Best Trading Signal Providers 2026

After testing extensively, we’ve identified these brokers as the top choices for trading signals, alerting traders to potential opportunities.

-

1NinjaTrader is a US-based brokerage regulated for trading futures. It offers three different pricing plans for varied needs and budgets, along with extremely low margins on popular contracts. The company's renowned charting software and trading platform provides extensive customization options and excellent technical analysis features.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.3 Moomoo is a regulated trading platform which is controlled by SEC. It provides a simple, cost-effective method to trade in stocks, ETFs, and various assets from China, Hong Kong, Singapore, the US, and Australia. They provide the option for margin trading, along with no deposit account and several bonus options. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 While testing IC Markets' signals, we found their key strength was speed—ideas reached MT4/MT5 almost instantly, matching market volatility. Scalpers benefited most from the low-latency execution linked to these alerts. Signals were precise enough to support short-term trading strategies.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 In our tests, RoboForex impressed with its mix of in-house and third-party signals, especially via CopyFX. Execution was fast, and the trade ideas adapted well to market changes rather than just repeating patterns. The variety of strategies was particularly valuable for traders seeking flexible, interactive signal options.

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 We found XM's trading signals clear and consistent across timeframes. Available on MT4/MT5, they are practical with defined risk levels. They show more reliability with major FX pairs, providing structure valuable for active traders.

Top Trading Signal Providers Comparison

Safety Comparison

Compare how safe the Best Trading Signal Providers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Trading Signal Providers 2026.

Comparison for Beginners

Compare how suitable the Best Trading Signal Providers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Trading Signal Providers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Trading Signal Providers 2026.

Detailed Rating Comparison

Compare how we rated the Best Trading Signal Providers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Trading Signal Providers 2026.

Broker Popularity

See how popular the Best Trading Signal Providers [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Moomoo |

|

| XM |

|

| NinjaTrader |

|

| RoboForex |

|

| IC Markets |

|

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- NinjaTrader is a well-regarded and acclaimed futures broker, approved by the NFA and CFTC.

- You can access thousands of applications and add-ons from developers worldwide for trading.

- Traders can access a free platform and trade simulation capabilities with the unlimited demo.

Cons

- You need to register with partner brokers to trade in securities other than forex and futures.

- Some payment methods require a withdrawal fee.

- The advanced trading tools require an additional fee.

Why Trade With Moomoo?

Moomoo is a great option for beginner and intermediate traders aiming to diversify their investment portfolio. The brokerage's app is easily navigable and the trading fees are significantly low.

Pros

- The broker requires no minimum deposit, making it suitable for beginner traders.

- Moomoo's insights and analytics are more comprehensive and detailed than other brands.

- The fees for options contracts have been lowered from $0.65 to $0.

Cons

- Regrettably, even with its existing security features, this platform still lacks 2 factor authentication (2FA).

- The protection against negative balance, a standard security measure at highly regulated brokers, is not available here.

- The broker doesn't offer phone or live chat support, options typically provided by other brokers.

Why Trade With IC Markets?

IC Markets provides excellent prices, quick execution, and smooth deposits. The utilization of sophisticated charting platforms such as TradingView and the Raw Trader Plus account makes it a preferred choice for intermediate to advanced traders.

Pros

- IC Markets provides some of the smallest spreads in the industry, offering 0.0-pip spreads on major currency pairs. This makes trading particularly cost-efficient for traders.

- IC Markets provides fast and reliable 24/5 support for account and funding issues.

- You can trade more than 2,250 CFDs in various markets, such as forex, commodities, indices, stocks, bonds, and cryptocurrencies. This range enables varied trading strategies.

Cons

- Some withdrawal methods require fees such as a $20 wire charge. This can reduce profits, particularly for traders who withdraw frequently.

- The range and quality of educational materials, such as tutorials and webinars, require improvement. This lag falls behind competitors like CMC Markets and reduces its suitability for novice traders.

- Despite having four top-tier third-party platforms, there is no in-house software or trading app specifically designed for new traders.

Why Trade With RoboForex?

RoboForex offers a broad selection of over 12,000 trading markets along with ECN accounts, impressive charting, and loyalty incentives. It is also advantageous for stock traders due to its intuitive R StocksTrader platform, which provides access to over 3,000 shares, lower fees starting at $0.01, and advanced watchlists.

Pros

- RoboForex offers tight spreads starting at 0 pips and low minimum deposits from $10, making it affordable. Trading with micro lots additionally reduces entry barriers for new traders.

- The R Stocks Trader platform competes with top platforms like MT4, offering netting and hedging abilities, thorough backtesting, Level II pricing, and a versatile workspace.

- The broker provides two free withdrawals each month in the Free Funds Withdrawal program, assisting traders in reducing transaction expenses.

Cons

- RoboForex, despite having many platforms, does not yet support the commonly used cTrader. This can dissuade traders who favor this platform for trading, which is accessible with firms such as Fusion Markets.

- RoboForex provides fair spreads, but some of its account types have high trading commissions up to $20 per lot, which are more expensive compared to more affordable brokers like IC Markets.

- RoboForex, with more than 15 years in the industry, is authorized by the IFSC in Belize, a 'Red-Tier' regulator. This authorization provides a lower level of regulatory protection for traders.

Why Trade With XM?

With a $5 minimum deposit, advanced charting on MT4 and MT5, a growing range of markets, and a Zero account with spreads from 0.0, XM offers what traders need. They have even won our 'Best MT4/MT5 Broker' award recently.

Pros

- XM has updated its platform with integrated TradingView charts and an XM AI assistant for faster execution, smarter analysis, and a more intuitive trading experience.

- In late 2025, XM received a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates, enhancing its regulatory standing and positioning it as a strong choice for traders in the Middle East.

- XM excels in trader education by providing well-organized resources like webinars, tutorials, and live trading sessions via XM Live.

Cons

- XM only uses the MetaTrader platforms for desktop trading, offering no in-house downloadable or web-based solutions with unique features for beginners.

- XM is lagging because it doesn’t offer cTrader and TradingView, which are now preferred over MetaTrader for their better user interface and charting tools.

- The XM app is user-friendly and offers unique copy trading products, but its technical analysis tools need enhancement for advanced traders.

Filters

Methodology

We evaluated numerous platforms offering trading signals and assigned each a comprehensive score. Using these scores, we created a definitive ranking.

What To Look For in a Signal Provider

Not all trading signal offerings are created equal, so picking a broker that matches your needs is essential.

Here’s a breakdown of the key factors to keep in mind when evaluating brokers with trading signals:

Signal Accuracy and Reliability

The effectiveness of trading signals depends on their accuracy. Check whether the broker’s signals have a proven track record or whether reputable providers generate them.

Look for user reviews or performance reports, as these can give you a clearer picture of the signals’ reliability.

Source of Signals

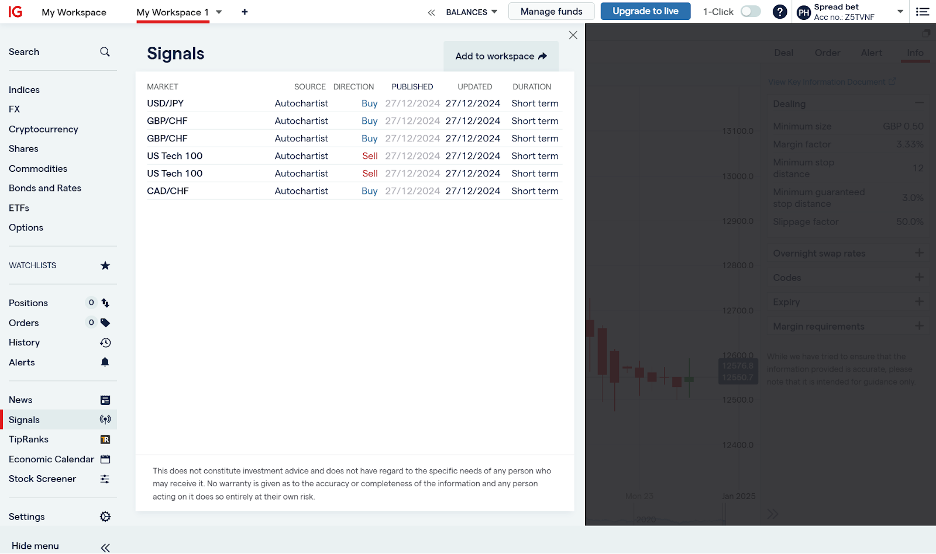

Manual vs automated signals: Some brokers provide signals crafted by professional analysts, while others rely on algorithmic models or AI-driven tools like Autochartist. Understand which type suits your trading style better.

Third-party integration: Brokers that support external signal providers, like TradingView or MetaTrader 4, offer more flexibility and variety.

IG – Signals

Asset Coverage

Ensure the broker provides signals for the markets and assets you’re interested in – whether it’s forex, stocks, cryptocurrencies, or commodities.

Broad asset coverage is critical if you like to diversify your trading portfolio.

Delivery Methods

Signals need to be timely, so consider how the broker delivers them. Common methods include:

- Platform alerts: Integrated directly into the trading platform.

- SMS or email: Ideal for traders who are often on the go.

- Mobile app notifications: Perfect for real-time updates.

Additional Features

Look for brokers offering extra features that complement trading signals, such as:

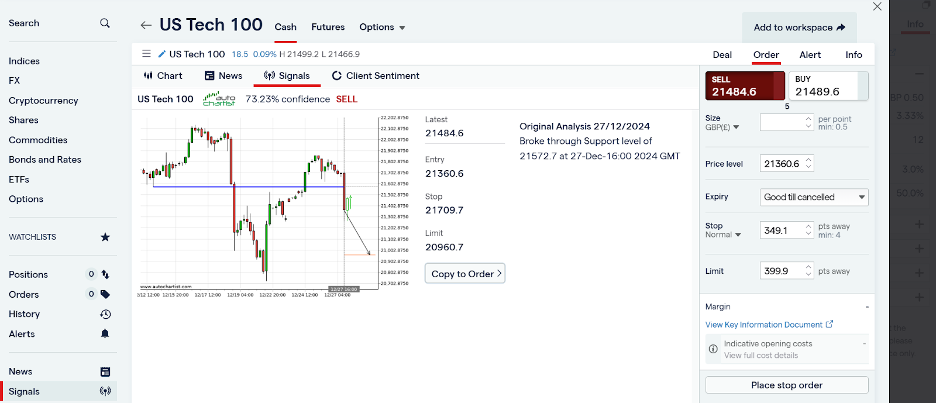

- Risk management tools (eg stop-loss and take-profit levels).

- Educational resources to help you understand the signals.

- Customizable signals based on your trading preferences.

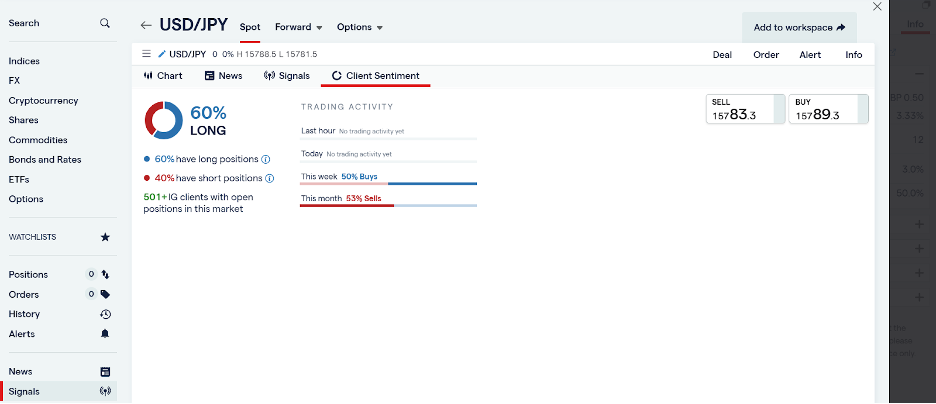

- Signals based on clients’ sentiments.

IG – Client Sentiment

Costs and Fees

While some brokers offer free trading signals, others may charge a subscription or higher spreads. Compare the costs and ensure the value justifies the expense.

Also, check for hidden fees that could impact your overall profitability.

Regulation and Trustworthiness

Always prioritize brokers regulated by reputable authorities to ensure your funds and data are secure.

A trustworthy broker will provide transparency about how their signals are generated and supported.

Support and Customer Service

Fast and reliable customer support can be a lifesaver if you encounter issues with trading signals.

Look for brokers that offer responsive service through multiple channels, such as live chat, phone, or email.

Demo Account Availability

Brokers with demo accounts let you test their trading signals without risking real money.

This can help you determine whether the signals align with your trading goals and style.

Tips for Choosing the Best Broker for Trading Signals

Finding the ideal broker with trading signals can feel overwhelming, but a few practical tips can make the process much smoother:

Define Your Trading Goals

- Are you a short-term trader who relies on frequent signals, or do you prefer long-term strategies? Understanding your goals helps you focus on brokers that align with your style.

- If you’re just starting, look for brokers with beginner-friendly signals and plenty of educational resources.

Research the Signal Providers

- Find out if the broker generates signals in-house or partners with trusted third-party providers. Platforms integrated with reputable tools like TradingView often offer diverse options.

- Check the credentials of the analysts or algorithms behind the signals.

Focus on User Experience

- Opt for brokers with intuitive platforms that make it easy to understand and act on trading signals. Clear charts, customizable alerts, and seamless navigation can save you time and effort. For example, I really like the clean design and interface at IG.

- Mobile-friendly platforms are a bonus if you trade on the go.

IG – Signals Interface

Check Reviews and Ratings

- Read reviews from other traders to gauge the reliability of the broker’s trading signals. Look for testimonials on accuracy, timeliness, and ease of use.

- Trust brokers with a strong reputation in the trading community.

Look for Customization Options

- Some brokers allow you to customize signals based on your risk tolerance, trading preferences, or asset focus. Tailored signals can make a big difference in your strategy.

Evaluate the Delivery Speed

- Timing is critical in trading. Make sure the broker delivers signals quickly via in-platform notifications, emails, or app alerts.

- Delayed signals could mean missed opportunities.

FAQ

What Are Trading Signals?

Trading signals are like having a trusted co-pilot in your trading journey. They’re recommendations or alerts based on market data, technical analysis, or algorithmic predictions.

Signals tell you when to potentially buy, sell, or hold a specific asset, often including details like price targets and stop-loss levels.

Professional analysts can manually create trading signals or generate them automatically through advanced algorithms, depending on their source.

Many brokers now integrate these signals directly into their platforms, making it easier for traders to act quickly and efficiently.

How Do Trading Signals Work?

Here’s a simple rundown:

- Data collection & analysis: Signals gather market info like price and trends.

- Signal generation: Based on this info, signals identify potential trading chances.

- Delivery: Signals can be sent via various channels like email, SMS, or increasingly apps.

- Interpretation: Traders use these signals with their strategies and risk assessments.

- Execution of trades: Decide whether to trade based on signals’ alert.

- Continuous monitoring: Keep an eye on your trades and adjust based on market changes.

Remember, while trading signals can be helpful, they’re not guaranteed. Always use your knowledge and strategy alongside them.

Are Trading Signals Legal?

Yes, they are legal, but legality can vary by region, depending on adherence to financial regulations.

What Are The Risks Of Using Trading Signals?

Risks include potential errors, over-reliance without understanding, and costs associated with subscription services.

Remember, there is no guarantee that a trading signal will work, regardless of the broker or provider.