Best Brokers With CZK Accounts 2026

Dig into our top brokers offering Czech koruna (CZK) accounts, designed to reduce conversion fees and optimize the experience for traders in the Czech Republic.

James Barra

Tobias Robinson

-

1Crypto.com is a major name in cryptocurrency trading, designed to speed up the global shift to DeFi technologies. The exchange provides token lending, prepaid cards, NFTs, and more. Founded in Germany in 2016, it serves 150 million users.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.1 Plus500, founded in 2008 and based in Israel, is a leading brokerage with more than 25 million registered traders across 50+ countries. The company specializes in CFD trading, provides a user-friendly platform and mobile app, and offers competitive spreads. It does not impose commission, deposit, or withdrawal fees. Plus500 holds the trust of its traders by being licensed by well-known regulators such as FCA, ASIC, and CySEC. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.8 Alpari is an offshore broker offering a variety of forex trading options, along with stock, index, and commodity CFDs. The broker also has fixed costs with pre-defined payouts. Trading is conducted on the trustworthy MT4 and MT5 platforms and the company's mobile app. Alpari is noteworthy for its narrow ECN spreads that cater well to active traders.

Compare Top Brokers With CZK Accounts

Broker Details Comparison

Safety Comparison

Compare how safe the Best Brokers With CZK Accounts 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Brokers With CZK Accounts 2026.

Comparison for Beginners

Compare how suitable the Best Brokers With CZK Accounts 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Brokers With CZK Accounts 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Brokers With CZK Accounts 2026.

Detailed Rating Comparison

Compare how we rated the Best Brokers With CZK Accounts 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Brokers With CZK Accounts 2026.

Broker Popularity

See how popular the Best Brokers With CZK Accounts [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Crypto.com |

|

| Plus500 |

|

| Alpari |

|

Why Trade With Crypto.com?

Crypto.com is ideal for new crypto traders looking to buy, sell, and trade over 400 digital tokens. Its strike options and prediction markets cover financial, economic, election, sport, and cultural events. As a CFTC-regulated platform, it provides a secure choice for US traders interested in binary-style contracts using an easy-to-use app.

Pros

- The platform offers unified tracking for cryptocurrencies, stocks, ETFs, and prediction markets within one interface, making multi-asset management simpler and providing combined insights.

- Crypto.com has expanded in some regions, now offering over 5000 stocks and ETFs for traders seeking diverse portfolios and opportunities in various sectors.

- Crypto.com uses a cold wallet system with multi-signature technology and geographic distribution to improve security. This method ensures strong protection of user assets with secure offline storage.

Cons

- The app has high bid-ask spreads on many coins, which can be expensive for traders using market orders. Wide spreads mean the buying price is significantly higher than the selling price, reducing profits, especially in low-volume trades.

- Fees apply to crypto and fiat withdrawals, which can be significant for active traders making smaller transfers. The minimum withdrawal limits are also high, limiting flexibility in managing smaller portfolios or immediate liquidity needs.

- Customer support mainly uses chatbots and email, with limited reliable phone support from our testing. This may cause delays in solving urgent issues like account access or transaction problems, which can be frustrating for crypto traders needing quick help.

Why Trade With Plus500?

Plus500 provides a streamlined experience for traders through a modern and dynamic CFD trading platform. However, its research tools are limited, it charges higher fees compared to some brokers, and its educational resources can be improved.

Pros

- Plus500 offers a WebTrader platform specifically made for CFD trading. It presents a neat and straightforward interface.

- Plus500 recently expanded its trading products. This includes offering VIX options with increased volatility and extended trading hours for 7 stock CFDs.

- The customer support team reliably offers 24/7 assistance through email, live chat, and WhatsApp.

Cons

- Compared to competitors like IG, Plus500's research and analysis tools are somewhat limited.

- The lack of educational resources adds a challenge for new traders, unlike top-tier brokers like eToro that offer extensive learning materials.

- Without social trading, users cannot mimic the trading actions of experienced traders.

Why Trade With Alpari?

Alpari is suitable for binary options traders who prefer short-term trading. They offer strong charting features, a rebate system, and require only a $5 deposit. Forex traders will appreciate the high leverage and narrow spreads. Additionally, Alpari's PAMM service is ideal for investors who prefer not to manage their trading.

Pros

- The broker provides up to 1:1000 leverage for skilled traders.

- Copy trading and PAMM services are also accessible for traders.

- Alpari has MT4 and MT5 platforms and supports Expert Advisors (EAs) for traders.

Cons

- It's disappointing that there aren't as many educational resources as other options offer.

- The costs for strategy manager copy trading tools are quite high.

- The market research and analysis tools are restricted.

Filters

How BrokerListings.com Chose The Best Brokers For CZK Accounts

To identify the best brokers offering CZK-denominated accounts, we utilized our continuously updated broker database covering hundreds of platforms.

We concentrated on brokers that allow clients to deposit, withdraw, and trade in Czech koruna (CZK), with a particular focus on their suitability for traders based in the Czech Republic or those holding CZK-denominated assets.

Rankings were determined based on scores across 200+ metrics, including trading fees, account funding options, platform reliability, range of instruments, and regulatory protections. Our rating process also involved hands-on testing from our experienced traders in Europe.

What Is a CZK Account?

A CZK trading account is one where your deposits, balances, profits, and losses are all denominated in Czech koruna.

As the official currency of the Czech Republic and a stable Central European currency, CZK accounts are ideal for local traders and those who wish to avoid the cost and hassle of constant currency conversion when dealing with koruna-linked assets.

Relatively fewer brokers offer CZK-based accounts compared to USD or EUR from our research, but several reputable platforms catering to Central and Eastern Europe do provide this option.

Key advantages of a CZK trading account:

- Avoiding Currency Conversion Fees: You won’t pay conversion charges when funding your account or withdrawing to a Czech koruna bank account, which is particularly useful for traders who are paid in CZK or hold CZK savings.

- Local Financial Alignment: Your profits and losses are measured in the same currency as your everyday expenses if you’re in the Czech Republic, simplifying tax reporting and budget management.

- Smooth CZK-Denominated Investing: Ideal for investing in Prague Stock Exchange (PSE) listings, Czech ETFs, or FX pairs like CZK/EUR or CZK/USD.

How Do I Open a CZK Account?

Setting up a CZK-denominated trading account is usually quick if the broker supports CZK as a base currency (I know I did it during our broker tests).

Here’s how to do it:

- Choose a CZK-Supporting Broker: Choose a broker that let you set CZK as your base account currency. Focus on fees for CZK accounts, funding/withdrawal methods, and local regulatory compliance, such as brokers authorized by the Czech National Bank (ČNB) or registered in the EU under MiFID II.

- Register and Verify Your Identity: Complete the account registration and provide KYC documentation, including proof of identity and residence (typical requirements in the Czech Republic and EU).

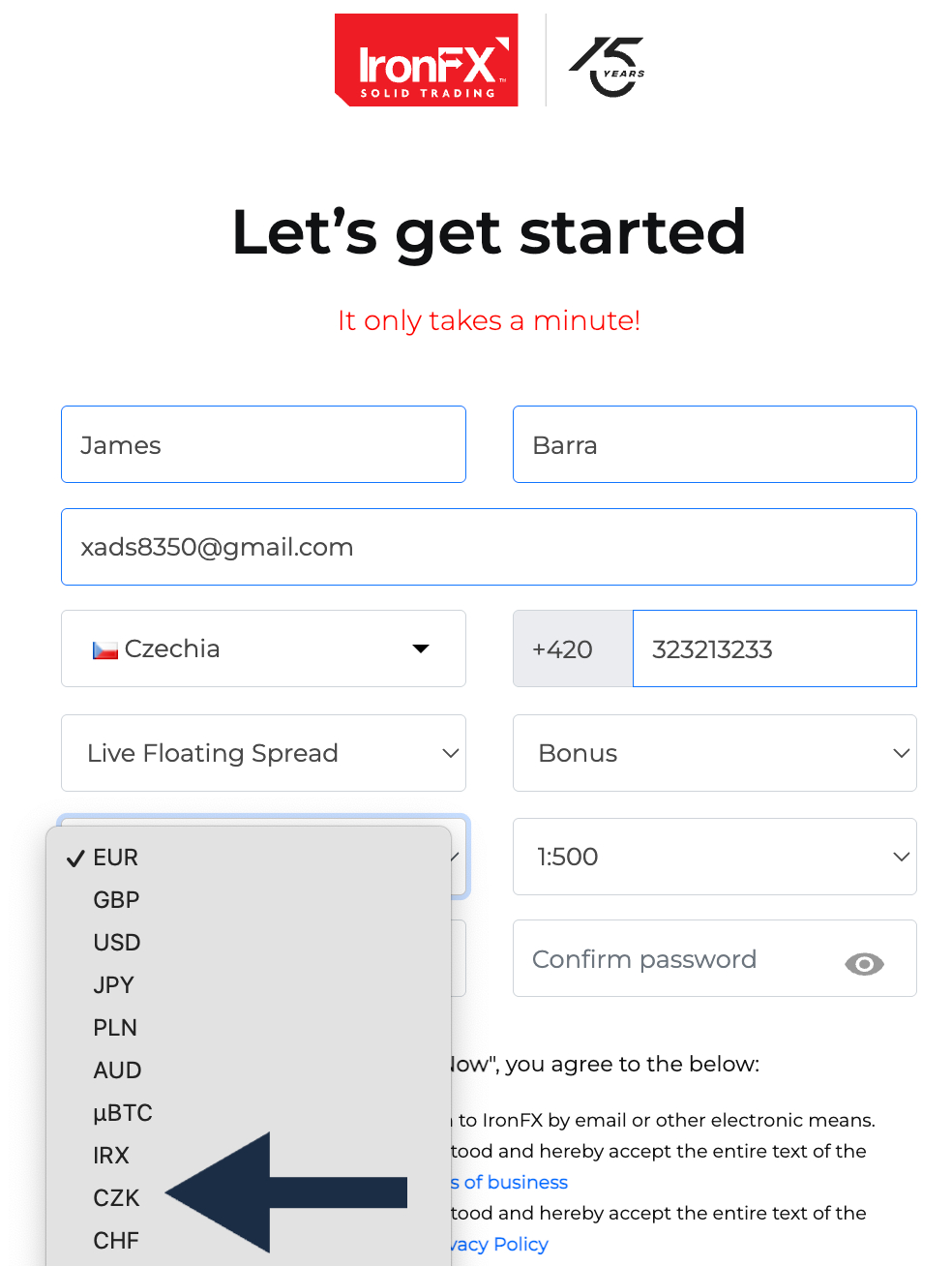

- Set CZK as Your Base Currency: During setup, select CZK to ensure your trading account is denominated in koruna.

- Fund with CZK: Use local bank transfers, SEPA, or supported e-wallets to deposit CZK directly, or convert another currency using the broker’s internal exchange (check conversion fees!).

- Start Trading: You can now trade Czech or international assets, while keeping all account activities in CZK, ideal for reducing your FX exposure.

Setting up a CZK trading account at IronFX

Should I Use a CZK Trading Account?

Based on our assessments of the best trading accounts, a CZK account could be a smart choice if:

- You Live in the Czech Republic: For Czech residents, it aligns naturally with local financial infrastructure and makes deposits/withdrawals seamless.

- You Trade CZK-Denominated Instruments: Ideal for exposure to Czech equities, koruna-denominated bonds, or FX pairs involving CZK, though these aren’t widely available in our experience.

- You Earn or Spend in CZK: Avoiding conversion into USD or EUR (most common trading account base currencies) minimizes exchange rate risk and transaction issues.

- You Want to Minimize FX Risk: A CZK account keeps your trading portfolio in sync with your home currency if you’re based in the Czech Republic, which is helpful for both personal budgeting and tax compliance.

What Are the Limitations of a CZK Trading Account?

Despite the advantages, there are a few limitations to consider:

- Limited Broker Support: Fewer global brokers support CZK-denominated accounts compared to EUR or USD from our analysis. You may need to choose between fewer providers or accept some trade-offs in features.

- FX Conversion When Trading Non-CZK Assets: If you invest in assets priced in USD, EUR, GBP, or other currencies, you may incur conversion fees or spread costs when trading or calculating returns.

- Lower Liquidity on Local Markets: Compared to global markets, Czech assets can have lower trading volumes, affecting spreads or order execution, a crucial consideration for active traders, notably day traders.

- Regulatory Access Issues: Post-Brexit and under EU law, some brokers serving EU clients (including Czech traders) may apply specific limitations or require additional verification for access to international products.