Best Brokers With PLN Accounts 2026

We test and list top brokers offering accounts with Polish złoty as the base currency, which helps to reduce conversion fees and optimize the experience for traders in Poland.

James Barra

Tobias Robinson

-

1Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.5 Crypto.com is a major name in cryptocurrency trading, designed to speed up the global shift to DeFi technologies. The exchange provides token lending, prepaid cards, NFTs, and more. Founded in Germany in 2016, it serves 150 million users. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.7 Founded in 2009, Vantage provides trading on over 1000 CFD products to more than 900,000 customers. Forex CFDs can be traded from 0.0 pips on the RAW account using TradingView, MT4 or MT5. Vantage is regulated by ASIC and keeps client funds separate. The company also offers a variety of social trading tools for those interested in copy trading. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.7 Founded in 2007, Axi is a forex and CFD broker regulated by multiple authorities. It has enhanced its trading experience by expanding stock offerings, upgrading the Axi Academy, and launching a copy trading app. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.4 Founded in 2006, FxPro is a reliable non-dealing desk (NDD) broker that offers trading on more than 2,100 markets to over 2 million clients globally. It has won over 100 industry awards for its favorable conditions for active traders.

Compare Brokers With PLN Accounts

Broker Details Comparison

Safety Comparison

Compare how safe the Best Brokers With PLN Accounts 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Brokers With PLN Accounts 2026.

Comparison for Beginners

Compare how suitable the Best Brokers With PLN Accounts 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Brokers With PLN Accounts 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Brokers With PLN Accounts 2026.

Detailed Rating Comparison

Compare how we rated the Best Brokers With PLN Accounts 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Brokers With PLN Accounts 2026.

Broker Popularity

See how popular the Best Brokers With PLN Accounts [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Crypto.com |

|

| Vantage |

|

| FxPro |

|

| FOREX.com |

|

| Axi |

|

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

Cons

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

- FOREX.com has expanded their trading offerings, but these remain limited to forex and CFDs. Unfortunately, they don't provide options to invest in actual stocks, ETFs, or cryptocurrencies.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

Why Trade With Crypto.com?

Crypto.com is ideal for new crypto traders looking to buy, sell, and trade over 400 digital tokens. Its strike options and prediction markets cover financial, economic, election, sport, and cultural events. As a CFTC-regulated platform, it provides a secure choice for US traders interested in binary-style contracts using an easy-to-use app.

Pros

- Crypto.com has expanded in some regions, now offering over 5000 stocks and ETFs for traders seeking diverse portfolios and opportunities in various sectors.

- The Crypto.com Exchange platform provides advanced bots like Dollar Cost Averaging (DCA), Time-Weighted Average Price (TWAP), and Grid Trading bots. Traders can automate strategies, including leveraged perpetual trades, reducing manual work and slippage.

- The platform offers unified tracking for cryptocurrencies, stocks, ETFs, and prediction markets within one interface, making multi-asset management simpler and providing combined insights.

Cons

- Customer support mainly uses chatbots and email, with limited reliable phone support from our testing. This may cause delays in solving urgent issues like account access or transaction problems, which can be frustrating for crypto traders needing quick help.

- The app has high bid-ask spreads on many coins, which can be expensive for traders using market orders. Wide spreads mean the buying price is significantly higher than the selling price, reducing profits, especially in low-volume trades.

- Fees apply to crypto and fiat withdrawals, which can be significant for active traders making smaller transfers. The minimum withdrawal limits are also high, limiting flexibility in managing smaller portfolios or immediate liquidity needs.

Why Trade With Vantage?

Vantage is a solid choice for CFD traders looking for a strictly-controlled broker that offers the dependable MetaTrader platforms. The registration process is swift and there’s a $50 minimum deposit, making it easy for traders to start quickly.

Pros

- Hedging and scalping are allowed with no restrictions on short-term trading strategies.

- The broker has recently enhanced its CFD offerings, enabling more trading opportunities.

- There's a great suite of trading software available, including the acclaimed platforms MT4 and MT5.

Cons

- To enjoy optimal trading conditions, a significant deposit of $10,000 is required. These conditions include a commission fee of $1.50 per side.

- Test results show that average transaction speeds of 100ms-250ms are slower than other trading options.

- Unfortunately, some customers may have to sign up with an offshore company, providing less regulation protection.

Why Trade With Axi?

Axi is an excellent choice for trading forex on the MetaTrader 4 platform. It offers over 70 currency pairs, the MT4 NextGen upgrade, and tight spreads from 0.2 pips with the Pro account.

Pros

- Advanced traders can now join the Axi Select funded trader program via the broker’s offshore entity, offering up to $1 million in funding with a 90% profit share.

- Axi provides an excellent MT4 experience, enhanced with the NextGen plug-in for advanced order management and analytics, featuring low execution latency of about 30ms.

- Axi's new copy trading app is intuitive, offering helpful filtering options to align strategies with individual risk preferences.

Cons

- Axi lags behind because it only provides MT4, while many competitors now offer MT5, cTrader, TradingView, and custom software for a smoother experience with better tools.

- Even after expanding its stock CFDs in US, UK, and EU markets, it is far less extensive than firms like BlackBull, which offer thousands of equities for diverse opportunities.

- Axi remains reliable, but recent issues with the ASIC and FMA require it to consistently ensure a secure environment while complying with licensing conditions.

Why Trade With FxPro?

FxPro is an excellent choice for traders, offering fast execution in under 12ms, competitive fees reduced in 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge.

Pros

- FxPro provides four reliable charting platforms, including the user-friendly FxPro Edge, which features over 50 indicators, 7 chart types, and 15 timeframes.

- FxPro's Wallet is a key feature that lets traders manage funds securely. By separating unused funds from active trading accounts, it offers extra protection and convenience.

- FxPro uses a 'No Dealing Desk' (NDD) model, providing fast and clear order execution, often under 12 milliseconds, suitable for short-term trading strategies.

Cons

- FxPro offers customer support 24/5 via multiple channels, performing well in tests, but it lacks 24/7 availability, which might be a drawback for traders needing help outside regular market hours.

- Despite having a growing Knowledge Hub and a $10M demo account, FxPro is mainly for advanced traders, and beginners might find the account and fee structure complicated.

- There are no passive investment tools like copy trading or interest on cash. While traders may not miss these features, competitors like eToro offer more options for both active and passive investors.

Filters

Methodology

To identify the best brokers offering PLN-denominated accounts, we turned to our continuously updated database, which encompasses hundreds of online brokers.

We focused on platforms that allow clients to deposit, withdraw, and trade in Polish złoty (PLN).

Rankings were determined based on their overall ratings, derived from our deep-dive into 200+ metrics. These included fees, platform functionality, regulatory compliance, and ease of access for Polish traders, supported by hands-on testing feedback.

What Is a PLN Account?

A PLN account is a trading account where all transactions, profits, and losses are recorded in Polish zloty.

As the official currency of Poland and one of the most actively traded currencies in Central Europe, PLN accounts are particularly useful for Polish traders who want to avoid unnecessary conversion fees.

Despite Poland being a major European economy, not all brokers support PLN accounts – less than 10% of firms we’ve evaluated.

Our research indicates that most international brokers primarily offer accounts in USD or EUR, meaning finding a PLN-denominated option requires careful selection.

PLN accounts provide several distinct advantages:

- Avoiding Currency Conversion Costs: If you live in Poland and use PLN for daily transactions, a PLN trading account eliminates conversion fees when depositing funds or withdrawing profits.

- Mitigating FX Volatility: A PLN-denominated account protects Polish traders from exchange rate fluctuations when dealing with domestic investments and financial obligations.

- Seamless Trading of Polish Assets: Having a PLN account simplifies trading in Polish stocks, bonds, ETFs, and other financial instruments listed on the Warsaw Stock Exchange (GPW).

How Do I Open a PLN Account?

Opening a PLN trading account requires selecting a broker that supports zloty-denominated transactions. Here are the key steps:

- Choose a Broker: Select a broker offering PLN as a base currency option. Consider factors such as fees, platform usability, available Polish assets, and whether the broker is regulated by Poland’s Financial Supervision Authority (KNF).

- Register an Account: Complete the broker’s onboarding process, which typically requires proof of identity and address verification in compliance with Polish and EU regulations.

- Select PLN as Your Base Currency: During account setup, choose PLN as your preferred account currency to ensure seamless transactions in Polish zloty.

- Fund Your Account: Deposit funds in PLN via local bank transfers, BLIK payments, or other available payment methods. Some brokers may allow funding in other currencies with automatic conversion to PLN.

- Start Trading: Once your account is funded, you can begin trading Polish and international financial assets without additional currency conversion fees.

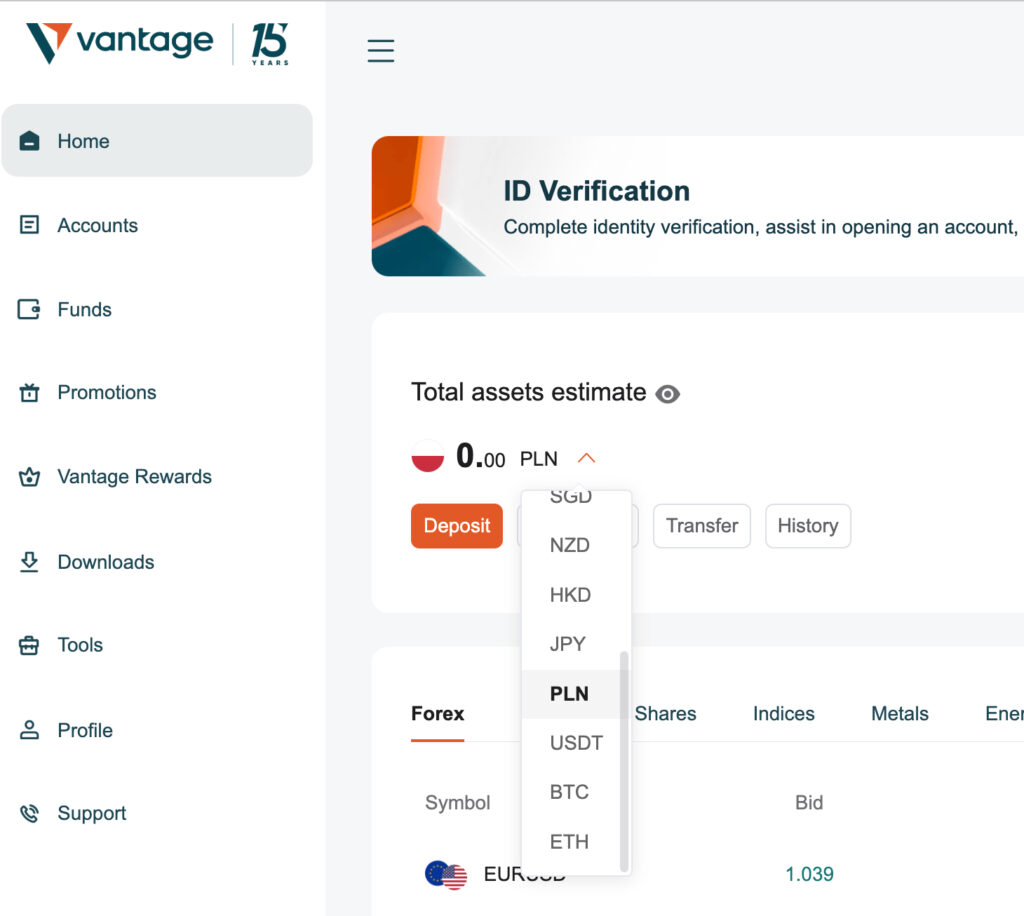

For example, below is an instance where I set up a PLN trading account at Vantage.

Configuring a PLN-based trading account at Vantage

Should I Use a PLN Trading Account?

Based on our examinations of the best trading accounts, a PLN trading account may be ideal for you if the following apply:

- You Live in Poland: A PLN account aligns with your domestic currency, making deposits, withdrawals, and tax reporting much simpler.

- You Trade Polish Stocks and ETFs: If you invest in companies listed on the Warsaw Stock Exchange (GPW) or trade Polish bonds and ETFs, using a PLN account eliminates conversion fees.

- You Want to Hedge Against Currency Fluctuations: If your expenses, income, or financial commitments are in PLN, holding a PLN-denominated account minimizes exchange rate risks.

- You Use Polish Payment Methods: Brokers that support PLN accounts often integrate local banking options such as BLIK and Przelewy24, offering faster and cheaper transactions.

What Are the Limitations of a PLN Trading Account?

- Limited Broker Availability: While PLN is widely used in Poland, many international brokers still do not offer PLN as a base currency, limiting your choice of platforms.

- Higher Costs for Non-PLN Assets: If you trade global instruments denominated in USD, EUR, or GBP, you may face conversion fees, adding an extra layer of costs.

- Currency Volatility: While the zloty is stable relative to other emerging market currencies, it can still experience fluctuations against major currencies, impacting returns on foreign investments.

- Less Liquidity for International Trading: Compared to USD and EUR accounts, PLN accounts may have fewer trading pairs and slightly wider spreads when trading forex and global assets.

- Banking and Withdrawal Limitations: Some brokers may impose additional withdrawal fees or have fewer international banking options for PLN-denominated accounts.