Best Cattle Brokers 2026

We’ve researched, tested, and ranked the top cattle brokers for 2026, using hands-on tests and expert-driven evaluations.

-

1Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 is a leading multi-asset platform offering trading in thousands of CFDs, stocks, and cryptoassets. Established in 2007, it has millions of active global traders and is regulated by top authorities like the FCA and CySEC. It is well-known for its social trading platform. Crypto trading is provided through eToro USA LLC. Investments are subject to market risk, including potential loss of principal. CFDs are not available in the US. Crypto investments carry risk and may not be suitable for retail investors, with a possibility of losing your entire investment. Understand the risks here. 61% of retail CFD accounts lose money. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 Founded in 2002 in Poland, XTB now serves over 1 million clients. This forex and CFD broker offers a regulated trading environment with a wide range of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with excellent tools for aspiring traders. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.1 Plus500, founded in 2008 and based in Israel, is a leading brokerage with more than 25 million registered traders across 50+ countries. The company specializes in CFD trading, provides a user-friendly platform and mobile app, and offers competitive spreads. It does not impose commission, deposit, or withdrawal fees. Plus500 holds the trust of its traders by being licensed by well-known regulators such as FCA, ASIC, and CySEC.

Compare The Best Brokers For Trading Cattle Across Key Features

How Safe Are The Top Cattle Trading Brokers?

Compare how safe the Best Cattle Brokers 2026 are.

Top Mobile Apps For Cattle Trading – Reviewed

Want to manage trades on the go? We tested the best mobile platforms for fast, reliable cattle trading from anywhere:

Are These Cattle Brokers Good For Beginners?

Just getting started with cattle trading? These platforms offer the tools and support ideal for new traders:

Do These Brokers Meet the Needs of Pro Cattle Traders?

Experienced trader? See how these brokers deliver fast execution, deep markets, and advanced features for professionals:

Accounts Comparison

Compare the trading accounts offered by Best Cattle Brokers 2026.

Full Ratings: Best Brokers For Cattle Trading

Explore our expert ratings of top cattle brokers, based on comprehensive testing:

Fees & Spreads Breakdown

We analyzed costs and spreads to show you which cattle brokers offer the best value for money:

Which Cattle Trading Brokers Are Most Popular?

Curious which brokers are attracting the most cattle traders? These platforms are leading the pack in user adoption:

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

Cons

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

- The funding options are not as extensive as those of top competitors such as IC Markets and lack several widely-used e-wallets, particularly UnionPay and POLi.

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

Why Trade With eToro?

eToro's social trading platform ranks highly due to its excellent user experience and active community chat, useful for beginners seeking trading opportunities. The platform also offers competitive fees on a vast selection of CFDs and actual stocks, alongside beneficial rewards for skilled strategy contributors.

Pros

- The web platform and mobile app receive higher user reviews and app rankings than leading competitors, including AvaTrade.

- eToro launched automated crypto staking for easy passive income, except for Ethereum, which requires opt-in.

- The broker offers excellent services for beginners, including commission-free stock trading, a low minimum deposit, and an unlimited demo account.

Cons

- Contact options are limited, except for the in-platform live chat.

- There are no guaranteed stop-loss orders, which would be a helpful risk management feature for beginners.

- The absence of extra charting platforms like MT4 may reduce the appeal for experienced traders used to third-party software.

Why Trade With XTB?

XTB is an excellent option for new traders due to its xStation platform, low trading costs, no minimum deposit, and outstanding educational tools, many of which are integrated into the platform.

Pros

- The xStation platform stands out with its easy-to-use interface and intuitive features. These include personalized news feeds, sentiment heat maps, and a trading calculator, making it simpler for new traders.

- XTB has increased the interest rate on uninvested funds and offers zero-fee ISAs (on ETFs and real shares, or 0.2% for transactions over €100k) for UK clients, providing access to a wide range of markets.

- XTB provides an extensive set of educational resources such as training videos and articles on its platform, making it suitable for traders of all skill levels.

Cons

- XTB does not provide a raw spread account. This is often given by competitors such as Pepperstone. This can be of disadvantage to traders searching for the narrowest spreads.

- The inability to modify the default leverage on XTB products is disappointing. Manual adjustment can greatly reduce trading risks, especially in forex and CFD trading.

- The demo account ends in four weeks. This is a limit for traders wanting to fully explore the xStation platform and try out strategies before using actual money.

Why Trade With Plus500?

Plus500 provides a streamlined experience for traders through a modern and dynamic CFD trading platform. However, its research tools are limited, it charges higher fees compared to some brokers, and its educational resources can be improved.

Pros

- Plus500 recently expanded its trading products. This includes offering VIX options with increased volatility and extended trading hours for 7 stock CFDs.

- Plus500 offers a WebTrader platform specifically made for CFD trading. It presents a neat and straightforward interface.

- The broker provides low-commission trading across various markets, reducing extra fees and attracting experienced traders.

Cons

- Compared to competitors like IG, Plus500's research and analysis tools are somewhat limited.

- The absence of MetaTrader or cTrader charting tools in Plus500 might deter experienced traders who value familiarity.

- The lack of educational resources adds a challenge for new traders, unlike top-tier brokers like eToro that offer extensive learning materials.

Filters

How We Chose the Top Cattle Brokers

To build our rankings, we focused on brokers that provide reliable access to live cattle and feeder cattle markets through CFDs, futures, or other instruments.

Each platform was scored using our proprietary rating system based on 200+ data points, including trading costs, platform tools, speed, charting features, and cattle-specific market access.

But we didn’t just analyze features – we tested every broker, placing trades to evaluate how each one performs.

How To Choose The Best Broker For Cattle Trading

After reviewing dozens of platforms, we know what separates an average cattle broker from a great one. Here’s what matters most:

Market Access: Why It Matters and Who Does It Best

Market access is one of the first boxes you’ll want to tick when trading cattle, whether you’re eyeing futures on live cattle or feeder cattle contracts. It’s no good having all the trading knowledge in the world if your broker doesn’t give you a clean, reliable pipeline into the markets where cattle actually trade.

We’ve seen it time and again: traders get set up with a broker only to find out they can’t access the CME Group‘s cattle futures, or they’re limited to obscure synthetic products that don’t track the real market with much accuracy. That’s a frustrating way to start, and it’s something we’ve specifically tested ourselves when reviewing brokers.

You’ll also want to be clear on what you’re trading. Your options will narrow if you’re after direct futures access on the CME, Chicago Mercantile Exchange (the main venue for cattle contracts).

Some brokers only offer exposure through ETFs, CFDs, or other synthetic instruments, which can work for short-term speculation but aren’t ideal if you’re looking for authentic price discovery or proper hedging. Who gets this right?

Top Pick: Pepperstone stands out from the crowd when it comes to cattle market access. While they don’t offer direct futures contracts, they provide competitive CFD exposure on cattle with strong execution and tight spreads, primarily through the cTrader-Spotware platform.

We particularly like that Pepperstone ties its pricing to real-time futures data, giving you exposure that’s as close to the real deal as possible without needing a complete CME account or going through a clearing firm. That’s huge if you want to move fast, stay flexible, and feel connected to the cattle market.

cTrader Platform, Cattle CFD, Pepperstone

Cattle-Specific Research and Insights: The Edge Smart Traders Look For

If you’re serious about trading cattle, you can’t rely on generic market news and hope for the best. This is a niche corner of the commodities world, and having access to cattle-specific research and insights separates informed decisions from guesses.

The best brokers in this space offer in-depth commodities research, and we’re not just talking about basic price summaries. You want insights into global supply chains, seasonal farming activity, feed costs, and weather disruptions. Throw in geopolitical factors that can affect major beef producers like the U.S., Brazil, Australia, and Argentina, and suddenly you’re seeing the complete picture.

We’ve spent time digging into what brokers deliver here, and here’s the truth: not many go deep enough on cattle. Many lump livestock into a general commodities overview and call it a day. That might work if you’re trading oil or gold, but it won’t cut it for cattle, where a dry season in Queensland or a trade ban in South America can move markets overnight.

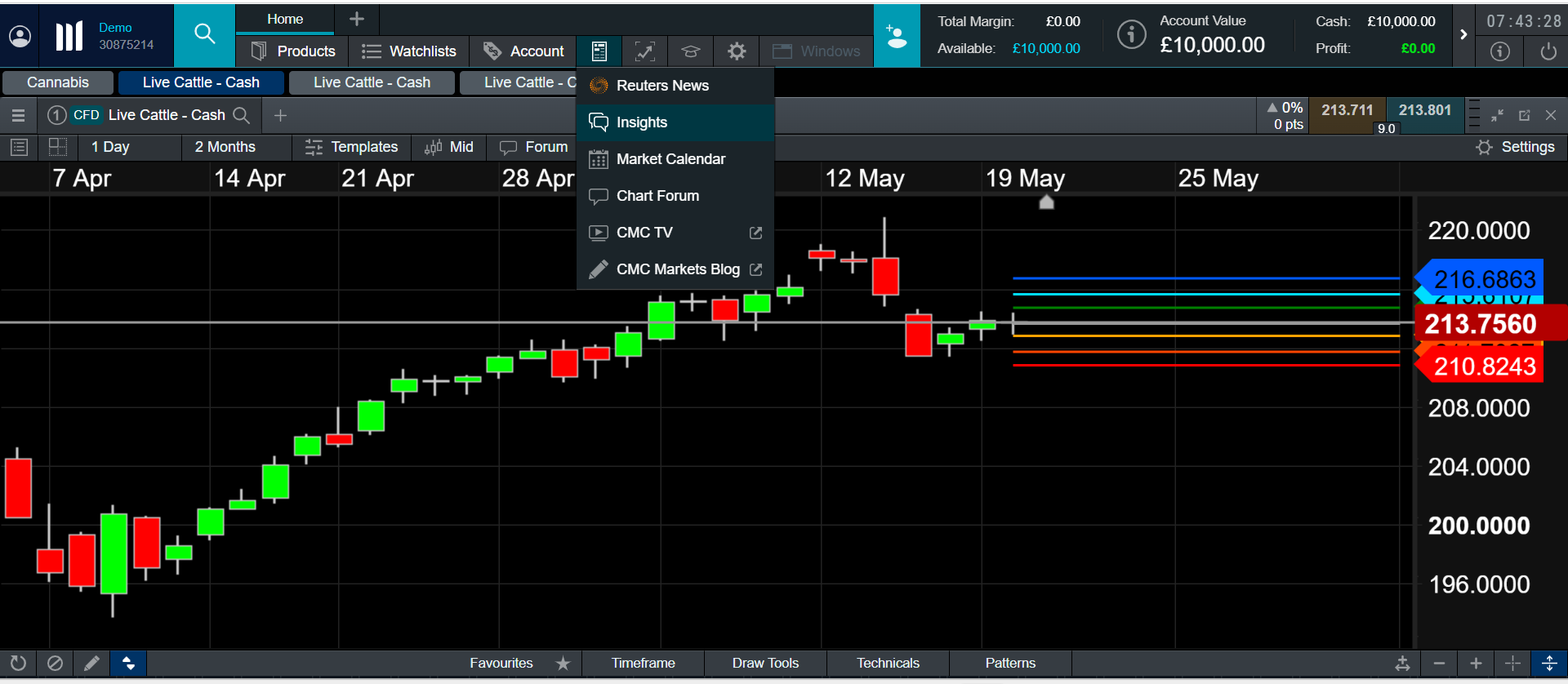

Top Pick: One broker that does a particularly solid job here is CMC Markets. While they’re known for their wide asset coverage, we’ve found their commodity research team punches above its weight in agricultural markets.

With a direct link to Reuters news for full account holders, their Next Gen platform features regular updates on livestock fundamentals, including supply and demand shifts, export data, and broader macroeconomic trends affecting the meat and dairy industries.

We’ve followed their Insights section during times of volatility, like drought concerns in the Midwest or changes in U.S. export policies. We found the commentary not only timely but genuinely helpful for positioning trades.

CMC Next Gen Platform, Cattle CFD Chart

Execution Speed and Reliability: Don’t Let Slippage Eat Your Profits

In the world of cattle trading, execution speed and platform reliability aren’t just nice-to-haves – they’re essential. Cattle markets can be surprisingly volatile, especially when macroeconomic data drops, USDA inventory reports hit the wires, or geopolitical tensions impact exports from key producers. If your broker lags during these moments, you’ll struggle.

We’ve stress-tested many platforms, placing cattle trades during high-impact news events to see how they hold up. The key thing we’ve learned? Milliseconds matter. Even a slight delay in execution can mean the difference between locking in the price quoted or suffering frustrating slippage.

And it’s not just speed, it’s stability. You’re entirely exposed if your broker’s platform crashes, freezes, or locks up just as cattle prices spike on a supply shock out of the U.S. or Brazil. So, reliability has to go hand-in-hand with speed.

Top Pick: Out of all the brokers we reviewed, XTB impressed us most in this department. Their proprietary xStation platform offers exceptionally fast execution, especially on their CFD products tied to cattle and agricultural commodities. During our testing, trades were filled instantly, even during volatile periods around USDA reports and inflation data.

What stood out to us was the consistency. We didn’t experience any noticeable downtime, lag, or re-quotes. Plus, their web-based xStation platform is user-friendly and rock-solid, even when market volumes are surging.

Data Feeds and Charts: Your Window Into the Real Cattle Market

When you’re trading cattle, data is your edge. If your broker can’t give you real-time pricing from the CME (where cattle futures actually trade), you’re flying blind. And if their charts are clunky or missing key technical indicators, good luck spotting the setups you need to act on.

We’ve tested plenty of platforms and trust us; there’s a massive gap between brokers when it comes to data quality and charting. Some only offer delayed prices or simplified charts that are more suited to beginner forex traders. That might work for basic trades, but not if you’re serious about cattle.

Here’s what you should demand:

- Live CME cattle futures pricing (not delayed by 10 or 15 minutes)

- Access to inventory reports and fundamental data feeds

- Professional-grade charting tools with commodity-specific overlays like seasonality, moving averages, and volume indicators

- Ideally, integration with technical analysis tools for backtesting and strategy refinement

Top Pick: After testing side by side, the broker that stood out most in this category was FOREX.com. Their platform offers real-time data feeds linked directly to the underlying cattle market, and their charting software is among the most robust we’ve used, especially for commodity traders.

You’ll find a full suite of customizable indicators, from RSI and MACD to more commodity-focused tools like Bollinger Bands with volatility overlays that reflect real-world supply shocks and inventory cycles.

We also appreciated the depth of historical data available. FOREX.com’s platform made it easy to go back years and pinpoint meaningful price action when we were analysing price patterns around past drought cycles or U.S. inventory reports.

Margin and Leverage Options: Know the Rules Before You Load Up

If you’re trading cattle futures or CFDs, margin and leverage can be your best friend – or your fastest route to a blown account. That’s why it’s critical to work with a broker that offers competitive leverage and keeps the margin terms clear and transparent. No hidden clauses. No vague margin call policies buried in fine print.

We’ve reviewed the small print ourselves and tested the live margin behaviour under trading conditions, and we can say with confidence that not all cattle brokers are created equal here. What were the key things we looked for?

- Flexible leverage depending on account type and experience

- Clear communication about initial and maintenance margin levels

- Fair stop-out policies (we’ve seen brokers pull the plug at 50% margin while others give you more room to manage a position). And critically, transparency – no surprises when markets spike or liquidity reductions

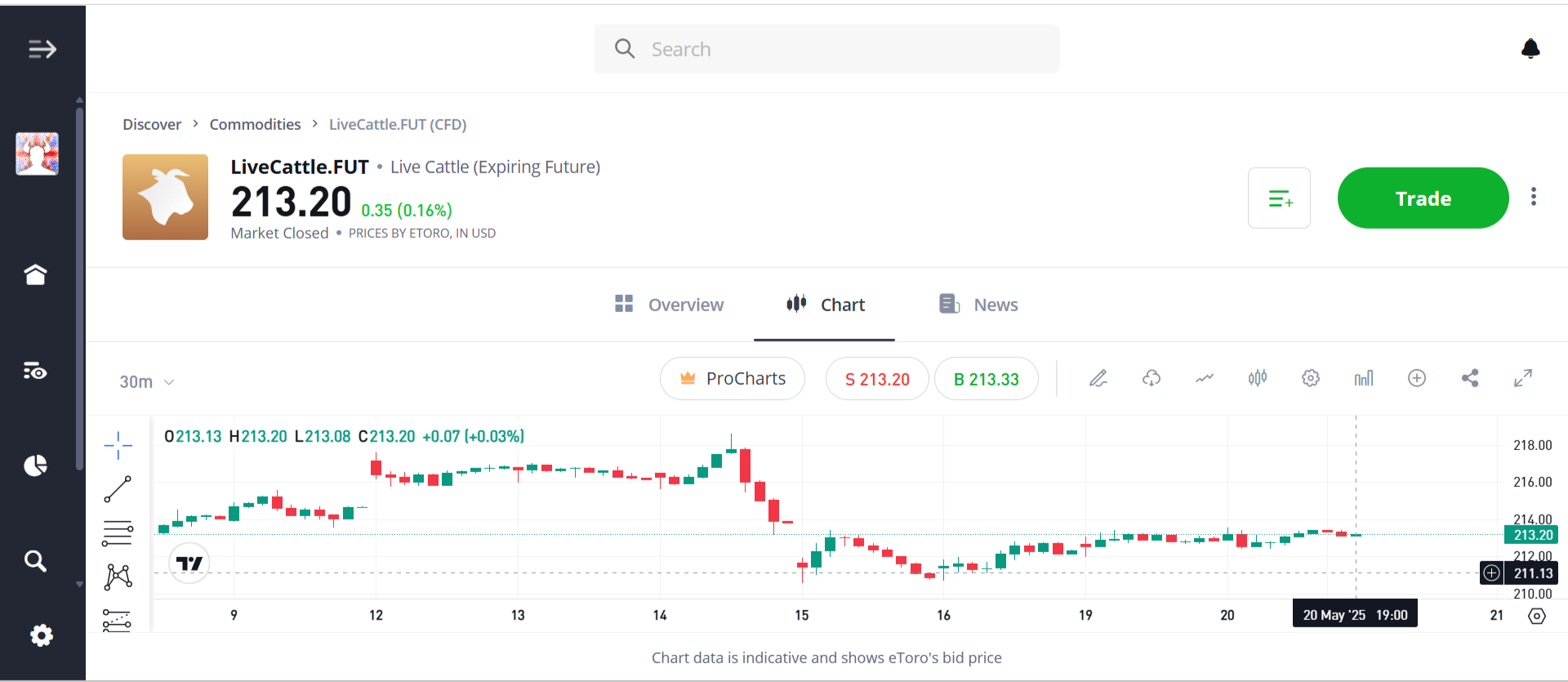

Top Pick: Among the brokers we tested, eToro offered one of the cleanest, most user-friendly margin setups for retail cattle traders. While they don’t provide traditional futures contracts, their CFD platform includes leveraged exposure to agricultural commodities, with clear margin requirements displayed upfront before you place a trade.

What we like about eToro is how approachable it makes margin trading, even for those still getting comfortable with leverage. During our own test runs, we were able to adjust position sizes easily, monitor margin use in real time, and manage risk with stop-loss and take-profit tools that work seamlessly on leveraged trades.

Cattle Futures Chart, eToro

Regulatory Oversight and Broker Credibility: Don’t Gamble

Let’s be blunt: cattle trading isn’t the place to take chances with some offshore, no-name broker. When you’re putting real money into a volatile commodity, you want to know that your broker is fully regulated, has a solid reputation, and has a proven track record.

We’ve been in this space long enough to know how fast things can go south when a broker lacks proper oversight. We’ve seen brokers go dark, delay withdrawals, or even mess with execution during market spikes.

That’s why we primarily test and recommend brokers that are regulated by top-tier authorities like the FCA (UK), ASIC (Australia), or CFTC/NFA (U.S.).

Top Pick: Of the names we looked at, Pepperstone excels in this area. They’re regulated across multiple major jurisdictions – including the UK, Australia, and the EU – and they’ve built a strong reputation over the years as a trustworthy, professional broker. More importantly, they’ve leaned into the commodities space with purpose, offering a range of agriculture-linked instruments, including cattle.

When we dug into Pepperstone’s history, we liked what we found: no significant scandals, consistently positive user reviews, and responsive support. We’ve even stress-tested their customer service ourselves – fast replies, helpful answers, no pushy sales nonsense.

Fees and Commissions: Don’t Let Costs Eat Your Trade Alive

Cattle trades can have tight profit margins, especially if you’re working short-term or scalping moves around supply reports. That makes low fees and competitive spreads absolutely crucial. One or two extra pips might not matter much in a stock trade, but in commodities? It adds up fast.

We’ve carefully compared the fee structures, spread consistency, and commission models across all the brokers in this space. We’ve also examined how costs hold up during quiet and volatile trading sessions. We also factored in swap/rollover fees for those holding cattle positions overnight – something many traders overlook.

Top Pick: One broker that impressed us here was XTB. They offer tight spreads on agricultural CFDs, including cattle, and do it all without layering on commissions for standard accounts. During our testing, we regularly saw low-latency executions with consistent pricing, even around market open and close, prime time for unexpected cost spikes.

Plus, XTB’s fee structure is incredibly transparent. We didn’t have to dig around to figure out what we’d pay on a cattle trade – it’s all laid out clearly in their platform and product sheets.

Risk Management Tools: Your Safety Net in a Wild Market

Cattle markets aren’t always calm. Prices can swing hard and fast – whether it’s a surprise USDA inventory report, weather hitting feed crops, or sudden shifts in global demand. That’s why having the right risk management tools built into your broker’s platform isn’t optional – it’s critical.

We’ve seen firsthand how fast things can unravel in a live cattle trade. One missed stop-loss or delayed alert, and suddenly you’re staring at a drawdown that could’ve easily been avoided. That’s why, when we test brokers, we spotlight what they offer in terms of real-time risk control. So what should you be looking for? Customizable stop-loss and take-profit settings (preferably with trailing options)

- Instant price alerts via desktop or mobile

- Volatility warnings before placing trades

- Easy-to-read margin monitoring and real-time P&L tracking

- And ideally, the ability to pre-set risk levels per trade or portfolio-wide

Top Pick: After putting the main platforms through their paces, CMC Markets came out ahead in this category. Their platform offers a full suite of professional-grade risk tools, from basic stop-losses to advanced order types that let you dial in exactly how much exposure you’re comfortable with.

We especially like the volatility alerts, which trigger when the underlying cattle market moves outside of normal bounds, and standard price alerts. That kind of heads-up can give you precious seconds to rethink an entry – or tighten your stop – before things move too far.

The risk tools worked flawlessly when we tested their system in volatile market conditions (including one exceptionally sharp swing driven by Australian export news). We were alerted, positions protected, and the platform stayed rock-solid.