passive investment. Investors can potentially earn up to a 50% return within 6 months, provided certain conditions are fulfilled.

Pros

- VPS hosting is suitable for algorithmic trading strategies. It uses a dedicated server to offer quick execution speeds, potentially as fast as 9 milliseconds.

- InstaTrade promises returns using its structured passive trading solution (FISP), with applications processed within 24 hours.

- InstaTrade provides a high-quality range of charting tools for traders. Its web trader includes over 250 indicators, 11 types of charts and a design that's easy to use.

Cons

- InstaTrade's learning resources are helpful for new traders but are not as organized or comprehensive as those provided by top companies such as eToro.

- Profits in the FISP are guaranteed only if investors do not make over 50% profit and recruit other users, earning $4 for each dollar in compensation.

- InstaTrade is registered in the British Virgin Islands, providing minimal regulatory protections for retail traders.

Why Trade With IC Markets?

IC Markets provides excellent prices, quick execution, and smooth deposits. The utilization of sophisticated charting platforms such as TradingView and the Raw Trader Plus account makes it a preferred choice for intermediate to advanced traders.

Pros

- IC Markets won DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its top-notch MetaTrader integration, perfected over years to enhance the platform experience.

- IC Markets provides fast and reliable 24/5 support for account and funding issues.

- IC Markets, a well-regulated and respected broker, emphasizes client security and transparency for a trustworthy global trading experience.

Cons

- Despite having four top-tier third-party platforms, there is no in-house software or trading app specifically designed for new traders.

- The range and quality of educational materials, such as tutorials and webinars, require improvement. This lag falls behind competitors like CMC Markets and reduces its suitability for novice traders.

- IC Markets have a selection of metals and cryptos for trading through CFDs, but their range is not as wide as brokers such as eToro. This may limit options for traders who are interested in these asset types.

Why Trade With RoboForex?

RoboForex offers a broad selection of over 12,000 trading markets along with ECN accounts, impressive charting, and loyalty incentives. It is also advantageous for stock traders due to its intuitive R StocksTrader platform, which provides access to over 3,000 shares, lower fees starting at $0.01, and advanced watchlists.

Pros

- RoboForex won the 'Best Forex Broker 2025' award from DayTrading.com for expanding their FX services, reducing spreads, and increasing availability in multiple countries.

- RoboForex offers tight spreads starting at 0 pips and low minimum deposits from $10, making it affordable. Trading with micro lots additionally reduces entry barriers for new traders.

- RoboForex offers more than 12,000 instruments for trading. This includes forex, stocks, indices, ETFs, commodities, and futures. Comparatively, this surpasses the trading opportunities available from most online brokers.

Cons

- RoboForex now only allows USD and EUR as base currencies. This could lead to conversion fees and inconvenience for traders who prefer managing their accounts in other currencies.

- RoboForex, with more than 15 years in the industry, is authorized by the IFSC in Belize, a 'Red-Tier' regulator. This authorization provides a lower level of regulatory protection for traders.

- RoboForex provides fair spreads, but some of its account types have high trading commissions up to $20 per lot, which are more expensive compared to more affordable brokers like IC Markets.

Why Trade With XM?

With a $5 minimum deposit, advanced charting on MT4 and MT5, a growing range of markets, and a Zero account with spreads from 0.0, XM offers what traders need. They have even won our 'Best MT4/MT5 Broker' award recently.

Pros

- XM offers over 1,000 instruments, giving traders various short-term opportunities, including turbo stocks, fractional shares, and thematic indices.

- In late 2025, XM received a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates, enhancing its regulatory standing and positioning it as a strong choice for traders in the Middle East.

- XM has updated its platform with integrated TradingView charts and an XM AI assistant for faster execution, smarter analysis, and a more intuitive trading experience.

Cons

- XM is lagging because it doesn’t offer cTrader and TradingView, which are now preferred over MetaTrader for their better user interface and charting tools.

- The XM app is user-friendly and offers unique copy trading products, but its technical analysis tools need enhancement for advanced traders.

- XM only uses the MetaTrader platforms for desktop trading, offering no in-house downloadable or web-based solutions with unique features for beginners.

Filters

How We Selected the Best Sugar Brokers

To build these rankings, we focused on brokers that offer reliable access to sugar markets — whether via CFDs, futures, or other instruments linked to sugar prices.

Each provider was scored using our in-house methodology, analyzing over 200 criteria — from spreads and regulation to platform features, execution quality, and access to sugar contracts.

But we didn’t stop at specs. We placed trades to evaluate the actual user experience.

What To Look For In A Broker For Trading Sugar

After evaluating a wide range of platforms, we’ve identified what really sets the best sugar brokers apart. Here’s what to look for:

Market Access: Go Beyond Just Clicking “Buy”

If you’re serious about trading sugar, you need a broker that offers real market access, not just a shiny platform and a long list of commodities that turn out to be primarily marketing fluff. We’ve seen this firsthand when evaluating platforms ourselves. You click on “sugar” only to discover it’s just a synthetic tracker with wide spreads and limited functionality.

What you want is direct access to sugar futures, especially those listed on major global exchanges like the Chicago Mercantile Exchange (CME).

Alternatively, if you’re more into synthetic instruments, like Contracts for Difference (CFDs) or Exchange-Traded Funds (ETFs), you still want tight spreads, real-time data, and the ability to trade around the clock — not just a vague promise of “exposure to the sugar market.”

Top Pick: When it comes to sugar trading, IG delivers where it matters: deep access to both futures and CFD instruments, all in one place.

IG gives you access to sugar futures contracts listed on the Chicago Mercantile Exchange (CME), and for those trading outside traditional futures markets, they also offer CFDs tied to sugar prices – ideal for shorter-term strategies or if you’re looking to trade with leverage.

What impressed us during our testing was how smoothly IG handled both sides of the spectrum. Whether we were placing futures orders during volatile sessions or testing sugar CFDs during off-peak hours, we found execution to be quick and reliable. Add in the fact that their data feeds are substantial and include both technical and fundamental sugar market insights, and you’ve got a broker that doesn’t just offer market access — they back it up with performance.

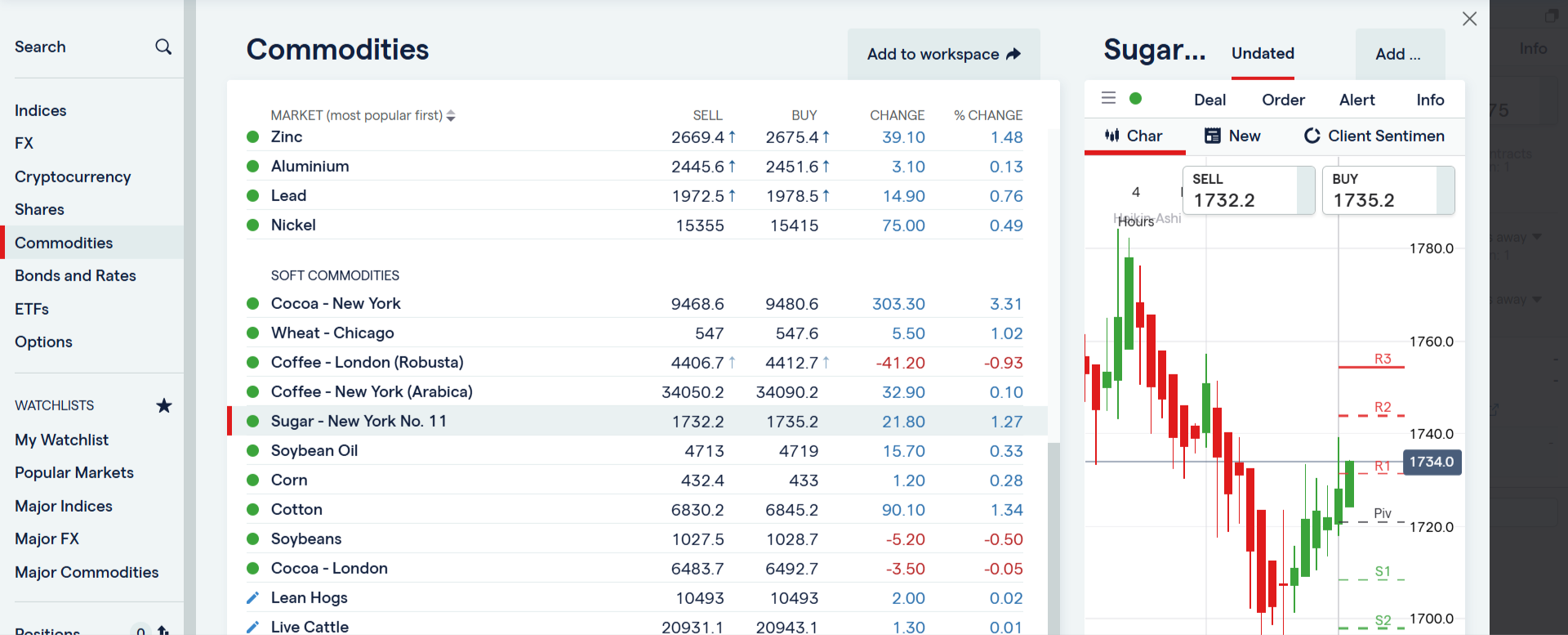

IG web trader platform sugar CFD chart

Specific Research and Insights: Don’t Trade Blindfolded

Sugar isn’t just about price charts and candlesticks. It’s a globally traded soft commodity that reacts to a range of factors, including weather anomalies in Brazil, political shifts in India, and changes in fuel policy in Thailand. If your broker doesn’t help you keep up with that, you’re flying blindfolded.

When evaluating sugar brokers, one of the key differentiators we look for is access to in-depth research, rather than just basic market summaries. We’re talking about in-depth commodity reports, real-time analysis of supply chain disruptions, climate trends, and the kind of geopolitical insight that affects sugar output and export patterns from top producers such as Brazil, India, Thailand, and the European Union.

Unfortunately, this is where many brokers fall short. Too many simply reskin generic macroeconomic commentary and call it “research.” We’ve seen it again and again during our reviews: bland overviews with no clear focus on commodities, let alone anything specific to sugar. And that just doesn’t cut it.

Top Pick: Out of all the brokers we tested, CMC Markets stood out for its consistently detailed, commodity-specific research, especially when it comes to sugar.

CMC doesn’t just offer a daily market wrap and call it a day. Their research team actively publishes insights on soft commodities, with a clear emphasis on weather risks, supply and demand fundamentals, and macroeconomic developments in major sugar-producing countries. We found updates on El Niño’s impact on Brazil’s harvest, commentary on India’s sugar export quotas, and even analysis tied to biofuel production trends, which heavily influence sugar demand.

During our hands-on testing, we appreciated how easily we could access these insights directly within the platform. No need to dig around in external PDFs or bounce between tabs — it’s all right there, helping you make faster, more informed decisions.

Execution Speed and Reliability: Because Sugar Doesn’t Wait

If you’ve ever watched sugar markets react to a surprise United States Department of Agriculture (USDA) report or sudden export curbs out of India, you already know — every second counts.

Sugar is a volatile commodity. Prices can spike or drop in a matter of moments, especially when macroeconomic news hits or when weather events threaten key harvests in places like Brazil or Thailand.

In these conditions, a slow or unstable trading platform can wreck your position. We’ve experienced it ourselves during testing — slippage, frozen charts, delayed order confirmations — and it’s not just frustrating, it’s costly.

What you want from a broker here is simple: fast, consistent trade execution even during high-volume news events, and a stable platform that won’t buckle under pressure. Not all brokers deliver this, but one consistently did when we put them to the test.

Top Pick: When it came to execution speed and overall reliability, Pepperstone was the clear standout in our tests, especially on the cTrader Spotware platform.

We ran a series of trades during peak volatility windows — including during major USDA releases and global news headlines affecting agricultural markets — and Pepperstone delivered near-instant execution every time. Orders filled fast, with virtually no slippage on sugar CFDs, and the platform remained remarkably stable under pressure.

Pepperstone also supports low-latency infrastructure and connects to top-tier liquidity providers, which really shows when sugar prices start moving fast. Their Smart Trader Tools and advanced analytics also helped us tweak our entries and exits with precision — something that’s only possible when execution speed is there to support your strategy.

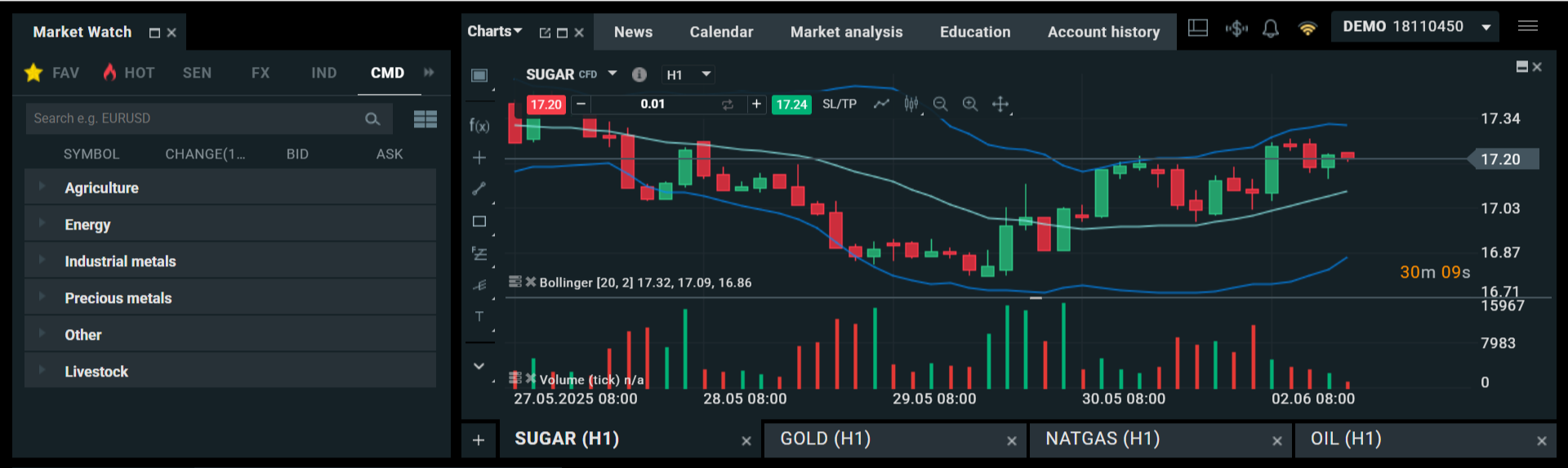

Pepperstone cTrader platform sugar CFD

Data Feeds and Charts: Your Eyes on the Sugar Market

Let’s be honest — trading sugar without live data and proper charts is like driving blindfolded. You can’t react to price moves you can’t see, and you definitely can’t time your entries or exits if your indicators are lagging.

We’ve tested sugar platforms extensively, and one of the most significant gaps we often find is around real-time data, especially for traders who want to track actual Chicago Mercantile Exchange (CME) sugar futures pricing, not just a rough CFD estimate.

Add to that the need for live global inventory numbers, export data, and technical tools explicitly built for commodities (not just generic FX overlays), and the bar gets even higher.

You’d be surprised how many brokers still limit access to delayed data or bury vital stats behind paywalls. If you want to trade sugar seriously, you need a broker that brings the complete picture into view — in real time, and without friction.

Top Pick: When it comes to real-time sugar data and pro-level charting tools, XTB gets it right. In our testing, XTB delivered real-time CME sugar pricing through their platform with no noticeable lag — a huge plus when you’re reacting to short-term volatility. They also offer detailed macro data feeds and periodic updates on global stockpiles and export flows, which are essential for anyone watching sugar supply trends.

But what stood out was the quality of their charting tools. Using the xStation platform, we had access to professional-level charts with deep customization options and technical indicators tailored to commodities. Think more than just RSI and MACD — we’re talking volume overlays that make sense for tracking seasonal trends, harvest cycles, and momentum shifts in volatile softs like sugar.

It’s also a clean, responsive interface — no clutter, no overcomplicated layouts, just fast access to the data and visuals you need to stay ahead of the curve.

XTB xStation platform sugar CFD chart

Margin and Leverage Options: Know What You’re Risking

If you’re trading sugar using futures or Contracts for Difference (CFDs), margin isn’t just a technicality — it’s a core part of your strategy. Leverage can magnify profits, yes, but it also magnifies risk. And when sugar markets get choppy (which they often do), precise, competitive, and transparent margin terms become non-negotiable.

We’ve seen brokers advertise “low margin requirements” only to bury the actual terms in fine print or shift them without warning during volatile periods. That kind of inconsistency can mess with your position sizing and risk management, especially if you’re trading across multiple soft commodities.

During our evaluations, we paid close attention to how brokers communicated leverage options, how quickly margin requirements updated in fast-moving markets, and whether risk controls (like margin call alerts or negative balance protection) were up to standard.

Top Pick: If you want transparency and flexibility when trading sugar with leverage, IC Markets is our top pick. They offer highly competitive margin terms, especially on sugar CFDs, with leverage options up to 1:200 depending on your jurisdiction and account type.

What we appreciated most during our testing was how all of this was communicated. No guessing games — margin requirements were listed, updated dynamically, and reflected market conditions in real time.

Regulatory Oversight and Broker Credibility: Trust Is the First Trade

Before you place a single sugar trade, ask yourself: Can I trust this broker? Because no matter how slick the platform looks or how tight the spreads seem, if the broker isn’t properly regulated, your capital could be at risk.

In commodities like sugar, where leveraged positions and futures contracts are common, regulation becomes even more critical. You want a broker that’s licensed by top-tier regulators — think the Financial Conduct Authority (FCA) in the United Kingdom, the Australian Securities and Investments Commission (ASIC) in Australia, or similar heavyweights — not just a checkbox from some offshore jurisdiction.

But regulation alone isn’t enough. We also look at how long the broker has been active in the commodities space, how they’ve handled volatility events in the past, and whether their customer support shows up when things go sideways.

We’ve tested all of this ourselves — from requesting support during high-volume trading windows to digging through the company’s legal history and client reviews.

Top Pick: When it comes to trust, IG consistently sets the standard. They’re regulated by the FCA in the United Kingdom, ASIC in Australia, and several other top-tier financial authorities. With over 45 years of market presence, IG has built a solid reputation for transparent operations, client fund protection, and deep experience in commodities, including sugar.

During our research, we stress-tested their platform during high-volatility events, reached out to their support team with margin-related questions, and even reviewed how they handled client communications during turbulent macroeconomic periods. The result? Consistently high marks.

Fees and Commissions: Don’t Let Costs Eat Your Profits

Sugar trading can offer big opportunities, but margins can be tight, especially if you’re scalping short moves or trading around news events. That’s why trading costs matter a lot more than most people realise. A couple of extra points in spread or a chunky commission can eat into your profits before your trade even gets going.

During our reviews, we closely compared spreads, commissions, overnight swap rates, and even hidden costs like inactivity fees. Some brokers offer zero-commission sugar trading but quietly widen the spread; others boast tight spreads but then hit you with hefty overnight charges.

Top Pick: IC Markets takes the crown here for its ultra-tight spreads and transparent fee structure. When we traded sugar CFDs through IC Markets, the spreads were among the lowest we saw, even during fast-moving sessions. They operate with a true ECN (Electronic Communication Network) model, which means you’re getting institutional-grade pricing with no dealing desk interference.

They also don’t tack on unnecessary commissions for CFD trades on sugar, and overnight financing charges were clearly stated upfront — something we always appreciate. Whether you’re swing trading or day trading sugar, low costs can make a real difference, and IC Markets keeps the playing field fair.

Risk Management Tools: Stay Sharp When Sugar Swings

If you’ve spent any time trading sugar, you know how quickly prices can move, sometimes on nothing more than a weather forecast or surprise export policy from a major producer. That kind of volatility isn’t something to fear, as long as you’re prepared.

We always evaluate what kind of risk management tools a broker offers: stop-loss orders, trailing stops, price alerts, volatility indicators, and — just as importantly — how easy those tools are to set up and adjust on the fly. Some platforms hide these features behind clunky menus or make changes take multiple clicks — not ideal when the market’s moving fast.

Top Pick: CMC Markets delivers when it comes to managing risk in fast-moving commodities like sugar. Their platform gives you intuitive access to all the essentials — stop-loss, take-profit, guaranteed stops, and customizable alerts.

We found their volatility warnings especially useful during high-risk sessions tied to USDA reports or production news from countries like India and Brazil. These real-time alerts helped us stay ahead of the market instead of reacting too late.

One thing we liked during testing: CMC’s risk settings are built into the order ticket. No need to go hunting through settings or open a new screen just to protect your trade — it’s all right there, easy to adjust, even mid-trade.

CMC Markets platform sugar CFD order ticket