Best DMA Brokers 2026

We tested brokers with Direct Market Access (DMA) and ranked the best options, providing transparency, tight spreads, and excellent market liquidity.

-

1

During our tests, Interactive Brokers provided institutional-grade DMA with excellent order book depth, fast execution, and minimal slippage, even in volatile markets. Commissions ranged by volume but averaged $2–$3 per lot. Its SmartRouting system ensured top-quality fills, making it perfect for high-frequency and professional traders who need precision and control.

-

2

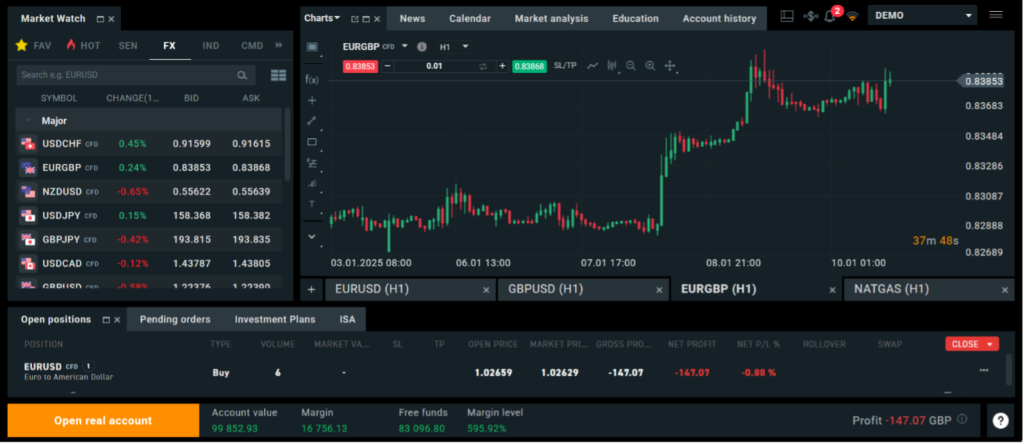

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 In our FOREX.com test, true DMA access was exclusive to their DMA account, not standard platforms. Execution was swift, offering full order book visibility and raw spreads with commissions starting at $6 per lot round turn. Suitable for professional, high-volume traders who value transparency and direct market interaction.

-

3

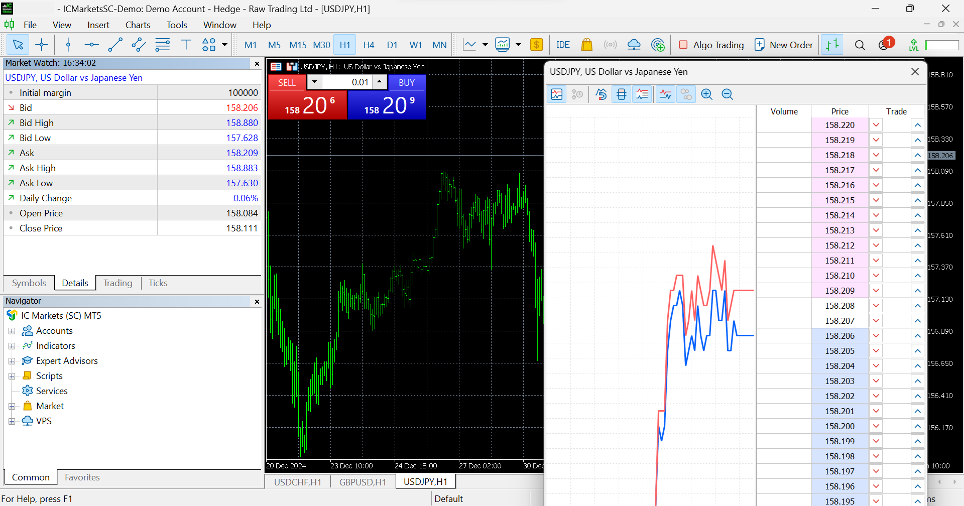

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 When we tested IC Markets' Raw Spread account, execution was seamless with tight 0.0 pip spreads, $3.50 per lot per side, and strong liquidity in major pairs. Orders filled quickly with minimal slippage, even during news events. Direct order book access offered high-volume traders excellent control and transparency.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 When testing Pepperstone’s DMA via cTrader, order book interaction was smooth with fast execution and low slippage, even in volatile conditions. Liquidity depth was impressive, with commissions averaging $3.50 per lot per side. It is cost-effective for high-volume traders needing speed, transparency, and accurate pricing.

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.7 LiteForex Europe offered DMA access through ECN accounts during our tests, enabling direct order book interaction with quick execution and moderate slippage. Commissions averaged $5 per lot round turn. The spreads were not the tightest, but the execution speed and pricing transparency made it suitable for mid- to high-volume traders looking for efficiency.

Top DMA Brokers Comparison

Broker Details Comparison

Safety Comparison

Compare how safe the Best DMA Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best DMA Brokers 2026.

Comparison for Beginners

Compare how suitable the Best DMA Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best DMA Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best DMA Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best DMA Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best DMA Brokers 2026.

Broker Popularity

See how popular the Best DMA Brokers 2026 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Interactive Brokers |

|

| Pepperstone |

|

| LiteForex Europe |

|

| FOREX.com |

|

| IC Markets |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- Interactive Brokers was named Best US Broker for 2025 by DayTrading.com for its dedication to US traders, ultra-low margin rates, and affordable global market access.

- IBKR is a highly regarded brokerage, regulated by prime authorities. This ensures the safety and reliability of your trading account.

- There's a large selection of free or paid research subscriptions available to all traders. If you subscribe to Toggle AI, you will also receive commission refunds from IBKR.

Cons

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

- The in-house Web Trader is a top platform for new traders, featuring a sleek design and over 80 technical indicators for market analysis.

Cons

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

Why Trade With IC Markets?

IC Markets provides excellent prices, quick execution, and smooth deposits. The utilization of sophisticated charting platforms such as TradingView and the Raw Trader Plus account makes it a preferred choice for intermediate to advanced traders.

Pros

- IC Markets won DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its top-notch MetaTrader integration, perfected over years to enhance the platform experience.

- You can trade more than 2,250 CFDs in various markets, such as forex, commodities, indices, stocks, bonds, and cryptocurrencies. This range enables varied trading strategies.

- IC Markets provides some of the smallest spreads in the industry, offering 0.0-pip spreads on major currency pairs. This makes trading particularly cost-efficient for traders.

Cons

- Despite having four top-tier third-party platforms, there is no in-house software or trading app specifically designed for new traders.

- Interest is not earned on unused funds, a feature commonly available at other platforms such as Interactive Brokers.

- Some withdrawal methods require fees such as a $20 wire charge. This can reduce profits, particularly for traders who withdraw frequently.

Why Trade With Pepperstone?

Pepperstone is a leading choice for trading with low spreads, quick execution, and advanced charting for experienced traders. New traders benefit from no minimum deposit, a wealth of educational resources, and 24/7 support. Operating under ASIC regulation, Pepperstone is a top option for Australian traders and won DayTrading.com's 'Best Aus Broker' award for 2025.

Pros

- Pepperstone has won several annual DayTrading.com awards, including 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner-up in 2025.

- Pepperstone now offers spread betting via TradingView, enabling tax-efficient trading with sophisticated analysis tools.

- Pepperstone provides impressive transaction completion speeds, averaging about 30ms. This allows for quick order processing and execution, making it suitable for traders.

Cons

- Despite expanding its market range, crypto options are limited compared to other brokers in this area, and there is no option to invest in actual coins.

- Pepperstone's demo accounts are available for 60 days, which might not be sufficient to fully learn the platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular feature in the cTrader platform available at alternatives like IC Markets, though it has launched an intuitive copy trading app.

Why Trade With LiteForex Europe?

LiteForex is a suitable choice for active traders due to its variable spreads starting from 0.0 pips, daily analysis and comprehensive training guides. Traders can also replicate the strategies of skilled traders through its forex copy system.

Pros

- LiteForex, a reputable trading firm regulated by CySEC, has been operating successfully for over 15 years.

- LiteForex's low $50 minimum deposit is suitable for beginner traders.

- Quickest ECN model with minimal spreads starting at 0.0 pips for trading.

Cons

- Trading in cryptocurrency is not available.

- Fees are relatively expensive. The Classic account has spreads starting at 2.0 pips, while the ECN account charges $10 forex commissions.

- The options for trading markets are more limited, as share CFDs are not available.

Filters

Methodology

We analyzed a wide range of brokers offering direct market access (DMA), considered over 200 data points, and assigned each broker an overall score.

Based on these ratings, we compiled a ranking of the top DMA forex and CFD brokers.

What To Look For in a Broker With DMA

Drawing on our years of testing DMA brokers and the best trading accounts on offer, these are the most important things to look out for when selecting a service provider:

Liquidity

A key feature of DMA trading is the deeper liquidity that it can provide.

Not only can this make for easy and swift trading, but a higher number of buyers and sellers also typically means better prices thanks to narrower bid and ask spreads.

Choose a broker that offers deep pools of liquidity and multiple markets. Saxo, for instance, utilizes over 25 top-tier liquidity pools to ensure optimal pricing.

Execution Speed

The ability to execute trades quickly is critical, especially for high-frequency short-term traders.

Search for fast brokers offering stable platforms that minimize the time delay (latency) between when an order is placed and when it’s executed in the marketplace.

Pepperstone, which introduced DMA trading, is seriously fast, with execution speeds averaging just 30ms.

Risk Management Tools

Effective risk management is an essential part of modern trading, particularly in fast-moving and volatile markets.

A failure to diligently handle this can cause you to miss out on potential profits or leave you nursing large losses.

Ensure that the broker you choose provides devices that allow you to manage risk. These can include take profit and stop loss instructions, tools which will automatically close my trade when an asset price rises or falls to a specified level, whichever happens first.

IG impressed during testing with its robust risk management tools, notably guaranteed stop loss orders.

Cost

The price of a DMA service can vary substantially from broker to broker based on our evaluations. This can be because of different bid and ask spreads, broker commissions and other fees.

The cost of DMA trading software, combined with the expense of obtaining Level 2 data, could cost you hundreds of dollars each year. So you need to consider how frequently you plan to trade, and whether paying for direct access is cost effective.

For example, IC Markets has long stood out for its excellent pricing in our tests, starting from 0.0 pips.

Leverage

The use of leverage (or lent funds from the broker) can be commonplace across active trading strategies.

Those planning to adopt this high-risk, high-reward practice should consider the amount of leverage on offer – this can differ considerably amongst brokers – as well as other margin requirements.

The amount of leverage on offer will depend on where you’re based and the market/s in which you’re trading. The use of borrowed funds is restricted or banned altogether in some regions to reduce trader risk.

FxPro offers high leverage reaching 1:1000 for some global clients, increasing returns but also the size of losses.

Platforms and Tools

Ensure that the broker offers a range of devices that aid swift and effective decision-making.

These can include advanced technical analysis tools, customizable order types, or sophisticated trading platforms like TradingView, which I love for its comprehensive features and ultra-sleek design.

Your broker may also provide additional resources like trading guides and demo accounts to help you get up to speed with the market.

For instance, XTB offers an easy access demo mode which is a great starting point for newer traders.

Regulation

Last – and certainly not least – make sure that the broker you choose is licenced to trade by a reputable financial authority.

Top-tier examples include the Financial Conduct Authority (FCA) in the UK, the Swiss Financial Market Supervisory Authority (FINMA), and the Japanese Financial Services Agency (JFSA).

Using an authorized company will help protect you from bad actors, and ensure that you enjoy a minimum standard of service when trading.

IG has long stood out as our most trusted DMA broker, with licenses from seven first-rate regulators. IG is also used personally by some of our team.

What is a DMA Broker?

A DMA broker allows you to deal directly in the market, in other words, to place buy and sell orders directly into say a stock exchange’s order book.

This real-time order execution can give traders an edge, particularly in fast-paced markets.

Pros and Cons of Using a DMA Broker

Pros

- More efficient trading. Direct access to the market gives you the opportunity to execute trades more quickly and simply. This is especially important for short-term traders and for fast-paced markets like forex.

- Superior pricing. You may be able to make greater profits thanks to tighter bid and ask spreads, though returns are never guaranteed and you need to watch out for hidden brokerage costs.

- Enhanced transparency. Full visibility of order books means traders can avoid hidden markups and costs. Furthermore, being able to see everyone else’s buy and sell instructions gives you a better idea of supply and demand, and therefore a clearer understanding of where to pitch your price.

- Price adjustment. DMA allows you to ‘test’ the price you wish to trade at, and to alter your buying and selling prices according to other bid and ask values in the order book.

Cons

- Added expense. The perks of direct access to the market can make it significantly more expensive than using the services of a traditional broker.

- Trading blackouts. Individuals may miss trading opportunities or book serious losses if their internet connection or trading platform breaks down. This is because not all DMA brokers accept telephone orders.

- Large minimum deposits. DMA brokers can require significant initial deposits that run into tens of thousands of dollars.