Best Brokers With NOK Accounts 2026

Dig into our top brokers offering NOK accounts after extensive testing, designed to reduce conversion fees and optimize the experience for traders in Norway.

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 Trade Nation is a leading foreign exchange and contract for difference broker regulated in various areas including the UK and Australia. This company provides affordable fixed and variable spreads on over 1000 assets and strong trading platforms and educational resources. Traders could use the Signal Centre for trading ideas. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 Skilling is a broker established in 2016, located in Cyprus. It provides a wide range of trading instruments with competitive spreads from 0.1 pips. The platform is beginner-friendly and is regulated in Europe and other regions with clear pricing. Registering and starting trading involves three simple steps. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.7 Established in 1989, CMC Markets is a reputable brokerage firm authorized by various top regulators such as the FCA, ASIC and CIRO, and is listed on the London Stock Exchange. They boast a global client base of over 1 million traders and have received numerous awards. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Founded in 1996, Swissquote is a Swiss bank and broker offering online trading with three million products, including forex, CFDs, futures, options, and bonds. Known for its reliability, Swissquote has built a strong reputation with innovative trading solutions, such as being the first bank to offer crypto trading in 2017 and recently introducing fractional shares and the Invest Easy service.

Compare Brokers With NOK Accounts

Broker Details Comparison

Safety Comparison

Compare how safe the Best Brokers With NOK Accounts 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Brokers With NOK Accounts 2026.

Comparison for Beginners

Compare how suitable the Best Brokers With NOK Accounts 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Brokers With NOK Accounts 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Brokers With NOK Accounts 2026.

Detailed Rating Comparison

Compare how we rated the Best Brokers With NOK Accounts 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Brokers With NOK Accounts 2026.

Broker Popularity

See how popular the Best Brokers With NOK Accounts 2026 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Interactive Brokers |

|

| CMC Markets |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- IBKR offers exceptional access to global stocks, with thousands of equities available from over 100 market centers in 24 countries, including the recent addition of the Saudi Stock Exchange.

- Interactive Brokers was named Best US Broker for 2025 by DayTrading.com for its dedication to US traders, ultra-low margin rates, and affordable global market access.

- Interactive Brokers has introduced ForecastTrader, a zero-commission service allowing users to trade yes/no Forecast Contracts on political, economic, and climate events. Contracts offer fixed $1 payouts, 24/6 market access, and a 3.83% APY on held positions.

Cons

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

Why Trade With Trade Nation?

Trade Nation is a suitable platform for new traders, offering diverse financial markets in a user-friendly environment. It has no minimum deposit requirement, provides free funding options, and robust educational resources.

Pros

- Trade Nation, a widely recognized and regulated broker, formerly functioned as Core Spreads.

- Beginners can start trading with a small initial deposit.

- Global traders can trade using various account currencies.

Cons

- Lower legal safeguards with overseas businesses.

Why Trade With Skilling?

Skilling is a great option for beginners wanting a competitive commission-free account with a copy trading feature. It's also suitable for seasoned strategy providers who want to earn commissions, or anyone interested in trading forex outside regular hours.

Pros

- Promotions offer up to $10,000 in bonuses

- Third-party charting tools exist for committed traders, offering numerous technical indicators and advanced order types.

- The broker is well-regarded worldwide and is overseen by leading regulators including the CySEC.

Cons

- Access to stocks on the Skilling Trader platform is limited, and the MT4 accounts offer a reduced selection of instruments.

- Skilling falls behind competitors such as IG in providing research tools that assist traders in making educated decisions.

Why Trade With CMC Markets?

CMC Markets offers a great online platform for traders. It has advanced charting tools and a wide variety of CFDs to trade, including a large selection of currencies and customized indices. It caters to traders at all levels.

Pros

- CMC Markets introduced an AI News feature, which uses AI to highlight and summarize market stories instead of executing trades for you. This suggests the future direction of broker research tools.

- The CMC web platform offers an excellent user experience, featuring advanced charting tools and customizable options for trading. It suits both beginners and experienced traders. It supports MT4 and will add TradingView in 2025.

- The brokerage excels by offering various useful resources. These include scanners that identify trading patterns, webinars, tutorials, updates from news outlets, and research from esteemed companies like Morningstar.

Cons

- A $10 monthly inactivity fee is charged after one year of no trading activity. This could discourage occasional traders.

- While the web platform has improved, it still needs more enhancements to be as user-friendly for trading as competitor software such as IG.

- The CMC Markets app provides full trading services, but its design and user experience are not as good as leading competitors such as eToro.

Why Trade With Swissquote?

Swissquote is a great option for active traders seeking a customizable platform, like its CXFD that includes Autochartist for automated chart analysis to assist trading decisions. However, its average fees and high $1,000 minimum deposit may be less accessible for beginners.

Pros

- Swissquote caters to fast trading strategies like scalping and high-frequency trading, offering 9ms average execution speeds, a 98% fill rate, and FIX API.

- Swissquote offers advanced research tools such as Autochartist for technical analysis and real-time news integration from Dow Jones. Their proprietary Market Talk videos and Morning News reports provide daily expert analysis, which is attractive to active traders.

- Swissquote is highly trusted for being a bank, listed on the Swiss stock exchange, and authorized by FINMA in Switzerland, FCA in the UK, and CSSF in Luxembourg.

Cons

- Swissquote mainly serves professional and wealthy clients, requiring high minimum deposits like $1,000 for Standard accounts. This makes it less suitable for smaller traders, who might prefer brokers offering higher leverage and no minimum deposit.

- Unlike brokers like eToro, which offer social trading features, Swissquote lacks tools for community interaction or copying successful traders. This limits its appeal for those who value peer learning.

- Analysis indicates Swissquote has relatively high fees, with forex spreads starting at 1.3 pips on Standard accounts, whereas Pepperstone and IC Markets offer 0.0 pips. Transaction fees for non-Swiss stocks and ETFs can increase costs for frequent traders.

Filters

Methodology

To identify the best brokers offering NOK-denominated accounts, we conducted a comprehensive evaluation using our frequently updated broker database, which tracks hundreds of platforms globally.

We focused on brokers that allow Norwegian traders to deposit, withdraw, and trade in Norwegian krone (NOK) while maintaining competitive fees and robust trading features.

Our final rankings were determined by analyzing over 200 data points, including transaction costs, platform reliability, access to financial markets, and regulatory compliance. We also incorporated hands-on testing feedback from our expert traders.

What Is an NOK Account?

An NOK trading account is a brokerage account where all trades, balances, and profits are recorded in Norwegian krone (NOK).

As the official currency of Norway, NOK is commonly used for domestic transactions. However, many international brokers default to USD or EUR as their primary account currencies from our investigations, making NOK-denominated accounts a more specialized offering.

Based on our analysis of the best trading accounts, using an NOK account has several advantages:

- Avoiding Currency Conversion Costs: If you live in Norway and earn in NOK, using an NOK trading account means you won’t have to convert funds when depositing or withdrawing, saving you on conversion fees.

- Reducing Foreign Exchange Risk: Trading with an NOK account helps Norwegian traders avoid unnecessary exposure to NOK fluctuations against USD or EUR.

- Streamlined Access to Norwegian Markets: If you trade Norwegian stocks, bonds, or ETFs listed on the Oslo Stock Exchange (OSE), an NOK account simplifies transactions and eliminates unnecessary conversion delays.

How Do I Open an NOK Account?

Opening an NOK-denominated trading account requires selecting a broker that supports transactions in Norwegian krone. Here’s how to get started:

- Choose a Broker: Select a broker that offers NOK as a base currency and supports convenient banking options. Check for regulatory approval from Finanstilsynet (Norwegian Financial Supervisory Authority) or another respected body to ensure reliability.

- Register an Account: Complete the broker’s onboarding process, which usually includes verifying your identity and proof of residence in Norway.

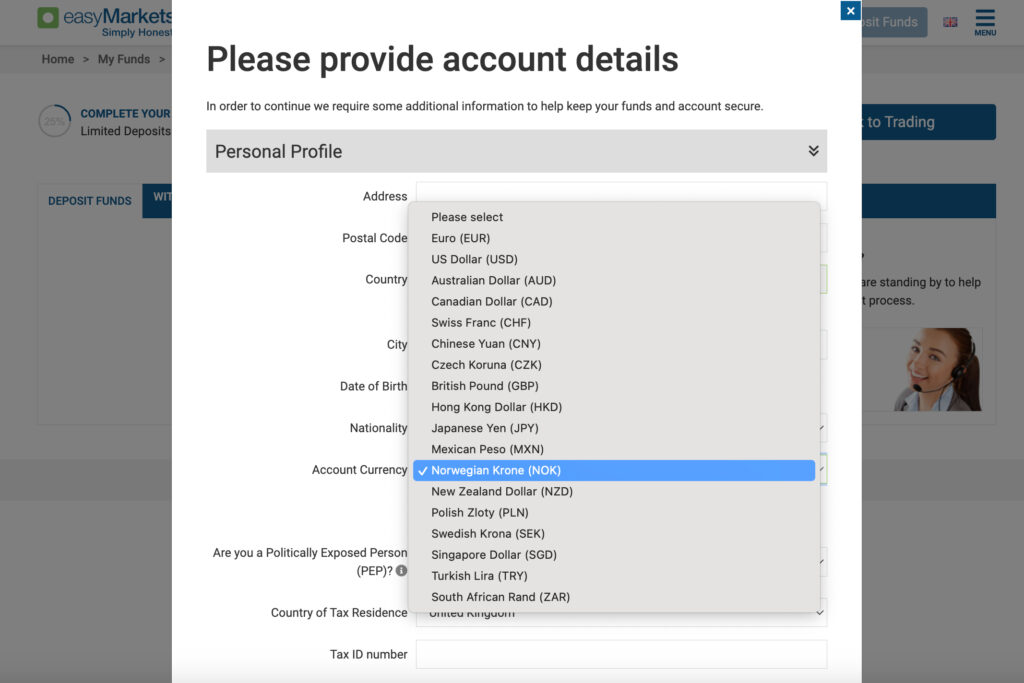

- Set NOK as Your Base Currency: When signing up, select NOK as your default account currency to ensure all transactions and balances remain in krone.

- Deposit Funds: Fund your account using Norwegian-friendly payment options like BankID transfers or Vipps. Many brokers we’ve used also support NOK deposits via credit/debit cards or e-wallets.

- Start Trading: Once funded, you can begin trading NOK-denominated assets or international instruments without extra conversion costs.

For instance, below is an example where I set up an NOK trading account at a leading brokerage, easyMarkets.

Setting up a NOK trading account with easyMarkets

Who Should Use an NOK Trading Account?

An NOK trading account is ideal for:

- Norwegian Residents: If you live in Norway and earn in NOK, having a trading account in krone makes managing finances easier.

- Investors Focused on Norwegian Assets: If your portfolio includes stocks from the Oslo Stock Exchange (OSE) or Norwegian ETFs, an NOK account helps eliminate foreign exchange costs.

- Traders Who Want to Minimize Currency Risks: If your expenses, income, or savings are in NOK, holding an NOK trading account prevents losses caused by exchange rate fluctuations.

- Users of Norwegian Banking Services: Some brokers that support NOK accounts also allow seamless integration with Norwegian banking solutions like Vipps, BankID, and local bank transfers.

What Are the Downsides of an NOK Trading Account?

- Limited Broker Selection: Many global brokers still do not offer NOK as a base currency, meaning fewer options for Norwegian traders.

- Higher Costs for Non-NOK Assets: If you trade assets denominated in USD, EUR, or GBP, you may encounter currency conversion fees when executing trades.

- Exchange Rate Risks for International Trading: While an NOK account protects you from domestic currency fluctuations, it also means you may face challenges if the krone weakens against the US dollar or euro, potentially affecting international investments.

- Liquidity and Spread Considerations: Some brokers charge slightly wider spreads on NOK-based forex pairs or offer fewer trading options compared to USD or EUR accounts.

- Banking and Withdrawal Limitations: Not all brokers support NOK withdrawals through local Norwegian banking systems, which could lead to higher fees or delays when cashing out profits.