Best Brokers With EUR Accounts 2026

Dig into our top brokers offering EUR accounts based on thorough tests, reducing conversion fees and optimizing the experience for traders in the Eurozone.

James Barra

Tobias Robinson

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 OANDA is a well-known broker that excels in quick trade executions, a low deposit requirement, and impressive charting and trading platform functions. The highly-regarded brand has over 25 years of expertise and is overseen by reliable authorities like the NFA/CFTC. It provides 24/7 support for traders and offers flexible contract sizes with automated trade executions. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.9 Kraken is a major cryptocurrency exchange that offers a unique trading terminal and over 220 cryptocurrencies for trading. It provides up to 1:5 leverage for spot crypto trading with consistent rollover fees, and up to 1:50 leverage on futures. Additionally, it offers crypto staking services and features an interactive NFT marketplace. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.5 Crypto.com is one of the biggest names in cryptocurrency trading, developed with the aim to expedite the world's transition to DeFi technologies. The crypto exchange offers token lending, pre-paid cards, NFTs and more. The firm was established in Germany in 2016 and its quality is proven by its 150 million users.

Compare Brokers With EUR Accounts

Broker Details Comparison

Safety Comparison

Compare how safe the Best Brokers With EUR Accounts 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Brokers With EUR Accounts 2026.

Comparison for Beginners

Compare how suitable the Best Brokers With EUR Accounts 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Brokers With EUR Accounts 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Brokers With EUR Accounts 2026.

Detailed Rating Comparison

Compare how we rated the Best Brokers With EUR Accounts 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Brokers With EUR Accounts 2026.

Broker Popularity

See how popular the Best Brokers With EUR Accounts [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Crypto.com |

|

| Kraken |

|

| Interactive Brokers |

|

| FOREX.com |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- IBKR provides a cost-effective platform for traders by offering low fees, narrow spreads, and clear pricing.

- Interactive Brokers has introduced ForecastTrader, a zero-commission service allowing users to trade yes/no Forecast Contracts on political, economic, and climate events. Contracts offer fixed $1 payouts, 24/6 market access, and a 3.83% APY on held positions.

- There's a large selection of free or paid research subscriptions available to all traders. If you subscribe to Toggle AI, you will also receive commission refunds from IBKR.

Cons

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

Why Trade With OANDA US?

OANDA is a reputable broker for US traders. It offers user-friendly tools for analysis and a simple sign-up process. It is very trustworthy due to heavy regulation.

Pros

- There's a robust selection of 68 currency pairs for committed forex traders focusing on short-term trades.

- The broker's API provides access to extensive historical data from the past 25 years and rates from over 200 currencies for traders.

- Traders can experience quick and dependable order execution.

Cons

- Customer support is not accessible during weekends.

- The trading markets are limited to only forex and cryptocurrencies.

- Few payment options are available and e-wallets are not supported.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

Cons

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

- FOREX.com has expanded their trading offerings, but these remain limited to forex and CFDs. Unfortunately, they don't provide options to invest in actual stocks, ETFs, or cryptocurrencies.

- The funding options are not as extensive as those of top competitors such as IC Markets and lack several widely-used e-wallets, particularly UnionPay and POLi.

Why Trade With Kraken?

Kraken is suitable for traders seeking a variety of cryptocurrencies, including Bitcoin, and a strong history of security.

Pros

- NFT marketplace and crypto staking options are accessible for traders.

- Excellent trading platform and mobile application.

- A highly safe and secure service, with no recorded breaches in the ten years since it was established.

Cons

- Pro account's verification process is slow.

- Slow verification times

- Low leverage on spot trading

Why Trade With Crypto.com?

Crypto.com is a snug fit for aspiring crypto traders who want to buy, sell and trade over 400 digital tokens. Its strike options and prediction markets spanning financial, economic, election, sport, and cultural events via its CFTC-regulated entity also make it a secure option for US traders interested in binary-style contracts on an intuitive app.

Pros

- The Crypto.com Exchange platform offers sophisticated bots, including Dollar Cost Averaging (DCA), Time-Weighted Average Price (TWAP), and Grid Trading bots. These tools allow traders to automate strategies, including leveraged perpetual trades, minimizing manual effort and slippage.

- The platform supports unified portfolio tracking across cryptocurrencies, stocks, ETFs, and more recently prediction markets, all within a single interface, simplifying asset management for multi-asset traders and providing consolidated insights.

- Crypto.com has expanded beyond crypto in some regions, offering over 5000 stocks and ETFs for traders looking to build diverse portfolios and opportunities in different sectors.

Cons

- Customer support primarily relies on chatbots and email, with limited reliable phone support from our testing. This can lead to delays in resolving urgent issues, such as account access or transaction problems, which can be frustrating for crypto day traders who need quick assistance.

- The app's high bid-ask spreads on many coins can be costly for traders placing market orders. Wide spreads mean the price you pay when buying is noticeably higher than the price you receive when selling, cutting into profits, especially on lower-volume trades.

- Withdrawal fees apply to crypto transfers and fiat withdrawals, and these can be significant for active traders making smaller transfers. The minimum withdrawal limits are also relatively high, which restricts flexibility for managing smaller portfolios or quick liquidity needs.

Filters

Methodology

To identify the best brokers offering EUR-denominated accounts, we utilized our continuously updated database, which encompasses hundreds of online brokers globally.

We focused on platforms that allow clients to deposit, withdraw, and trade in Euros (EUR).

Rankings were determined based on their overall scores, derived from our in-depth analysis of 200+ metrics. These included fees, platform functionality, and regulatory compliance, supplemented by hands-on testing experience feedback.

What Is a EUR Account?

A EUR account is a trading account where all transactions, profits, and losses are recorded in Euros.

As the base currency of the European Union and one of the most widely used reserve currencies globally, the Euro is a natural choice for many traders.

Over 75% of the brokers we’ve evaluated offer trading accounts denominated in EUR.

After testing the best trading accounts, we’ve found that EUR accounts provide several distinct advantages:

- Avoiding Currency Conversion Costs: You can save on fees by avoiding conversions into Euros, which is particularly beneficial for European traders.

- Mitigating FX Volatility: A EUR account protects traders from unfavorable exchange rate fluctuations if their income, expenses, or investments are tied to the Euro.

- Access to EU-Based Financial Instruments: It simplifies trading in European stocks, bonds, ETFs, and other instruments, particularly for traders focusing on the EU economy.

How Do I Open a EUR Account?

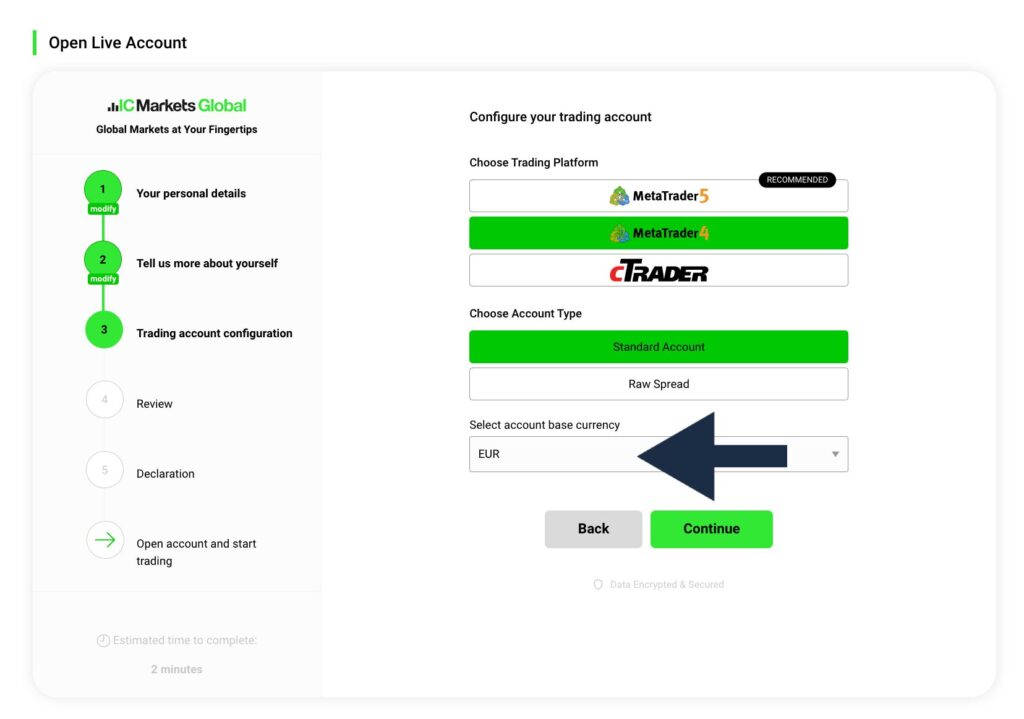

Opening a EUR trading account is straightforward. Here are the five key steps:

- Choose a Broker: Select a broker offering EUR as a base currency option. Consider factors like fees, platform usability, available instruments (e.g., DAX stocks, EU-listed ETFs), and regulation (e.g., brokers regulated by ESMA, BaFin, or CySEC).

- Register an Account: Complete the broker’s onboarding process, which usually requires submitting proof of identity and address in line with EU regulations.

- Select EUR as Your Base Currency: During account setup, choose EUR as your preferred account currency.

- Fund Your Account: Deposit funds in Euros directly or use the broker’s platform to convert other currencies into EUR.

- Start Trading: Once funded, begin trading European financial assets without the friction of currency conversion.

For instance, below is an example where I set up a EUR trading account at IC Markets.

Should I Use a EUR Trading Account?

A EUR trading account may be ideal for you if the following apply:

- You Live in the Eurozone: A EUR account aligns with your domestic currency, simplifying tax reporting, bookkeeping, and withdrawals.

- You Trade EU-Based Assets: If your portfolio focuses on European stocks, indices, or bonds, a EUR account eliminates unnecessary exchange rate fees and conversion delays.

- You Want to Hedge Currency Risks: If your income, expenses, or investments are denominated in EUR, this account helps mitigate the impact of exchange rate volatility.

- You Operate in Euro-Tied Economies: For traders in countries using or closely tied to the Euro (e.g., Monaco, Andorra), a EUR account ensures seamless transactions.

What Are the Limitations of a EUR Trading Account?

- Exposure to EUR-Related Risks: If the Euro weakens relative to other currencies, the value of your holdings may decrease when converted.

- Less Accessibility in Non-EUR Regions: If you’re trading from outside the Eurozone, EUR accounts might incur additional costs when funding or withdrawing in other currencies.

- Currency Conversion Costs for Non-EUR Assets: If you trade assets denominated in currencies other than EUR (often USD, GBP, or JPY), you may face currency conversion fees when buying or selling those instruments. This can add a layer of cost that impacts profitability.

- Competition with USD Dominance: In global trading, the USD still provides greater flexibility for international transactions. Using an EUR account in a USD-dominated market can lead to inefficiencies, such as higher costs for settlements or delays when converting to USD-based assets.