Best Brokers For Beginners 2026

Jump into our selection of the top brokers for beginners, selected after careful testing of their platforms, tools and accounts, considering the unique needs of newer traders.

-

1

In our tests, Pepperstone was beginner-friendly, offering a low minimum deposit, responsive 24/5 support, and free demo accounts. Educational resources included webinars, trading guides, and strategy tutorials. The MT4, MT5, and cTrader platforms were intuitive and fast. Access to forex, indices, commodities, and crypto provided new traders with a secure, low-risk environment to practice and build skills.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 In our tests, XTB supported beginners with a low minimum deposit, responsive support, and free demo accounts. Educational resources included videos, webinars, and detailed guides. The xStation platform provided intuitive tools and risk management features. Access to forex, indices, commodities, and cryptocurrencies enabled new traders to learn and practice in a secure, low-cost environment.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.2 Our tests show that InstaForex helps beginners with a low minimum deposit, 24/7 support, and free paper trading accounts. Educational tools include tutorials, webinars, and daily market analysis. Execution is efficient on MT4 and MT5 platforms, giving new traders access to forex, indices, commodities, and crypto for learning and practicing trading strategies in a low-risk setting.

Top Brokers For Beginners Comparison

Broker Details Comparison

Safety Comparison

Compare how safe the Best Brokers For Beginners 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Brokers For Beginners 2026.

Comparison for Beginners

Compare how suitable the Best Brokers For Beginners 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Brokers For Beginners 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Brokers For Beginners 2026.

Detailed Rating Comparison

Compare how we rated the Best Brokers For Beginners 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Brokers For Beginners 2026.

Broker Popularity

See how popular the Best Brokers For Beginners 2026 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| XTB |

|

| InstaForex |

|

| Pepperstone |

|

Why Trade With Pepperstone?

Pepperstone is a leading choice for trading with low spreads, quick execution, and advanced charting for experienced traders. New traders benefit from no minimum deposit, a wealth of educational resources, and 24/7 support. Operating under ASIC regulation, Pepperstone is a top option for Australian traders and won DayTrading.com's 'Best Aus Broker' award for 2025.

Pros

- Get top-notch customer support through phone, email, or live chat. Expect responses within <5 minutes based on our trials.

- Pepperstone now offers spread betting via TradingView, enabling tax-efficient trading with sophisticated analysis tools.

- Pepperstone has simplified deposits and withdrawals, adding Apple Pay and Google Pay in 2025, and PIX and SPEI for Brazilian and Mexican clients in 2024.

Cons

- Pepperstone's demo accounts are available for 60 days, which might not be sufficient to fully learn the platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular feature in the cTrader platform available at alternatives like IC Markets, though it has launched an intuitive copy trading app.

- Despite expanding its market range, crypto options are limited compared to other brokers in this area, and there is no option to invest in actual coins.

Why Trade With XTB?

XTB is an excellent option for new traders due to its xStation platform, low trading costs, no minimum deposit, and outstanding educational tools, many of which are integrated into the platform.

Pros

- The xStation platform stands out with its easy-to-use interface and intuitive features. These include personalized news feeds, sentiment heat maps, and a trading calculator, making it simpler for new traders.

- XTB provides an extensive set of educational resources such as training videos and articles on its platform, making it suitable for traders of all skill levels.

- Signing up for an XTB account is simple and entirely digital, taking only a short while. This enables a seamless transition into trading for new traders.

Cons

- The inability to modify the default leverage on XTB products is disappointing. Manual adjustment can greatly reduce trading risks, especially in forex and CFD trading.

- The demo account ends in four weeks. This is a limit for traders wanting to fully explore the xStation platform and try out strategies before using actual money.

- Trading costs are fair with typical spreads of around 1 pip on the EUR/USD. However, they're not as low as those offered by the least expensive brokers, like IC Markets. Also, an inactivity fee applies after one year.

Why Trade With InstaForex?

InstaForex is a leading forex broker offering more currency products than most competitors. Its narrow spreads and low minimum deposits cater to traders of all experience levels, particularly those knowledgeable in the MT4 and MT5 platforms.

Pros

- InstaForex provides an excellent trading setting, equipped with the robust MT4 and MT5 platforms. These platforms include various technical analysis tools, automation features, and several types of orders.

- The broker is an excellent choice for serious forex traders. It offers over 100 currency pairs, narrow spreads starting from 0.0 pips, and a top-tier collection of forex market resources.

- The broker is beginner-friendly, offering low initial deposits and commission-free trading.

Cons

- The broker's website and client interface are not user-friendly, particularly for new traders.

- Customer support is offered in English, Czech, Polish, and Slovak.

- The broker only offers CFDs for trading.

Filters

Methodology

To rank the top brokers for beginner traders, we prioritized:

- Quality learning materials.

- Free access to demo trading.

- Beginner-friendly accounts.

- User-friendly platforms and apps.

- Special features for new traders like social trading.

- Reliable customer support.

- Trustworthiness based on our experts’ opinions.

What to Look For in a Beginner-Friendly Broker

These are the key factors to consider when picking the right broker for your needs as a beginner:

Education Resources

Knowledge is your most powerful tool as a new trader. Look for brokers that provide comprehensive educational materials to help you learn the basics and improve over time. This can include:

- Guides and tutorials: Step-by-step articles, videos, and webinars explaining trading fundamentals.

- Glossaries: Clear explanations of technical terms so you won’t feel lost.

- Interactive learning tools: Quizzes, courses, and practice exercises.

Why it matters: Knowledge is power. Comprehensive resources save you time scouring the internet for credible information and help you build confidence.

After years of personally reading guides, watching webinars, and completing quizzes, IG stands out with superior education, featuring its own academy and content specifically tailored to beginners.

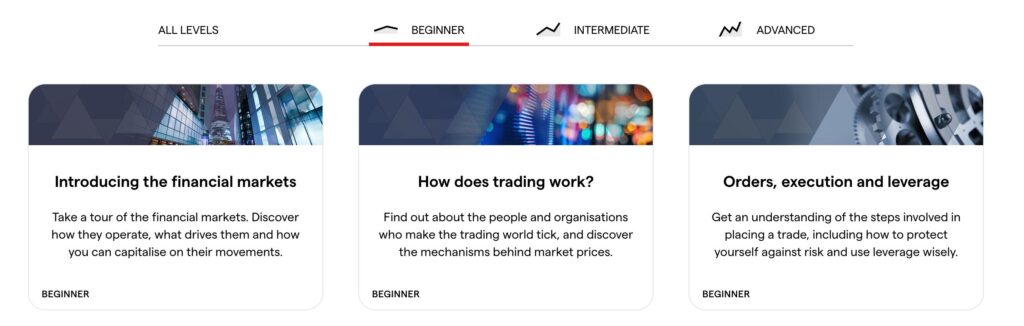

IG – Beginner Courses

Demo Trading

Before you risk real money, demo accounts let novice traders practice in a risk-free environment. These accounts use virtual funds, typically $10,000 to $100,000, so you can:

- Get familiar with the broker’s platform and app.

- Test out trading strategies.

- Build confidence without pressure.

- Experiment with different trading styles to find what suits you.

Why it matters: Mistakes in a demo account won’t cost you a penny, but they’ll teach you invaluable lessons.

I’ve used dozens of demo trading accounts over the years, but I return to the paper trading mode at AvaTrade’ because it never expires – perfect for beginners who want to continue testing trading strategies, even after they’ve transitioned to real-money trading.

AvaTrade – Demo Platform

Beginner-Friendly Accounts

Starting small is key when you’re learning the ropes. Beginner-friendly accounts are designed to lower barriers to entry:

- Micro or cent accounts: Trade with very small position sizes to reduce risk.

- Low minimum deposits: Start with as little as $10 or increasingly $0 instead of hundreds.

- Simple fee structures: Avoid hidden fees and confusing commission models.

Why it matters: Starting small lets you learn at your own pace without stressing about losing significant money upfront.

XTB ticks every box when it comes to beginner-friendly trading accounts with no minimum deposit, trade sizes of just 0.01 lots and a commission-free trading account that keeps pricing simple.

User-Friendly Platform

Trading platforms can be intimidating at first, so prioritize brokers with intuitive platforms and mobile apps. Features to look for:

- Clean, simple interface: Easy navigation and straightforward charting tools.

- Intuitive design: Easy navigation and clearly labelled features.

- Mobile compatibility: A functional app for trading on the go.

- Customizable dashboards: Set up the platform to suit your needs.

Why it matters: If the platform frustrates you, trading becomes a chore. A smooth experience keeps you motivated.

The TradingView platform at Eightcap is among the best I’ve used. I love the intuitive workspace, modern look and feel, plus the heaps of charting tools, including 21 customizable chart types and over 100 indicators.

Opportunities to Learn from Experienced Traders

You can benefit from observing and copying more experienced traders as a beginner. Social trading and copy trading features allow you to:

- Follow skilled traders: Learn their strategies and understand their decisions.

- Copy trades automatically: Mirror the trades of successful traders in real-time.

- Social trading: Follow discussions and insights from a trading community.

- Engage with a trading community: Ask questions, get tips, and learn collaboratively.

Why it matters: These tools give you a shortcut to learning successful strategies and understanding market behavior.

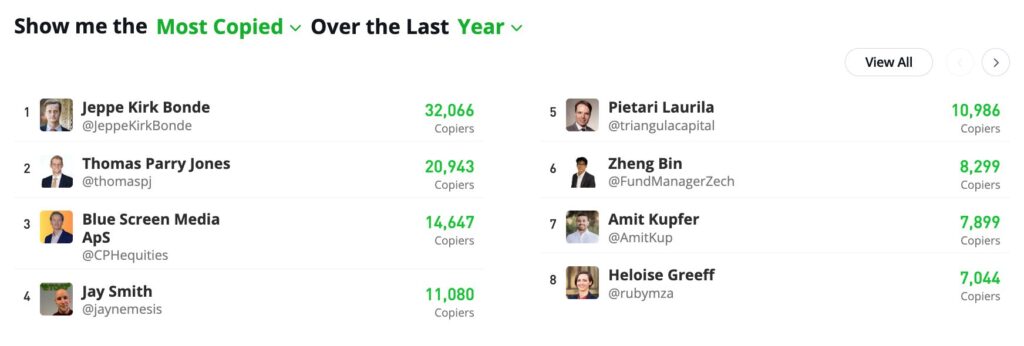

The social trading network at eToro continues to lead the pack with an unrivalled user design, a hugely active community, and the ability to follow the trades of pros in a few clicks.

eToro – Copy Traders

Excellent Support

When you’re new to trading, questions will arise. Reliable customer support can make or break your experience. Look for:

- 24/5 or 24/7 support: Especially important if you trade across global markets.

- Multiple support channels: Live chat, email, phone, a detailed FAQ section, and increasingly social media.

- Responsive, helpful answers: Quick and clear assistance without canned responses.

Why it matters: Quick, clear answers help you stay confident and keep moving forward, especially in fast-moving markets.

I’ve tested the support at countless brokers over the years and Pepperstone remains at the top if you want fast, dependable responses, typically received in less than 5 minutes through live chat.