Best Swing Trading Brokers 2026

Discover our top swing trading brokers, picked for their low fees, diverse investment options, advanced platforms, and strong regulatory protections, all designed to help you capitalize on short-to-medium-term market movements.

-

1

Interactive Brokers consistently ranked as a top broker for swing traders. It offers stocks, options, futures, forex, and ETFs on 160+ markets through its TWS platform. Commissions start at $0.005 per share. Overnight fees apply to leveraged positions, and swap-free options are limited. It provides fast execution, stock leverage up to 1:4, advanced charting, new AI tools, and strong regulation ensures security.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 NinjaTrader is a strong choice for swing traders interested in forex, futures, and CFDs using its powerful platform. Spreads begin at 0.0 pips, with futures commissions starting at $0.09 per contract. Overnight fees apply to leveraged positions. It offers advanced charting and automation tools for various swing strategies.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 In our recent tests, eToro USA excelled for swing traders with access to stocks, ETFs, and cryptocurrencies on its user-friendly platform. Overnight fees applied to leveraged positions, and weekend fees were triple the daily rate. Crypto trades carried a 1% commission. Execution was consistent, though slippage could occur during volatile periods, which might affect some swing trading strategies.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 In our recent tests, Plus500 USA provided swing traders with an excellent futures service in indices, energy, metals, and forex. Overnight fees for leveraged positions were competitive, based on position size, price, and funding rate. Execution times averaged under 50ms, which is fast enough for swing trading strategies.

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 In our tests, FOREX.com provided swing traders with forex, indices, commodities, and crypto through its proprietary platform, one of the most user-friendly we've experienced. RAW Pricing accounts had spreads starting at 0.0 pips with a $7/100k commission. Overnight funding fees also applied. The advanced charting and customizable layouts were especially impressive for serious swing traders.

Top Swing Trading Brokers Comparison

Broker Details Comparison

Safety Comparison

Compare how safe the Best Swing Trading Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Swing Trading Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Swing Trading Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Swing Trading Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Swing Trading Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Swing Trading Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Swing Trading Brokers 2026.

Broker Popularity

See how popular the Best Swing Trading Brokers [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Interactive Brokers |

|

| eToro USA |

|

| NinjaTrader |

|

| FOREX.com |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- The TWS platform is designed for intermediate to advanced traders. It includes over 100 order types and a dependable real-time market data feed that rarely experiences downtime.

- IBKR provides a cost-effective platform for traders by offering low fees, narrow spreads, and clear pricing.

- Interactive Brokers has introduced ForecastTrader, a zero-commission service allowing users to trade yes/no Forecast Contracts on political, economic, and climate events. Contracts offer fixed $1 payouts, 24/6 market access, and a 3.83% APY on held positions.

Cons

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- NinjaTrader provides detailed charting software for active traders, complete with custom technical indicators and widgets.

- Traders can access a free platform and trade simulation capabilities with the unlimited demo.

- You can access thousands of applications and add-ons from developers worldwide for trading.

Cons

- The advanced trading tools require an additional fee.

- Some payment methods require a withdrawal fee.

- You need to register with partner brokers to trade in securities other than forex and futures.

Why Trade With eToro USA?

eToro is a top choice for traders due to its top-notch social investing and copy trading services. The broker caters well to new traders with its low deposit requirement, commission-free trading, and user-friendly platform.

Pros

- eToro USA Securities is a reliable broker that's regulated by the SEC, part of FINRA, and a member of SIPC.

- A free demo account enables new users and potential traders to test the broker without risk.

- Traders can use Smart Portfolios for a simpler approach, covering multiple sectors and markets like renewable energy and artificial intelligence.

Cons

- The exclusive terminal does not accommodate trading bots and lacks extra equity market analysis tools.

- There are fewer trading options available, including only stocks, ETFs, and cryptos, compared to competitors.

- Traders used to third-party charting tools won't find MetaTrader 4 platform integration.

Why Trade With Plus500US?

Plus500US is an excellent choice for beginners, offering a user-friendly platform, low trading margins, and access to the Futures Academy to improve trading skills. Its powerful tools and reliable service earned it second place in DayTrading.com's annual 'Best US Broker' award.

Pros

- The Futures Academy is a useful resource for beginner traders due to its captivating videos and simple articles. Its unrestricted demo account is also beneficial for practicing trading strategies.

- The account setup, pricing structure, and web platform make futures trading simpler than competitors like NinjaTrader.

- Plus500US stands out for its low fees, competitive trading margins, and no charges for inactivity, live data, routing, or platform use.

Cons

- Plus500US lacks social trading features, unlike competitors such as eToro US, which might enhance its appeal to aspiring traders.

- Plus500US is expanding its investment options, but it currently only offers around 50+ futures and no stocks.

- Plus500US offers competitive pricing but does not have a discount program for high-volume traders, unlike brokers like Interactive Brokers.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

Cons

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

- FOREX.com has expanded their trading offerings, but these remain limited to forex and CFDs. Unfortunately, they don't provide options to invest in actual stocks, ETFs, or cryptocurrencies.

Filters

How We Chose The Best Brokers For Swing Trading

We ranked the top brokers for swing trading using our overall ratings, which combine hands-on tests with a data-driven rating system to ensure objective recommendations.

Key swing trading factors we analyzed:

- Trading Costs & Fees – Assessed spreads and commissions, and overnight financing to ensure competitive pricing.

- Charting & Analysis – Personally evaluated platforms for advanced charting, technical indicators, and multi-timeframe analysis.

- Execution & Trade Management – Investigated execution speeds and tools like stop-loss/take-profit, and trailing stops.

- Market Access & Leverage – Examined tradable assets (stocks, indices, forex, commodities, ETFs, crypto) and margin availability.

What To Look For In A Top Broker For Swing Trading

Swing trading sits right between day trading and long-term investing, making it a popular choice for traders who like to hold positions for a few days to weeks.

But to make the most of this strategy, you’ll need a broker that offers the right mix of tools, pricing, and market access to maximize your potential profits.

Here’s what to look for when choosing a broker for swing trading:

Low Commissions & Tight Spreads

Swing traders don’t trade as frequently as day traders, but trading costs can still add up. The ideal broker should offer:

- Low or zero commissions on stocks, ETFs, and forex (depending on the market).

- Tight spreads for forex and CFD trading, minimizing entry and exit costs.

- No hidden fees such as inactivity charges or high withdrawal fees.

Expert take: I discovered, in my early trading career, that if a broker charges a high commission per trade, it can eat into swing trading profits, especially when trading small price movements.

Top swing trading broker for low commissions and tight spreads: OANDA is excellent for its transparent pricing and reliable execution that supports strategy refinement. There’s also no minimum deposit, making it accessible to traders with varying capital levels.

Competitive Overnight Financing (Swap) Rates

Since swing traders hold positions overnight, you’ll want to check the broker’s swap rates (interest charged for holding leveraged positions overnight).

- For forex & CFDs: Lower swap fees mean you keep more of your profits.

- For stocks and ETFs: A broker that offers cash accounts (no leverage) can help avoid interest costs.

Pro Tip: Some brokers offer swap-free accounts, which can be helpful for traders looking to minimize overnight fees.

Top swing trading broker for overnight financing rates: Pepperstone is one of the best brokers for competitive pricing from our tests, with raw spreads starting from 0.0 pips on ECN-style accounts, low overnight rates or the option of a swap-free account for some traders.

Advanced Charting & Technical Analysis Tools

Since swing traders rely heavily on technical analysis, a good broker should provide:

- Multiple timeframes (daily, 4-hour, 1-hour charts).

- Built-in indicators like moving averages, RSI, MACD, Bollinger Bands, etc.

- Drawing tools for support/resistance lines, trendlines, and Fibonacci retracements.

Expert take: I’d consider trading platforms like MetaTrader 5 (MT5) and TradingView because I’ve found they offer advanced charting features tailored for swing traders.

Top swing trading broker for advanced charting and technical analysis tools: CMC Markets offers a terrific Next Generation platform, alongside MT4, which is optimized for swing traders, featuring enhanced charting tools, news feeds, and risk management features.

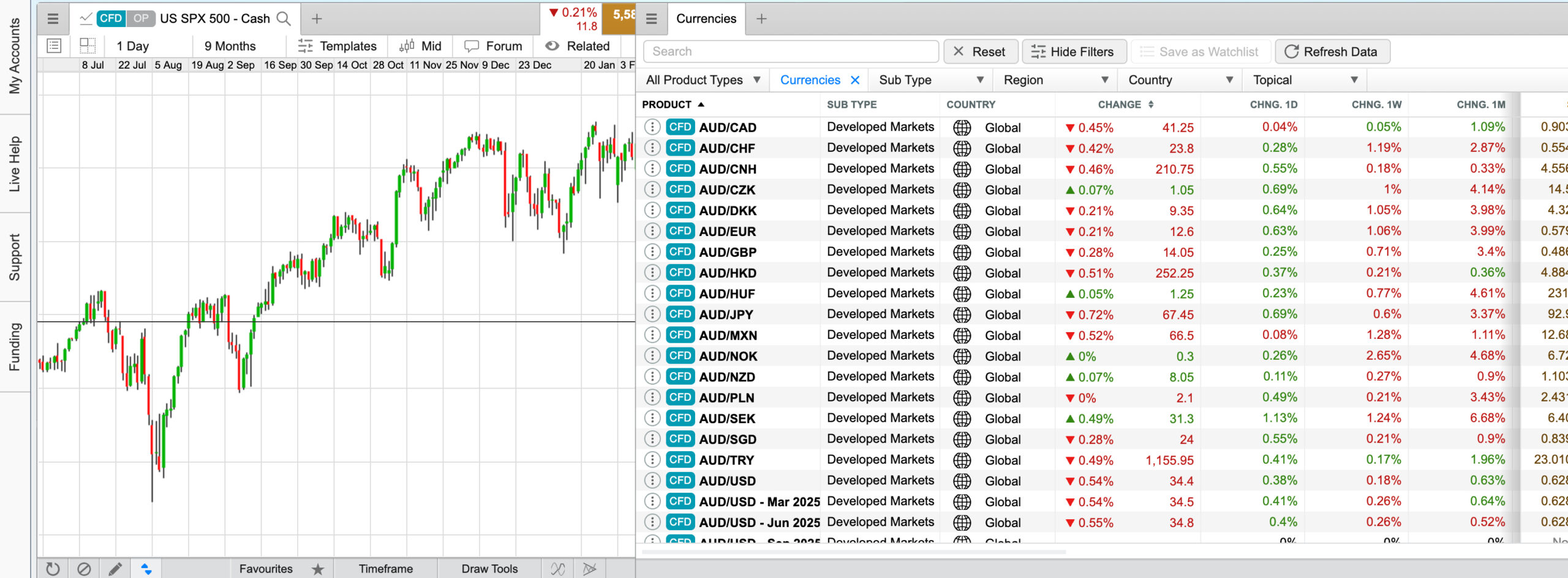

CMC Markets Next Gen platform is perfect for swing traders with charts, thousands of instruments, news, analysis, watchlists and more

Wide Market Access

A good swing trading broker should offer a diverse range of assets so you can find the best opportunities. Look for brokers that provide access to:

- Stocks & ETFs (US, European, and Asian markets)

- Forex pairs (major, minor, and exotic pairs)

- Commodities (gold, oil, silver, etc.)

- Cryptocurrencies (Bitcoin, Ethereum, etc., if you want to swing trade crypto)

- CFDs (for leveraged trading on multiple assets)

Top swing trading broker for wide market access: IG offers a vast array of 17,000+ instruments, including forex, indices, shares, commodities, and cryptocurrencies. It’s also one of a select few swing trading brokers with pre-market and after-hours trading, allowing you to react to news outside regular trading hours.

Reliable Execution & Fast Order Processing

Swing traders don’t need ultra-fast execution like scalpers, but you still need a broker that:

- Processes trades quickly to avoid slippage.

- Offers multiple order types (stop-loss, take-profit, limit, and trailing stops).

- Has minimal downtime to ensure you can enter/exit trades efficiently.

Top swing trading broker for reliable execution and fast order processing: In my early trading days, I quickly discovered that brokers with ECN (Electronic Communication Network) execution, like FXCC, often provide better pricing and faster order execution than market maker brokers.

Strong Regulation & Security

To protect your funds, always choose a broker regulated by a reputable financial authority, such as:

Pro Tip: Check if the broker offers segregated accounts (which keep your funds separate from the broker’s operational funds) for added security.

Top swing trading broker for regulation and security: Saxo is highly trusted as a licensed Danish bank while catering to serious swing traders with premium services and extensive market access align with substantial investment strategies. It’s also multi-regulated by trusted bodies (DFSA, MAS, FCA, SFC, FINMA, AMF, CONSOB).

Good Customer Support & Educational Resources

A broker with responsive customer support and educational materials can be a game-changer for swing traders. Look for:

- 24/5 or 24/7 customer service (live chat, phone, email).

- Webinars, guides, and market analysis to improve your trading strategy.

- Demo accounts to test the platform before trading real money.

Some brokers also provide daily market insights and technical analysis reports, which can be useful for swing traders looking for trade ideas.

Top swing trading broker for customer support and educational resources: IG has an impeccable reputation and the best educational resources we’ve seen, including a standalone Academy app, a daily morning show, and interactive courses that help upskill new swing traders.

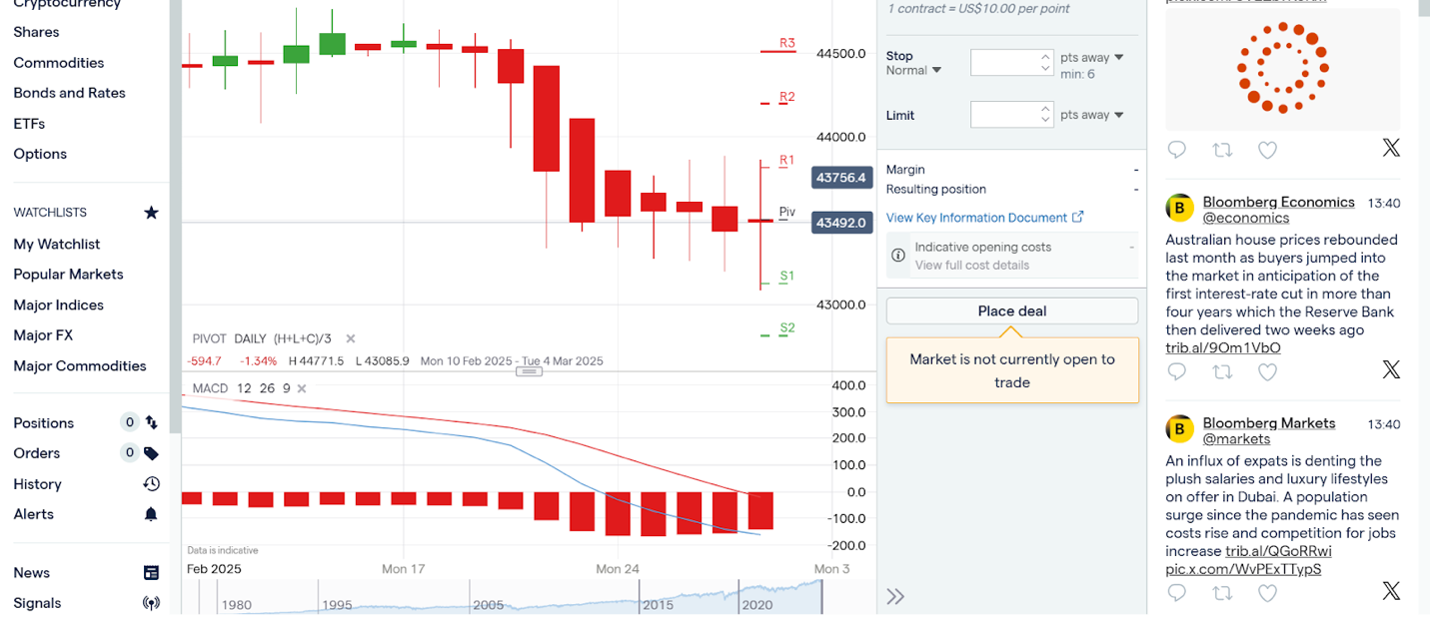

IG’s web platform was built for swing traders in mind, featuring a simple design

FAQ

What is Swing Trading?

Swing trading is a trading style that aims to capture short to medium-term price movements in financial markets.

Unlike day traders, who close positions within the same trading day, swing traders hold trades for several days or even weeks, riding the “swings” of market momentum.

This approach is popular because it strikes a balance between active trading and longer-term investing. It allows traders to take advantage of market trends without being glued to their screens all day.

How Does Swing Trading Work?

Swing traders typically use a mix of technical and fundamental analysis to identify trade opportunities. Here’s a quick breakdown of how they approach the market:

- Trend Identification: Traders look for stocks, forex pairs, or other assets trending upward or downward.

- Entry and Exit Points: Traders time their entries and exits using tools like moving averages, the RSI (Relative Strength Index), and support/resistance levels.

- Holding Period: Depending on market conditions, positions are typically held for a few days to a few weeks.

- Risk Management: Stop-loss and take-profit levels are set to protect against major losses and lock in gains.

Let’s say an index is in an uptrend, and the price pulls back to a key support level. A swing trader might buy at the support level, expecting the price to bounce back toward recent highs. Once the price reaches a predetermined target, the trader sells and locks in the profit.