Best Financial Supervision Authority (KNF) Regulated Brokers 2026

We’ve personally tested and ranked the top brokers regulated by the Financial Supervision Authority (KNF) in Poland, ensuring high standards of trust and reliability.

-

1Founded in 2002 in Poland, XTB now serves over 1 million clients. This forex and CFD broker offers a regulated trading environment with a wide range of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with excellent tools for aspiring traders.

Compare the Best KNF-Regulated Brokers

Safety Comparison

Compare how safe the Best Financial Supervision Authority (KNF) Regulated Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Financial Supervision Authority (KNF) Regulated Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Financial Supervision Authority (KNF) Regulated Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Financial Supervision Authority (KNF) Regulated Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Financial Supervision Authority (KNF) Regulated Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Financial Supervision Authority (KNF) Regulated Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Financial Supervision Authority (KNF) Regulated Brokers 2026.

Broker Popularity

See how popular the Best Financial Supervision Authority (KNF) Regulated Brokers [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| XTB |

|

Why Trade With XTB?

XTB is an excellent option for new traders due to its xStation platform, low trading costs, no minimum deposit, and outstanding educational tools, many of which are integrated into the platform.

Pros

- XTB provides an extensive set of educational resources such as training videos and articles on its platform, making it suitable for traders of all skill levels.

- XTB offers a wide range of instruments, including CFDs on stocks, indices, ETFs, raw materials, forex, crypto, real stocks, real ETFs, share dealing, and investment plans, catering to both short-term traders and long-term investors.

- Great customer support 24/5, including a live chat service. During tests, responses were typically provided in less than two minutes.

Cons

- The demo account ends in four weeks. This is a limit for traders wanting to fully explore the xStation platform and try out strategies before using actual money.

- XTB has stopped supporting MT4, making traders use its own platform, xStation. This could discourage advanced traders who are accustomed to the MetaTrader suite.

- XTB's research tools are decent but could be improved by expanding beyond their own features to include top external tools like Autochartist, Trading Central, and TipRanks.

Filters

How BrokerListings.com Selected the Top KNF Brokers

To highlight the most reliable brokers overseen by the KNF (Komisja Nadzoru Finansowego) – Poland’s financial supervisory authority – we applied a three-stage review process:

- Regulatory Screening: Verified each broker’s authorization with the KNF register to confirm they meet Polish standards as well as EU-wide MiFID II obligations.

- Comprehensive Broker Analysis: Scored firms across 200+ performance factors, including order execution, fees, trading platforms, leverage policies, and client asset safeguards.

- Hands-on Testing: Conducted trading trials to measure the trading experience, from spreads and tools to funding speed and customer support quality.

What Is KNF?

Poland’s financial markets are safeguarded by the Komisja Nadzoru Finansowego (KNF). Established in 2006, the body is responsible for regulating the financial services industry, supervising the activities of market participants like online brokers, and initiating enforcement action when it identifies breaches of standards.

Known as the Polish Financial Supervision Authority in English, it operates in accordance with the Financial Market Supervision Act of 2006.

Furthermore, its principles and practices align with those of the European Securities and Markets Association (ESMA). This reflects Poland’s place in the European Economic Area (EEA), and the requirement for harmonized regulations across the region.

Both the KNF and ESMA are classified as Category A regulators under BrokerListings’ broker regulator classification system. As a result, traders and investors can expect strong protection against poor industry practices and bad brokers.

What Powers Does KNF Have?

The organization says that its supervisory remit “aims at ensuring its proper functioning, stability, security and transparency, trust [in] the financial market, and protection of the participants’ interests by providing reliable information on the market.”

Like most regulators, the KNF is tasked with issuing licenses to financial services companies including brokerages, banks, insurance companies and payment services providers.

In its supervisory capacity, it has the power to conduct on-site inspections, request documents and data, and to interview relevant individuals.

When it deems that rules have been broken, it can undertake a wide range of actions including:

- Demanding that entities implement corrective measures to address non-compliance issues.

- Imposing financial penalties on brokers.

- Revoking and suspending companies’ licenses.

- Removing members of a company’s management.

- Issuing public warnings about untrustworthy brokerages.

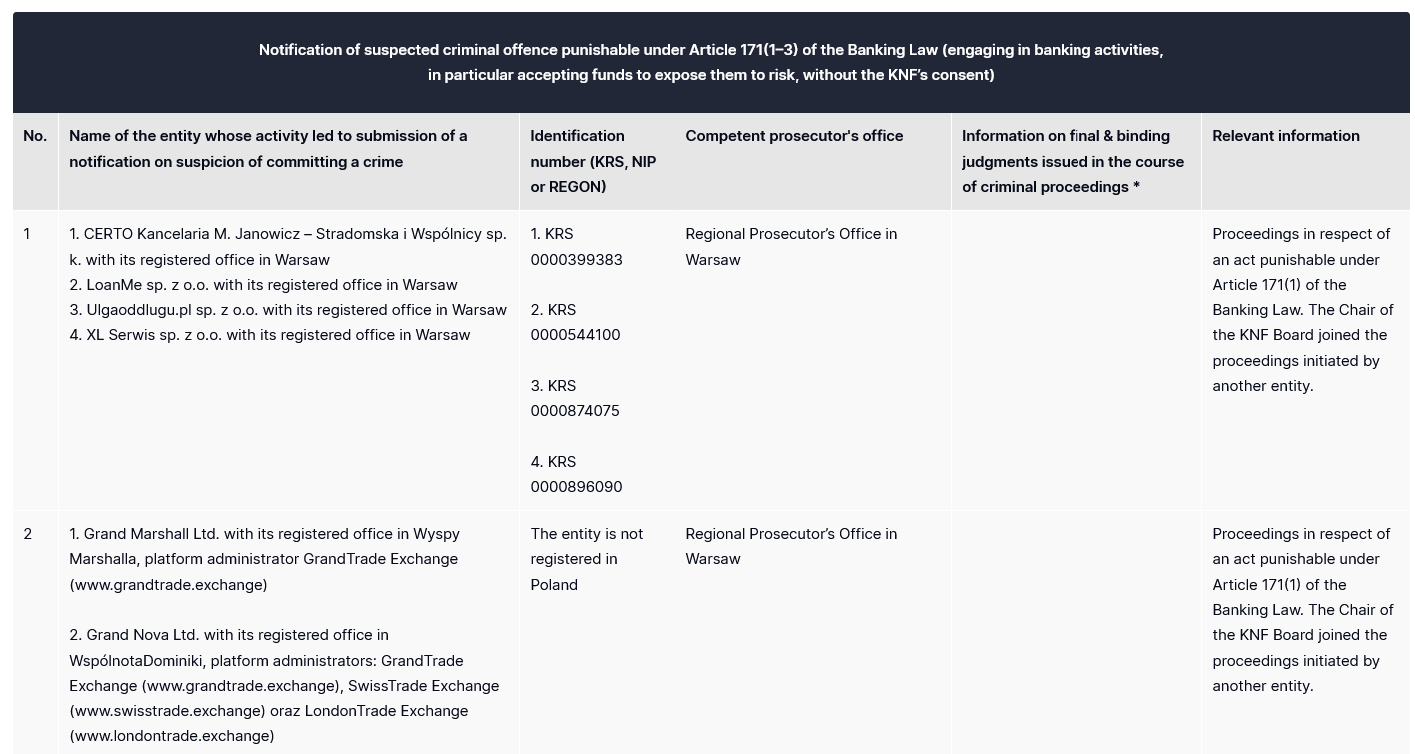

Pro tip: The KNF maintains a list of warnings on its website for companies suspected of a criminal offence, and entities subject to criminal proceedings in which the KNF or another ESMA-affiliated regulator is involved.

The KNF’s online warnings list. Source: KNF

In 2018, the KNF fined broker X-Trade Brokers (now known as XTB) 9.9 million Polish złoty (PLN) for rule breaches. It deemed that the company benefitted from differential slippage, in which its customers suffered losses from price slippage without receiving any benefits when price movements should have worked in their favor.

The actions took place between January 2014 and May 2015. An appeal by XTB was rejected by the Polish Supreme Administrative Court in 2023.

What Rules Must A KNF Broker Follow?

The KNF’s close relationship with ESMA means brokerages need to observe rules set out in the Markets in Financial Instruments Directive II (MiFID II).

To receive a license from Poland’s regulator, brokers offering trading services must adhere to a wide range of standards. These include:

- Targeting the best-possible trading result for clients. This is based on criteria including price, transaction charges and other costs, trade size and execution speed.

- Ensuring that all advertising material is clear, fair and not misleading.

- Disclosing the risks associated with online trading and specific financial instruments.

- Discussing and promoting products and services that are appropriate to the client. This will take into account an individual’s investing experience, tolerance of risk and other personal circumstances.

- Creating policies and procedures to detect, prevent, and manage conflicts of interest between the firm, its employees and its customers.

- Segregating the customer’s funds from those of the company to protect their assets in case of insolvency.

Establishing robust practices for record keeping. This is essential for KNF’s supervisory functions, and for the potential pursuit of enforcement action.

How Can I Check If A Brokerage Is KNF Regulated?

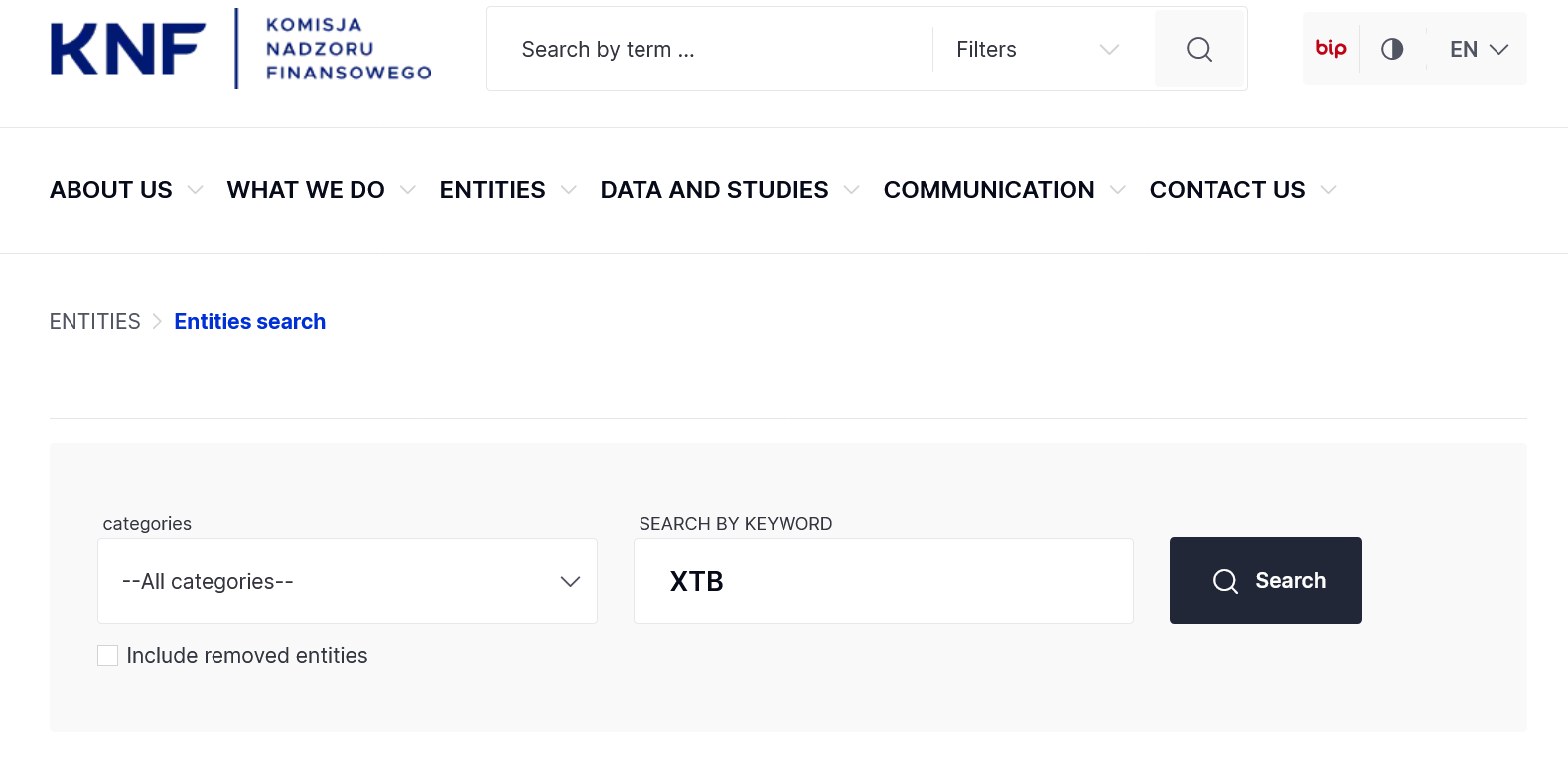

Verifying that a broker is KNF-approved is essential before handing over any money or personal details. Fortunately, this can be done simply and quickly using the regulator’s online Entities Search facility.

Let’s say I wish to check the regulatory status of XTB. I type the broker’s name into the search bar and hit the ‘Search’ button (as you can see I did below).

Typing XTB into the KNF’s search facility. Source: KNF

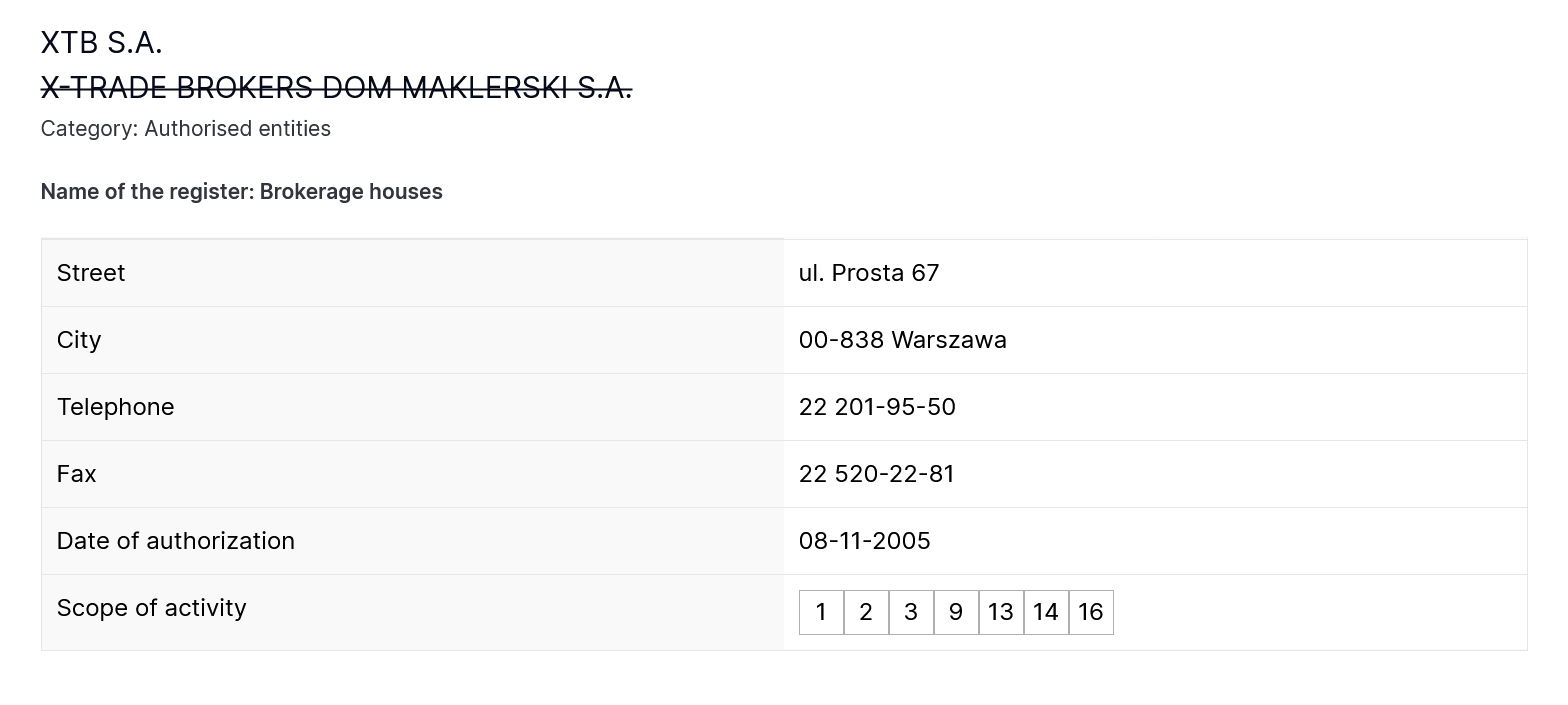

I am greeted with several options, but choose XTB’s entry under the ‘Brokerage houses’ tab, which is the most relevant category to me. Here I can see details including the company’s address, telephone numbers, and information on the activities it’s authorized to undertake.

XTB’s profile on the KNF Entities Search. Source: KNF

Pro tip: My search also reveals that XTB has operations in other EEA territories including Germany, France, Spain, Portugal, Czechia, Slovakia and Romania.

Under ‘passporting’ rules, financial services providers can operate in countries across the bloc, even if they only hold a license from one national regulator.

Bottom Line

Traders in Poland – as with those in any other regions – need to be constantly vigilant for fraudulent entities and individuals when they’re choosing a broker. Thanks to strong regulation and supervision from the KNF, investors who use officially licensed brokers can be confident that their interests are well safeguarded.

Article Sources

Komisja Nadzoru Finansowego (KNF)

What are the main sources of regulatory laws in your jurisdiction? – Baker McKenzie

European Securities and Markets Association (ESMA)

Polish Financial Supervision Authority (KNF) – KNF

Report on the Activities of the UKNF and the KNF in 2023 – KNF

List of the KNF’s public warnings – KNF

Polish Court Upholds XTB’s $2.2m Fine over Differential Slippage from 2018 – Finance Magnates

Markets in Financial Instruments Directive II (MiFID II) – ESMA