Best Brokers With Micro Accounts 2026

Explore our top brokers offering micro accounts, perfect for minimizing risk and refining trading strategies. Ideal for beginners, these accounts allow small investments.

-

1

NinjaTrader offers trading with micro futures contracts like Micro E-mini S&P 500 and Nasdaq, with low margins from $50 and commissions starting at $0.09 per contract in our tests. Execution is fast, platforms are reliable, and no minimum deposit is required. Advanced charting, strategy testing, and simulated trading are available for all traders.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 When we tested it, OANDA US permitted trading with as little as 1 unit of currency, allowing micro-lot positions without rounding to 1,000 units. This flexibility, along with no minimum deposit, was ideal for low-capital traders. Spreads began at 0.6 pips on major pairs, and commissions were as low as $0.01 per trade.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 When we assessed FOREX.com, the $50 minimum and demo access made micro-lot trading easy to start. Execution on both the FOREX.com platform and MT4 was reliable, allowing us to explore currencies, indices, commodities, and cryptocurrencies cautiously.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.0 When testing InstaTrade's micro account, the $100 minimum and demo access provided a secure way to learn. MT4/MT5 were easy to use, and support responded promptly through chat and email. The core offerings—forex, indices, and commodities—allowed building confidence with small trades.

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 In our tests, Exness provided trading with micro-lots starting from a $1 deposit and notably tight spreads, beginning at about 0.1 pips on major FX (~$1 per standard lot), with no commissions. Execution was consistently fast and dependable. The absence of inactivity fees and no minimum balance requirement make it ideal for traders with limited capital.

Compare the Best Micro Account Brokers Across Key Features

We reviewed top brokers offering true micro accounts - here’s how they stack up on trade size flexibility and more:

How Safe Are the Top Micro Account Brokers?

Trading with a small balance still requires a safe platform. See how top micro account brokers handle fund protection:

Micro Account Trading on Mobile

Prefer to trade micro lots on the go? We tested which brokers offer the best mobile trading experience for small account holders:

Are The Top Micro Account Brokers Good for Beginners?

Just starting out? These brokers offer low deposit requirements, simple platforms, and solid educational tools for new traders:

Do The Top Micro Account Brokers Work for Experienced Traders?

Even small accounts can be useful for testing or controlled-risk strategies. See how the top brokers meet the needs of more advanced traders:

Accounts Comparison

Compare the trading accounts offered by Best Brokers With Micro Accounts 2026.

Detailed Ratings: Best Micro Account Brokers

Check how each micro account broker scored across our independent rating system:

Compare Trading Fees

We analyzed spreads, commissions, and other costs to reveal which micro account brokers offer the best value:

Which Micro Account Brokers Are Most Popular?

Looking for a broker trusted by small account traders? These brokers are seeing high sign-up rates among micro lot users:

| Broker | Popularity |

|---|---|

| InstaTrade |

|

| NinjaTrader |

|

| Exness |

|

| FOREX.com |

|

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- Traders can access a free platform and trade simulation capabilities with the unlimited demo.

- NinjaTrader provides detailed charting software for active traders, complete with custom technical indicators and widgets.

- Low costs, with $50 trading margins and commissions starting at $.09 per micro contract.

Cons

- You need to register with partner brokers to trade in securities other than forex and futures.

- Some payment methods require a withdrawal fee.

- The advanced trading tools require an additional fee.

Why Trade With OANDA US?

OANDA is a reputable broker for US traders. It offers user-friendly tools for analysis and a simple sign-up process. It is very trustworthy due to heavy regulation.

Pros

- Experienced traders can use top-notch tools like an MT4 premium upgrade and advanced charting from MotiveWave.

- The broker's API provides access to extensive historical data from the past 25 years and rates from over 200 currencies for traders.

- The OANDA web platform offers an exceptional charting environment with over 65 technical indicators provided by TradingView.

Cons

- The trading markets are limited to only forex and cryptocurrencies.

- Few payment options are available and e-wallets are not supported.

- Customer support is not accessible during weekends.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

Cons

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

- The funding options are not as extensive as those of top competitors such as IC Markets and lack several widely-used e-wallets, particularly UnionPay and POLi.

Why Trade With InstaTrade?

InstaTrade provides active trading on an extensive platform. It has a unique offering known as Fixed Income Structured Product (FISP), which allows for passive investment. Investors can potentially earn up to a 50% return within 6 months, provided certain conditions are fulfilled.

Pros

- InstaTrade provides approximately 300 assets for investment. It particularly shines in the area of currency pairs, making it an excellent platform for experienced traders interested in volatile exotics.

- InstaTrade TV provides video interviews and insightful market information about stocks, cryptocurrencies, and more. It assists in identifying opportunities for quick trading.

- InstaTrade promises returns using its structured passive trading solution (FISP), with applications processed within 24 hours.

Cons

- InstaTrade is registered in the British Virgin Islands, providing minimal regulatory protections for retail traders.

- InstaTrade's learning resources are helpful for new traders but are not as organized or comprehensive as those provided by top companies such as eToro.

- InstaTrade's website and client interfaces are quite complex which can be confusing for new traders. On the other hand, XTB offers a more straightforward and user-friendly trading experience.

Why Trade With Exness?

Exness is an excellent choice for active forex traders aiming to reduce costs after lowering spreads, enhancing execution speeds, and offering trading on over 100 currency pairs with more than 40 account currencies.

Pros

- Wide variety of account types for all experience levels, including Cent, Pro, and the new Raw Spread, ideal for traders.

- Fast and reliable 24/7 multilingual customer support through phone, email, and live chat, validated by practical tests.

- Competitive spreads for USOIL and BTCUSD in 2024 start from 0 pips, with low commissions from $2 per side.

Cons

- Retail trading services are not available in some areas, including the US, UK, and EU, making them less accessible compared to leading brokers like Interactive Brokers.

- Exness has increased its variety of CFDs and introduced a copy trading feature, but it still lacks real assets like ETFs, cryptocurrencies, or bonds.

- Besides a mediocre blog, educational resources are lacking, especially compared to category leaders like IG, which offer a more comprehensive trading journey for new traders.

Filters

How BrokerListings.com Chose The Top Micro Account Brokers

We selected the best micro account brokers using over 200 data points and then sorting providers by their overall ratings.

Each broker was verified to offer real micro accounts, allowing small position sizes and low minimum deposits, ideal for new traders, strategy testing, or trading with limited capital.

What To Look For In a Micro Account Broker

Budget-Friendly to Start? Here’s What You’ll Pay Upfront

When you’re opening a micro trading account, fees can nibble away at your capital before you’ve even placed a trade. That’s why account opening charges and ongoing maintenance costs should be the first thing you examine.

Micro accounts are designed for smaller trades, ideal for newer traders or anyone who wants to test strategies with limited risk. But not all brokers price these accounts the same. Some slap on monthly charges. Others make deposits tough or add unexpected withdrawal fees.

From our testing and comparisons of the best trading accounts, we look closely at things like:

- Minimum deposit requirements

- Inactivity fees or maintenance charges

- Withdrawal and funding costs

- Hidden costs baked into spreads

Top Pick: FXCC impressed us with its micro account offering, which feels genuinely beginner-friendly on MT4. There’s no minimum deposit requirement, which is a standout advantage if you’re just testing the waters. That means you can start small and scale up when you’re ready.

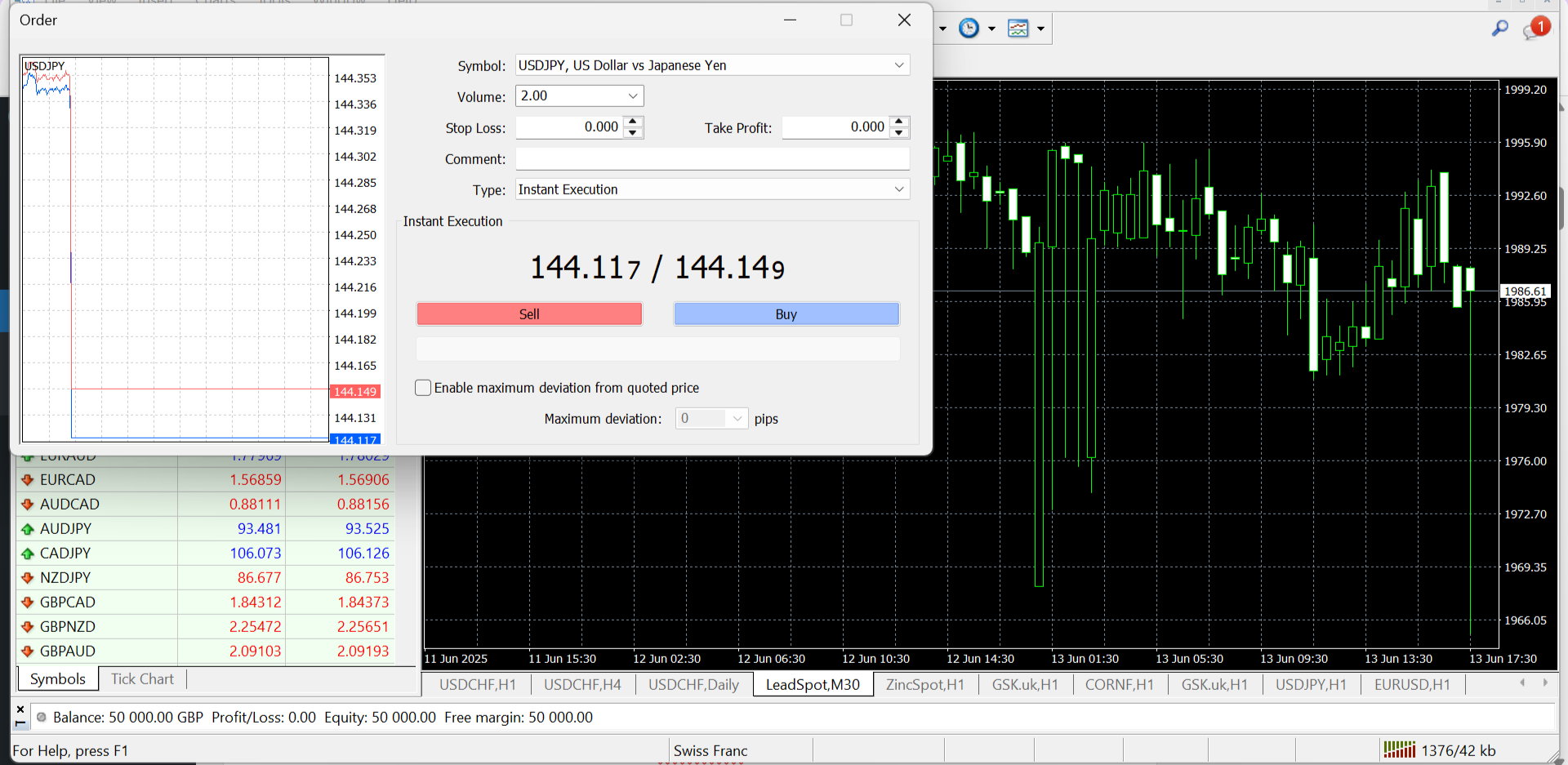

FXCC MT4 platform micro account USDJPY

True Micro Lot Access Without the Catch

If you’re opening a micro account, you expect to trade small. That’s the point, right? But some brokers advertise micro trading only to quietly push you toward standard lots once you’re on the platform.

Others allow micro lots (0.01), but execution is clunky, or minimum trade sizes creep up depending on the instrument.

When we test micro accounts, this is one of the first things we check. We want to see:

- True micro lot trading (0.01 lots or even smaller if fractional)

- No forced minimums on specific instruments

- Smooth execution with no lag on small positions

- Clear info about lot sizing in both MetaTrader and proprietary platforms

This matters because micro traders are often experimenting, testing strategies, or building confidence. Being able to scale in with small trades – and not have your hands tied – is key.

Top Pick: Pepperstone makes micro trading seamless. We were able to open trades as small as 0.01 lots across major forex pairs, indices, and commodities, without any restrictions sneaking in.

When we put their MetaTrader 4 and cTrader platforms through their paces, everything felt fast, clean, and stable, even with tiny position sizes. Micro traders won’t get penalized with slower execution, which sometimes happens with other brokers.

Low Spreads That Won’t Eat Your Tiny Trades

If you’re working with a small balance, spreads matter – a lot. Even a one-pip difference can feel big when your position size is micro and your margin is tight.

That’s why it’s worth digging into how tight a broker keeps its spreads, specifically for micro accounts, and whether the low spread you see on the website holds up in real-time trading.

Here’s what we look for during our testing:

- Live spread accuracy, not just advertised rates

- Spreads during volatile times – do they widen out or hold steady?

- Fair pricing on major and minor pairs

- No hidden spread padding on micro trades

Top Pick: IC Markets came out on top when it came to tight, reliable spreads, even on micro lots. On their Raw Spread account, we consistently saw spreads as low as 0.1 pips on EUR/USD, with no added markup for trading small.

We placed dozens of micro trades across different sessions and found execution to be sharp and pricing to be steady. Even during active news periods, spreads stayed impressively tight for a retail-level account.

Leverage That Works for Small Balances

Leverage can either help a micro account grow or wipe it out in minutes. The key is flexibility: you want enough leverage to make small capital work, without being forced into risky territory.

Some brokers offer high leverage by default, but don’t offer proper risk tools or education to back it up.

Here’s what we look for when testing leverage on micro accounts:

- Flexible leverage settings you can adjust, not just fixed high limits

- Jurisdiction-based options, with complete transparency on what’s available to you

- Risk management tools like stop-outs, margin calls, and calculators

- No pushy tactics encouraging over-leveraging

Top Pick: XTB strikes a healthy balance between useful leverage and responsible risk management. Depending on your region, leverage can be as high as 1:500, but what we liked most is that you can adjust it directly from the platform before you trade.

When we tested XTB’s setup, changing leverage was quick, clearly explained, and didn’t require emailing support or digging through legal pages. For micro traders learning the ropes, this makes a significant difference.

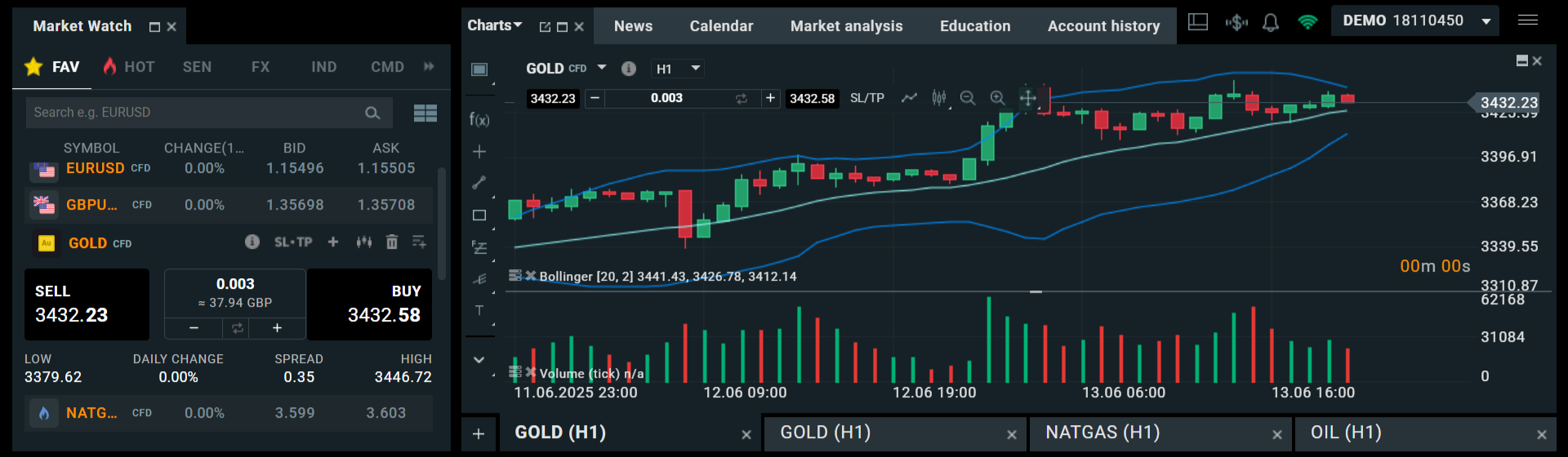

Gold CFD chart XTB xStation platform micro account

Deposit from Just a Few Dollars, Withdraw Without the Wait

One of the biggest advantages of a micro account is the ability to start small, so it’s frustrating when brokers demand big deposits or charge you to move your money. For micro traders, fast, low-fee (or no-fee) transfers are essential.

We check how easy it is to fund and withdraw from the account without paying more in fees than you’re trading with.

Here’s what we focused on during our testing:

- Low or no minimum deposit requirements

- Free funding and withdrawal methods, especially local options

- Fast processing times – no unnecessary delays

- Transparency around fees and currency conversions

Top Pick: CMC Markets offers a clean, hassle-free experience when it comes to deposits and withdrawals. There’s no minimum deposit, and during our tests, we funded the account with as little as $10 using a debit card — no delays, no added costs.

Withdrawals were just as smooth. We requested a small withdrawal mid-week and had it in our bank account within 24 hours. There were zero processing fees from CMC’s side, and everything was trackable from the account dashboard.

Micro-Friendly Platforms That Run Smoothly

When you’re trading micro lots, the last thing you want is lag, slippage, or a clunky platform. Micro traders often rely on precision, whether you’re scalping small moves or just learning the ropes with low-risk trades. That’s why platform performance matters just as much for small trades as it does for big ones.

Here’s what we pay attention to when testing platforms with micro accounts:

- Execution speed and reliability, especially for 0.01 lot trades

- Ease of placing and adjusting trades in small sizes

- Low system resource usage, ideal for older or basic hardware

- Availability of MetaTrader, cTrader, or strong proprietary options

- Customisation and clean interface – no clutter, just control

One broker gave us a consistently smooth experience across both desktop and mobile, even with rapid-fire small trades.

Top Pick: Pepperstone nails the balance between performance and usability. Whether you’re using MetaTrader 4, MetaTrader 5, or cTrader, micro lot trading feels just as fast and stable as trading larger sizes.

We tested micro trades across multiple platforms and devices. Execution was nearly instant, and order placement was smooth, even when running a lightweight setup on a mid-range laptop. The interface is clean and intuitive – ideal for traders who don’t want to get buried in menus or struggle to place a quick 0.01 lot order.

What impressed us most:

- Ultra-fast execution with minimal slippage

- Consistent performance across MT4, MT5, and cTrader

- Micro trade support without weird restrictions or platform limitations

- Customisable layouts that suit both beginners and more advanced strategies

When you’re trading small, a platform glitch or delay can eat into profits or shake your confidence. Pepperstone’s stability makes it easy to focus on your trading, not the tech behind it.

Safe Hands — Regulated Brokers That Welcome Micro Traders

When you’re trading with a micro account, every penny counts. That’s why it’s crucial to choose a broker with strong regulation and clear policies protecting your funds. Some brokers may allow tiny trades but lack proper licensing or security measures, putting your capital at risk.

Here’s what we check for in a micro-friendly regulated broker:

- Licenses from top-tier regulators like the FCA (UK), ASIC (Australia), or CySEC (Cyprus)

- Segregated client funds to keep your money separate from company finances

- Transparent terms on withdrawal, margin calls, and dispute resolution

- Clear communication about how your funds are protected

We ran compliance and security checks on several brokers and found one stood out for combining solid regulation with a welcoming micro account environment.

Top Pick: CMC Markets is regulated by the Financial Conduct Authority (FCA) in the UK, one of the strictest regulators globally. When we tested their micro account features, it was clear they take client security seriously. Funds are held in segregated accounts, and their terms are straightforward – no surprises or hidden clauses.

Start Micro, Scale When You’re Ready

One of the biggest advantages of a micro account is that it lets you learn without pressure. You can test strategies, get familiar with the market, and build confidence – all with smaller risk. But the real magic happens when you’re ready to scale up.

Here’s what we recommend based on our testing and experience:

- Use your micro trades to refine your plan before adding more capital

- Track your progress carefully – small wins add up

- Look for brokers that allow seamless upgrades from micro to standard accounts without hassle

- Keep risk management front and center as your size grows

We’ve tested how well different brokers support this growth journey, and one stood out for making the transition smooth and transparent.

Top Pick: XTB‘s platform and account setup make it easy to start small and move up when you’re ready. We tried switching from a micro to a standard account, and the process was smooth – no extra paperwork or confusing steps.

What we liked:

- Clear upgrade paths within the same platform

- No forced margin calls or surprises when increasing trade sizes

- Educational resources tailored to each stage of trading growth

- Dedicated support during the transition phase