Best Managed Trading Accounts 2026

After putting dozens of brokers with managed trading accounts through their paces, these came out on top if you want intuitive, affordable, and efficient passive trading opportunities.

-

1

When evaluating IBKR’s managed account setup, we found excellent transparency with detailed reports, trade specifics, and compliance statements. Personalization was notable with flexible fee structures, allocation models, and risk controls. Administration tools were high-quality. Majors had spreads averaging 0.1–0.3 pips, and tiered commissions began at $2 per lot.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 In testing eToro’s managed account tools, transparency was excellent with real-time stats, risk scores, and portfolio breakdowns, making oversight easy. Reporting was intuitive and regularly updated. Personalization and customization were limited to trader selection. Spreads averaged 1 pip on major currencies with no admin fees or performance-based charges.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.0 Testing InstaTrade's managed account setup showed solid transparency with detailed trader performance, drawdowns, and history stats. Customization options offer flexible deposit terms and profit-sharing settings. Reports were timely and easy to understand. Administration tools functioned smoothly. Spreads averaged 1.2 pips on EUR/USD, with no hidden management fees.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 In our review of Exness’ Social Trading platform, we found clear transparency: investors easily accessed performance stats, drawdowns, and trade history. Customization was limited to strategy selection, but reporting was consistent and easy to use. Administration was efficient. Spreads averaged 0.3–0.5 pips on major currencies, with no extra commission for investors.

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 When testing IC Markets’ MAM solutions, we found extensive customization options for risk allocation, lot sizing, and strategies. Reporting was timely and detailed with high transparency. Administrative tools were strong. Spreads averaged 0.1–0.3 pips on major pairs, with a $3.5 commission per lot, suitable for precision-focused managers.

Compare The Best Managed Trading Account Brokers

We evaluated the top brokers offering managed accounts - here’s how they compare across the features that matter most:

How Safe Are The Top Managed Trading Accounts?

Your capital needs protection. Here’s how the leading brokers safeguard managed account funds:

Mobile Access to Managed Accounts

Want to stay connected to your managed investments while on the move? Here's how the top brokers perform on mobile platforms:

Are The Best Managed Accounts Suitable For Beginners?

New to trading or investing? Managed accounts can offer a great starting point - see how each broker supports first-time users:

Are The Best Managed Accounts Good For Experienced Investors?

Looking for professional-grade portfolio management? Here’s how the top brokers cater to sophisticated investors:

Accounts Comparison

Compare the trading accounts offered by Best Managed Trading Accounts 2026.

Detailed Ratings: Best Managed Accounts

See how each leading managed account provider scored across our independent broker rating system:

Compare Account Fees & Trading Costs

We broke down fees across the leading managed account brokers so you can find the best value:

Most Popular Brokers for Managed Trading Accounts

Looking to partner with a broker trusted by other hands-free investors? These managed account providers are seeing the highest client sign-ups:

| Broker | Popularity |

|---|---|

| InstaTrade |

|

| Interactive Brokers |

|

| eToro USA |

|

| Exness |

|

| IC Markets |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- Interactive Brokers has introduced ForecastTrader, a zero-commission service allowing users to trade yes/no Forecast Contracts on political, economic, and climate events. Contracts offer fixed $1 payouts, 24/6 market access, and a 3.83% APY on held positions.

- The TWS platform is designed for intermediate to advanced traders. It includes over 100 order types and a dependable real-time market data feed that rarely experiences downtime.

- IBKR provides a cost-effective platform for traders by offering low fees, narrow spreads, and clear pricing.

Cons

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

Why Trade With eToro USA?

eToro is a top choice for traders due to its top-notch social investing and copy trading services. The broker caters well to new traders with its low deposit requirement, commission-free trading, and user-friendly platform.

Pros

- eToro USA Securities is a reliable broker that's regulated by the SEC, part of FINRA, and a member of SIPC.

- Traders can use Smart Portfolios for a simpler approach, covering multiple sectors and markets like renewable energy and artificial intelligence.

- A free demo account enables new users and potential traders to test the broker without risk.

Cons

- Average fees can reduce the profits of traders.

- The exclusive terminal does not accommodate trading bots and lacks extra equity market analysis tools.

- There are fewer trading options available, including only stocks, ETFs, and cryptos, compared to competitors.

Why Trade With InstaTrade?

InstaTrade provides active trading on an extensive platform. It has a unique offering known as Fixed Income Structured Product (FISP), which allows for passive investment. Investors can potentially earn up to a 50% return within 6 months, provided certain conditions are fulfilled.

Pros

- InstaTrade promises returns using its structured passive trading solution (FISP), with applications processed within 24 hours.

- InstaTrade TV provides video interviews and insightful market information about stocks, cryptocurrencies, and more. It assists in identifying opportunities for quick trading.

- InstaTrade provides approximately 300 assets for investment. It particularly shines in the area of currency pairs, making it an excellent platform for experienced traders interested in volatile exotics.

Cons

- InstaTrade's website and client interfaces are quite complex which can be confusing for new traders. On the other hand, XTB offers a more straightforward and user-friendly trading experience.

- The advertising of FISP, specifically about its "profit guarantee" and "risk-free trading," creates unease.

- Profits in the FISP are guaranteed only if investors do not make over 50% profit and recruit other users, earning $4 for each dollar in compensation.

Why Trade With Exness?

Exness is an excellent choice for active forex traders aiming to reduce costs after lowering spreads, enhancing execution speeds, and offering trading on over 100 currency pairs with more than 40 account currencies.

Pros

- Wide variety of account types for all experience levels, including Cent, Pro, and the new Raw Spread, ideal for traders.

- Fast and reliable 24/7 multilingual customer support through phone, email, and live chat, validated by practical tests.

- Exness Terminal provides an easy experience for beginners with interactive charts, and creating watchlists is simple.

Cons

- Exness has increased its variety of CFDs and introduced a copy trading feature, but it still lacks real assets like ETFs, cryptocurrencies, or bonds.

- Besides a mediocre blog, educational resources are lacking, especially compared to category leaders like IG, which offer a more comprehensive trading journey for new traders.

- Retail trading services are not available in some areas, including the US, UK, and EU, making them less accessible compared to leading brokers like Interactive Brokers.

Why Trade With IC Markets?

IC Markets provides excellent prices, quick execution, and smooth deposits. The utilization of sophisticated charting platforms such as TradingView and the Raw Trader Plus account makes it a preferred choice for intermediate to advanced traders.

Pros

- IC Markets provides fast and reliable 24/5 support for account and funding issues.

- IC Markets, a well-regulated and respected broker, emphasizes client security and transparency for a trustworthy global trading experience.

- You can trade more than 2,250 CFDs in various markets, such as forex, commodities, indices, stocks, bonds, and cryptocurrencies. This range enables varied trading strategies.

Cons

- Interest is not earned on unused funds, a feature commonly available at other platforms such as Interactive Brokers.

- Some withdrawal methods require fees such as a $20 wire charge. This can reduce profits, particularly for traders who withdraw frequently.

- IC Markets have a selection of metals and cryptos for trading through CFDs, but their range is not as wide as brokers such as eToro. This may limit options for traders who are interested in these asset types.

Filters

How BrokerListings.com Ranked the Best Managed Account Brokers

We reviewed various brokers offering managed trading accounts and ranked the best using over 200 factors, including performance transparency, regulation, fee structures, and investor controls.

We also factored in our hands-on tests of the provider’s trading software so the user experience is captured in our rankings.

What to Look for in a Managed Trading Account

Managed accounts allow investors to delegate trading decisions to qualified professionals or algorithmic systems – ideal for those seeking market exposure without day-to-day involvement.

Whether you’re a beginner looking for a passive income stream, or an experienced investor seeking diversification through active strategies, a good managed account broker should offer:

Account Opening and Ongoing Fees

When you’re considering a managed account, one of the first things to check is how much it’s going to cost you to get started—and to keep things running.

Some brokers throw in hidden fees like monthly maintenance charges, high minimum deposits, or sneaky inactivity fees that can eat into your returns before you’ve even made a trade.

At our end, we’ve looked at what it costs to open, hold, and run a managed account across a variety of popular brokers’ platforms.

Top Pick for Low-Cost Entry: Fusion Markets came out on top when we tested for cost-efficiency. We love that they’ve kept the barriers low for managed account investors.

There are no account opening fees, no minimum deposit requirement for managed accounts, and no ongoing maintenance charges. That’s a massive win if you’re looking to get started without committing a large chunk of capital upfront.

The best trading accounts offer competitive pricing too—raw spreads starting from 0.0 pips and low commission per lot, which indirectly benefits you if your managed account manager is an active trader.

Trade Transparency and Oversight

Handing over the reins of your trading account doesn’t mean you should be left in the dark. One of the most important things to look for in a managed account is real trade visibility.

You should be able to see what’s being traded, when, and how it’s affecting your balance – even if you’re not the one placing the orders.

Based on our experience testing multiple brokers, the difference between good and bad is night and day. Some platforms make it challenging to understand what your manager is doing, while others lay it out clearly with live reporting, trade-by-trade details, and precise exposure tracking.

Whether you’re curious about your current open positions or want to dig into how your account has performed over the last month, transparent reporting gives you peace of mind and a chance to spot any red flags early on.

Top Pick for Transparency: IG stands out in this category because they don’t just give you access – they provide you with clarity. When we tested their managed account structure, we were impressed with how easily we could view individual trades, monitor the manager’s performance, and access daily reporting.

They’ve built their system around MyIG, a centralized client dashboard that’s intuitive and packed with real-time data. You can track your equity curve, review exposure by asset class, and even download detailed trade histories – all without needing to hunt through endless menus.

Strategy Transparency and Manager Track Record

A managed account is only as good as the person – or algorithm – behind it. So before you hand over capital, you’ll want to know what kind of strategy your account manager runs, how long they’ve been at it, and how they’ve performed under different market conditions.

We’ve looked closely at which brokers offer that level of disclosure upfront. Some give you vague descriptions and glossy numbers. Others let you dig deep into past drawdowns, risk settings, and even the win/loss breakdown of specific managers.

From our side, we always favor platforms that let you understand the strategy before you sign up, not after your account takes a hit.

Top Pick for Strategy Transparency: NordFX does a great job here. When we tested their managed account setup, we were impressed by how open they are with data. Every manager on their platform comes with a fully viewable performance history, including max drawdown, monthly returns, and risk rating.

They also show how long the manager has been active and how many clients are currently following them – key details that gave us confidence when evaluating options.

What stood out for us was the strategy description section, where managers are required to explain their trading approach, asset focus, and risk controls. You don’t have to guess whether they’re scalping, trend trading, or using high leverage – you can see it clearly before committing a cent.

Risk Controls and Drawdown Protection

Markets can move fast, and even the best strategies hit rough patches. That’s why a solid managed account should have built-in risk protections that stop things from spiraling out of control.

We look for brokers that let investors set custom stop-loss limits, provide automatic risk management tools, and offer real-time alerts when equity levels dip. These features don’t just protect your account—they help you sleep at night.

In our testing, we focused on how easy it is to set risk caps, monitor drawdowns, and react when things don’t go as planned.

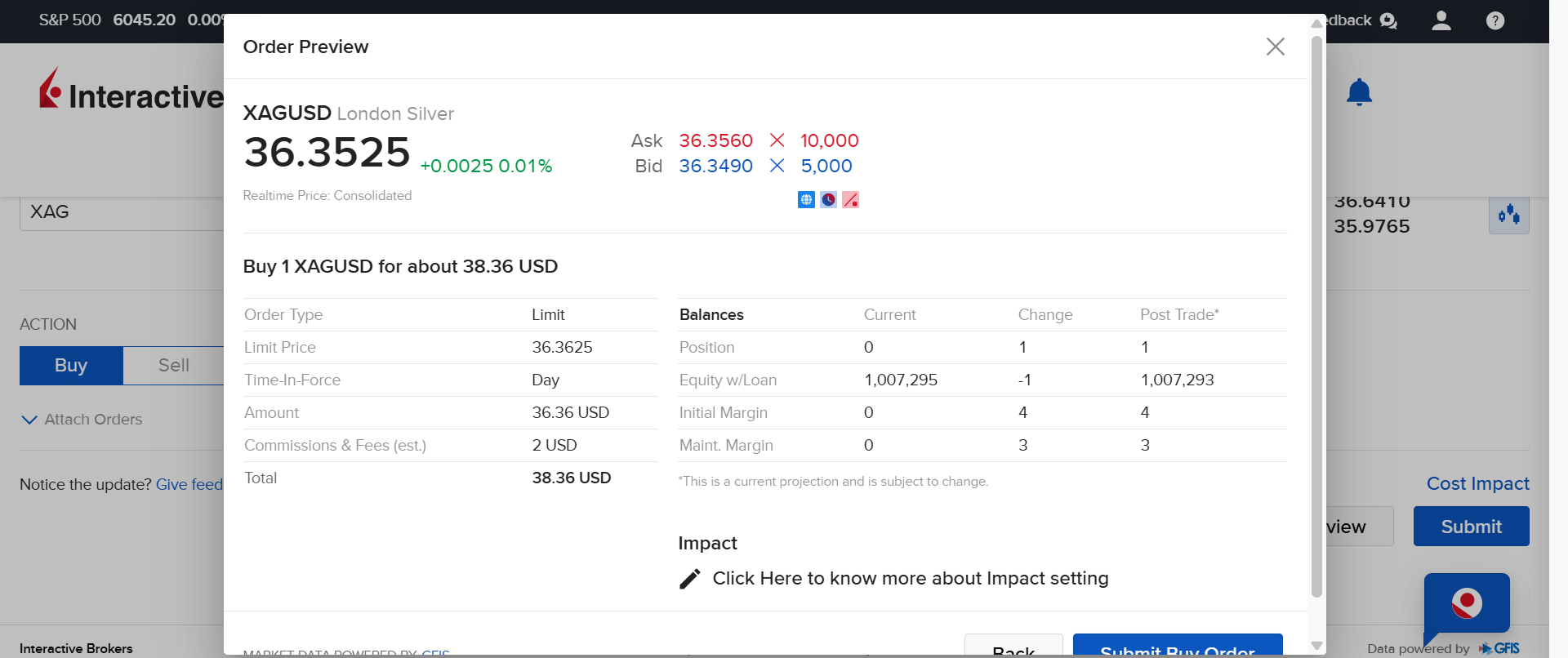

Top Pick for Risk Management: Interactive Brokers delivers one of the most robust setups we’ve tested when it comes to risk control. Their managed account infrastructure includes highly customizable tools that let you define your own maximum drawdown limits, set liquidation thresholds, and receive alerts if the account performance breaches preset boundaries.

What we liked during our evaluation was the ability to automate risk responses. For example, you can instruct the system to stop trading or close positions once your equity drops by a certain percentage.

Interactive Brokers also provides daily margin reports, stress tests, and real-time equity tracking, all through their powerful Trader Workstation platform. For those who don’t just want growth, but controlled growth, this level of oversight is worth its weight in gold.

Interactive Brokers order ticket for silver CFD contract

Regulation and Fund Security

Before you even look at returns or strategies, there’s a fundamental question to ask: How safe is your money with this broker?

A managed account means handing over control, so you want to make sure your funds are protected by strong regulatory oversight, proper segregation of client funds, and transparent operational practices. Without that, even the best-performing manager isn’t worth the risk.

We prioritize brokers that are regulated by top-tier authorities, and during our checks, we thoroughly examine their licensing, capital requirements, and how client money is handled.

Top Pick for Safety: IG sets the standard here. They’re regulated by the Financial Conduct Authority (FCA) in the UK, along with other top regulators like the Australian Securities and Investments Commission (ASIC) and the Monetary Authority of Singapore (MAS). That kind of global compliance gives us serious confidence.

When we tested IG’s managed account setup, we also confirmed that client funds are kept in segregated accounts, which means your money is never mixed with the broker’s capital. It’s protected even in the unlikely event that something goes wrong with the firm itself.

They also offer investor protection schemes in certain regions, like the FSCS in the UK, which can cover you up to a set limit if the broker fails.

Deposits, Withdrawals, and Exit Terms

Getting your money into a managed account should be simple. Getting it out should be just as easy. But not all brokers make that happen.

We check how fast deposits are processed, whether there are any withdrawal restrictions or lock-in periods, and what the exit terms look like if you decide to stop using a particular manager. Some platforms make you wait days – or worse, charge fees to access your own funds.

When we tested managed account providers, we paid close attention to how quickly we could fund an account, how seamless the withdrawal process was, and whether any fine print slowed things down.

Top Pick for Smooth Access: Fusion Markets impressed us here. During our evaluation, we found their deposit and withdrawal process to be fast, frictionless, and completely fee-free on their side. There’s no lock-in period, and you can exit a managed account at any time, with full control over how and when to pull your funds.

They accept a wide range of funding methods – including bank transfer, credit/debit cards, and e-wallets – and most withdrawals are processed within 24 hours. That responsiveness makes a big difference, especially if you’re managing cash flow or reacting to a change in market conditions.

Fusion also provides complete transparency on manager fees and exit conditions before you sign up, so you know exactly what to expect..

Platform Features and Integration

A managed account isn’t much good if it’s sitting inside a clunky, outdated platform. You want smooth navigation, fast execution, real-time performance tracking, and access to all the tools you’d expect as a hands-on trader – even if you’re not placing the trades yourself.

We put a lot of weight on how the platform feels during day-to-day use. That means we tested across desktop, web, and mobile, looked at the reporting dashboards, and paid attention to how easily we could find relevant account info.

Some brokers bury the good stuff in layers of menus. Others, like our pick here, make it all accessible with just a few clicks.

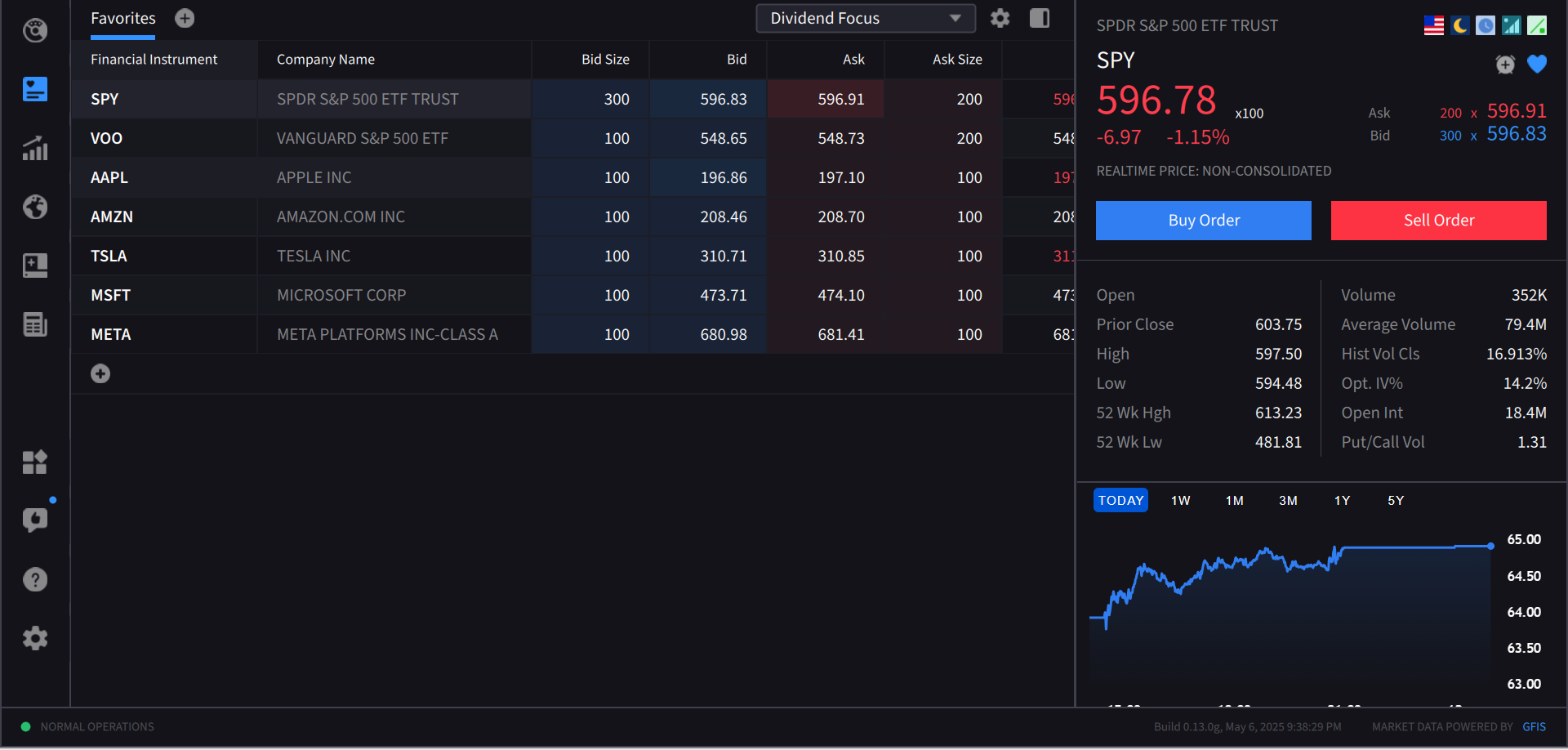

Top Pick for Powerful Platform Integration: Interactive Brokers offers one of the most sophisticated platforms we’ve seen for managed accounts. Their Trader Workstation (TWS) system is a powerhouse, packed with tools, charts, and custom reporting features that give you deep visibility into your account, even if a manager is handling the trades.

During our hands-on testing, we appreciated how seamless it was to track performance in real-time, run detailed reports, and manage account settings. It’s not just a passive experience—you’re still plugged in with complete transparency.

IBKR also supports managed accounts through its Advisor and Institutional portals, meaning there’s solid infrastructure backing every move. And for those who prefer mobile access, their app is fast, intuitive, and doesn’t cut corners on functionality.

Interactive Brokers desktop platform SPY chart

Performance Reporting and Fee Breakdown

One of the biggest red flags in a managed account is not knowing how your money is performing – or what it’s costing you to keep it invested.

We look for brokers that provide transparent and up-to-date performance reporting, including profit and loss statements, drawdowns, and returns on investment.

Just as important is fee transparency – you should know exactly how much you’re paying in performance fees, management fees, or volume-based costs.

When we tested different platforms, we examined how frequently performance data was updated, its level of detail, and whether any fees were hidden or difficult to track down.

Top Pick for Full Disclosure: NordFX impressed us again here. Each managed account includes a dedicated dashboard that updates performance metrics in real time. You can see monthly returns, cumulative gains, max drawdown, and more – all displayed in a clean, easy-to-read format.

On the fee side, NordFX doesn’t leave you guessing. Before you sign up with any manager, the whole fee structure is laid out: performance fees, success fee models, volume commissions – everything is disclosed upfront. There are no surprise deductions mid-month or vague “platform charges” you didn’t agree to.

Help When It Counts: Customer Support and Account Assistance

Even in a fully managed setup, questions come up. Whether it’s a query about performance, fees, or account settings, getting fast, helpful support can make or break your experience.

We always test the support ourselves – using live chat, phone, and email – to see how quickly someone responds, how knowledgeable they are, and whether they resolve the issue without just copying FAQ answers.

We also look for brokers that offer dedicated account managers or priority help for managed account clients.

Top Pick for Customer Support: IG stood out during our support tests. Their 24/5 live chat was responsive, and the team didn’t just provide surface-level answers – they understood the intricacies of managed accounts.

What we especially liked was the dedicated account support. Once we set up a managed account, we had access to a team that knew our setup, responded quickly, and followed up without us needing to chase. For investors running larger allocations, that level of personalisation makes a big difference.

Ready to Scale? High-Volume and Institutional Options

If you’re starting to think bigger, such as a six-figure portfolio – you’ll want a managed account provider that can handle larger sums without hiccups.

We looked for brokers with customized service tiers, dedicated account managers, and special terms for high-net-worth clients. It’s not just about bigger numbers – it’s about better pricing, priority support, and advanced reporting.

Top Pick for Big Investors: Interactive Brokers excels with its institutional-grade infrastructure, tailored specifically for high-volume traders and professional clients. Their managed account solutions include flexible commission structures, access to exclusive trading tools, and premium account servicing.

During our review, we noted how smoothly IBKR handles large deposits and withdrawals, without delays or extra fees. They also provide custom reporting and portfolio analytics designed for advanced investors who demand detailed insight.