Best Brokers With BRL Accounts 2026

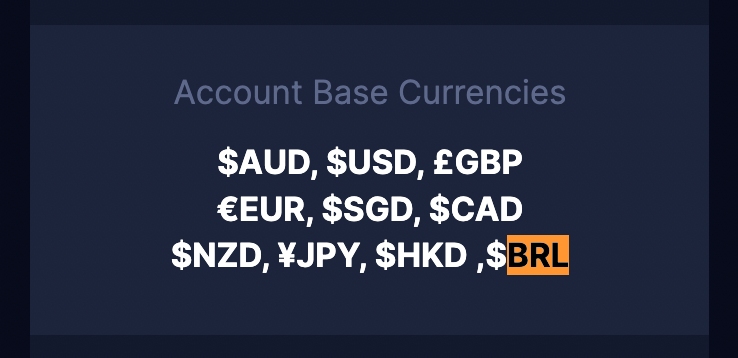

Dig into our top brokers offering Brazilian real (BRL) accounts, based on thorough testing, designed to reduce conversion fees and optimize the trading experience for traders in Brazil.

-

1Established in 2008, Exness is a respected broker known for offering over 40 account currencies, a wide choice of CFD instruments, and an intuitive web platform with features like currency converters and trading calculators.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.4 Established in 2019 in Johannesburg, South Africa, Moneta Markets provides over 1000 instruments for immediate trading. Traders can select between STP and ECN accounts. The straightforward registration process has gained 70,000 registered traders.

Compare Brokers

Safety Comparison

Compare how safe the Best Brokers With BRL Accounts 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Brokers With BRL Accounts 2026.

Comparison for Beginners

Compare how suitable the Best Brokers With BRL Accounts 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Brokers With BRL Accounts 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Brokers With BRL Accounts 2026.

Detailed Rating Comparison

Compare how we rated the Best Brokers With BRL Accounts 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Brokers With BRL Accounts 2026.

Broker Popularity

See how popular the Best Brokers With BRL Accounts 2026 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Exness |

|

| Moneta Markets |

|

Why Trade With Exness?

Exness is an excellent choice for active forex traders aiming to reduce costs after lowering spreads, enhancing execution speeds, and offering trading on over 100 currency pairs with more than 40 account currencies.

Pros

- Competitive spreads for USOIL and BTCUSD in 2024 start from 0 pips, with low commissions from $2 per side.

- Exness Terminal provides an easy experience for beginners with interactive charts, and creating watchlists is simple.

- Execution speeds now average under 25ms, providing ideal conditions for short-term traders.

Cons

- Retail trading services are not available in some areas, including the US, UK, and EU, making them less accessible compared to leading brokers like Interactive Brokers.

- Besides a mediocre blog, educational resources are lacking, especially compared to category leaders like IG, which offer a more comprehensive trading journey for new traders.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader are not available yet, despite increasing demand from traders and their integration with other platforms like Pepperstone.

Why Trade With Moneta Markets?

Moneta Markets is a top choice for experienced traders with ECN pricing, starting spreads of 0, commissions from $1, high leverage up to 1:1000, and great charting platforms.

Pros

- The broker provides advantageous leverage rates up to 1:1000. This allows seasoned traders to enhance their positions and possibly boost their earnings.

- Moneta Markets allows easy funding of accounts, offering a range of account currencies, no transfer fee, and diverse traditional, digital, and crypto-backed payment methods.

- Moneta Markets offers over 1000 tradable assets which include a substantial array of commodities and newly introduced index CFDs.

Cons

- Clients require a minimum account balance of $500 to access our educational materials. This can be a disadvantage for beginners, as some brokers like IG and eToro offer similar resources for free.

- Even though the ASIC and more recently the FCA regulate it, trading via the Seychelles-based entity might offer limited regulatory protections. Moneta Markets' short history also means it hasn't gained a reputation as one of the safest brokers.

- The ECN Ultra account, which offers the most favorable prices, requires a $20,000 deposit. This makes it inaccessible for most regular traders.

Filters

How BrokerListings.com Chose The Best Brokers For BRL Accounts

To identify the top brokers offering Brazilian real (BRL) trading accounts, we reviewed our global broker database, which is updated on an ongoing basis. We prioritized platforms that let traders deposit, withdraw, and manage balances in BRL.

Our assessment covered more than 200 data points, from trading costs and payment processing speed to platform performance, market access, and regulatory strength. In addition, our team, that included experienced traders, tested every shortlisted broker, so the rankings reflect how BRL accounts perform.

What is a BRL Account?

A BRL account is a trading account where the base currency is set to Brazilian real (BRL). This means all deposits, withdrawals, and account balances are handled in BRL, which can be especially useful for traders based in Brazil or managing funds primarily in this currency.

Using a BRL account helps avoid frequent currency conversions, cutting down on extra costs and making it easier to track profits and losses in your local currency. It also gives a clearer picture of your performance without having to constantly factor in exchange rate fluctuations.

Brokers offering BRL accounts often provide Brazil-specific services, including local bank transfers, Portuguese-language support, and account structures designed to align with local market hours.

The number of brokers offering BRL accounts has increased over the years as Latin America has become a target region for many online brokers.

Should I Use a BRL Trading Account?

For traders in Brazil or those regularly handling Brazilian real, a BRL trading account can offer several advantages. Here’s why it might be a good fit:

- Avoid Currency Conversion Fees: Funding your account in BRL eliminates the extra costs of converting deposits and withdrawals from other currencies, helping you keep more of your capital in play.

- Simplified Account Tracking: With balances, profits, and losses all in Brazilian real, it’s easier to monitor performance without constantly checking exchange rates.

- Faster Local Transactions: Deposits and withdrawals from Brazilian bank accounts typically clear quickly when using a BRL account, often within a day.

- Align Your Account with Local Market Conditions: If your trading strategy is influenced by Brazilian economic data, interest rates, or regional equities, having your base currency in BRL ensures your funds stay in sync with the local market.

- Reduced Exchange Rate Risk: Holding funds in BRL lowers your exposure to fluctuations in other currencies when funding, trading, or withdrawing from your account.

- Access to Brazil-Focused Broker Services: Some brokers offering BRL accounts provide Portuguese-language support, local payment methods, and account features tailored to traders in Brazil.

What Are the Limitations of a BRL Trading Account?

While BRL accounts offer advantages for traders in Brazil, they aren’t ideal for everyone. Here are some potential drawbacks to consider:

- Limited Broker Options: While growing, fewer brokers offer BRL as a base currency compared to accounts in United States dollars or euros, which can restrict your choice of platforms and trading tools.

- Potentially Wider Spreads: Some brokers apply higher spreads on BRL forex pairs due to lower liquidity in Brazilian markets, increasing trading costs.

- Regulatory Limitations with Foreign Brokers: If it isn’t a broker licensed in Brazil, you could face restrictions on leverage, account features, or the range of tradable instruments.

- Hidden Conversion Costs for Global Trades: Trading instruments priced in US dollars, euros, or other major currencies may involve behind-the-scenes conversions, which can raise costs.

- Slower International Transfers: Sending or receiving BRL from outside Brazil can take longer and may require intermediary bank processing, delaying access to funds.

Five Steps to Opening a BRL Account

- Research Reputable Brokers: Start by looking at our regulated brokers that offer Brazilian real as a base currency. Consider their fees, platform features, funding options, and reputation in Latin America.

- Complete the Online Registration: Once you’ve chosen a broker, fill in the application form with your personal details, contact information, and trading experience as required by regulatory standards.

- Verify Your Identity: Upload a valid passport or Brazilian national ID, along with a recent proof of address such as a utility bill or bank statement, to comply with Know Your Customer (KYC) regulations.

- Choose BRL as Your Base Currency: During the setup process, select Brazilian real as your account currency to ensure that all balances, deposits, and withdrawals remain in BRL.

- Fund Your Account and Begin Trading: Transfer funds using a local Brazilian bank, debit or credit card, or other accepted regional payment methods like Boleto. Once the funds clear, you can start trading with a fully BRL-denominated account.

Moneta Markets offers BRL as a base currency across all of its accounts