Best Brokers With PAMM Accounts 2026

We’ve tested and rated the best PAMM brokers for hands-free trading with expert management and profit-sharing for traders seeking passive income.

-

1

In recent tests, IC Markets’ PAMM accounts showed excellent execution speed and transparency. Investors could trade forex, indices, crypto, and commodities, with spreads from 0.0 pips and a commission of $6–$7 per lot. The system provides detailed performance tracking, flexible allocations, and easy-to-use manager controls, ideal for scalable strategies.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.9 In our tests, AvaTrade’s PAMM accounts stood out with a diverse range of assets, including forex, CFDs, and cryptocurrencies. The platform offers clear performance reports, flexible investment options, and robust customization for managers. It operates efficiently, with competitive spreads starting at about 0.9 pips per lot, improving trader control and transparency.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 In our review of Pepperstone’s PAMM accounts, they provided excellent execution speed and transparency. Investors could access a wide range of assets—forex, indices, crypto, and commodities—with account spreads from 0.0 pips and a $3.5 commission per lot. The system offers detailed performance tracking, flexible capital allocation, and easy integration for professional strategy management.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 When we evaluated Fusion Markets’ PAMM accounts, they stood out for their low commissions and tight spreads starting at 0.1 pips, along with wide access to forex and indices. The system provides transparent, real-time reporting and flexible management tools, enabling personalized strategies and straightforward administration for both investors and managers.

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.7 While testing BlackBull Markets’ PAMM accounts, we noted their impressive low spreads starting at 0.1 pips and real-time performance reports. The platform supports a wide variety of assets, such as forex, indices, and commodities. It offers flexible investor allocations and efficient administration, making it suitable for both new and experienced fund managers.

Compare The Best PAMM Account Brokers Across Key Features

We reviewed the leading PAMM brokers - here’s how they stack up across essential features for both investors and money managers:

How Safe Are The Top PAMM Brokers?

Fund security is crucial when your capital is pooled with others. See how the top PAMM brokers protect investor funds:

PAMM Account Access On Mobile

Need to monitor your PAMM investments on the go? Here’s how the top brokers perform when it comes to mobile platform functionality:

Are The Best PAMM Account Brokers Suitable for Beginners?

Thinking of investing in a PAMM account for the first time? Here’s how well our top brokers support new investors and first-time users:

Are The Best PAMM Accounts Brokers a Good Fit for Experienced Traders?

If you’re a money manager looking to grow AUM, here’s how our top PAMM brokers support professional-level traders:

Accounts Comparison

Compare the trading accounts offered by Best Brokers With PAMM Accounts 2026.

Detailed Ratings: Best PAMM Accounts

Explore how each leading PAMM broker scored across our independent rating system:

Compare Trading Fees

We analyzed fees and commissions to reveal which of our top PAMM brokers offer the best value:

Which PAMM Brokers Are Most Popular?

Want to invest through a broker trusted by other hands-free investors? These PAMM brokers are seeing the highest levels of client sign-ups:

| Broker | Popularity |

|---|---|

| Pepperstone |

|

| AvaTrade |

|

| IC Markets |

|

| Fusion Markets |

|

Why Trade With IC Markets?

IC Markets provides excellent prices, quick execution, and smooth deposits. The utilization of sophisticated charting platforms such as TradingView and the Raw Trader Plus account makes it a preferred choice for intermediate to advanced traders.

Pros

- IC Markets won DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its top-notch MetaTrader integration, perfected over years to enhance the platform experience.

- IC Markets, a well-regulated and respected broker, emphasizes client security and transparency for a trustworthy global trading experience.

- IC Markets provides fast and reliable 24/5 support for account and funding issues.

Cons

- Despite having four top-tier third-party platforms, there is no in-house software or trading app specifically designed for new traders.

- Some withdrawal methods require fees such as a $20 wire charge. This can reduce profits, particularly for traders who withdraw frequently.

- IC Markets have a selection of metals and cryptos for trading through CFDs, but their range is not as wide as brokers such as eToro. This may limit options for traders who are interested in these asset types.

Why Trade With AvaTrade?

AvaTrade provides traders with essential tools: an intuitive WebTrader, strong AvaProtect risk management, a quick 5-minute sign-up, and reliable support for fast-paced markets.

Pros

- The WebTrader performed well in our tests, featuring an easy-to-use interface for beginners and strong charting tools, including 6 chart layouts and over 60 technical indicators.

- Years later, AvaTrade is still among the few brokers with a custom risk management tool, AvaProtect, which insures losses up to $1M for a fee and is simple to use on the platform.

- AvaTrade introduced AvaFutures for low-margin global market access and expanded in 2025 by adding CME’s Micro Grain Futures. Later that year, they integrated with TradingView.

Cons

- The AvaSocial app is satisfactory but could be better. Its design, usability, and navigation between strategy providers and account management need improvement to compete with top platforms like eToro.

- AvaTrade’s WebTrader has improved, but it needs more customization as widgets like market watch and watchlists can't be hidden, moved, or resized.

- While the deposit process is smooth, AvaTrade doesn't support crypto payments, unlike TopFX, which caters to crypto-focused traders.

Why Trade With Pepperstone?

Pepperstone is a leading choice for trading with low spreads, quick execution, and advanced charting for experienced traders. New traders benefit from no minimum deposit, a wealth of educational resources, and 24/7 support. Operating under ASIC regulation, Pepperstone is a top option for Australian traders and won DayTrading.com's 'Best Aus Broker' award for 2025.

Pros

- Pepperstone is a low-cost broker, ideal for serious traders. The Razor account offers spreads from 0.0, with rebates up to 30% for indices and commodities, and $3 per lot for forex through the Active Trader program.

- Pepperstone has simplified deposits and withdrawals, adding Apple Pay and Google Pay in 2025, and PIX and SPEI for Brazilian and Mexican clients in 2024.

- Support for numerous top-charting platforms such as MT4, MT5, TradingView, and cTrader. These cater to different short-term trading styles, including algorithmic trading.

Cons

- Pepperstone's demo accounts last for 30 days. This might be insufficient for learning the various platforms and testing trading strategies.

- Pepperstone does not support cTrader Copy, a popular feature in the cTrader platform available at alternatives like IC Markets, though it has launched an intuitive copy trading app.

- Despite expanding its market range, crypto options are limited compared to other brokers in this area, and there is no option to invest in actual coins.

Why Trade With Fusion Markets?

Fusion Markets is a top choice for forex traders seeking competitive prices with near zero spreads, minimal commissions, and new TradingView integration. The company, based and regulated in Australia by the ASIC, is especially suitable for Australian traders.

Pros

- Fusion Markets provides superior support with quick and friendly responses during evaluations. There is no need to deal with annoying automated chatbots.

- The Market Buzz and Analyst Views features are useful tools for finding opportunities. They are easily accessible within the client dashboard.

- Execution speeds averaging 37 milliseconds significantly outpace many competitors, assisting traders in obtaining the best prices in quickly changing markets.

Cons

- The demo account lasts for 30 days, reducing its usefulness as a trading tool together with a real-money account.

- The broker provides a wide selection of currency pairs, surpassing most competitors. However, their alternative investment options are just average and offer no stock CFDs outside of the US.

- Non-Australian traders need to register with global entities that have less regulation, limited safety measures, and no protection against negative balances.

Why Trade With BlackBull?

After upgrading its trading infrastructure with Equinix servers in New York, London, and Tokyo to reduce latency for traders, BlackBull is a top choice for trading stock CFDs with ECN pricing.

Pros

- BlackBull has partnered with ZuluTrade and Myfxbook, enhanced its own CopyTrader, and enabled cTrader Copy, offering a comprehensive trading experience.

- BlackBulls’s research is excellent, particularly the daily ‘Trading Opportunities’ articles, which make complex market movements easy to understand and help traders capitalize on new trends.

- BlackBull's updated ECN Prime account is now better suited for new traders. It offers improved spreads averaging 0.16 on EUR/USD and has removed the previous $2,000 minimum deposit, making it more accessible with a $0 deposit.

Cons

- BlackBull doesn't have its own platform and uses MetaTrader, cTrader, and TradingView. Though these are excellent, other brokers' platforms, like eToro’s, often offer unique features for beginner traders.

- Despite having over 26,000 assets, including new Asia Pacific indices, the selection primarily consists of stocks, with an average range of currency pairs and indices.

- Unlike most top brokers, BlackBull charges a $5 withdrawal fee, which can reduce cost-effectiveness, especially for active traders who often transfer funds.

Filters

How BrokerListings.com Chose The Top PAMM Brokers

We selected the best PAMM brokers using over 200 data points, from execution speed and fund allocation mechanisms to transparency, and regulatory oversight.

Each broker was confirmed to support a true PAMM (Percent Allocation Management Module) setup, where profits and losses are distributed based on the investor’s share of the total pool.

This is distinct from MAM or LAMM models, which may offer more trader-side control but less clarity for passive investors.

What To Look For In a PAMM Broker

A PAMM account allows traders to manage pooled capital from multiple investors, with performance automatically distributed proportionally based on account size.

This structure is ideal for passive investors seeking expert-led exposure, and for traders looking to scale their strategies with outside capital – without manually managing multiple accounts.

When evaluating PAMM brokers, the key factors to consider are:

No Nasty Surprises: Account Opening Fees & Ongoing Costs

When you’re choosing a PAMM account provider, the last thing you want is to be hit with unexpected costs. We always start our evaluations of the best trading accounts by digging into the fine print around account opening charges and maintenance fees.

For us, a good PAMM setup should keep things simple — no charges just to open the account, no sneaky monthly “service” fees, and competitive trading costs overall.

We also keep a close eye on things like minimum deposits, inactivity fees, and whether you’ll face any charges just for moving your own or your clients’ money around. If there’s anything that puts friction in the way of building your PAMM strategy smoothly, we’ll flag it.

Top Pick for Cost-Friendly PAMM Accounts: FXCC takes the lead when it comes to low-cost PAMM account access. When we ran our test accounts through their system, we found zero opening fees and no ongoing account maintenance charges, which sets the tone for a straightforward and trader-friendly experience.

There’s also no minimum deposit requirement, which is a huge plus if you’re testing the waters or managing a small pool of investor funds. Trading conditions are tight too, with spreads from 0.0 pips on ECN (Electronic Communication Network) accounts and competitive commissions.

Performance Transparency: Can You Track Real Results?

If you’re trusting a PAMM (Percentage Allocation Management Module) manager with your money — or managing others’ — you need crystal-clear performance data.

One of the first things we look for when testing PAMM brokers is how well they display trading history. We’re talking live stats, risk metrics, profit/loss breakdowns, and whether investors can view account performance in real time.

Too often, we see brokers offering limited transparency, or worse, relying on cherry-picked marketing claims with no data to back them up. For a PAMM account to be worth your time (and capital), the platform should offer investors a clean interface with access to live, verifiable performance data.

Ideally, we want to see:

- Daily/weekly/monthly returns

- Drawdown levels

- Equity curves

- Trade history, or at least trade frequency

- Open and closed trade P&L

- Number of active investors

- If a broker can’t give you that? Move on.

Top Pick for Transparent PAMM Tracking: When we tested Vantage for PAMM account transparency, we were impressed with the level of control and visibility they offer to both investors and money managers.

PAMM managers at Vantage can create public profiles with live performance stats, and investors can filter available strategies by return, drawdown, risk level, and time period. During our testing, the interface was smooth, fast, and — importantly — didn’t hide anything behind paywalls or vague dashboards.

We especially appreciate that investor accounts are updated in real-time, and profits or losses are reflected promptly. Vantage also gives money managers access to in-depth trade reporting tools, making it easy to share performance insights with clients and maintain trust over the long term.

Profit Sharing Made Simple: How Fees Are Split

The beauty of PAMM (Percentage Allocation Management Module) accounts is that they align interests — managers earn only when investors profit. B

ut not all fee structures are created equal. When we evaluate PAMM brokers, we look at how performance fees are handled, how transparent the split is, and whether investors know exactly what they’re being charged.

Key things to look out for:

- Is the performance fee percentage clear upfront?

- Is a high-water mark or profit hurdle in place to protect investors from being charged twice on the same profit?

- Are management fees or entry/exit fees included?

- Can investors see how and when fees are applied?

- We always prefer PAMM setups that let investors view all this in their dashboard — no guesswork, no surprises.

Top Pick for Fair Fee Structure: GO Markets offers one of the cleanest and most investor-friendly PAMM fee models we’ve tested. When we reviewed their setup, performance fees were fully transparent and clearly outlined before investors joined any strategy.

They also apply a high-water mark model, which ensures investors aren’t charged performance fees unless the account hits a new peak in profitability. That’s a big win for fairness and long-term trust.

GO Markets also allows money managers to set their terms within a flexible range, which is great if you want to customize fee tiers based on performance or client size. On the investor side, everything — including pending and paid fees — is visible inside the client dashboard.

Top-Notch Platforms: What Tools Are in Your Hands?

A good PAMM account is only as good as the platform it runs on. Whether you’re the manager executing trades or the investor checking performance, the tech behind the scenes needs to be fast, stable, and user-friendly.

We test how well the broker’s PAMM system integrates with popular platforms — especially MetaTrader 4 (MT4) and MetaTrader 5 (MT5) — and how smooth the experience is for both sides.

For managers, key features we look for include:

- Quick execution and order management

- Account grouping tools

- Lot and percentage-based allocation options

- Trade reporting and analytics

For investors, we want to see:

- Clean dashboards to monitor results

- Real-time performance data

- Easy deposit/withdrawal options

- Mobile and desktop access

It’s not just about what the platform can do — it’s about how easy and reliable it is to use it.

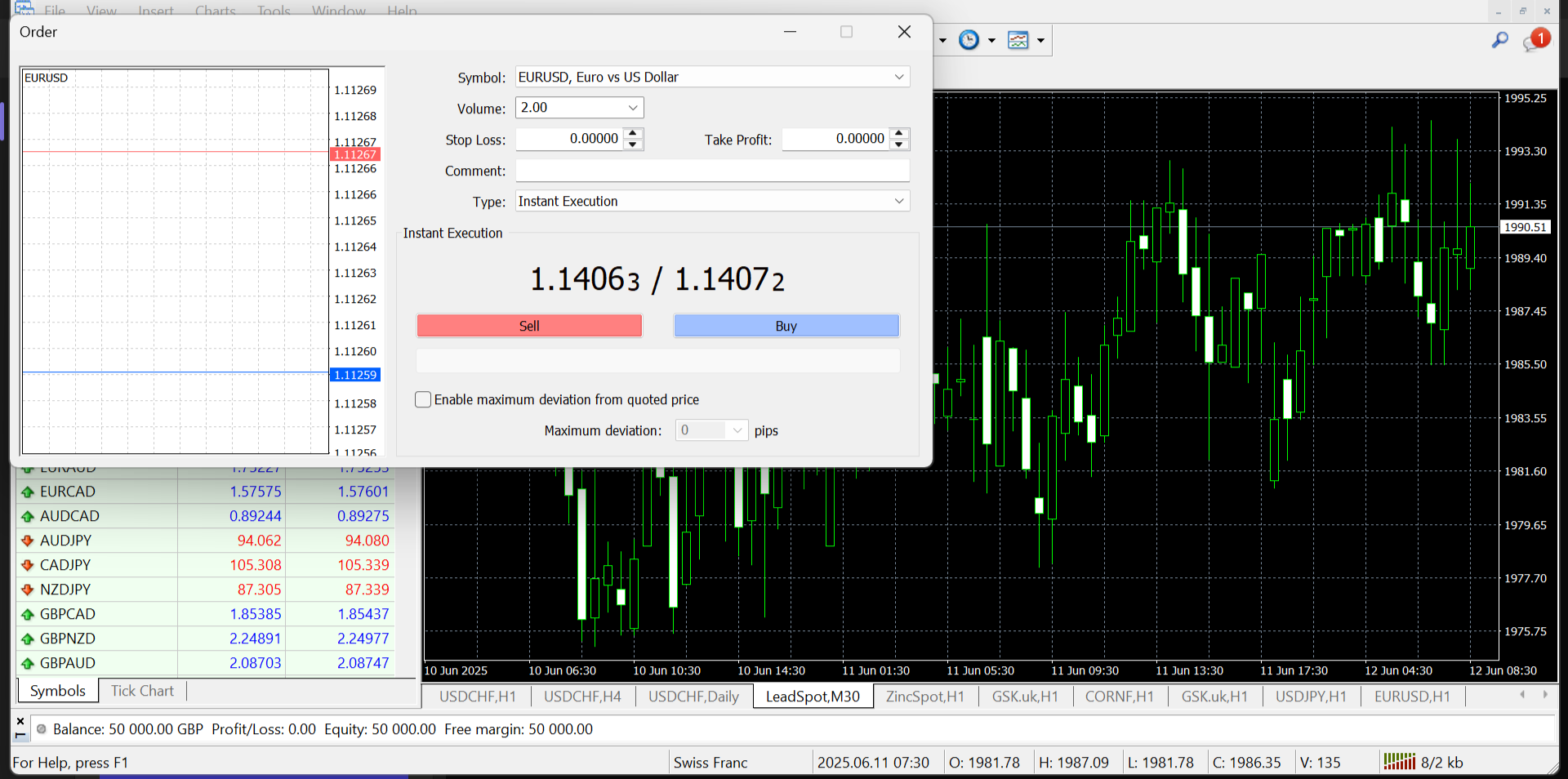

Top Pick for PAMM Platform Quality: IC Markets nails the tech side of PAMM trading. During our hands-on testing, their integration with MetaTrader 4 was seamless, and their proprietary PAMM dashboard provided a wealth of detail for both money managers and investors.

Execution speed was excellent — ideal for high-frequency or scalping strategies — and the allocation system handled trades with precision, even during volatile sessions.

We especially like how IC Markets provides managers with tools to automate allocations, monitor investor equity in real-time, and export reports directly from the interface.

For investors, the web portal and mobile apps provided fast access to live stats, and deposits were reflected quickly in the trading account. Whether you’re running the show or watching from the sidelines, the platform delivers.

IC Markets MT4 platform PAMM account

Regulation and Fund Protection: Is Your Money Safe?

No matter how strong the strategy or how slick the platform, none of it matters if your funds aren’t protected. Regulation is a non-negotiable in PAMM trading — it tells us the broker operates under proper oversight and follows rules that safeguard both managers and investors.

When we evaluate PAMM brokers, we look for:

- Licensing by top-tier financial regulators (like ASIC, FCA, CySEC)

- Segregated client accounts (your funds aren’t mixed with company funds)

- Transparent dispute resolution processes

- Investor compensation schemes (where applicable)

We also test how easy it is to verify the broker’s regulatory status. If we have to dig through 10 pages of their site to find a license number, that’s a red flag.

Top Pick for Trust and Oversight: Fusion Markets, regulated by the Australian Securities and Investments Commission (ASIC), gives us confidence when it comes to compliance and transparency. When we tested their PAMM service, we found their client fund segregation policies to be tight, and all regulatory credentials were easy to find and verify.

Fusion doesn’t just tick the boxes — they provide complete clarity on how client money is handled. All accounts are held in segregated trust accounts with top-tier Australian banks, and no shortcuts are taken when it comes to investor protection standards.

We also appreciate the transparency around their internal policies — including risk disclosures, execution practices, and complaint procedures — which were straightforward and easy to access.

Client Control: Can Investors Withdraw Anytime?

Flexibility matters. One of the key factors we evaluate when reviewing PAMM accounts is the level of control investors have over their funds. Can they join or exit a strategy whenever they want? Are there lock-in periods, withdrawal windows, or penalties for pulling out?

Some brokers give managers complete control over client access, which might suit specific fund structures, but isn’t ideal if you want investor confidence and long-term retention. We look for PAMM accounts that offer:

- Flexible entry and exit options

- No withdrawal lock-ups or blackout periods

- Real-time balance updates

- Clear terms on profit distribution and exit timing

For us, investor freedom is a sign of a well-structured, trustworthy PAMM offering.

Top Pick for Investor Flexibility: FXCC earns our top spot here thanks to how investor-friendly their PAMM setup is. When we put their system through its paces, we found that investors could enter and exit strategies with zero lock-in, no penalties, no awkward waiting periods, and no minimum holding time.

Funds are updated in real time, and the withdrawal process is fast and straightforward. This is especially useful for money managers who want to attract smaller investors or maintain fluid portfolios without worrying about delays in capital access.

FXCC’s transparency also extends to how profits are distributed — we liked how investors can track their earnings and know precisely when and how much they’ll be paid upon exiting a strategy.

Execution Speed and Spread Quality: What Are You Paying in Pips?

In PAMM trading, execution speed and trading costs can make or break your returns, especially if you’re running short-term strategies or scalping.

Here’s what we focus on:

- Average spread on EUR/USD and other key pairs

- Commission structure (if any)

- Execution time (especially during news spikes)

- Availability of ECN (Electronic Communication Network) accounts for better pricing

Top Pick for Speed and Spreads: IC Markets is one of the few PAMM brokers that consistently delivers institutional-grade execution, and our testing confirmed it. Their true ECN account offers spreads from 0.0 pips on major pairs, and even during peak volatility, our orders were filled quickly and with minimal slippage.

What sets IC Markets apart is its deep liquidity pool, which is ideal for PAMM managers executing high-volume strategies or managing multiple accounts simultaneously. They use Equinix servers (a global data centre standard), which means ultra-low latency and super-fast order routing.

During our tests, EUR/USD spreads often sat at 0.1 or 0.2 pips during London and New York sessions, with commissions that remained competitive and predictable.

Power Up Your PAMM: Manager Tools That Make Life Easy

If you’re running a PAMM account, having the right management tools isn’t just helpful — it’s essential. A top broker equips money managers with dashboards that simplify trade allocation, investor tracking, and reporting so you can focus on growing the portfolio, not wrestling with clunky spreadsheets.

When we put brokers to the test, here’s what stands out:

- Simple allocation by percentages

- Real-time equity and margin updates

- Detailed trade analytics and performance reports

- Built-in client communication features

- Automation for scaling and rebalancing

Strong tools here mean better risk management, smoother workflows, and happier investors — all crucial for building trust and scaling your PAMM.

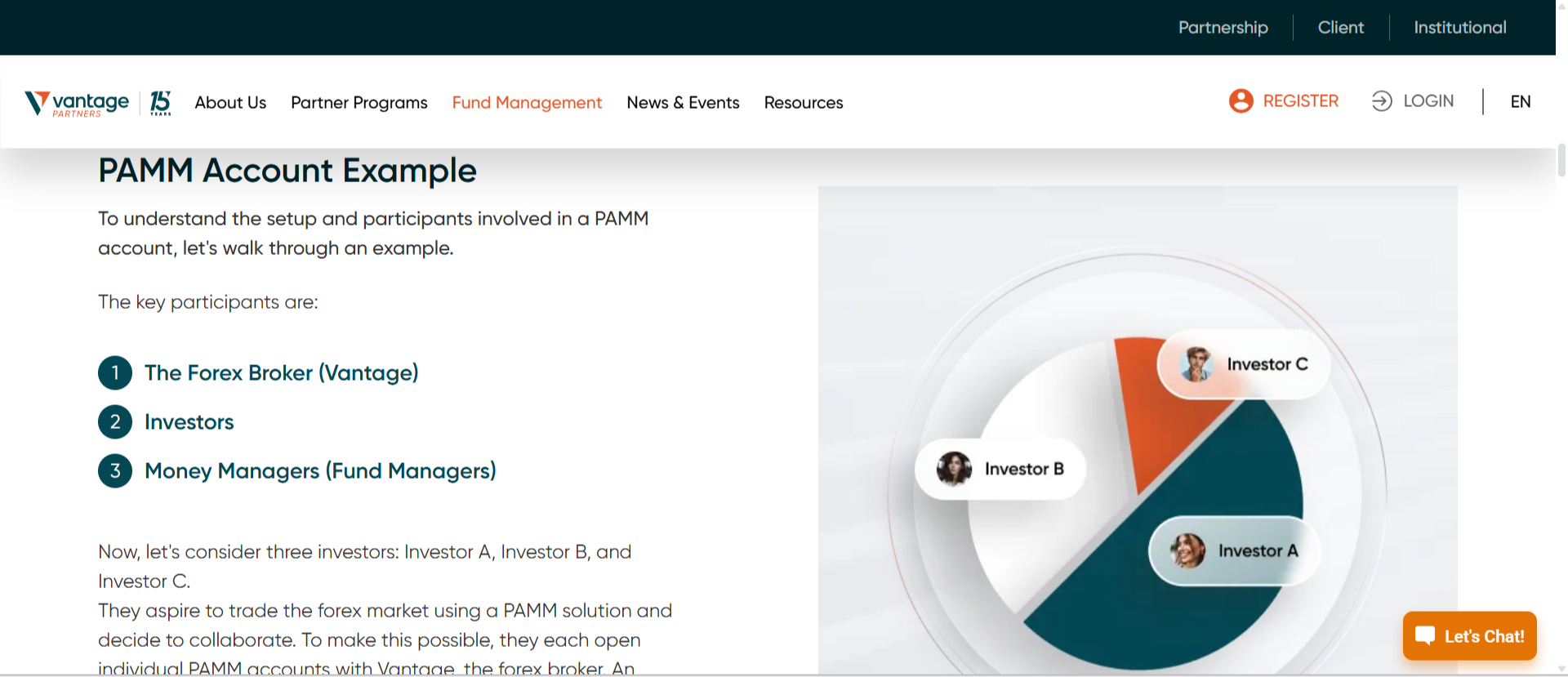

Top Pick for Manager Tools: Vantage nailed it with a sleek, user-friendly PAMM dashboard designed for professional money managers. From our hands-on tests, allocating trades and monitoring investor equity proved to be fast, clear, and intuitive.

They offer flexible allocation options, comprehensive trade-level analytics, and even automated trade distribution — perfect for managers handling multiple investors. Plus, Vantage’s integrated messaging helps managers keep communication flowing, boosting client confidence.

Vantage PAMM account management tools

Funding Freedom: Easy Deposits and Withdrawals for PAMM Investors

Nothing kills momentum faster than complicated funding or withdrawal processes. When we test PAMM brokers, one of our primary concerns is the ease with which investors can deposit funds into their PAMM accounts and, more importantly, withdraw profits without hassle.

Key points we check:

- Variety of deposit and withdrawal methods (bank transfer, credit card, e-wallets)

- Speed of processing transactions

- Clear minimum deposit and withdrawal amounts

- Transparent fees (or ideally, no fees) on funding operations

- How well the broker handles currency conversions if you trade across multiple currencies

Smooth, flexible funding means investors can get in and out quickly, boosting confidence and encouraging more participation.

Top Pick for Funding Flexibility: Fusion Markets excels when it comes to funding ease. During our tests, deposits and withdrawals were processed rapidly via multiple methods, including bank wire, credit/debit cards, and popular e-wallets.

There were no hidden fees on deposits, and withdrawals cleared faster than many other brokers we reviewed. Their minimum deposit is also investor-friendly, making it easy to get started or add funds.

Fusion Markets also supports multi-currency accounts, which helps investors avoid unnecessary currency conversion costs — a smart plus for international clients.