Best Orange Juice Brokers 2026

Looking to trade orange juice? We’ve researched, tested, and ranked the best orange juice brokers for 2026 through hands-on evaluations and in-depth comparisons.

-

1Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.0 InstaTrade, located in the British Virgin Islands, is an online broker that focuses on structured fixed income products and active trading via CFDs. Its no-spread accounts, outstanding research primarily from InstaTrade TV, and access to the well-known MT4 and InstaTrade Gear make it a good choice for traders of all levels. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 IC Markets is a renowned forex and CFD broker recognized for its high-quality pricing, extensive range of trading tools, and superior trading technology. Established in 2007 in Australia, it operates under the oversight of ASIC, CySEC, and FSA. It has drawn in over 180,000 traders from across 200 countries. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.2 IC Trading, a component of the larger IC Markets group, is designed for high-level traders. It offers favorable spreads, dependable order execution, and sophisticated trading instruments. However, it's registered in Mauritius, an offshore financial center with limited regulation, which allows it to provide high leverage. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 Pepperstone, established in Australia in 2010, is a highly-regarded forex and CFD broker serving more than 400,000 international clients. It provides access to over 1,300 instruments through leading trading platforms such as MT4, MT5, cTrader, and TradingView, while keeping fees relatively low and transparent. The company is regulated by known authorities including FCA, ASIC, and CySEC, offering a safe trading environment for all.

Compare the Best Orange Juice Trading Brokers by Key Features

How Secure Are Today’s Leading Orange Juice Brokers?

Protecting your funds is non-negotiable. Here’s how the top brokers ensure safety for orange juice traders:

Best Mobile Apps for Orange Juice Trading – Tested

On the go? We tested the highest-rated orange juice trading apps to keep you connected to the market anytime:

Are The Top Orange Juice Brokers Beginner-Friendly?

Just starting out in orange juice trading? See which brokers make it easy with simple tools and solid education:

Are The Top Orange Juice Brokers Built for Advanced Traders?

Experienced trader? Discover which platforms offer the speed, tools, and execution capabilities serious orange juice traders demand:

Accounts Comparison

Compare the trading accounts offered by Best Orange Juice Brokers 2026.

Detailed Ratings: Top Orange Juice Trading Brokers

Explore our expert ratings for the leading orange juice brokers — backed by real-world testing:

Compare Fees & Spreads Across Orange Juice Brokers

We analyzed costs in detail to help you find the orange juice trading platforms that offer the most value:

Which Orange Juice Brokers Are Traders Favoring?

Wondering which platforms orange juice traders trust the most? Discover the most popular choices right now:

| Broker | Popularity |

|---|---|

| InstaTrade |

|

| Pepperstone |

|

| FOREX.com |

|

| IC Markets |

|

| IC Trading |

|

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

Cons

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

- The funding options are not as extensive as those of top competitors such as IC Markets and lack several widely-used e-wallets, particularly UnionPay and POLi.

Why Trade With InstaTrade?

InstaTrade provides active trading on an extensive platform. It has a unique offering known as Fixed Income Structured Product (FISP), which allows for passive investment. Investors can potentially earn up to a 50% return within 6 months, provided certain conditions are fulfilled.

Pros

- InstaTrade provides approximately 300 assets for investment. It particularly shines in the area of currency pairs, making it an excellent platform for experienced traders interested in volatile exotics.

- VPS hosting is suitable for algorithmic trading strategies. It uses a dedicated server to offer quick execution speeds, potentially as fast as 9 milliseconds.

- InstaTrade TV provides video interviews and insightful market information about stocks, cryptocurrencies, and more. It assists in identifying opportunities for quick trading.

Cons

- The advertising of FISP, specifically about its "profit guarantee" and "risk-free trading," creates unease.

- InstaTrade's learning resources are helpful for new traders but are not as organized or comprehensive as those provided by top companies such as eToro.

- Profits in the FISP are guaranteed only if investors do not make over 50% profit and recruit other users, earning $4 for each dollar in compensation.

Why Trade With IC Markets?

IC Markets provides excellent prices, quick execution, and smooth deposits. The utilization of sophisticated charting platforms such as TradingView and the Raw Trader Plus account makes it a preferred choice for intermediate to advanced traders.

Pros

- IC Markets won DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its top-notch MetaTrader integration, perfected over years to enhance the platform experience.

- You can trade more than 2,250 CFDs in various markets, such as forex, commodities, indices, stocks, bonds, and cryptocurrencies. This range enables varied trading strategies.

- IC Markets provides some of the smallest spreads in the industry, offering 0.0-pip spreads on major currency pairs. This makes trading particularly cost-efficient for traders.

Cons

- Some withdrawal methods require fees such as a $20 wire charge. This can reduce profits, particularly for traders who withdraw frequently.

- IC Markets have a selection of metals and cryptos for trading through CFDs, but their range is not as wide as brokers such as eToro. This may limit options for traders who are interested in these asset types.

- Despite having four top-tier third-party platforms, there is no in-house software or trading app specifically designed for new traders.

Why Trade With IC Trading?

IC Trading's fast execution speeds, strong liquidity, and advanced charting software provide an ideal environment for scalpers, traders, and algorithmic traders.

Pros

- IC Trading offers leading spreads, such as 0.0-pip spreads on major currencies like EUR/USD. This makes it suitable for traders.

- The digital account opening process is efficient, enabling traders to quickly start trading without a lot of paperwork. The process takes only a few minutes in testing.

- IC Trading provides great flexibility with its accounts. Traders can operate up to 10 live and 20 demo accounts, allowing them to have distinct profiles for varied activities like manual and algo trading.

Cons

- The educational resources need enhancement, particularly for beginners who seek a thorough learning experience, contrasted to top-ranking platforms like eToro. This issue is lessened if you visit the IC Markets website, but it can present a challenge for traders.

- Though IC Trading is part of the reputable IC Markets group, it only holds authorization from a less recognized regulator, the FSC of Mauritius. This results in diminished financial transparency and regulatory protections.

- During testing, customer support was disappointing. Multiple attempts to reach out through live chat were unsuccessful and emails went unanswered. This raises concerns about their capacity to handle urgent trading issues.

Why Trade With Pepperstone?

Pepperstone is a leading choice for trading with low spreads, quick execution, and advanced charting for experienced traders. New traders benefit from no minimum deposit, a wealth of educational resources, and 24/7 support. Operating under ASIC regulation, Pepperstone is a top option for Australian traders and won DayTrading.com's 'Best Aus Broker' award for 2025.

Pros

- Pepperstone has simplified deposits and withdrawals, adding Apple Pay and Google Pay in 2025, and PIX and SPEI for Brazilian and Mexican clients in 2024.

- Get top-notch customer support through phone, email, or live chat. Expect responses within <5 minutes based on our trials.

- Pepperstone now offers spread betting via TradingView, enabling tax-efficient trading with sophisticated analysis tools.

Cons

- Despite expanding its market range, crypto options are limited compared to other brokers in this area, and there is no option to invest in actual coins.

- Pepperstone does not support cTrader Copy, a popular feature in the cTrader platform available at alternatives like IC Markets, though it has launched an intuitive copy trading app.

- Pepperstone's demo accounts last for 30 days. This might be insufficient for learning the various platforms and testing trading strategies.

Filters

How We Identified the Top Orange Juice Brokers

To create our rankings, we tapped into our extensive broker database to identify platforms offering orange juice trading through futures, CFDs, and other instruments.

Each broker was scored using a proprietary system covering 200+ data points across eight key categories — from ease of use and cost structure to trading tools and market research.

But we didn’t stop at the numbers. Our team ran tests to see how each platform performs for orange juice trading — so the recommendations are grounded in experience.

What To Look For In a Top Broker To Trade Orange Juice

After evaluating hundreds of platforms, we’ve learned what separates the best from the rest. Here are the essentials to keep in mind when picking a broker for orange juice trading:

Market Access: Why It’s the First Box to Tick

When it comes to trading orange juice, market access is the first thing we look at—and for good reason. Whether you’re planning to trade orange juice futures directly or use a synthetic like an exchange-traded fund or contract for difference, you need a broker that offers clean, reliable, and consistent exposure to the market. Not every broker does.

Orange juice futures are listed on the CME, Chicago Mercantile Exchange, one of the few major trading exchanges offering them. But here’s the catch: not every retail broker provides direct access to that market.

And when you’re looking at synthetics – like CFDs or ETFs – it gets even more nuanced. Some brokers offer these instruments, but under the hood, the pricing or execution can be off, especially during lower liquidity windows..

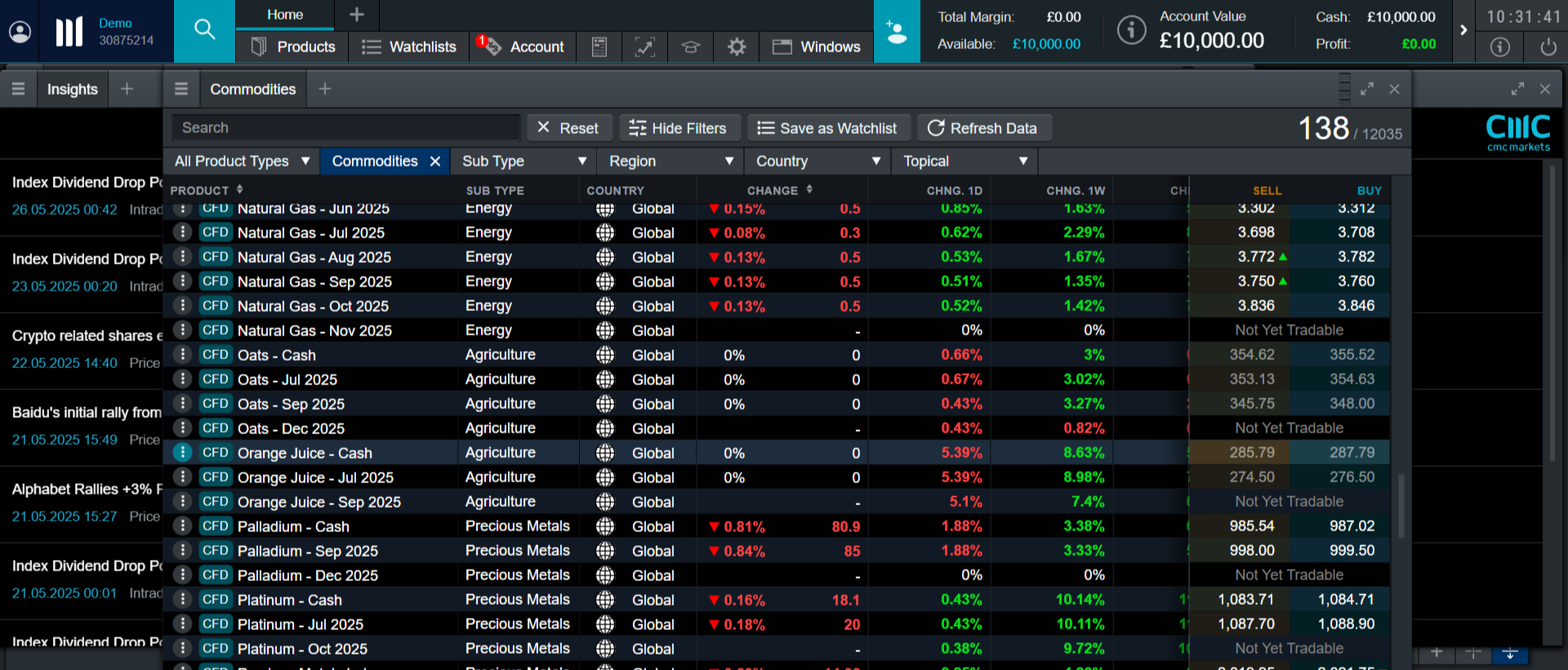

Top Pick: CMC Markets gives you the edge if you’re serious about orange juice. They offer comprehensive access to soft commodity futures, including orange juice, directly or via their well-structured CFD products.

Another thing we liked? Their platform is genuinely built for commodities traders. From customizable charting to integrated news and economic data, like USDA, United States Department of Agriculture reports, you can make decisions without flipping between tabs or platforms.

List of orange juice contracts on the CMC platform

Specific Research and Insights: The Edge Is in the Intel

Orange juice isn’t like trading gold or oil, where news is everywhere and everyone’s an expert. The orange juice market is niche, seasonal, and heavily influenced by a web of unpredictable factors.

We’re talking about weather disruptions in Florida and Brazil, crop disease trends, and sudden changes in trade policy or export restrictions. If your broker isn’t offering sharp, relevant research on these elements, you’re being shortchanged.

When we evaluate brokers, we take this seriously. We look for consistent, commodity-specific updates, especially the kind that dives into citrus crop forecasts, hurricane season outlooks, or the impact of USDA data releases.

And we don’t just want headlines. We want context, clarity, and actionable insights that help us decide whether to buy, hold, or cut and run. After putting a few brokers under the microscope, one stood out for delivering this kind of depth.

Top Pick: XTB came through for us big time in the research department. Their in-house analysts regularly publish commodities-focused outlooks that don’t just lump orange juice in with broader agriculture—orange juice gets proper, focused attention when the market calls for it.

That includes commentary on weather anomalies in Brazil, disease impacts like citrus greening in Florida, and how geopolitical shifts might affect export dynamics.

We especially appreciate how their insights are usable. You’re not scrolling through filler or overly technical language; they break down why a weather pattern matters or how a new USDA forecast might impact futures pricing. The research is also available inside their trading platform, so you’re not chasing links or buried PDFs.

Execution Speed and Reliability: Don’t Let a Sluggish Platform Cost You

Speed isn’t just a luxury in the orange juice market—it’s survival. Prices can jump on a dime. A sudden freeze warning in Florida, a crop downgrade from the United States Department of Agriculture, or even macro news like inflation data can send futures or synthetic instruments moving fast. If your broker lags—either in execution or platform stability—you pay for it.

We look at order execution under stress, platform responsiveness during high-volatility periods, and how often slippage or downtime creeps in. We don’t rely on what brokers say they offer—we log in, trade, and see for ourselves. One broker clearly rose to the top in this category.

Top Pick: IC Markets impressed us with its consistently fast and reliable execution, especially during the kind of macro volatility that can rattle less capable platforms. Whether it was during high-impact news windows or sudden commodity-specific shifts, orders filled fast and with minimal slippage. That’s not something we take for granted.

They offer access through both MetaTrader and cTrader, and in our tests across both platforms, latency was impressively low. Even during the occasional spike in orange juice volatility, execution didn’t buckle. Plus, the server stability, particularly on cTrader, was rock solid. No freezing, no “server busy” messages, no weird disconnects when things got hot.

Data Feeds and Charts: The Tools You Need to Trade Like a Pro

Orange juice may be a niche commodity, but that doesn’t mean you can get by with basic tools. To make informed decisions, you need the complete picture—real-time pricing from the Chicago Mercantile Exchange, live inventory data (especially citrus stock reports), and professional-grade charting tools that go beyond cookie-cutter setups.

We’ve seen the gap firsthand. Some brokers offer decent platforms, but their charting tools feel like an afterthought, missing key commodity-specific overlays or limited in how they visualise volume, seasonality, or price correlation. Worse yet, we’ve come across lagging data, especially during pre-market or volatile sessions.

If you’re trying to anticipate moves or spot breakouts in a fast-moving soft commodity like orange juice, that kind of delay can wreck your edge. We ran a side-by-side comparison of available tools across several platforms, and one broker stood out as having the most complete offering.

Top Pick: Pepperstone delivers the charting and data experience we look for when trading a complex product like orange juice. They provide real-time CME pricing through their integration with TradingView and cTrader, both of which we tested extensively. The feeds are fast and clean and don’t suffer from the occasional lag or gaps we noticed on other platforms.

What stands out is the charting flexibility. With TradingView integration, you can overlay custom indicators like commodity-specific moving averages, price seasonality curves, and even weather-driven models if you’re inclined. Their tools also let you set up alerts tied to fundamental data, like sudden moves around USDA inventory releases. That kind of integration gives you a significant leg up when trading news-sensitive products like orange juice.

cTrader Spotware chart of Pepperstone orange juice CFD

Margin and Leverage Options: Get the Firepower Without the Hidden Traps

Trading orange juice—whether you’re going directly with futures or via contracts for difference—often requires leverage. That’s just the nature of commodity markets.

But the key is smart leverage: competitive rates that don’t eat into your capital with hidden fees, and margin requirements that are clearly laid out, not buried in fine print or changing by the hour.

When we evaluate brokers here, we look for two things: transparency and flexibility. We want to see margin terms that are clear, posted in advance, and consistent with actual market risk.

When it comes to leverage, we check not just the headline number but also how the platform handles things during volatility or rollover periods, especially for futures contracts.

Top Pick: IC Trading delivers the best balance of leverage and transparency. Their margin requirements are published across futures and CFD products, and we were impressed by how consistently they aligned with market conditions, even during volatility spikes tied to macro data or USDA citrus reports.

They offer flexible leverage tiers, perfect for adjusting exposure across a diversified commodity portfolio. More importantly, there were no unpleasant surprises—no stealthy margin hikes during rollovers, no sudden increase in maintenance requirements just as liquidity thins out.

Regulatory Oversight and Broker Credibility: Trust Is Non-Negotiable

Orange juice might be a niche trade, but you’re still putting real money on the line. So we treat broker credibility as a dealbreaker. It’s not just about regulation (though that’s critical). It’s about a broker’s track record in commodities, handling client funds, and managing risk during volatile market events.

We’ve personally reviewed each broker’s regulatory standing, public disclosures, and past handling of major events. We look at licensing across major jurisdictions like the Financial Conduct Authority in the United Kingdom or the Australian Securities and Investments Commission.

And we pay close attention to how long they’ve been in the commodities space, not just forex or indices.

Top Pick: CMC Markets is one of the most tightly regulated and longest-standing brokers in the business, and it shows. They’re licensed in multiple tier-one jurisdictions, including the United Kingdom and Australia, and their operations are consistently praised for transparency and client fund protection.

More than that, CMC has decades of experience offering access to commodities, including softs like orange juice. They’ve weathered market crashes, liquidity crunches, and periods of extreme volatility while maintaining client trust. We’ve seen them respond quickly to volatility spikes, provide proactive communication, and prioritise stability.

Fees and Commissions: Don’t Let Costs Squeeze Your Profits

Orange juice is one of those commodities where the margins can be razor-thin. You’re not always looking for massive moves—sometimes you’re trading small shifts based on supply forecasts or weather events. That makes fees a big deal. Even a few extra points in spread or an opaque commission structure can turn a winning trade into a breakeven or worse.

So when we evaluate brokers here, we go deep. We check live spreads during peak and off-peak hours. We compare commission structures across account types. And we look at the fine print—rollover charges, inactivity fees, the whole lot.

We also run test trades to see what actual costs come out on the other side. In terms of cost-efficiency, one broker stood out as our top pick.

Top Pick: Pepperstone consistently offered the tightest spreads and lowest total cost structure for orange juice-related trades during our tests. The fees are lean and fully transparent, whether trading directly on commodity futures or using CFDs. We saw tighter spreads than competitors, especially during high liquidity windows, and no hidden charges were sneaking up in the background.

They also offer a range of account types, including Razor accounts, which are explicitly geared for low-cost execution. Combine that with competitive swap rates and no unexpected admin fees, and Pepperstone becomes a top choice for active traders who want to keep costs under control.

Risk Management Tools: Because Orange Juice Can Turn Sour Fast

Orange juice might seem low-key, but trust us—it can move like a tech stock on bad earnings. Sudden frost warnings, revised USDA crop data, or even unexpected geopolitical disruptions in Brazil can send prices swinging wildly. That’s why risk management isn’t optional—it’s your safety net.

When we test brokers, we look for more than just the basics. Yes, we want stop-loss and take-profit orders—but we also want smart price alerts, volatility notifications, and margin call protection that works. A good risk tool helps you react fast or, better yet, avoid nasty surprises altogether. One broker offered an exceptionally well-rounded risk management suite.

Top Pick: XTB nails this. Their platform is built with risk-conscious traders in mind, which shows up in the tools. We found it easy to set and adjust stop-loss and take-profit orders, and we appreciated how the platform proactively calculates potential risk per trade in real time.

The alert system impressed us. You can set custom price alerts on key commodities, and XTB notifies you the moment orange juice hits your target levels—even via mobile push or email. They also provide volatility warnings during high-risk sessions, which helped us avoid overexposure during major USDA updates and weather-related spikes.