Best Brokers For Traders With No Time 2026

Through hands-on tests, we’ve pinpointed the top brokers for traders with no time – designed to make trading effortless with user-friendly, hands-off investing tools.

-

1

With eToro US's top copy trading service, you can replicate the positions and strategies of up to 100 traders. eToro offers more portfolio control than many rivals, letting you stop or pause a copied trade anytime. Pricing is competitive, needing just $1 to copy a position. eToro copy trading is only for crypto.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.0 InstaTrade provides automated trading through its Fixed Income Structured Product, allowing clients to mirror active traders' positions. Uniquely, InstaTrade promises a 50% return to clients by covering any shortfall if they refer other users.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 Pionex users can follow successful traders and replicate their trading bot setups. This feature enables them to trade cryptocurrencies 24/7 via an intuitive platform and app.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 Exness has added a unique copy trading feature to its web platform and mobile app. It is user-friendly, but the performance statistics for strategies could be more detailed to better help investor decisions.

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 Introduced in February 2023, the IC Social app provides an easy way to learn, share, and replicate the positions of other traders quickly. The app includes risk management tools and supports trading groups. IC Markets also offers access to Signal Start and popular third-party copy trading platforms like ZuluTrade and cTrader Copy.

Compare The Best Brokers For Traders With No Time

Compare the hands-off trading features offered by our top brokers:

Broker Details Comparison

How Safe Are The Best Brokers For Time-Strapped Traders?

Trading platforms built for busy investors still need strong security — here’s how these brokers protect your assets:

Best Mobile Apps For Traders With No Time

We tested mobile apps built for busy traders who need fast, easy access on the go:

Are The Top Time-Saving Brokers Good For Beginner Traders?

For beginners, here’s what to look for in a time-saving broker:

Are The Top Time-Saving Brokers Good For Advanced Traders?

For experienced traders, here's what to look for in a time-saving broker:

Accounts Comparison

Compare the trading accounts offered by Best Brokers For Traders With No Time 2026.

Detailed Ratings: Top Brokers For Traders With Limited Time

Discover how the top brokers for busy traders scored across our key performance categories:

Trading Fees At The Best Brokers For Traders With Less time

Fast, hands-off service is key, but fees still matter — compare how these brokers stack up on costs:

Which Brokers Are Most Popular With Busy Traders?

See which top brokers for time-poor traders have the most clients:

| Broker | Popularity |

|---|---|

| InstaTrade |

|

| Pionex |

|

| eToro USA |

|

| Exness |

|

| IC Markets |

|

Why Trade With eToro USA?

eToro is a top choice for traders due to its top-notch social investing and copy trading services. The broker caters well to new traders with its low deposit requirement, commission-free trading, and user-friendly platform.

Pros

- The online broker provides a user-friendly social investment network for easy crypto trading replication.

- A free demo account enables new users and potential traders to test the broker without risk.

- The broker's Academy provides extensive educational resources for traders, ranging from beginners to advanced levels.

Cons

- Average fees can reduce the profits of traders.

- Traders used to third-party charting tools won't find MetaTrader 4 platform integration.

- The exclusive terminal does not accommodate trading bots and lacks extra equity market analysis tools.

Why Trade With InstaTrade?

InstaTrade provides active trading on an extensive platform. It has a unique offering known as Fixed Income Structured Product (FISP), which allows for passive investment. Investors can potentially earn up to a 50% return within 6 months, provided certain conditions are fulfilled.

Pros

- InstaTrade provides approximately 300 assets for investment. It particularly shines in the area of currency pairs, making it an excellent platform for experienced traders interested in volatile exotics.

- InstaTrade promises returns using its structured passive trading solution (FISP), with applications processed within 24 hours.

- InstaTrade provides a high-quality range of charting tools for traders. Its web trader includes over 250 indicators, 11 types of charts and a design that's easy to use.

Cons

- InstaTrade's website and client interfaces are quite complex which can be confusing for new traders. On the other hand, XTB offers a more straightforward and user-friendly trading experience.

- InstaTrade's learning resources are helpful for new traders but are not as organized or comprehensive as those provided by top companies such as eToro.

- Profits in the FISP are guaranteed only if investors do not make over 50% profit and recruit other users, earning $4 for each dollar in compensation.

Why Trade With Pionex?

Pionex is a great choice for crypto traders interested in advanced AI and automated trading.

Pros

- The advanced AI chatbot 'PionexGPT' assists users in setting up trading bots using Pine script.

- Offers support for crypto derivatives through futures trading.

- Trading fees on this platform are lower than most major exchanges, at only 0.05% for both buyers and sellers.

Cons

- Limited contact options

- No demo account

- Limited regulation increases worries about safety in trading.

Why Trade With Exness?

Exness is an excellent choice for active forex traders aiming to reduce costs after lowering spreads, enhancing execution speeds, and offering trading on over 100 currency pairs with more than 40 account currencies.

Pros

- Fast and reliable 24/7 multilingual customer support through phone, email, and live chat, validated by practical tests.

- Wide variety of account types for all experience levels, including Cent, Pro, and the new Raw Spread, ideal for traders.

- Execution speeds now average under 25ms, providing ideal conditions for short-term traders.

Cons

- Besides a mediocre blog, educational resources are lacking, especially compared to category leaders like IG, which offer a more comprehensive trading journey for new traders.

- Exness has increased its variety of CFDs and introduced a copy trading feature, but it still lacks real assets like ETFs, cryptocurrencies, or bonds.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader are not available yet, despite increasing demand from traders and their integration with other platforms like Pepperstone.

Why Trade With IC Markets?

IC Markets provides excellent prices, quick execution, and smooth deposits. The utilization of sophisticated charting platforms such as TradingView and the Raw Trader Plus account makes it a preferred choice for intermediate to advanced traders.

Pros

- IC Markets, a well-regulated and respected broker, emphasizes client security and transparency for a trustworthy global trading experience.

- IC Markets provides some of the smallest spreads in the industry, offering 0.0-pip spreads on major currency pairs. This makes trading particularly cost-efficient for traders.

- IC Markets won DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its top-notch MetaTrader integration, perfected over years to enhance the platform experience.

Cons

- The range and quality of educational materials, such as tutorials and webinars, require improvement. This lag falls behind competitors like CMC Markets and reduces its suitability for novice traders.

- Some withdrawal methods require fees such as a $20 wire charge. This can reduce profits, particularly for traders who withdraw frequently.

- Interest is not earned on unused funds, a feature commonly available at other platforms such as Interactive Brokers.

Filters

How We Chose The Best Brokers For Traders With Limited Time

We searched our growing database of online brokers to identify the best platforms for traders with limited time to manage their accounts.

In particular, we looked for brokers offering hands-off trading features such as copy trading, managed trading accounts, robo-advisors, and automated trading tools that streamline the trading process.

We then ranked these brokers based on their overall ratings, drawing from over 200 individual data points across 8 key categories, including automation capabilities, platform usability, and risk management features.

Our rankings also reflect the results of our hands-on testing, where we considered how effectively each broker supports busy traders through low-maintenance, time-saving solutions.

What To Look For In A Top Broker If You Have Limited Time To Trade

Copy Trading or Signal Services

If you barely have time to grab a coffee between meetings, then building and managing your own trading strategy can feel totally out of reach.

That’s where copy trading and signal services come in. These tools let you automatically copy the trades of top-performing traders or get notified when a professional spots an opportunity, with no hours of chart-watching required.

But here’s the catch: not all brokers offering copy trading are created equal. We know this because one of our team is an experienced copy trader. Some have clunky platforms, limited trader pools, or hidden fees that eat into your profits.

If you’re short on time, you need a broker that makes the whole process simple, transparent, and fast.

Top Pick: When it comes to copy trading done right, Pepperstone stands out from the crowd. They partner with multiple high-quality third-party platforms like Myfxbook AutoTrade, DupliTrade, cTrader, and MetaTrader Signals, giving you a massive range of experienced traders to follow — all within a few clicks.

Peppertone offers the user-friendly cTrader Copy feature where you can mirror established traders

Automated Trading Systems

Sitting in front of a trading screen for hours is unrealistic if you juggle work, family, and a social life. That’s where automated trading systems come into play.

These tools — whether you call them Expert Advisors (EAs), bots, or trading scripts — let you set up your strategy once and let the system do all the heavy lifting.

Sounds perfect. Well, not every broker is a good fit for automated trading. Some restrict the use of bots, have slow servers that cause slippage, or offer platforms that are a nightmare to set up. For traders who want real automation without real headaches, picking the right broker is crucial.

Top Pick: When it comes to automated trading, IC Markets is the gold standard from our tests. They are built with algorithmic traders in mind, offering super-fast execution, raw spread pricing, and support for every type of automation you can imagine. Whether using MetaTrader 4, MetaTrader 5, TradingView or cTrader, IC Markets gives you the perfect environment to run your EAs or scripts efficiently.

Simple Mobile Trading Apps

When you barely have time to check your phone between meetings or life in general, you need a mobile trading app that is fast, clean, and seriously easy to use: no clunky menus, no confusing layouts, and no slow loading times.

Plus, real-time push notifications and one-click trading are must-haves if you want to actually react to the markets, not just watch them.

Many trading apps we’ve used are either bloated with useless features or just plain outdated. If you want to trade on the go without frustration, you need a broker that understands busy traders’ needs.

Top Pick: When it comes to simple, powerful mobile trading, XTB knocks it out of the park. Their award-winning app, xStation 5, is one of the best in the business for traders who want speed, clarity, and complete control without a learning curve. It’s perfect for traders with no time thanks to its super clean interface – everything you need is right there — charts, open positions, account balance — no digging around. You can also open and close trades instantly with a single tap.

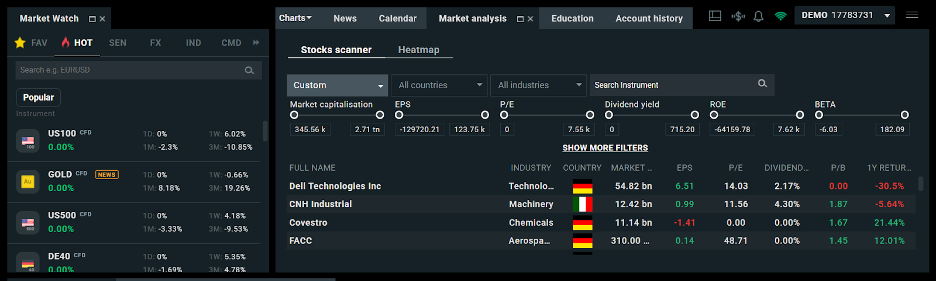

XTB offers an intuitive screener for quickly finding potential trading opportunities

Minimal Maintenance Portfolios or Asset Baskets

Sometimes you just want to set it and forget it. If you are short on time, actively managing a bunch of trades every day probably isn’t going to happen. That’s where minimal maintenance portfolios and asset baskets come in.

These are ready-made groups of assets — like stocks or commodities — bundled together so you can invest in a whole theme or sector without picking every single trade yourself.

The problem? Some brokers we’ve tested offer asset baskets that are either expensive, super complicated, or just plain underwhelming. If you are aiming for real low-maintenance investing, you need a broker that keeps it simple, affordable, and effective.

Top Pick: When it comes to minimal maintenance trading, CMC Markets is a fantastic choice. They offer a wide range of thematic portfolios and asset baskets that let you tap into big-picture trends — think tech innovation, renewable energy, or emerging markets – all without needing to manage dozens of positions individually. CMC Markets is perfect for no-fuss traders thanks to its award-winning platform that’s clean, easy-to-navigate design makes finding and investing in asset baskets a breeze.

Smart Alerts and Trade Recommendations via Email, SMS, or AI

If you are always on the move, you cannot afford to miss major trading opportunities, but you cannot sit glued to your screen all day. That’s where smart alerts and trade recommendations come in.

The best brokers today offer real-time notifications through email, SMS, or even AI-powered tools that can spot market setups for you and send them straight to your phone.

Of course, not every broker nails this. Some platforms send generic, spammy alerts that are either too late or too vague to be useful. You need innovative, timely, and actionable updates if you are serious about trading efficiently with minimal effort.

Top Pick: When it comes to intelligent trade alerts and recommendations, FxPro delivers. They offer a variety of real-time market notifications, price alerts, and trade ideas that can be customised to suit your trading style — all delivered right to your inbox or mobile. If you want to stay ahead of the markets without being chained to your desk, FxPro’s smart alert system gives you the tools to trade smarter and faster.

Quick Access to Support

When you barely have time to trade, you definitely don’t have time to deal with slow customer service. If something goes wrong — a deposit issue, a login problem, a glitchy order — you need help now, not in 48 hours.

The best brokers for time-starved traders offer fast live chat, 24/5 support, and actual humans (not bots) who can fix problems quickly.

Pro tip: If you’re so tight on time that you can only catch up on your investment portfolio on the weekend, look for a brokerage with 24/7 assistance.

Top Pick: Pepperstone’s customer service is one of the best worldwide, especially for traders in a hurry. We know, we’ve used it many times over the years. They offer live chat, email, and phone support 24/5 — and their team is actually helpful, not just reading scripts. You can expect to connect with an actual agent in under a minute during trading hours.

Risk Management Tools Built-In

Automated risk management tools are your best friend when you can’t babysit your trades 24/7. You need tools like stop loss, take profit, and negative balance protection baked right into the platform to protect your account even when you’re away.

The catch? Some brokers we’ve used offer these features but make them clunky or hard to set up.

Top Pick: IC Markets does a fantastic job offering built-in, easy-to-use risk management tools for traders with limited time. You can add stop losses and take profits with a click — no extra steps, no complicated settings. If you want to trade with peace of mind without having to monitor every move, IC Markets’ built-in protection will protect you.

One-Click Portfolio Monitoring

Keeping an eye on your trades and overall performance shouldn’t feel like another full-time job. If you’re low on time, you need simple account snapshots and performance reports you can check at a glance.

Some brokers overload you with charts and complicated reports. Not helpful when you just want the essentials.

Top Pick: XTB stands out in our tests with super clean portfolio views right inside its mobile and desktop platforms. With a tap, you can see your account balance, open trades, profit/loss, and detailed stats. If you want a no-fuss way to stay on top of your trading health, XTB makes it ridiculously easy.

Integrated News and Market Updates

It’s tough to trade smart if you don’t know what’s moving the markets. But who has time to scroll through multiple news sites and social media feeds?

The best brokers deliver relevant market news and updates straight inside their platforms, saving you serious time. Some platforms, though, either overload you with news or miss the important stuff.

Top Pick: CMC Markets absolutely nails this by offering real-time news, market insights, and event alerts built directly into their trading platform. With its integrated Reuters news feed you get live market news without needing external apps. You can also access CMC’s in-house analyst reports right from the platform, while customizable alerts provide updates only on the assets you care about.

FAQ

What Are The Best Ways To Trade If I Have No Time?

If you have limited time to actively trade, you can use these hands-off investing tools: