Best Brokers With AED Accounts 2026

Dig into our top brokers offering United Arab Emirates dirham (AED) accounts, based on thorough testing, designed to reduce conversion fees and optimize the experience for traders in the UAE.

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.5 Crypto.com is a major name in cryptocurrency trading, designed to speed up the global shift to DeFi technologies. The exchange provides token lending, prepaid cards, NFTs, and more. Founded in Germany in 2016, it serves 150 million users. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 Established in 2008, Exness is a respected broker known for offering over 40 account currencies, a wide choice of CFD instruments, and an intuitive web platform with features like currency converters and trading calculators. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.1 OKX, established in 2017, is a respected cryptocurrency firm offering a wide range of products, including trading and NFTs. Traders have access to over 400 crypto tokens through OTC trading and derivatives. With a strong web platform, developer tools, and advanced charts, OKX is a popular choice for technical traders. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Founded in 1996, Swissquote is a Swiss bank and broker offering online trading with three million products, including forex, CFDs, futures, options, and bonds. Known for its reliability, Swissquote has built a strong reputation with innovative trading solutions, such as being the first bank to offer crypto trading in 2017 and recently introducing fractional shares and the Invest Easy service.

Compare Top Brokers With AED Accounts

Broker Details Comparison

Safety Comparison

Compare how safe the Best Brokers With AED Accounts 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Brokers With AED Accounts 2026.

Comparison for Beginners

Compare how suitable the Best Brokers With AED Accounts 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Brokers With AED Accounts 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Brokers With AED Accounts 2026.

Detailed Rating Comparison

Compare how we rated the Best Brokers With AED Accounts 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Brokers With AED Accounts 2026.

Broker Popularity

See how popular the Best Brokers With AED Accounts [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Crypto.com |

|

| OKX |

|

| Interactive Brokers |

|

| Exness |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- IBKR provides a cost-effective platform for traders by offering low fees, narrow spreads, and clear pricing.

- Interactive Brokers was named Best US Broker for 2025 by DayTrading.com for its dedication to US traders, ultra-low margin rates, and affordable global market access.

- The TWS platform is designed for intermediate to advanced traders. It includes over 100 order types and a dependable real-time market data feed that rarely experiences downtime.

Cons

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

Why Trade With Crypto.com?

Crypto.com is ideal for new crypto traders looking to buy, sell, and trade over 400 digital tokens. Its strike options and prediction markets cover financial, economic, election, sport, and cultural events. As a CFTC-regulated platform, it provides a secure choice for US traders interested in binary-style contracts using an easy-to-use app.

Pros

- Crypto.com has expanded in some regions, now offering over 5000 stocks and ETFs for traders seeking diverse portfolios and opportunities in various sectors.

- The Crypto.com Exchange platform provides advanced bots like Dollar Cost Averaging (DCA), Time-Weighted Average Price (TWAP), and Grid Trading bots. Traders can automate strategies, including leveraged perpetual trades, reducing manual work and slippage.

- Crypto.com uses a cold wallet system with multi-signature technology and geographic distribution to improve security. This method ensures strong protection of user assets with secure offline storage.

Cons

- The app has high bid-ask spreads on many coins, which can be expensive for traders using market orders. Wide spreads mean the buying price is significantly higher than the selling price, reducing profits, especially in low-volume trades.

- Customer support mainly uses chatbots and email, with limited reliable phone support from our testing. This may cause delays in solving urgent issues like account access or transaction problems, which can be frustrating for crypto traders needing quick help.

- Fees apply to crypto and fiat withdrawals, which can be significant for active traders making smaller transfers. The minimum withdrawal limits are also high, limiting flexibility in managing smaller portfolios or immediate liquidity needs.

Why Trade With Exness?

Exness is an excellent choice for active forex traders aiming to reduce costs after lowering spreads, enhancing execution speeds, and offering trading on over 100 currency pairs with more than 40 account currencies.

Pros

- Wide variety of account types for all experience levels, including Cent, Pro, and the new Raw Spread, ideal for traders.

- Competitive spreads for USOIL and BTCUSD in 2024 start from 0 pips, with low commissions from $2 per side.

- Execution speeds now average under 25ms, providing ideal conditions for short-term traders.

Cons

- Besides a mediocre blog, educational resources are lacking, especially compared to category leaders like IG, which offer a more comprehensive trading journey for new traders.

- Retail trading services are not available in some areas, including the US, UK, and EU, making them less accessible compared to leading brokers like Interactive Brokers.

- Exness has increased its variety of CFDs and introduced a copy trading feature, but it still lacks real assets like ETFs, cryptocurrencies, or bonds.

Why Trade With OKX?

OKX is a preferred choice for traders seeking new cryptocurrencies and projects for investment. Traders can benefit from its copy trading feature and automated bots.

Pros

- In 2025, OKX obtained a MiFID II license, allowing it to offer regulated derivatives products in Europe, ensuring confidence.

- Active traders will experience competitive maker and taker fees, at 0.02% and 0.05% respectively.

- OKX, licensed by the Dubai Virtual Assets Regulatory Authority, enjoys a strong reputation among its 20 million worldwide clients.

Cons

- The company provides minimal regulatory supervision, a typical feature among crypto trading platforms.

- Customer support quality varied during testing.

- The broker's platform and features might be hard to understand for new traders.

Why Trade With Swissquote?

Swissquote is a great option for active traders seeking a customizable platform, like its CXFD that includes Autochartist for automated chart analysis to assist trading decisions. However, its average fees and high $1,000 minimum deposit may be less accessible for beginners.

Pros

- Swissquote offers advanced research tools such as Autochartist for technical analysis and real-time news integration from Dow Jones. Their proprietary Market Talk videos and Morning News reports provide daily expert analysis, which is attractive to active traders.

- Swissquote is highly trusted for being a bank, listed on the Swiss stock exchange, and authorized by FINMA in Switzerland, FCA in the UK, and CSSF in Luxembourg.

- Swissquote caters to fast trading strategies like scalping and high-frequency trading, offering 9ms average execution speeds, a 98% fill rate, and FIX API.

Cons

- Swissquote mainly serves professional and wealthy clients, requiring high minimum deposits like $1,000 for Standard accounts. This makes it less suitable for smaller traders, who might prefer brokers offering higher leverage and no minimum deposit.

- Unlike brokers like eToro, which offer social trading features, Swissquote lacks tools for community interaction or copying successful traders. This limits its appeal for those who value peer learning.

- Analysis indicates Swissquote has relatively high fees, with forex spreads starting at 1.3 pips on Standard accounts, whereas Pepperstone and IC Markets offer 0.0 pips. Transaction fees for non-Swiss stocks and ETFs can increase costs for frequent traders.

Filters

How BrokerListings.com Chose The Best Brokers For AED Accounts

To identify the best brokers offering United Arab Emirates dirham (AED) accounts, we drew on our constantly updated broker database, which tracks and compares hundreds of brokers and their trading platforms worldwide.

We focused on brokers that let traders deposit, withdraw, and operate their accounts in AED, paying special attention to how well these options suit those based in the United Arab Emirates or holding AED-denominated balances.

Rankings were based on performance across more than 200 criteria, covering everything from trading costs and funding flexibility to platform stability, product range, and the strength of regulatory oversight.

Our assessment also included direct, hands-on testing by our team of experienced traders to ensure the results reflect genuine performance.

What is an AED Account?

An AED account is a trading account where your base currency is set to United Arab Emirates dirham (AED). This means all deposits, withdrawals, and balance calculations are in dirham, which can be a significant advantage for traders who live in the UAE or regularly deal in this currency.

Using an AED account helps avoid unnecessary currency conversion costs, which can quickly add up if you’re funding your account from a UAE bank or receiving profits in dirham. It also makes it easier to track your performance without having to constantly convert figures into your local currency.

These accounts are offered by certain brokers who either operate in the UAE or cater to clients trading in the Gulf region. They’re especially popular with forex traders, but you can also use them for commodities, indices, and even cryptocurrency trading, depending on the broker’s range of instruments.

Should I Use an AED Trading Account?

For traders based in the United Arab Emirates or dealing regularly in United Arab Emirates dirham, an AED trading account can offer some significant advantages. Here are the main reasons it makes sense for certain traders:

- Avoid Extra Conversion Costs: With AED as your base currency, you won’t be charged for converting deposits and withdrawals from another currency. Over time, those savings can have a real impact on your overall returns.

- Simplified Account Management: When everything is shown in AED, it’s much easier to track profits, losses, and balances without having to constantly calculate exchange rates.

- Faster Transfers from Local Banks: Depositing and withdrawing via a UAE bank is usually quicker when the transaction stays in AED, often clearing the same day.

- Better Alignment with Local Economic Conditions: If your trading decisions are influenced by Gulf-region interest rates, oil prices, or UAE market data, keeping your account in AED ensures your base currency is aligned with your market environment.

- Reduced Exchange Rate Risk: Holding your funds in AED means you’re less exposed to unpredictable moves in other currencies when funding or cashing out your account.

- Access to Region-Specific Broker Services: Some brokers with AED accounts that we’ve used also provide Arabic-language support, regional payment methods, and offers tailored specifically for traders in the Middle East

What Are the Limitations of an AED Trading Account?

While an AED trading account can be an excellent fit for some traders, it’s not without its downsides. Here are a few potential drawbacks to keep in mind:

- Fewer Broker Choices: Compared to accounts in US dollars or euros, much fewer brokers offer AED as a base currency, which can limit your options for platforms, fees, and features.

- Possible Wider Spreads: Some brokers may apply slightly wider spreads on AED-denominated accounts, particularly if they don’t have deep local liquidity for specific markets.

- Limited Currency Pair Options: You may find fewer AED-based trading pairs compared to more widely traded currencies, which can restrict some forex strategies.

- Regional Regulatory Restrictions: If a broker is not licensed in the UAE, you may face limits on funding options, leverage, or available products when using an AED account.

- Potentially Higher Conversion Costs for Global Trades: If you’re trading in instruments priced in US dollars, euros, or other major currencies, your trades may involve conversions behind the scenes, which could increase costs.

- Slower Access When Trading Abroad: Funding or withdrawing in AED from outside the UAE can take longer, as transactions may require extra processing through international payment networks.

Five Steps to Opening an AED Account

- Compare Trusted Brokers: Start by looking at our list of regulated brokers that offer United Arab Emirates dirham as a base currency. Check their fees, platform features, funding methods, and our expert reviews to find one that matches your trading style.

- Complete the Registration Form: Once you’ve chosen a brokerage, open their online application. You’ll need to provide personal details, contact information, and sometimes your trading experience to meet regulatory requirements.

- Verify Your Identity: Brokers are required to confirm your identity under Know Your Customer rules. You’ll typically upload a valid passport or Emirates ID plus a recent proof of address, such as a utility bill or bank statement.

- Select AED as Your Base Currency: During the account setup, make sure to choose AED as your base currency. This ensures all deposits, withdrawals, and account balances are in dirham from day one.

- Fund Your Account and Start Trading: Transfer funds via your preferred payment method – often a UAE bank transfer, card payment, or regional e-wallet. Once cleared, you’re ready to place your first trade with an AED-denominated balance.

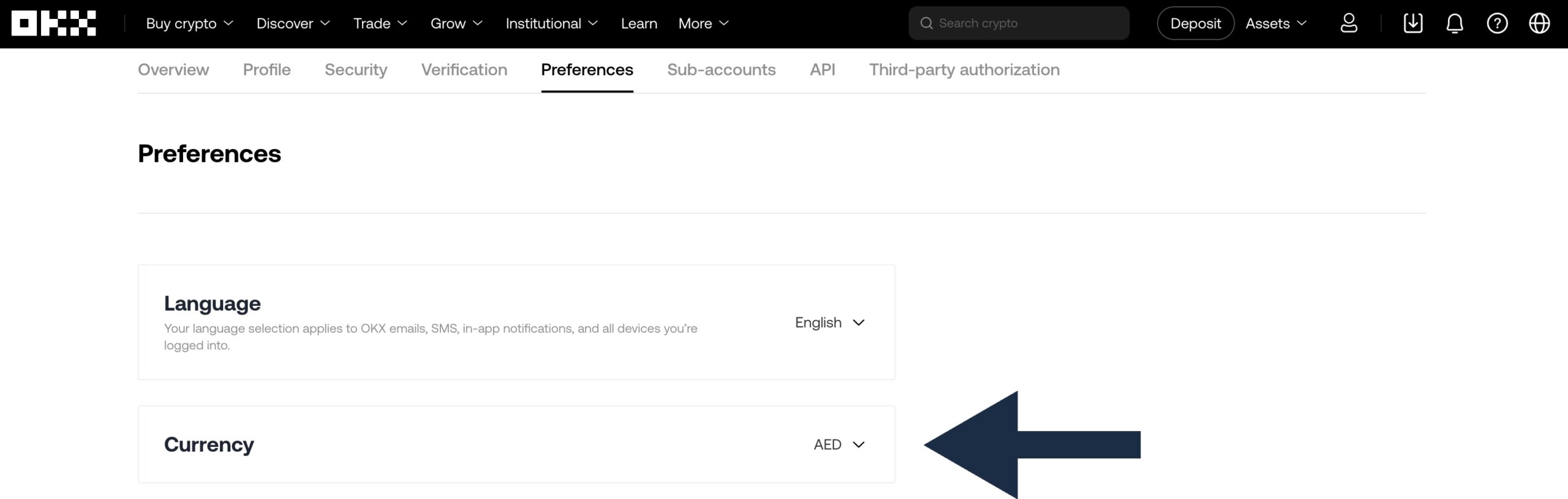

To show how simple it is, below you can see where I set up an AED trading account at OKX. It took me less than 10 minutes to provide the required information.

OKX AED account setup