Best Joint Brokerage Accounts 2026

Explore our top joint brokerage accounts, exhaustively tested by our experts so you can combine resources, diversify strategies, and achieve shared financial goals.

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Firstrade is a US-based discount broker-dealer authorized by the SEC and a member of FINRA/SIPC. It offers welcome bonuses, advanced tools and apps, and commission-free trading. Firstrade Securities is a popular top online brokerage, and opening a new account is fast and simple. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.7 Founded in 2009, Vantage provides trading on over 1000 CFD products to more than 900,000 customers. Forex CFDs can be traded from 0.0 pips on the RAW account using TradingView, MT4 or MT5. Vantage is regulated by ASIC and keeps client funds separate. The company also offers a variety of social trading tools for those interested in copy trading. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.4 Founded in 2006, FxPro is a reliable non-dealing desk (NDD) broker that offers trading on more than 2,100 markets to over 2 million clients globally. It has won over 100 industry awards for its favorable conditions for active traders. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.8 Global Prime is a widely regulated trading broker providing access to over 150 markets. With a minimum deposit of $200, traders can leverage up to 1:100. The company is highly trusted and reputable, holding a license from the ASIC.

Compare the Best Joint Account Brokers Across Key Features

We reviewed top brokers that support joint trading accounts - here’s how they compare on core features:

How Safe Are the Top Joint Account Brokers?

Joint accounts involve shared capital so safety is critical. See how the top brokers handle fund protection:

Joint Account Access on Mobile

Need to manage a joint trading account on the go? We tested which brokers offer reliable mobile platforms:

Are the Top Joint Account Brokers Good for Beginners?

Opening a joint account for the first time? Here's which top brokers offer simple setup processes and helpful tools for new users:

Do the Top Joint Account Brokers Suit More Experienced Traders?

See which advanced features these top providers offer for experienced traders or investing partners:

Accounts Comparison

Compare the trading accounts offered by Best Joint Brokerage Accounts 2026.

Detailed Ratings: Best Joint Account Brokers

See how each joint account broker performed in our independent rating system:

Compare Trading Fees

We analyzed fees and account charges to show which top joint account brokers offer the best value for co-managed portfolios:

Which Joint Account Brokers Are Most Popular?

Looking for a broker trusted by partners, spouses, or co-investors? These joint account brokers have some of the highest sign-up rates:

| Broker | Popularity |

|---|---|

| Vantage |

|

| Interactive Brokers |

|

| FxPro |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- The new IBKR Desktop platform combines the advantages of TWS and adds unique tools like Option Lattice and Screeners with MultiSort to make trading accessible and impressive for traders of all levels.

- The TWS platform is designed for intermediate to advanced traders. It includes over 100 order types and a dependable real-time market data feed that rarely experiences downtime.

- There's a large selection of free or paid research subscriptions available to all traders. If you subscribe to Toggle AI, you will also receive commission refunds from IBKR.

Cons

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

Why Trade With Firstrade?

Firstrade is ideal for beginners wanting to trade US stocks without commission fees. It offers plenty of free educational resources and high-quality research, including its new FirstradeGPT tool. Users also get trading ideas from Morningstar, Briefing.com, Zacks, and Benzinga.

Pros

- Great broker for cost-conscious traders with low OTC fees

- In 2025, Firstrade Invest 3.0 will enhance the platform with a cleaner interface and faster order entry, benefiting active traders in key areas such as watchlists and options chains.

- Trusted US-regulated broker, member of SIPC

Cons

- Over 90% of the evaluated options lack a demo or paper trading account.

- Visa card deposits and withdrawals are not accepted.

- Customer support needs improvement after testing, with no 24/7 help available.

Why Trade With Vantage?

Vantage is a solid choice for CFD traders looking for a strictly-controlled broker that offers the dependable MetaTrader platforms. The registration process is swift and there’s a $50 minimum deposit, making it easy for traders to start quickly.

Pros

- Opening a live trading account is a swift and straightforward process that takes less than 5 minutes.

- Hedging and scalping are allowed with no restrictions on short-term trading strategies.

- The ECN accounts offer competitive terms, including spreads from 0.0 pips and a commission of $1.50 per side for traders.

Cons

- To enjoy optimal trading conditions, a significant deposit of $10,000 is required. These conditions include a commission fee of $1.50 per side.

- Unfortunately, some customers may have to sign up with an offshore company, providing less regulation protection.

- Test results show that average transaction speeds of 100ms-250ms are slower than other trading options.

Why Trade With FxPro?

FxPro is an excellent choice for traders, offering fast execution in under 12ms, competitive fees reduced in 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge.

Pros

- FxPro provides four reliable charting platforms, including the user-friendly FxPro Edge, which features over 50 indicators, 7 chart types, and 15 timeframes.

- FxPro's Wallet is a key feature that lets traders manage funds securely. By separating unused funds from active trading accounts, it offers extra protection and convenience.

- FxPro uses a 'No Dealing Desk' (NDD) model, providing fast and clear order execution, often under 12 milliseconds, suitable for short-term trading strategies.

Cons

- There are no passive investment tools like copy trading or interest on cash. While traders may not miss these features, competitors like eToro offer more options for both active and passive investors.

- Despite having a growing Knowledge Hub and a $10M demo account, FxPro is mainly for advanced traders, and beginners might find the account and fee structure complicated.

- FxPro offers customer support 24/5 via multiple channels, performing well in tests, but it lacks 24/7 availability, which might be a drawback for traders needing help outside regular market hours.

Why Trade With Global Prime?

Global Prime is a good fit for both novice and experienced traders, providing leading market access, low costs, and features such as copy trading.

Pros

- Segregated client funds

- 24/7 customer support

- Trade receipts

Cons

- Limited account choices for trading.

- No MetaTrader 5 integration

- US and Canada-based clients are not eligible for trading services.

Filters

How BrokerListings.com Chose The Top Joint Account Brokers

We selected the best joint account brokers using over 200 data points, then ranked providers based on their total ratings.

Each broker was verified to support true joint accounts — with shared access, customizable permissions, and compliant ownership structures for partners, spouses, or co-investors.

What To Look For In a Joint Broker

Upfront Costs? Let’s Talk Opening Fees and Ongoing Charges

Before you and a partner, friend, or family member go all-in on a joint trading account, it’s worth lifting the hood on what the account will cost you. Some brokers love to shout about “zero commission” while slipping in maintenance charges, inactivity fees, and other hidden surprises. That’s why we always dig into the fine print before recommending anything.

When we tested joint accounts across multiple brokers, we didn’t just look at how much it costs to open the account. We looked at:

- Whether there were any one-off or recurring maintenance charges

- If inactivity would hit you with penalties (not everyone trades daily)

- How transparent the broker was about fees from the get-go

Top Pick for Low Fees: We’ve tested a lot of brokers, and Firstrade came out as the top pick when it comes to keeping your joint account low-cost and fuss-free.

Here’s why Firstrade impressed us during our evaluations of the best trading accounts:

- $0 account opening fee: You and your co-account holder can get started without spending a cent.

- $0 maintenance fee: No monthly charges or admin costs, whether you’re an active trader or a long-term investor.

- No inactivity penalties: If you both decide to hold positions or take a break from trading, you’re not punished for it.

- Commission-free trading on US-listed stocks and ETFs: This is a standout feature we appreciated during our testing of the joint account for longer-term investing goals.

Who Owns What? How Joint Accounts Are Structured

One of the first things we tell people considering a joint trading account is this: you need to know how the ownership is divided. It’s not just about whose name goes first – it affects who can make decisions, how assets are shared, and even what happens if one of you passes away or wants to exit the account.

When evaluating joint account brokers, we delve into the legal and operational structure behind the scenes. Specifically, we look at:

- Whether the broker offers joint tenants (where both co-account holders own the account equally with rights of survivorship)

- Or tenants in common (where ownership can be split unequally and passed on to someone else)

- Whether both parties can place trades and request withdrawals

- And how disputes, closure, or separation are handled within the platform

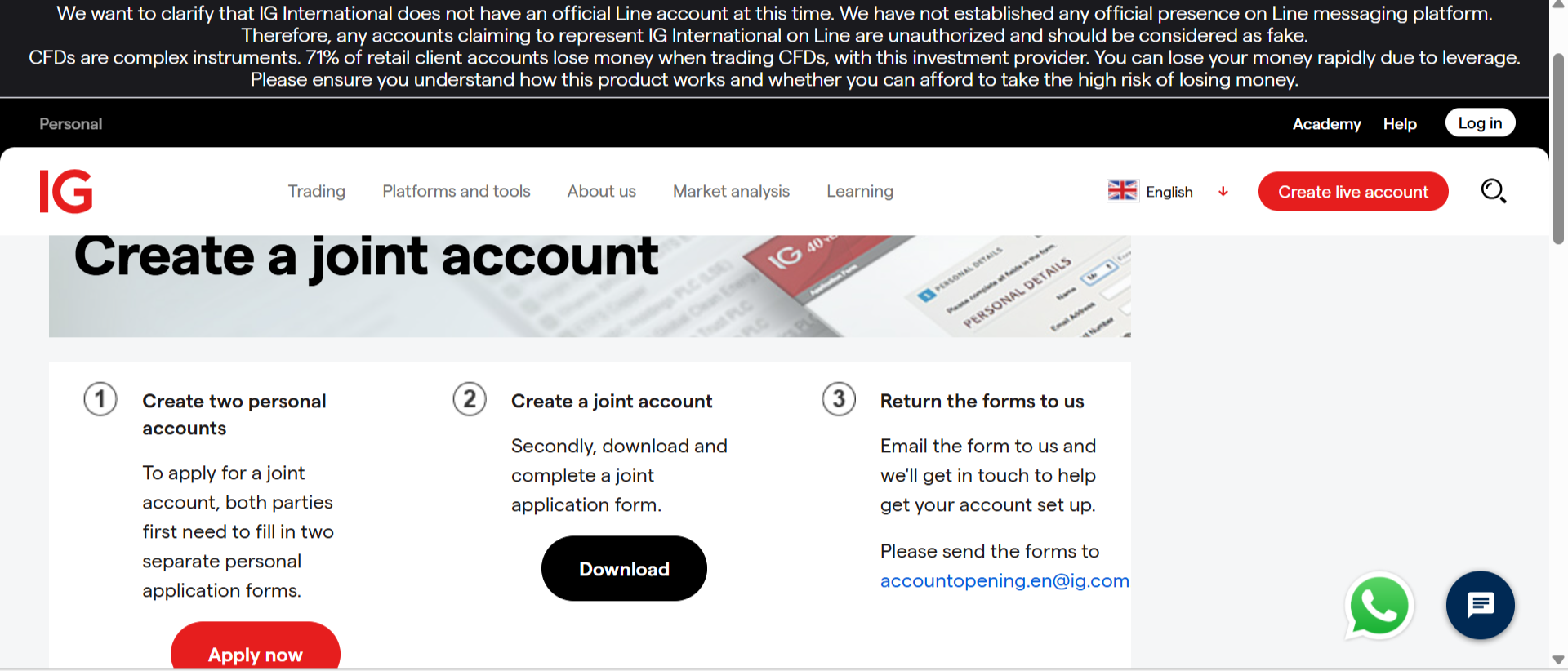

Top Pick for Clarity on Ownership: IG stood out to us for how well they support and explain joint account structures. Here’s why we rated IG Markets so highly:

- Precise definitions of account types: When we opened a test joint account with IG, we were guided through choosing between joint tenants and tenants in common, with explanations that didn’t sound like they were lifted from a legal textbook.

- Full access for both holders: Both people on the account can place trades, fund the account, and view statements equally — no hidden restrictions or permissions toggles buried in a menu.

- Transparent survivorship rights: IG outlines what happens if one party passes away, including how the account transfers and what documentation is needed.

- Support for diverse use cases: Whether you’re a married couple, business partners, or siblings investing together, IG doesn’t force you into a one-size-fits-all account setup.

IG Markets joint account application

Getting Started Without the Headache

Opening a joint account shouldn’t feel like applying for a mortgage. But with some brokers, that’s exactly what it’s like – confusing forms, unclear ID requirements, and no guidance on how to register as two people. That’s why we always test how simple it is to get both parties through the door.

Here’s what we look for when evaluating joint account onboarding:

- How the broker handles ID verification for both co-account holders

- Whether you can register and upload documents in one go

- If the process works smoothly on both desktop and mobile

- How clear the communication is from the broker during setup

- And how quickly you can move from sign-up to first trade

Top Pick for Setup Simplicity: FxPro makes the joint account opening process feel smooth from start to finish, even when uploading documents for two different individuals in different locations. That alone sets it apart from most brokers we reviewed.

Here’s what we liked most:

- Unified onboarding: From the first screen, FXPro lets you know you’re creating a joint account. There’s no need to open a personal account first and convert it later (which is what some brokers still require).

- Fast, separate ID checks: Each person gets a secure link to upload their ID and proof of address. No awkward email threads or manual uploads. It took us less than 15 minutes to verify both parties.

- Responsive support team: We had a question about signing in from different IP addresses – they answered within minutes and reassured us that location differences wouldn’t hold up approval.

- Mobile-friendly from start to finish: Whether you’re registering from a laptop or a phone, the forms and upload process work cleanly on both ends.

Easy Access for Both of You

It’s one thing to open a joint account – it’s another to use it together without stepping on each other’s toes. From login credentials to trade permissions and dashboard access, the user experience needs to work for two people managing the same account.

We’ve seen plenty of brokers treat joint accounts like personal ones with a second name slapped on. That’s not enough. We specifically look for:

- Separate logins or secure shared access

- Equal visibility of positions, balances, and history

- The ability for both holders to place trades, fund, and withdraw

- Optional permission settings if you want to split roles or responsibilities

- Whether the platform feels designed with shared usage in mind

Some brokers still only give complete control to the first-named applicant, which defeats the point of joint ownership.

Top Pick for Shared Usability: Interactive Brokers set the bar for shared access. When we tested the joint account setup and day-to-day use, it felt like the platform was built with co-managed accounts in mind, not just repurposed from a personal layout.

Here’s what stood out:

- Separate credentials for each account holder: You’re not forced to share passwords. Each co-owner gets their own login, complete with 2FA (two-factor authentication) and full account access.

- Customizable permissions: If you want both parties to have equal control, great. But you can also set things up so one person handles funding while the other focuses on trading. This flexibility is ideal for couples or partners with different investing styles.

- Shared alerts and notifications: Market updates, order fills, and account changes go out to both email addresses — no one’s left out of the loop.

- Smooth multi-device usage: You can be logged in at the same time from different devices without issues, no conflicts, lag, or data errors.

Support That Understands You’re a Team

When you’re managing a joint account, sooner or later you’ll hit a point where you need help – whether that’s verifying a document, sorting out a deposit, or asking about a suspicious transaction.

The issue? A lot of brokers only want to talk to the “primary” holder, ignoring the second person on the account.

When we assess joint account support, we make sure brokers:

- Offer full support to both co-account holders

- Can verify and speak with either person confidently

- Allow either person to raise a ticket, call, or live chat

- Don’t require awkward email forwarding between account holders

- Respect your shared preferences for communication, statements, and alerts

Top Pick for Support That Works for Two: Vantage made us feel like we were equals from the start. When we contacted them, their support team recognized the account structure immediately and responded with the same level of priority and clarity.

Here’s what we liked:

- Fast response from either contact: Whether we live chatted, submitted a ticket, or called in, we were treated as co-owners, not “main user” and “backup.” Both names on the account were recognised in their CRM system.

- No need to play message relay: Some brokers only communicate with one party. Vantage allowed us to ask questions and get answers directly, thereby speeding up problem resolution.

- Support for joint preferences: We were able to set shared email alerts, designate who receives what kind of communication, and request dual copies of monthly statements – all without extra fees or back-and-forth.

- 24/5 coverage that works across time zones: When one of us was overseas, we could still get help without waking up the other person or needing joint login coordination.

Vantage joint account opening help

How Joint Accounts Handle Tax and Withdrawals

Once your joint account is up and running, two things matter long term: how taxes are handled, and how easily either of you can move money in or out.

These are areas where confusion (or bad design) can create real friction between co-account holders, and unfortunately, some brokers gloss over the details.

When we test for this, we look at:

- Whether tax documents are issued jointly or separately

- If both account holders can access full transaction histories

- Whether either party can initiate withdrawals, and how that’s verified

- How the broker handles reporting for capital gains or dividends

- And what documentation is available at year-end for tax filings

Some platforms bury these features or only provide documents to the primary holder. That’s a red flag, especially if both parties are responsible for reporting income.

Top Pick for Tax Clarity and Withdrawal Flexibility: We brought Interactive Brokers back in here for good reason – they’ve built a seriously robust reporting engine, and it’s designed to support joint account logistics from day one.

Here’s what we found:

- Full document access for both account holders: Annual tax forms, monthly statements, and capital gains reports are available to both people through their individual logins.

- Withdrawals from either party with proper authorization: You don’t need joint approval for every action, but security measures are in place to protect against mistakes or fraud.

- Clear tax ID linking: During setup, you can assign taxpayer identification numbers (like National Insurance numbers or Social Security Numbers) to each holder. This makes the broker’s reporting cleaner when both of you need to submit returns separately.

- Easy export to accountants or third-party tax tools: Whether you’re self-filing or handing it off, everything is available in clean formats – PDF, CSV, or direct feed into specific tax tools.

From a practical point of view, this saves a ton of back-and-forth at tax time. You don’t have to request extra documents or contact support for missing info – everything will be where you expect it to be, for both holders.