Best National Futures Association (NFA) Regulated Brokers 2026

We’ve personally tested and ranked the top brokers regulated by the US National Futures Association (NFA), ensuring high standards of trust and reliability.

-

1NinjaTrader is a US-based brokerage regulated for trading futures. It offers three different pricing plans for varied needs and budgets, along with extremely low margins on popular contracts. The company's renowned charting software and trading platform provides extensive customization options and excellent technical analysis features.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Plus500US, a reputable broker since 2021, is authorized by the CFTC and NFA. It offers futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a quick 10-minute signup, a $100 minimum deposit, and an easy-to-use web platform, Plus500 is enhancing its services for traders in the US. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 OANDA is a well-known broker that excels in quick trade executions, a low deposit requirement, and impressive charting and trading platform functions. The highly-regarded brand has over 25 years of expertise and is overseen by reliable authorities like the NFA/CFTC. It provides 24/7 support for traders and offers flexible contract sizes with automated trade executions. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms.

Compare the Best NFA-Regulated Brokers

Safety Comparison

Compare how safe the Best National Futures Association (NFA) Regulated Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best National Futures Association (NFA) Regulated Brokers 2026.

Comparison for Beginners

Compare how suitable the Best National Futures Association (NFA) Regulated Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best National Futures Association (NFA) Regulated Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best National Futures Association (NFA) Regulated Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best National Futures Association (NFA) Regulated Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best National Futures Association (NFA) Regulated Brokers 2026.

Broker Popularity

See how popular the Best National Futures Association (NFA) Regulated Brokers [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| NinjaTrader |

|

| FOREX.com |

|

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- Low costs, with $50 trading margins and commissions starting at $.09 per micro contract.

- Traders can access a free platform and trade simulation capabilities with the unlimited demo.

- You can access thousands of applications and add-ons from developers worldwide for trading.

Cons

- Some payment methods require a withdrawal fee.

- The advanced trading tools require an additional fee.

- You need to register with partner brokers to trade in securities other than forex and futures.

Why Trade With Plus500US?

Plus500US is an excellent choice for beginners, offering a user-friendly platform, low trading margins, and access to the Futures Academy to improve trading skills. Its powerful tools and reliable service earned it second place in DayTrading.com's annual 'Best US Broker' award.

Pros

- The account setup, pricing structure, and web platform make futures trading simpler than competitors like NinjaTrader.

- Plus500US stands out for its low fees, competitive trading margins, and no charges for inactivity, live data, routing, or platform use.

- The Futures Academy is a useful resource for beginner traders due to its captivating videos and simple articles. Its unrestricted demo account is also beneficial for practicing trading strategies.

Cons

- Testing showed fast response times for support, but phone aid is not available.

- Plus500US lacks social trading features, unlike competitors such as eToro US, which might enhance its appeal to aspiring traders.

- The private trading platform is easy to use, but doesn't have the advanced analysis tools that platforms like MetaTrader 4 do.

Why Trade With OANDA US?

OANDA is a reputable broker for US traders. It offers user-friendly tools for analysis and a simple sign-up process. It is very trustworthy due to heavy regulation.

Pros

- There's a robust selection of 68 currency pairs for committed forex traders focusing on short-term trades.

- The broker's API provides access to extensive historical data from the past 25 years and rates from over 200 currencies for traders.

- You can start trading as a beginner with no minimum initial deposit required.

Cons

- Customer support is not accessible during weekends.

- The trading markets are limited to only forex and cryptocurrencies.

- Few payment options are available and e-wallets are not supported.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

Cons

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

Filters

How BrokerListings.com Selected the Top NFA-Regulated Brokers

To identify the most reputable brokers regulated by the NFA (National Futures Association), BrokerListings.com followed a structured process:

- Regulatory Verification: We confirmed each broker’s registration and standing through the NFA’s BASIC database, indicating compliance with U.S. financial laws and the association’s strict standards on client fund protection, transparency, and ethical conduct.

- Comprehensive Broker Analysis: Using our in-house scoring system, we examined more than 200 factors for every NFA-regulated broker, assessing execution quality, spreads and fees, available platforms, trading tools, and customer support.

- Testing: Our team opened and used trading accounts to evaluate each broker. This hands-on testing helped us verify that strong NFA regulation is matched by reliability and a user experience that meets the expectations of active traders.

What Is The NFA?

The National Futures Association (NFA) is one of multiple organizations in the US charged with regulating and overseeing the country’s financial services sector and markets.

Set up in 1982, the NFA’s role is “to safeguard the integrity of the derivatives markets, protect investors and ensure members meet their regulatory responsibilities,” its website says.

It is a self-regulatory organization that operates under the supervision of the Commodity Futures Trading Commission (CFTC). This is the federal body responsible for the broader regulation of US derivatives markets and products including futures, options and swaps.

The NFA has been classified as a Category A regulator under BrokerListings.com’s broker regulator rating system. This means traders and investors can expect an excellent level of protection from fraudulent activity and unfair business practices.

What Powers Does NFA Have?

To offer derivatives trading in the US, brokerages need to apply for NFA membership and agree to ongoing supervision. Companies that fall short of the regulator’s standards – as set out by the NFA Rulebook – can be subject to a range of enforcement actions.

The NFA has over 2,800 member firms including futures commission merchants, introducing brokers, swap dealers, and commodity trading advisors.

The regulator monitors its members’ activities and conduct through regular audits, data submissions and compliance reviews. If the NFA suspects rule breaches, its Compliance Department has the authority “to compel testimony, subpoena documents and require statements under oath from any member, associate or person connected therewith,” according to its website.

Some of the measures the NFA can impose on members include:

- Removal or suspension for a specified period from the NFA database.

- Prohibition or suspension for a specified period from contact with an NFA member.

- Censure or reprimand.

- Financial penalty (up to a maximum of $500,000 per rules violation).

- Order to cease and desist.

In May 2025, the NFA slapped a $600,000 financial penalty on US brokerage, OANDA, for a series of rule breaches, including:

- “failing to maintain adequate net capital by not collecting required security deposits on forex transactions with an affiliate counterparty.”

- “failing to collect the correct security deposits from customers for certain currency transactions.”

- “failing to observe high standards of commercial honor and just and equitable principles of trade” due to a pricing display issue that impacted some forex customers.

- “using deficient promotional material to advertise its partnership with a cryptocurrency broker.”

OANDA was also required to pay restitution of $428,592.26 to clients affected by the pricing display issue. The broker neither admitted nor denied the allegations under the settlement offer.

What Rules Must A NFA Broker Follow?

The NFA Rulebook provides in detail the obligations that the organization’s members must adhere to. These include:

- Seeking the best possible result for the client based on factors like price, speed of execution, liquidity, volatility, size of trade and type of transaction.

- Ensuring that promotional material is fair and not misleading. This includes making sure that advertisements do not deceive the public or contain incorrect information, nor discuss potential profit without affording equal weight to possible losses.

- Providing customers with a full list of fees and charges for the product or service discussed.

- Maintaining adequate personnel and facilities for the delivery of client orders and reporting of trades.

- Introducing robust online security measures that protect the reliability and confidentiality of client information and market orders.

- Making sure that customers can still use the broker’s services if the online platform fails, which may include allowing clients to place orders over the telephone.

- Dealing with complaints in a prompt and efficient manner.

- Establishing procedures that prevent customers placing trades that create excessive risk for the firm and for other clients.

- Supervising all employees and agents in all aspects of their futures operations.

- Devising and implementing policies, procedures and systems that prevent it being used for money laundering or the financing of terrorism.

- Adhering to NFA compliance requirements, and co-operating fully and promptly with any investigations and regulatory orders.

How Can I Check If A Brokerage Is NFA Regulated?

Individuals can swiftly and simply check the NFA status of a company or individual with BASIC (Background Affiliation Status Information Center), the regulator’s online database.

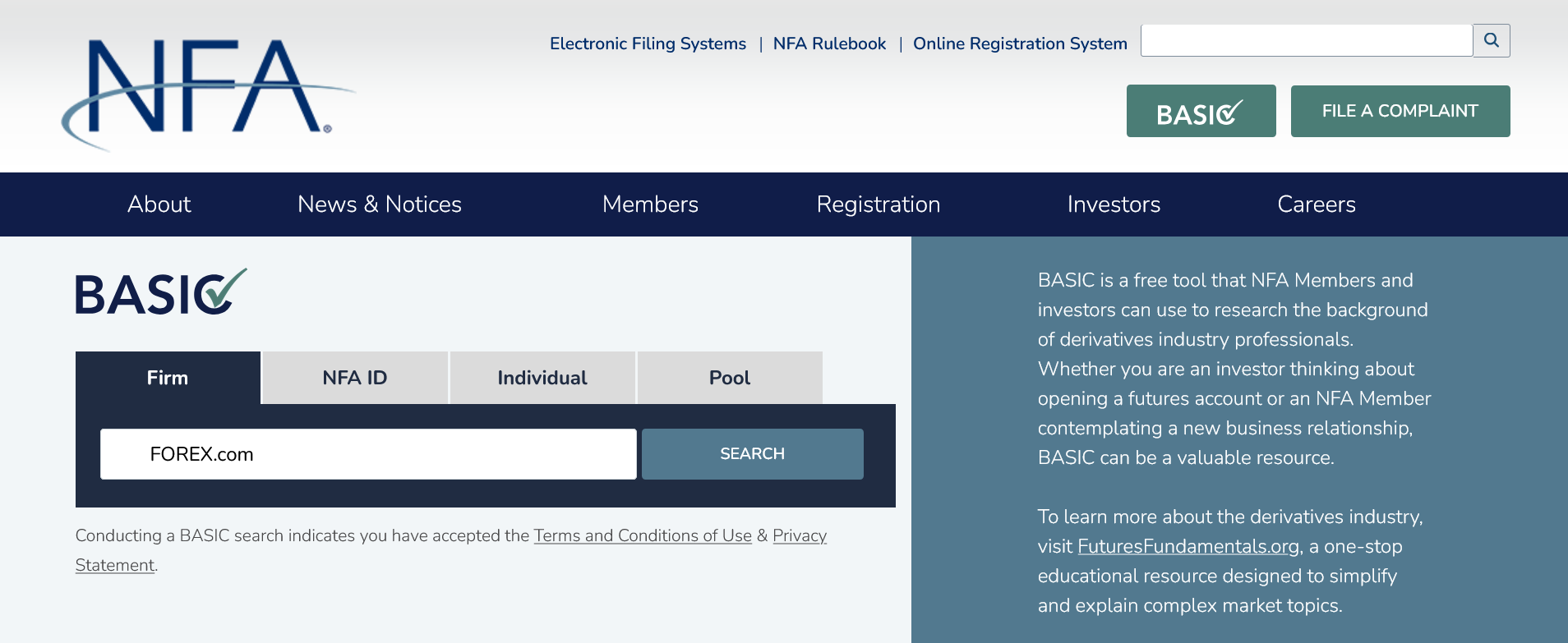

Let’s say I wish to check whether FOREX.com is authorized to trade in the US derivatives market. I bring up the database, type the company’s name into the search box under the ‘Firm’ tab, and hit ‘Search.’

Typing FOREX.com into the NFA’s BASIC database

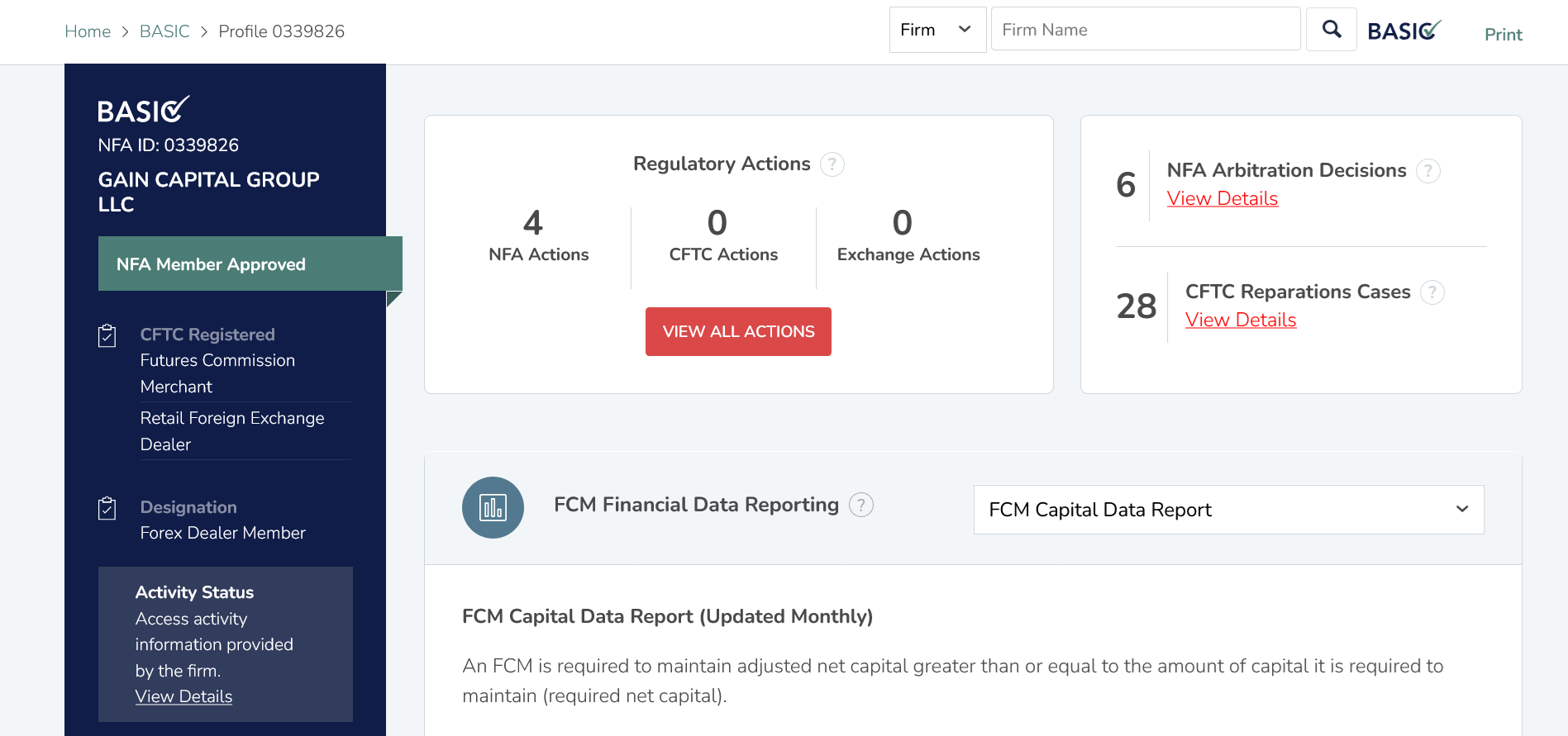

My search shows that FOREX.com is ‘NFA Member Approved,’ so I click on the profile to discover more information about it.

Here I can see details such as the activities the broker is authorized to provide; its address and telephone number; past regulatory action taken against it; and its capital reserves.

FOREX.com’s listing on the BASIC database. Source: NFA

The NFA’s Information Center can help individuals try to locate a firm or individual if they cannot find it on the BASIC database.

The center can be contacted by telephone on 312-781-1410 or 800-621-3570. It can also be e-mailed at information@nfa.futures.org.

Pro tip: Individuals who trade in the US can save themselves from costly currency conversion fees by using a USD trading account. Most NFA-authorized firms we’ve tested offer this.

Bottom Line

Individuals can trade with confidence by choosing a brokerage with NFA membership. Companies that operate under the regulator’s supervision must offer a high level of service, and put in place systems to protect client funds and provide the best possible trading results.

It’s important to remember, however, that investors aren’t completely insulated from bad business practices. The NFA will carry out enforcement action on brokers it deems to have broken its rules and regulations, and can seek restitution for affected customers.

Article Sources

National Futures Association (NFA)

Rulebook Table of Contents – NFA

Membership and Directories – NFA

OANDA Settles Alleged Violations of NFA Requirements – OANDA

BASIC (Background Affiliation Status Information Center) – NFA