Best Corn Brokers 2026

Looking to trade corn? We’ve reviewed, tested, and ranked the top corn brokers for 2026 through hands-on tests and detailed analysis.

-

1Plus500US, a reputable broker since 2021, is authorized by the CFTC and NFA. It offers futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a quick 10-minute signup, a $100 minimum deposit, and an easy-to-use web platform, Plus500 is enhancing its services for traders in the US.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.0 InstaTrade, located in the British Virgin Islands, is an online broker that focuses on structured fixed income products and active trading via CFDs. Its no-spread accounts, outstanding research primarily from InstaTrade TV, and access to the well-known MT4 and InstaTrade Gear make it a good choice for traders of all levels. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 IC Markets is a renowned forex and CFD broker recognized for its high-quality pricing, extensive range of trading tools, and superior trading technology. Established in 2007 in Australia, it operates under the oversight of ASIC, CySEC, and FSA. It has drawn in over 180,000 traders from across 200 countries. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 RoboForex is a registered online broker since 2009 under the IFSC in Belize. Traders can select from five different account types (Prime, ECN, R StocksTrader, ProCent, Pro). These accounts allow trades starting from 0.01 lots and offer spreads beginning from 0 pips. In addition to the original service, RoboForex has expanded its platform by introducing the trading of CFDs and by developing a stock trading platform, including the CopyFX system. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 XM is a global forex and CFD broker with over 15 million clients in more than 190 countries. Since 2009, it has offered low trading fees on over 1000 instruments. The broker is well-regulated by authorities such as ASIC, CySEC, DFSA, and SCA in the UAE, and provides a full MetaTrader experience.

Compare the Best Corn Trading Brokers by Key Features

We examined leading corn trading platforms side-by-side - see how they stack up across core metrics:

How Safe Are the Leading Corn Brokers?

Your capital's security is vital. Here’s how top corn brokers are protecting client funds:

Top Mobile Apps for Corn Trading – Tested

Need to trade while on the move? We reviewed the best-rated corn trading apps so you can stay connected wherever you are:

Are The Best Corn Brokers Good For Beginners?

Just starting out with corn trading? Here's how our top brokers offer intuitive platforms and helpful educational tools for new traders:

Are The Best Corn Brokers Good For Advanced Traders?

Experienced trader? See which platforms offer the speed, depth, and advanced tools professionals dealing in corn expect:

Accounts Comparison

Compare the trading accounts offered by Best Corn Brokers 2026.

Complete Ratings: The Best Corn Trading Brokers

Check out our comprehensive ratings of the top corn brokers, based on firsthand testing and expert insight:

Compare Fees & Spreads Across The Top Corn Brokers

We broke down costs to reveal which corn trading platforms offer the best value for your money:

Which Top Corn Brokers Are Traders Choosing?

Curious where other corn traders are placing their trust? Explore the most popular platforms right now:

| Broker | Popularity |

|---|---|

| XM |

|

| InstaTrade |

|

| RoboForex |

|

| IC Markets |

|

Why Trade With Plus500US?

Plus500US is an excellent choice for beginners, offering a user-friendly platform, low trading margins, and access to the Futures Academy to improve trading skills. Its powerful tools and reliable service earned it second place in DayTrading.com's annual 'Best US Broker' award.

Pros

- The Futures Academy is a useful resource for beginner traders due to its captivating videos and simple articles. Its unrestricted demo account is also beneficial for practicing trading strategies.

- Plus500 is a reputable publicly traded company with over 24 million traders and sponsors the Chicago Bulls.

- The trading app offers an excellent user interface with an updated design, straightforward layout, and charts optimized for mobile use.

Cons

- Testing showed fast response times for support, but phone aid is not available.

- Plus500US lacks social trading features, unlike competitors such as eToro US, which might enhance its appeal to aspiring traders.

- Plus500US offers competitive pricing but does not have a discount program for high-volume traders, unlike brokers like Interactive Brokers.

Why Trade With InstaTrade?

InstaTrade provides active trading on an extensive platform. It has a unique offering known as Fixed Income Structured Product (FISP), which allows for passive investment. Investors can potentially earn up to a 50% return within 6 months, provided certain conditions are fulfilled.

Pros

- VPS hosting is suitable for algorithmic trading strategies. It uses a dedicated server to offer quick execution speeds, potentially as fast as 9 milliseconds.

- InstaTrade promises returns using its structured passive trading solution (FISP), with applications processed within 24 hours.

- InstaTrade provides a high-quality range of charting tools for traders. Its web trader includes over 250 indicators, 11 types of charts and a design that's easy to use.

Cons

- InstaTrade's website and client interfaces are quite complex which can be confusing for new traders. On the other hand, XTB offers a more straightforward and user-friendly trading experience.

- Profits in the FISP are guaranteed only if investors do not make over 50% profit and recruit other users, earning $4 for each dollar in compensation.

- InstaTrade is registered in the British Virgin Islands, providing minimal regulatory protections for retail traders.

Why Trade With IC Markets?

IC Markets provides excellent prices, quick execution, and smooth deposits. The utilization of sophisticated charting platforms such as TradingView and the Raw Trader Plus account makes it a preferred choice for intermediate to advanced traders.

Pros

- IC Markets provides fast and reliable 24/5 support for account and funding issues.

- You can trade more than 2,250 CFDs in various markets, such as forex, commodities, indices, stocks, bonds, and cryptocurrencies. This range enables varied trading strategies.

- IC Markets won DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its top-notch MetaTrader integration, perfected over years to enhance the platform experience.

Cons

- Some withdrawal methods require fees such as a $20 wire charge. This can reduce profits, particularly for traders who withdraw frequently.

- Despite having four top-tier third-party platforms, there is no in-house software or trading app specifically designed for new traders.

- Interest is not earned on unused funds, a feature commonly available at other platforms such as Interactive Brokers.

Why Trade With RoboForex?

RoboForex offers a broad selection of over 12,000 trading markets along with ECN accounts, impressive charting, and loyalty incentives. It is also advantageous for stock traders due to its intuitive R StocksTrader platform, which provides access to over 3,000 shares, lower fees starting at $0.01, and advanced watchlists.

Pros

- RoboForex offers tight spreads starting at 0 pips and low minimum deposits from $10, making it affordable. Trading with micro lots additionally reduces entry barriers for new traders.

- The broker provides two free withdrawals each month in the Free Funds Withdrawal program, assisting traders in reducing transaction expenses.

- RoboForex offers more than 12,000 instruments for trading. This includes forex, stocks, indices, ETFs, commodities, and futures. Comparatively, this surpasses the trading opportunities available from most online brokers.

Cons

- RoboForex provides fair spreads, but some of its account types have high trading commissions up to $20 per lot, which are more expensive compared to more affordable brokers like IC Markets.

- RoboForex offers many account types which, although flexible, can be daunting for new traders to select the most appropriate for their trading preferences. Other platforms like eToro simplify the process with a single retail account option.

- RoboForex, with more than 15 years in the industry, is authorized by the IFSC in Belize, a 'Red-Tier' regulator. This authorization provides a lower level of regulatory protection for traders.

Why Trade With XM?

With a $5 minimum deposit, advanced charting on MT4 and MT5, a growing range of markets, and a Zero account with spreads from 0.0, XM offers what traders need. They have even won our 'Best MT4/MT5 Broker' award recently.

Pros

- XM’s Zero account is ideal for trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, without requotes or rejections.

- In late 2025, XM received a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates, enhancing its regulatory standing and positioning it as a strong choice for traders in the Middle East.

- XM excels in trader education by providing well-organized resources like webinars, tutorials, and live trading sessions via XM Live.

Cons

- The XM app is user-friendly and offers unique copy trading products, but its technical analysis tools need enhancement for advanced traders.

- XM is lagging because it doesn’t offer cTrader and TradingView, which are now preferred over MetaTrader for their better user interface and charting tools.

- XM is generally trusted and well-regulated but is registered with weak regulators such as FSC Belize. It no longer accepts UK clients, limiting its market reach.

Filters

How We Identified the Top Corn Brokers

To create our rankings, we pulled from our extensive broker database to find platforms offering corn trading through futures, CFDs, and other instruments.

Each broker was evaluated using a proprietary scoring system that covers more than 200 data points across eight critical dimensions — including usability, pricing, research tools, and market access.

We didn’t just rely on the data. Our team conducted in-depth testing to see how these platforms perform in trading scenarios, so you get analysis grounded in experience, not just specs.

How to Choose the Right Corn Trading Broker

After analyzing hundreds of platforms, we’ve learned what sets the best corn brokers apart. Here’s what to keep in mind:

Access to Corn Markets: Futures, CFDs, and Getting In Clean

Market access is the first box you need to tick when trading corn. If your broker doesn’t offer direct access to corn futures on the CME (Chicago Mercantile Exchange) or high-quality synthetic alternatives like corn-related ETFs or CFDs, you’re already on the back foot.

We’ve seen many new traders get tripped up here. They jump in with a broker that sounds great on paper, only to find out later they can’t trade corn in any meaningful way – or worse, they’re stuck with clunky workarounds that kill their edge.

That’s why we always test platforms ourselves and pay close attention to how easily and efficiently a broker lets us access core agricultural markets like corn.

Now, not every broker gets this right. Some only offer indirect exposure or bury commodity access behind layers of filters and confusing interfaces. Others have the right assets, but make you jump through hoops to get a trade on. We’re not about that.

Top Pick: After testing all the major players, XTB stood out as our top pick for corn market access. Why? Because they keep things simple and effective. Whether you’re looking to trade corn futures via CME access or dip your toes into the market with corn CFDs, XTB delivers both options through a fast, clean, and intuitive platform.

Plus, they’ve done an excellent job making commodities accessible to retail traders without sacrificing quality. We didn’t hit any walls when testing corn trades, and that’s a big win in a space where barriers are far too common.

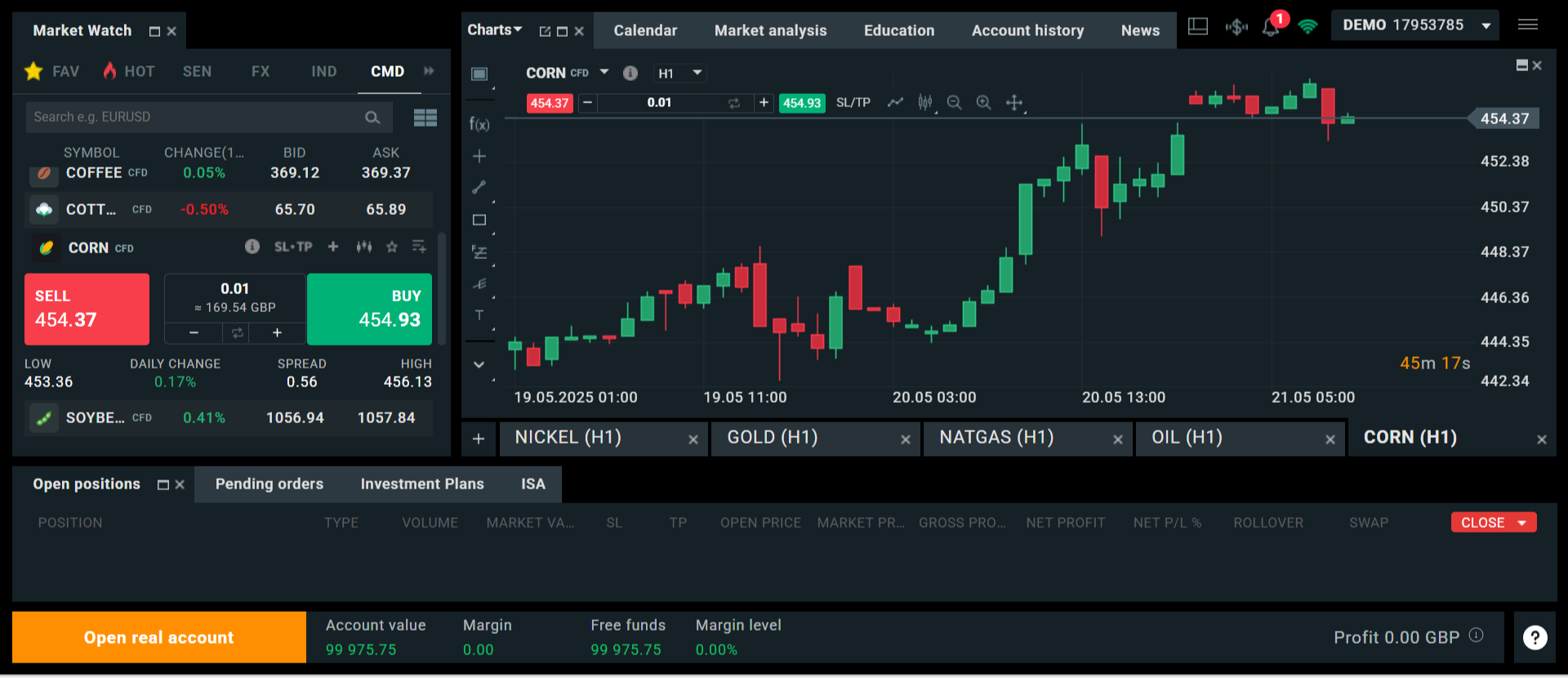

Corn CFD Chart, XTB, xStation Platform

Specific Research and Insights: Go Beyond the Chart

Corn trading isn’t just about reading the chart — you need to understand the story behind the price. That means keeping an eye on supply chains, global farming trends, weather disruptions, and the kind of geopolitical risks that can shake up major producers like the U.S., Brazil, China, and Ukraine.

We’ve found that many brokers fall short here. Sure, most offer some basic market commentary, but it’s often recycled news or generic outlooks. When we’re trading corn, we want insights that help us get ahead, not just filler.

That’s why we personally investigate each broker’s research hub, looking for depth, relevance, and a real agricultural focus. If they don’t discuss planting conditions in Iowa, port congestion in Brazil, or drought forecasts in the Midwest, they’re not helping us trade corn.

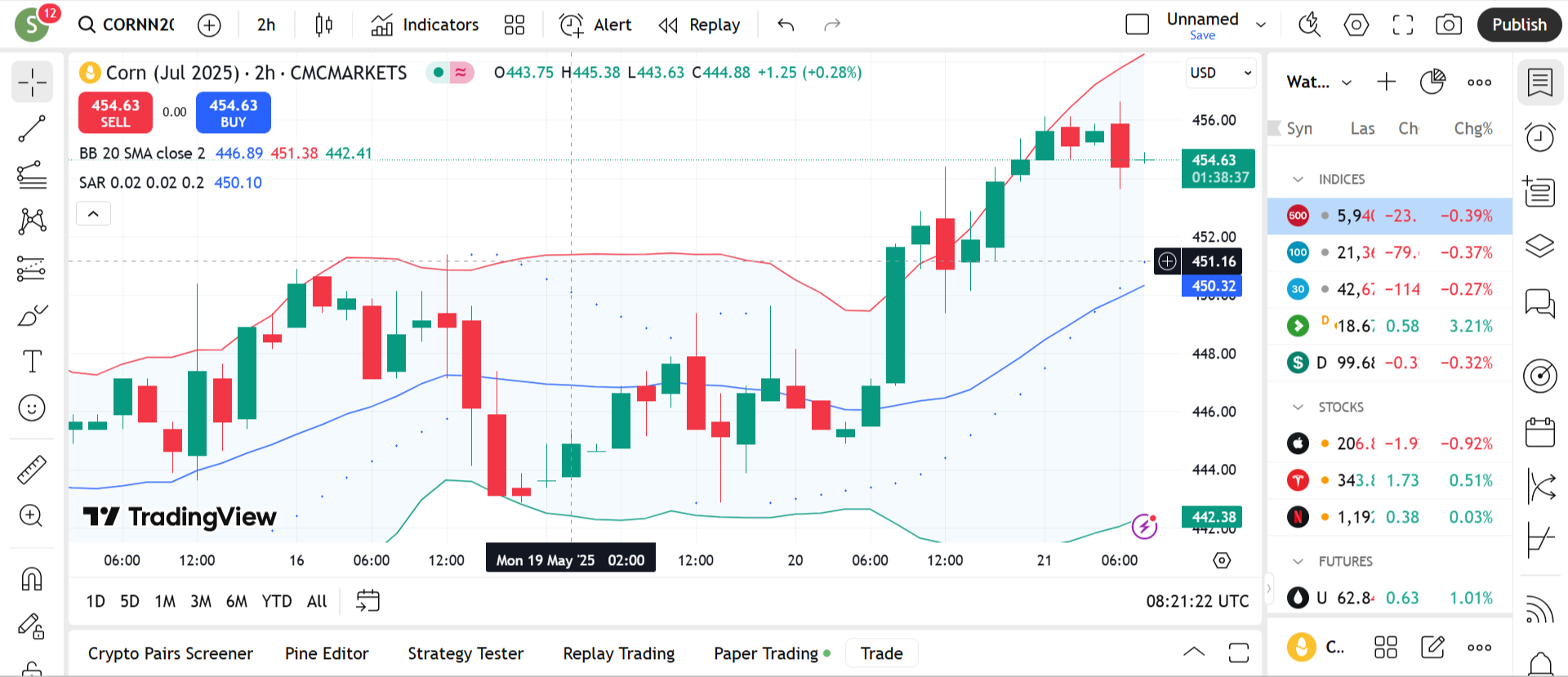

Top Pick: After reviewing all our recommended brokers, Pepperstone impressed us most on the research front. Their commodity coverage, available through a choice of platforms, including TradingView, includes genuinely valuable insights.

While it’s not always corn-specific day in and day out, their macro and weather-related analysis often touches on key crop-producing regions. Plus, they publish frequent updates on global supply chain issues and geopolitical tensions that could affect corn pricing, like grain corridor risks in Ukraine or Chinese import policy shifts.

Their market analysis section is well-organised, easy to digest, and backed by analysts who know commodities. We didn’t have to hunt around or cross-check everything externally to understand the context, and that saves time when you’re trying to move fast on a trade.

CMC Next Gen Platform, Corn CFD

Execution Speed and Reliability: Don’t Get Left Behind in a Corn Spike

Corn may not get the same headlines as oil or gold, but when it moves, it really moves and often happens fast. A surprise USDA report, a weather scare in the Midwest, or a geopolitical flare-up in a key exporter can all trigger sharp price swings in a matter of minutes.

That’s why execution speed and platform stability are deal-breakers for us. We’ve seen it too often — a trader spots a great setup, hits buy, and nothing happens: delayed execution, lag, or even a platform freeze during peak volatility. By the time the trade goes through, the edge is gone — or worse, the loss is locked in.

So we test every platform, considering periods of elevated volatility. We want to see how brokers perform when things get intense, not just on a calm Tuesday afternoon.

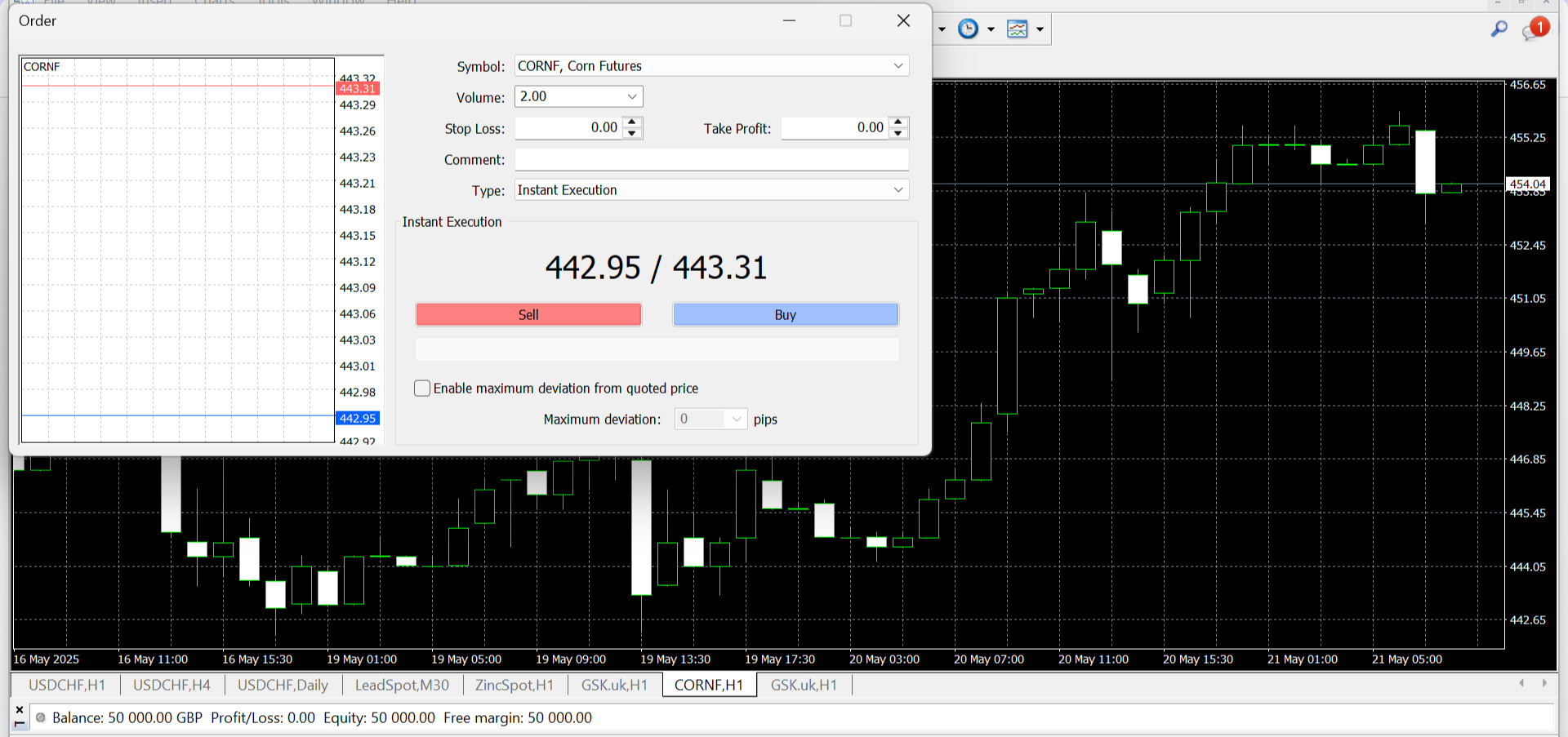

Top Pick: In this area, IC Markets came out ahead. Their execution on MT4, MT5 and cTrader is among the fastest we’ve tested, with low-latency order routing and deep liquidity access, even during significant news events. On our side, trades went through quickly and cleanly, with no noticeable slippage or platform hiccups, even when corn futures were spiking on key data drops.

And that’s not just marketing fluff. We ran trades through during a USDA WASDE release (World Agricultural Supply and Demand Estimate), and the fill speeds were spot on. There were no timeouts, mystery disconnects, or frustrating delays. That kind of reliability is a serious edge for anyone trading short-term setups or scalping moves in the corn market.

Corn Futures, MT4 Platform, ICMarkets

Data Feeds and Charts: See the Full Picture in Real Time

When trading a fast-moving market like corn, laggy data or clunky charts can be an absolute liability. You need real-time pricing, access to live inventory reports, and charting tools built with commodities in mind, not just generic indicators slapped onto a basic price graph.

We’ve tested brokers where the charting feels like an afterthought – slow to load, lacking key overlays, or just plain hard to use. While that might be fine for long-term stock traders, it’s nowhere near good enough for someone trying to trade corn around seasonal trends, storage data, or supply shocks.

That’s why we spend a lot of time digging into the quality of data feeds and the flexibility of charting platforms. We want to see tools that let us pull up historical yield trends, overlay futures curves, and zoom in on the price action without jumping to five different platforms.

Top Pick: FxPro offered the best blend of real-time data and professional-grade charting of all the brokers we looked at. Their platform includes live commodity pricing, economic calendar integration, and many customizable indicators tailored for futures and CFD trading. We especially like how you can directly overlay market events, like inventory reports or weather alerts, onto the charts.

It’s also worth noting that FXPro provides access to MetaTrader and cTrader, which offer clean, responsive charting environments. That gives traders room to grow, whether you’re doing simple trendline analysis or building out a complete technical model with custom indicators.

Margin and Leverage Options: Power When You Need It

Corn trading isn’t always a game of small moves. Whether you’re trading futures or CFDs, having access to competitive, transparent leverage can make all the difference when a big opportunity shows up.

But leverage cuts both ways — and you don’t want surprises when it comes to margin terms.

We’ve tested plenty of brokers that talk a big game about leverage, but bury the actual margin requirements in fine print or hit you with sudden changes when the market heats up. That’s a huge red flag, especially in a market like corn where seasonal volatility and report-driven price spikes are part of the landscape.

That’s why we personally evaluate how brokers handle leverage and margin on commodity trades, keeping in mind flexibility and risk transparency.

Top Pick: After testing the leading contenders, IC Trading stood out. They offer clear, consistent leverage options across their commodity lineup, including corn CFDs, with no shady margin adjustments mid-trade. Their platform spells out your exposure up front, and margin calls are predictable, not sudden or arbitrary.

That clarity matters, especially if you’re trading actively or scaling in and out of positions. With IC Trading, you know exactly where you stand, giving you more confidence to act when the market moves.

Regulatory Oversight and Broker Credibility

We don’t mess around when it comes to broker trust. If you’re going to trade corn – or any volatile commodity – your broker needs to be fully regulated and have a proven track record in commodity markets.

There’s too much risk with an offshore operation or a flashy new platform that hasn’t stood the test of time.

So we dig deep into regulatory licenses, reputation, years in operation, and how brokers handle commodity flows specifically. We’re not just looking for any regulated entity – we want brokers with real experience in agricultural trading, not just forex.

Top Pick: FxPro ticks all the right boxes here. It’s regulated by top-tier authorities, including the FCA and CySEC, and it’s been in the game for over a decade. But more importantly, it’s built a name for itself in commodities and metals, not just currencies.

We’ve traded corn and other softs with them ourselves, and never ran into any concerns about execution, account safety, or shady back-end behavior. That consistency is precisely what we want when putting capital to work in fast-moving commodity markets.

Fees and Commissions: Keep Your Edge, Don’t Pay It Away

In corn trading, margins can be tight, especially if running shorter-term strategies or trading around fundamental news. That’s why keeping your trading costs low is a non-negotiable.

Spreads, commissions, and hidden fees can quietly eat into your profits — or even flip a good trade into a loser.

We’ve traded corn across several platforms and made it a point to track fees and compare real-world spreads, not just the advertised “from 0.0 pips” promises. Some brokers look competitive on the surface, but once you’re live, those tight spreads mysteriously widen, especially when volatility hits.

Top Pick: Pepperstone consistently delivered the best value in our tests. Their spreads on corn CFDs were reliably low, even during higher-volatility sessions. On top of that, they don’t hit you with unnecessary add-on fees, and they’re fully transparent about what you’re paying per trade.

They offer commission-based and spread-only account types, which give you flexibility depending on your trade preferences. If you’re scalping corn or managing tight risk-reward ratios, that cost structure difference can matter over time.

Risk Management Tools: Stay in Control When Corn Gets Wild

Corn might seem like a calm, slow mover to the untrained eye, but if you’ve traded it during a surprise USDA report or drought update, you already know — volatility can hit hard and fast.

That’s why having the correct risk management tools for trading is just as important as having the right trade idea.

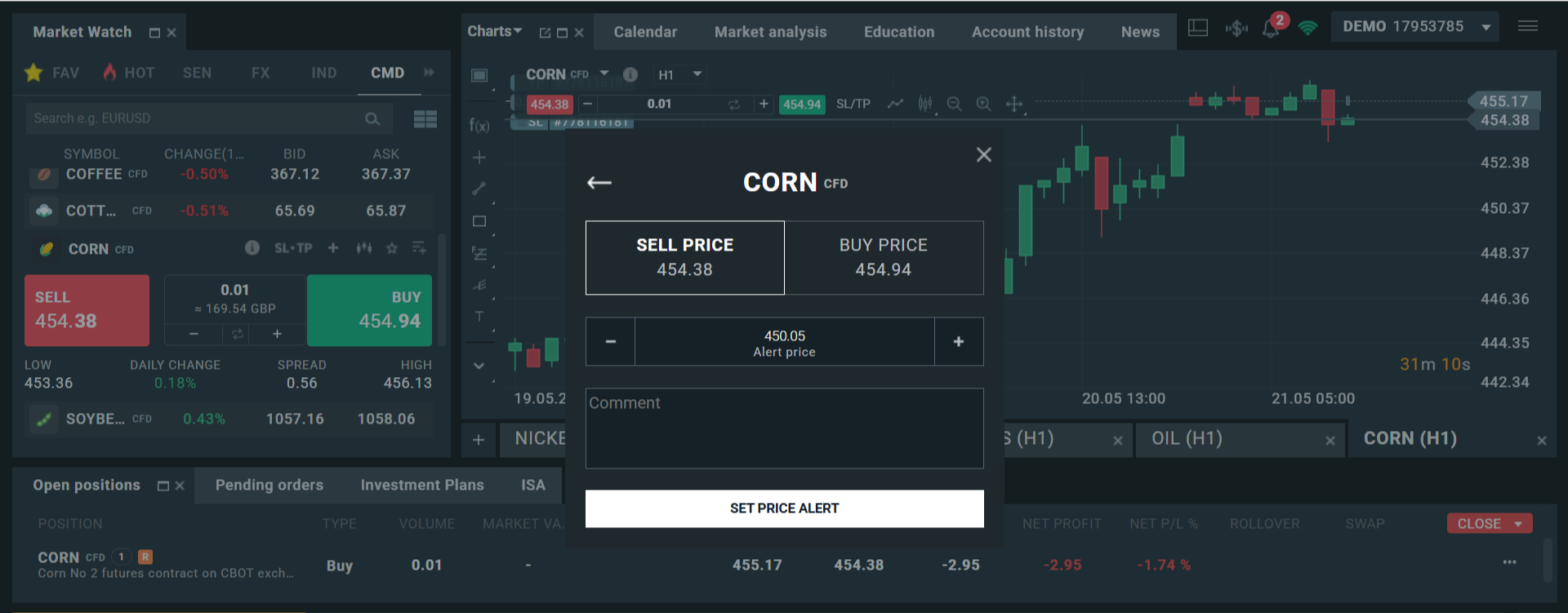

We test for simple but essential features like stop-loss and take-profit settings, but we also look for extras like price alerts, margin warnings, and even volatility notifications that can help keep us one step ahead when the market shifts.

Top Pick: XTB delivered in this department. Their platform gives you tight control over order risk, lets you set up custom price alerts, and includes built-in risk calculators that update in real time based on trade size and leverage. That’s especially helpful when managing exposure on leveraged corn CFDs — a place where things can unravel quickly without proper stops in place.

Even better, their interface makes all these tools easy to use — no digging around in menus or wasting precious seconds during a fast-moving session.

XTB, xStation Platform, Corn CFD