Best Coffee Brokers 2026

Explore our ranking of the best coffee brokers, curated through hands-on testing and in-depth analysis by industry experts and seasoned traders.

-

1Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 IC Markets is a renowned forex and CFD broker recognized for its high-quality pricing, extensive range of trading tools, and superior trading technology. Established in 2007 in Australia, it operates under the oversight of ASIC, CySEC, and FSA. It has drawn in over 180,000 traders from across 200 countries. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 RoboForex is a registered online broker since 2009 under the IFSC in Belize. Traders can select from five different account types (Prime, ECN, R StocksTrader, ProCent, Pro). These accounts allow trades starting from 0.01 lots and offer spreads beginning from 0 pips. In addition to the original service, RoboForex has expanded its platform by introducing the trading of CFDs and by developing a stock trading platform, including the CopyFX system. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 XM is a global forex and CFD broker with over 15 million clients in more than 190 countries. Since 2009, it has offered low trading fees on over 1000 instruments. The broker is well-regulated by authorities such as ASIC, CySEC, DFSA, and SCA in the UAE, and provides a full MetaTrader experience. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.9 Founded in 2006, AvaTrade is a top forex and CFD broker trusted by over 400,000 traders. Regulated in 9 regions, it handles more than 2 million trades monthly. AvaTrade offers platforms like MT4, MT5, and WebTrader, with over 1,250 instruments. Traders of all levels can explore CFDs, AvaOptions, and AvaFutures for short-term trading. AvaTrade provides excellent education and 24/5 multilingual customer support for a complete trading experience.

Best Coffee Brokers Comparison

Safety Comparison

Compare how safe the Best Coffee Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Coffee Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Coffee Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Coffee Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Coffee Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Coffee Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Coffee Brokers 2026.

Broker Popularity

See how popular the Best Coffee Brokers [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| XM |

|

| RoboForex |

|

| FOREX.com |

|

| AvaTrade |

|

| IC Markets |

|

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

Cons

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

Why Trade With IC Markets?

IC Markets provides excellent prices, quick execution, and smooth deposits. The utilization of sophisticated charting platforms such as TradingView and the Raw Trader Plus account makes it a preferred choice for intermediate to advanced traders.

Pros

- IC Markets provides some of the smallest spreads in the industry, offering 0.0-pip spreads on major currency pairs. This makes trading particularly cost-efficient for traders.

- IC Markets, a well-regulated and respected broker, emphasizes client security and transparency for a trustworthy global trading experience.

- IC Markets provides fast and reliable 24/5 support for account and funding issues.

Cons

- The range and quality of educational materials, such as tutorials and webinars, require improvement. This lag falls behind competitors like CMC Markets and reduces its suitability for novice traders.

- Despite having four top-tier third-party platforms, there is no in-house software or trading app specifically designed for new traders.

- Interest is not earned on unused funds, a feature commonly available at other platforms such as Interactive Brokers.

Why Trade With RoboForex?

RoboForex offers a broad selection of over 12,000 trading markets along with ECN accounts, impressive charting, and loyalty incentives. It is also advantageous for stock traders due to its intuitive R StocksTrader platform, which provides access to over 3,000 shares, lower fees starting at $0.01, and advanced watchlists.

Pros

- RoboForex offers tight spreads starting at 0 pips and low minimum deposits from $10, making it affordable. Trading with micro lots additionally reduces entry barriers for new traders.

- The broker provides two free withdrawals each month in the Free Funds Withdrawal program, assisting traders in reducing transaction expenses.

- The R Stocks Trader platform competes with top platforms like MT4, offering netting and hedging abilities, thorough backtesting, Level II pricing, and a versatile workspace.

Cons

- RoboForex, with more than 15 years in the industry, is authorized by the IFSC in Belize, a 'Red-Tier' regulator. This authorization provides a lower level of regulatory protection for traders.

- RoboForex provides fair spreads, but some of its account types have high trading commissions up to $20 per lot, which are more expensive compared to more affordable brokers like IC Markets.

- RoboForex offers many account types which, although flexible, can be daunting for new traders to select the most appropriate for their trading preferences. Other platforms like eToro simplify the process with a single retail account option.

Why Trade With XM?

With a $5 minimum deposit, advanced charting on MT4 and MT5, a growing range of markets, and a Zero account with spreads from 0.0, XM offers what traders need. They have even won our 'Best MT4/MT5 Broker' award recently.

Pros

- In late 2025, XM received a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates, enhancing its regulatory standing and positioning it as a strong choice for traders in the Middle East.

- XM offers over 1,000 instruments, giving traders various short-term opportunities, including turbo stocks, fractional shares, and thematic indices.

- XM excels in trader education by providing well-organized resources like webinars, tutorials, and live trading sessions via XM Live.

Cons

- XM only uses the MetaTrader platforms for desktop trading, offering no in-house downloadable or web-based solutions with unique features for beginners.

- XM is generally trusted and well-regulated but is registered with weak regulators such as FSC Belize. It no longer accepts UK clients, limiting its market reach.

- The XM app is user-friendly and offers unique copy trading products, but its technical analysis tools need enhancement for advanced traders.

Why Trade With AvaTrade?

AvaTrade provides traders with essential tools: an intuitive WebTrader, strong AvaProtect risk management, a quick 5-minute sign-up, and reliable support for fast-paced markets.

Pros

- The WebTrader performed well in our tests, featuring an easy-to-use interface for beginners and strong charting tools, including 6 chart layouts and over 60 technical indicators.

- AvaTrade's support team did well in tests, responding within 3 minutes and providing local support in major regions like the UK, Europe, and the Middle East.

- Years later, AvaTrade is still among the few brokers with a custom risk management tool, AvaProtect, which insures losses up to $1M for a fee and is simple to use on the platform.

Cons

- While the deposit process is smooth, AvaTrade doesn't support crypto payments, unlike TopFX, which caters to crypto-focused traders.

- Signing up is easy, but AvaTrade doesn't offer an ECN account like Pepperstone or IC Markets, which provides raw spreads and fast execution that many traders want.

- The AvaSocial app is satisfactory but could be better. Its design, usability, and navigation between strategy providers and account management need improvement to compete with top platforms like eToro.

Filters

How We Chose the Best Coffee Brokers

To determine the best brokers for trading coffee, we assigned overall ratings and ranked platforms accordingly.

Here’s how we evaluated each provider:

- Data-Driven Analysis – We assessed over 200 key factors across multiple categories, including available coffee instruments, spreads, and leverage access.

- Hands-On Testing – Beyond the data, we personally tested each broker’s platform to evaluate trading tools and overall user experience. We also looked for unique features such as market insights and bespoke risk management tools.

What to Look for in a Top Coffee Trading Broker

Choosing the right broker is like picking the perfect coffee bean – quality matters. A good broker can make your trading experience smooth and profitable, while a bad one can leave a bitter taste.

Here’s a checklist of what to look for:

Regulation and Security

- Why It Matters: You want a broker that’s trustworthy and operates within legal frameworks.

- What to Look For:

For example, IG is one of the largest and most trusted coffee brokers globally, regulated by respected bodies like the FCA (UK) and BaFin (Germany). You can trade CFDs on coffee futures, making it accessible for beginners, with competitive spreads and no commission on CFD trades.

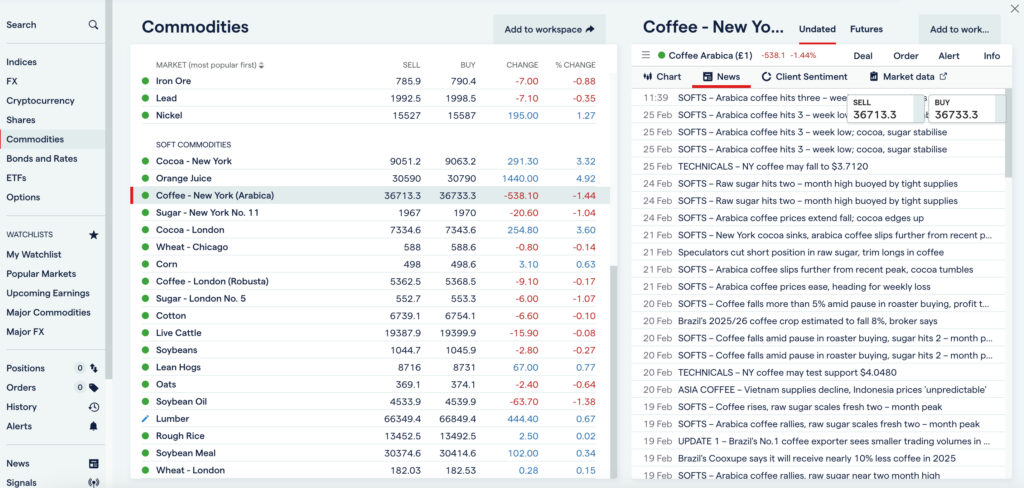

IG offers an intuitive platform for trading coffee, complete with integrated news and market sentiment

Trading Platform and Tools

- Why It Matters: A user-friendly platform with the right tools can make or break your trading experience.

- What to Look For:

- Intuitive interface for beginners.

- Advanced charting tools and technical indicators for experienced traders.

- Mobile trading app for on-the-go access.

For example, CMC Markets stood out during testing with its next-generation trading platform with customizable charts and over 115 technical indicators, allowing you to track coffee trends with precision.

Fees and Commissions

- Why It Matters: High fees can eat into your profits, especially if you’re trading coffee frequently.

- What to Look For:

- Low spreads (the difference between buying and selling prices of coffee).

- Transparent fee structure with no hidden charges.

- Competitive commission rates for coffee trading.

For example, XTB offers CFDs on coffee futures with competitive pricing, featuring spreads from 0.25. You can trade the soft commodity between 10:15 am – 7:30 pm.

Leverage and Margin Requirements

- Why It Matters: Leverage can amplify your gains, but it also increases risk.

- What to Look For:

- Flexible leverage options.

- Precise margin requirements to avoid unexpected surprises.

For example, City Index offers coffee CFDs with transparent leverage up to 1:10, or a 10% margin requirement. Following enhancements to its Performance Analytics, it can now offer greater insights into the success of your coffee trading strategies.

Educational Resources and Support

- Why It Matters: Learning resources and customer support are crucial for beginners.

- What to Look For:

- Tutorials, webinars, and guides on coffee trading.

- Responsive customer support (24/7 availability is a plus).

For example, CMC Markets offers excellent education, notably its ‘Complete guide to coffee trading‘, which goes into more depth than the resources at many competitors, including potential opportunities in coffee-related stocks.

Execution Speed and Reliability

- Why It Matters: In fast-moving markets like coffee, delays can cost you money.

- What to Look For:

- Fast order execution with minimal slippage.

- Reliable platform uptime with no crashes during peak trading hours.

For example, Pepperstone trumps most of the coffee brokers we’ve assessed with low latency servers near key financial centers facilitating execution speeds of sub 30 milliseconds on trades.

Demo Accounts

- Why It Matters: A demo account lets you practice trading coffee without risking real money.

- What to Look For:

- Free demo account with realistic trading conditions.

- Access to all features available in the live account.

Over 90% of the coffee brokers we’ve evaluated offer a free demo account so you can refine coffee trading systems.

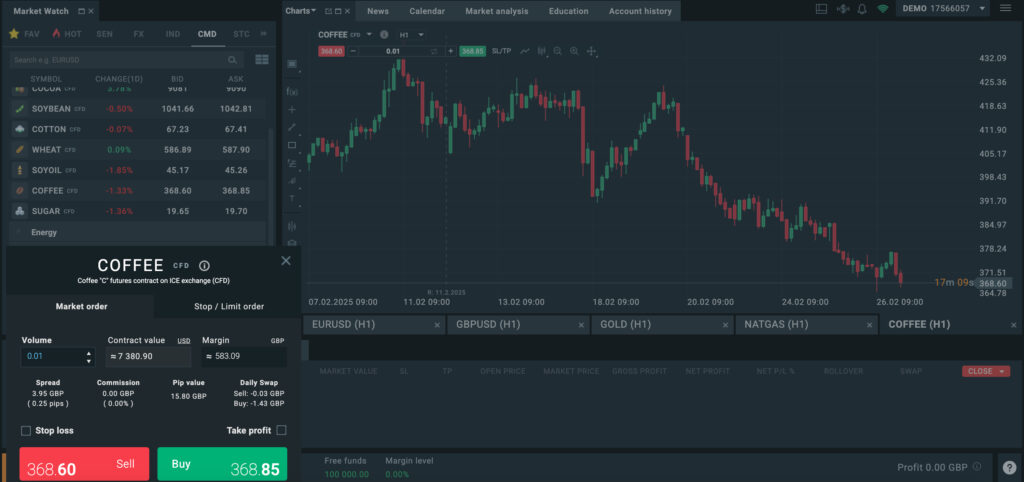

XTB has an easy-access demo account where you can chart and trade coffee

How to Trade Coffee with the Best Brokers

So, you’ve picked a broker that ticks all the boxes – now what?

Step 1: Understand the Coffee Market

Before diving in, it’s essential to know what drives coffee prices. Here are the key factors:

- Weather Conditions: Droughts, frost, or excessive rain in major coffee-producing regions (like Brazil or Vietnam) can impact supply.

- Global Demand: Changes in consumption patterns, especially in emerging markets, can affect prices.

- Political and Economic Factors: Trade policies, currency fluctuations, and geopolitical events can influence the market.

- Seasonality: Coffee prices often follow seasonal patterns, with harvest cycles affecting supply.

Step 2: Choose Your Trading Instrument

Coffee can be traded in different ways, depending on your broker and trading style. Here are the most common options:

- Futures Contracts: Agreements to buy or sell coffee at a predetermined price and date. Ideal for experienced traders.

- CFDs (Contracts for Difference): Allow you to speculate on price movements without owning the physical commodity. Great for beginners.

- ETFs (Exchange-Traded Funds): Invest in a basket of assets tied to coffee prices—a more passive approach.

Step 3: Open and Fund Your Trading Account

- Sign up with your chosen broker and complete the verification process.

- Deposit funds into your account. If you’re a beginner, start small— you can always add more later.

- Familiarize yourself with the trading platform using a demo account if available.

Step 4: Analyze the Market

Use a combination of fundamental and technical analysis to make informed decisions:

- Fundamental Analysis: Focus on supply and demand factors, weather reports, and global economic trends.

- Technical Analysis: Use charts, indicators, and patterns to predict price movements. Common tools include:

- Moving Averages

- RSI (Relative Strength Index)

- Support and Resistance Levels

Step 5: Place Your Trade

- Decide whether to go long (buy) if you expect coffee prices to rise or go short (sell) if you expect prices to fall.

- Set your position size based on your risk tolerance. Never risk more than you can afford to lose.

- Use stop-loss and take-profit orders to manage risk and lock in profits.

Pro tip: Begin with a small investment to get a feel for the coffee market.

Step 6: Monitor and Adjust

- Keep an eye on your coffee trade and stay updated on supply and demand, weather and crop harvest news.

- Be prepared to adjust your strategy if market conditions change.

- Don’t let emotions drive your decisions—stick to your trading plan.

Step 7: Close Your Trade and Review

- Close your trade when your target is met or if the market moves against you.

- Review your performance: What worked? What didn’t? Use this insight to improve your next trade.

FAQ

How is Coffee Traded?

Coffee is one of the most widely consumed beverages in the world, making it a highly traded commodity.

It’s primarily traded in two forms:

- Arabica: The premium, high-quality bean used in speciality coffees.

- Robusta: A stronger, more bitter bean often used in instant coffee and espresso blends.

Coffee is traded on major commodity exchanges like the Intercontinental Exchange (ICE) and the New York Mercantile Exchange (NYMEX).

Why Trade Coffee?

Here’s why coffee trading might be worth your attention:

- Diversification: Coffee adds variety to your portfolio, reducing reliance on traditional assets like stocks and bonds.

- Volatility: Coffee prices can swing due to weather, political instability, or supply chain issues, creating opportunities for profit.

- Global Demand: Coffee is a staple in many cultures, ensuring consistent demand.

What Are the Risks of Trading Coffee?

- Price Fluctuations: Coffee prices can be unpredictable due to factors like droughts, pests, or geopolitical events.

- Leverage Risks: Trading on margin can amplify both gains and losses.

- Market Complexity: Commodity trading like coffee can be more complex than traditional stock trading, so it’s essential to educate yourself.