Best Soybeans Brokers 2026

Interested in trading soybeans? We’ve put many soybean brokerages under the microscope, combining platform tests with hard data to list the top brokers for trading soybeans in 2026.

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Plus500US, a reputable broker since 2021, is authorized by the CFTC and NFA. It offers futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a quick 10-minute signup, a $100 minimum deposit, and an easy-to-use web platform, Plus500 is enhancing its services for traders in the US. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.0 InstaTrade, located in the British Virgin Islands, is an online broker that focuses on structured fixed income products and active trading via CFDs. Its no-spread accounts, outstanding research primarily from InstaTrade TV, and access to the well-known MT4 and InstaTrade Gear make it a good choice for traders of all levels. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 IC Markets is a renowned forex and CFD broker recognized for its high-quality pricing, extensive range of trading tools, and superior trading technology. Established in 2007 in Australia, it operates under the oversight of ASIC, CySEC, and FSA. It has drawn in over 180,000 traders from across 200 countries.

Key Features: Top Soybean Trading Platforms Compared

We evaluated the top brokers for soybean trading across critical features — see how each one performs where it matters most:

Broker Safety: How Secure Are Your Funds?

Your capital deserves protection. We looked at the safety measures in place across the top brokers in the soybean space:

Best Apps for Soybean Trading on the Go

Need flexibility? We reviewed the top mobile apps that let you monitor and trade soybeans anywhere, anytime:

Best Soybean Brokers for New Traders

Just getting started with soybeans? See how the top brokers stand out for their tools and educational support for beginners:

Advanced Soybean Brokers

Looking for professional-grade tools and execution speed? See how the top brokers cater to experienced soybean traders:

Accounts Comparison

Compare the trading accounts offered by Best Soybeans Brokers 2026.

Our Full Ratings: The Best Soybean Brokers

Dive into our complete ratings — based on expert reviews and hands-on testing:

Fee and Cost Comparison

We broke down spreads and hidden costs to reveal which soybean trading platforms offer the best pricing:

What Are the Most Popular Soybean Trading Brokers?

Looking for tried-and-tested options? These brokers are currently favored by the soybean trading community:

| Broker | Popularity |

|---|---|

| InstaTrade |

|

| Interactive Brokers |

|

| FOREX.com |

|

| IC Markets |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- IBKR, primarily designed for skilled traders, has expanded its appeal recently by eliminating its initial $10,000 deposit requirement.

- The new IBKR Desktop platform combines the advantages of TWS and adds unique tools like Option Lattice and Screeners with MultiSort to make trading accessible and impressive for traders of all levels.

- Interactive Brokers was named Best US Broker for 2025 by DayTrading.com for its dedication to US traders, ultra-low margin rates, and affordable global market access.

Cons

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

Why Trade With Plus500US?

Plus500US is an excellent choice for beginners, offering a user-friendly platform, low trading margins, and access to the Futures Academy to improve trading skills. Its powerful tools and reliable service earned it second place in DayTrading.com's annual 'Best US Broker' award.

Pros

- The account setup, pricing structure, and web platform make futures trading simpler than competitors like NinjaTrader.

- The Futures Academy is a useful resource for beginner traders due to its captivating videos and simple articles. Its unrestricted demo account is also beneficial for practicing trading strategies.

- Plus500US stands out for its low fees, competitive trading margins, and no charges for inactivity, live data, routing, or platform use.

Cons

- The private trading platform is easy to use, but doesn't have the advanced analysis tools that platforms like MetaTrader 4 do.

- Plus500US lacks social trading features, unlike competitors such as eToro US, which might enhance its appeal to aspiring traders.

- Plus500US is expanding its investment options, but it currently only offers around 50+ futures and no stocks.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

Cons

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

- FOREX.com has expanded their trading offerings, but these remain limited to forex and CFDs. Unfortunately, they don't provide options to invest in actual stocks, ETFs, or cryptocurrencies.

Why Trade With InstaTrade?

InstaTrade provides active trading on an extensive platform. It has a unique offering known as Fixed Income Structured Product (FISP), which allows for passive investment. Investors can potentially earn up to a 50% return within 6 months, provided certain conditions are fulfilled.

Pros

- InstaTrade provides approximately 300 assets for investment. It particularly shines in the area of currency pairs, making it an excellent platform for experienced traders interested in volatile exotics.

- VPS hosting is suitable for algorithmic trading strategies. It uses a dedicated server to offer quick execution speeds, potentially as fast as 9 milliseconds.

- InstaTrade promises returns using its structured passive trading solution (FISP), with applications processed within 24 hours.

Cons

- InstaTrade is registered in the British Virgin Islands, providing minimal regulatory protections for retail traders.

- Profits in the FISP are guaranteed only if investors do not make over 50% profit and recruit other users, earning $4 for each dollar in compensation.

- InstaTrade's learning resources are helpful for new traders but are not as organized or comprehensive as those provided by top companies such as eToro.

Why Trade With IC Markets?

IC Markets provides excellent prices, quick execution, and smooth deposits. The utilization of sophisticated charting platforms such as TradingView and the Raw Trader Plus account makes it a preferred choice for intermediate to advanced traders.

Pros

- IC Markets provides some of the smallest spreads in the industry, offering 0.0-pip spreads on major currency pairs. This makes trading particularly cost-efficient for traders.

- IC Markets won DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its top-notch MetaTrader integration, perfected over years to enhance the platform experience.

- You can trade more than 2,250 CFDs in various markets, such as forex, commodities, indices, stocks, bonds, and cryptocurrencies. This range enables varied trading strategies.

Cons

- Despite having four top-tier third-party platforms, there is no in-house software or trading app specifically designed for new traders.

- Some withdrawal methods require fees such as a $20 wire charge. This can reduce profits, particularly for traders who withdraw frequently.

- IC Markets have a selection of metals and cryptos for trading through CFDs, but their range is not as wide as brokers such as eToro. This may limit options for traders who are interested in these asset types.

Filters

How We Chose the Best Top Brokers For Trading Soybeans

To identify the top platforms for soybean trading, we pulled from our proprietary broker database and filtered for those offering futures, CFDs, and other soybean-linked products.

We assessed each broker across 200+ metrics — from charting tools and trade execution to pricing transparency and support quality. Our process blends data with hands-on testing to ensure trustworthy, experience-driven insights.

What To Look For In a Soybean Broker

Not every platform is right for every trader. Based on our in-depth analysis, here’s what to focus on when selecting a broker for trading soybeans:

Best Market Access for Soybean Trading

When you’re trading soybeans, market access is where everything begins. Whether you’re aiming to trade soybean futures on the Chicago Mercantile Exchange (CME) or prefer synthetic products like Exchange-Traded Funds (ETFs) or Contracts for Difference (CFDs), having the right broker makes all the difference.

We’ve tested a wide range of platforms ourselves, and one thing became clear fast: not all brokers are created equal when it comes to commodities like soybeans. Some don’t offer direct access to futures markets, while others only provide limited or hard-to-find exposure through ETFs or CFDs.

If you’re trying to trade efficiently or react quickly to market-moving news like United States Department of Agriculture (USDA) reports, that’s a serious issue.

Top Pick: Our top pick for soybean market access is CMC Markets. When we dug into CMC, we found they go above and beyond in offering multiple ways to gain exposure to soybean prices.

For starters, they offer soybean CFDs that mirror the underlying futures market, giving you real-time price action without the hassle of rolling contracts or managing margin like you would on a traditional futures exchange.

What really impressed us during our tests was how easy it was to find and trade soybean-linked instruments. The CMC platform is clean, intuitive, and designed with commodity traders in mind. You can go from login to trade execution in seconds, with all the charting tools and price data you need — even during high-impact events like USDA crop forecasts or global supply chain shifts.

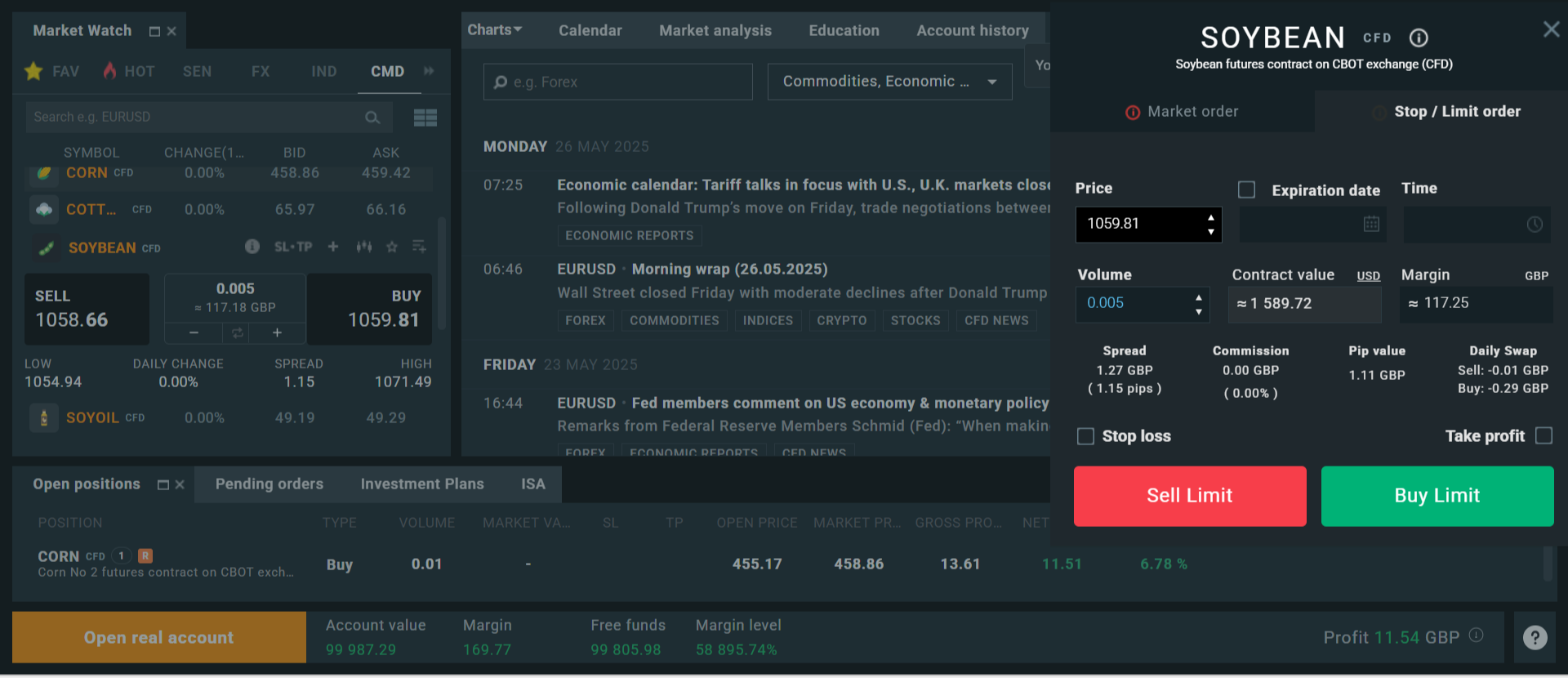

Soybean CFD chart CMC platform

Soybean Market Research and Trading Insights

When trading soybeans, having the right market research and insights can give you a serious edge. Charts and technical patterns don’t move prices; they’re shaped by real-world events: global supply chains, planting and harvesting updates, shifting demand from big importers like China, tariffs, and all the usual geopolitical curveballs that affect top producers like the United States, Brazil, and Argentina.

As part of our hands-on evaluation, we looked closely at which brokers go the extra mile when it comes to commodities research. Some offered generic market commentary — helpful if you’re brand-new to trading, but not nearly enough if you’re serious about tracking supply disruptions, USDA crop reports, or the ripple effects of global policy changes.

Top Pick: XTB stood out to us during testing for a straightforward reason: they talk about soybeans, not just in passing. Their in-house market analysts regularly publish detailed reports that cover everything from agricultural output and demand forecasts to macroeconomic shifts and trade tensions. This content is gold if you like to dig into the “why” behind a price move.

Even better, XTB integrates this research right into their platform and app. You don’t need to bounce between tabs or hunt down third-party sources. You’ll find soybean-specific commentary, real-time updates on global weather conditions, and breakdowns of how things like tariffs or export bans could impact pricing.

XTB chart of soybean market analysis and deal ticket

Execution Speed and Quality

In the world of soybean trading, execution speed and platform reliability aren’t just nice-to-haves — they’re key. Commodities can move fast, especially when there’s breaking macroeconomic news, a surprise USDA report, or unexpected shifts in global inventories. If your broker lags, freezes, or delays your order, you could miss the move or enter at the wrong price.

We’ve tested a range of platforms under various trading conditions, including during busy market hours and high-volatility events. What we found is that not every broker handles the pressure equally. Some platforms start to stutter when volume spikes, while others take a few extra seconds to confirm trades, which is a lifetime when soybeans react to a tariff announcement or a crop yield downgrade.

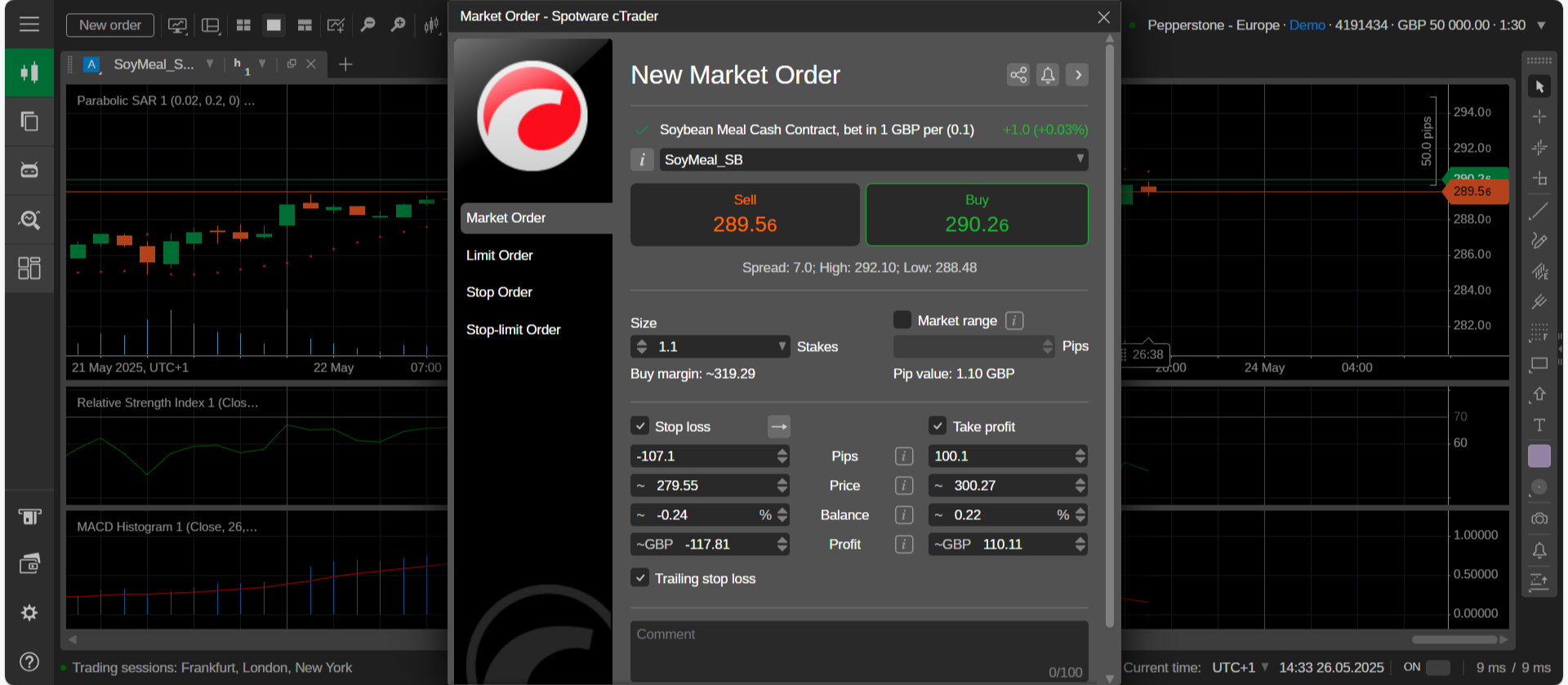

Top Pick: During our testing, Pepperstone consistently delivered lightning-fast execution on commodity CFDs, including soybeans. Whether we were placing market orders or setting tight stop-losses around key levels, the fills were clean on TradingView and cTrader, the slippage minimal, and the execution felt instant, even when markets were volatile.

What also stood out to us was the platform’s overall stability. We ran tests during peak USDA data releases and other high-volume events, and Pepperstone’s cTrader platform held up without a hitch: no crashes, disconnects, or annoying order rejections—just smooth, uninterrupted trading.

cTrader Spotware platform soybean CFD order ticket

Charting Tools and Real-Time Data

If you’re trading soybeans seriously, access to real-time data and pro-level charting tools isn’t optional — it’s the foundation of your trading decisions.

You need live pricing from the Chicago Mercantile Exchange (CME), up-to-date inventory data, and commodity-specific technical indicators that help you track everything from seasonal trends to short-term volatility.

We’ve personally tested all the major brokers in this space to see which platforms give you the data and tools you need to trade soybeans confidently. Some brokers offer delayed feeds unless you pay extra, while others don’t integrate live inventory or fundamental data. That’s a problem when you’re trying to get ahead of market moves, not react to them after the fact.

Top Pick: When we tested IC Markets, we first noticed how clean and fast their charting setup is. They offer direct access to CME-derived pricing on their CFD products, with live updates that don’t lag or refresh slowly. That’s crucial when monitoring key levels or trying to time entries around reports from the United States Department of Agriculture (USDA) or global crop updates.

What stood out during our evaluation was how well their charts support commodity traders specifically. You get all the major technical indicators — moving averages, RSI, MACD, Bollinger Bands — plus drawing tools that make technical analysis intuitive.

We also like that they support external platforms like MetaTrader 5 and cTrader, which are highly customizable if you’re into multi-timeframe analysis or custom scripts.

Margin and Leverage Options

Margin and leverage terms can make or break your strategy when trading soybeans, primarily through futures or Contracts for Difference (CFDs). You want access to competitive leverage that lets you scale your exposure when opportunities arise, without hidden risks or confusing small print.

And transparency matters. We’ve seen brokers advertise attractive leverage levels, only to bury the actual margin requirements deep in the fine print or adjust them without much notice during periods of market volatility.

We tested each broker’s soybean margin setup ourselves, examining how clearly the leverage is explained, how margin levels change under stress, and whether traders have the flexibility to manage risk effectively.

Top Pick: FxPro stood out for offering straightforward, transparent margin terms for soybean CFDs. Their leverage options are clearly outlined up front, and — just as importantly — they don’t change on a whim unless there’s a serious shift in global market conditions.

When trading soybeans through FxPro, we had access to flexible leverage (up to 1:10 for most retail traders, depending on your region and regulatory status), which is well-suited for short-term strategies or hedging larger portfolios.

We also appreciated how easy it was to monitor margin usage in real time. FxPro’s platform gives you a clear breakdown of available margin, margin used, and how close you are to a margin call, which helps when markets get volatile, like during USDA stockpile updates or weather-driven supply shocks.

Trust and Regulation

Regulatory oversight and broker credibility are non-negotiable in any market, especially in commodities like soybeans. You’re putting your capital in someone else’s hands, so you need to be 100% sure the broker is appropriately licensed, financially stable, and known for treating traders fairly. A lack of regulation or a shaky reputation can mean slow withdrawals, poor dispute resolution, or worse.

When we evaluate brokers, this is the first area we investigate. We look at what regulators oversee them, how long they’ve been in the business, and whether they’ve built a name for themselves in the commodity space specifically, not just in forex or equities.

Top Pick: IC Markets is one of the most heavily regulated brokers we’ve tested. It’s licensed by several top-tier authorities, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), and it’s maintained a clean track record over the years of operation. That adds peace of mind, especially when trading leveraged soybean CFDs or holding positions through volatile conditions.

Beyond the paperwork, IC Markets has earned strong credibility with commodity traders. We’ve traded with them across multiple market cycles and always found their execution, account handling, and platform stability to be consistent. Withdrawals are processed smoothly, and client funds are kept in segregated accounts — precisely the protections we want to see.

Trading Fees

Let’s talk about the thing no one wants to pay but everyone has to — trading fees and commissions. In the soybean market, where price movements can be tight and trading margins are often slim, high costs can eat into your profits faster than a crop fungus.

Whether you’re trading futures-linked CFDs or other soybean products, low-cost execution is key. When we reviewed brokers, we didn’t just look at headline spreads. We placed calculated the cost of opening and closing soybean positions.

Top Pick: Pepperstone offers consistently tight spreads on soybean CFDs, especially during peak market hours when liquidity is high. In our testing, we often saw spreads as low as 1–2 points — a big win if you’re scalping or making multiple trades in a day.

Even better, they offer multiple account types, including Razor accounts with raw spreads plus a small commission, which is often more cost-effective than all-in spread models, especially for high-volume traders.

No hidden platform fees, inactivity charges, or surprise swaps are buried in the fine print. Everything is transparent, which makes it easier to calculate your risk-to-reward ratios and stay in control of your bottom line.

Managing Risk

Soybean markets can move fast, sometimes very fast. Whether it’s a surprise USDA report, a weather shock in Brazil, or an export restriction from a major producer, prices can swing hard in either direction.

That’s why solid risk management tools are essential when trading soybeans. We’re talking about features like stop-loss orders, trailing stops, price alerts, and even platform-level volatility warnings that help you stay ahead of sudden shifts.

We’ve personally tested how each broker handles these tools – not just whether they exist but also how easy they are to use, how reliable they are during live market conditions, and how they integrate into your overall trading workflow.

Top Pick: CMC Markets impressed us here. They offer a full suite of risk control tools right out of the box, and they’re built into the trading experience, not hidden away in some settings menu. Placing a stop-loss or take-profit order is intuitive and lightning fast. You can also set guaranteed stop-loss orders on some products, an excellent option in highly volatile conditions where slippage is a concern.

During our tests, we found the price alert system especially useful. You can set custom alerts based on price levels, percentage changes, or technical indicator triggers, and receive notifications across desktop and mobile. That means you’re not glued to your screen 24/7 — you can trade with confidence knowing you’ll be alerted if the market starts moving against you.