Kraken Review 2025

Why Trade With Kraken?

"Kraken is suitable for traders seeking a variety of cryptocurrencies, including Bitcoin, and a strong history of security."

Detailed Ratings

Quick Facts

Pros

- Crypto staking

- A highly safe and secure service, with no recorded breaches in the ten years since it was established.

- Low minimum deposit of $10

- Mobile investing

- Wide range of over 220 established cryptocurrencies available for trading.

Cons

- Low leverage on spot trading

- Pro account's verification process is slow.

- Does not accept fiat deposits

- Slow verification times

- Doesn't support many new alternative coins.

Regulation & Trust

Launched in September 2013 and based in San Francisco, Kraken is one of the world’s leading cryptocurrency exchanges.

It serves over six million users and offers a reliable platform for trading a wide range of cryptocurrencies with fiat currencies like USD, EUR and JPY.

Kraken’s strong regulatory foundation sets it apart from many competitors. It is licensed in the US, Canada, UK, Australia and Japan—some of the most heavily regulated financial markets.

Kraken also operates Kraken Bank, chartered by the Wyoming Division of Banking, reinforcing its role as a bridge between traditional finance and crypto. This makes it a more transparent and trustworthy option compared to less regulated exchanges.

Kraken is widely regarded as one of the most secure platforms in the industry. It has never been hacked, stores 95% of assets in cold storage, and uses advanced encryption and account protection measures.

Unlike some exchanges with unclear reserve practices, Kraken maintains full reserves and works with regulated banking partners to securely hold client fiat deposits.

Regulation & Trust Details

- Regulator: FCA, FinCEN, FINTRAC, AUSTRAC, FSA

- Guaranteed Stop Loss: No

- Negative Balance Protection: No

- Segregated Accounts: No

Accounts & Banking

Live Accounts

Kraken offers two main types of accounts: Personal and Business. Each is designed to suit different user needs while maintaining a strong focus on regulatory compliance and security.

A Personal account is ideal for individual traders, whether you’re new to crypto or an experienced investor. Within this category, you can progress through different verification levels—Starter, Intermediate, and Pro—which unlock additional features such as higher funding limits, margin trading, and futures. Verification requirements increase with each level to ensure compliance with global financial regulations.

A Business account, however, is designed for entities such as companies, hedge funds, and professional trading firms. These accounts offer higher transaction limits, access to Kraken’s OTC (over-the-counter) desk, API integration, and tailored support from Kraken’s institutional team. Businesses must submit documentation proving legal status and ownership as part of the onboarding process.

While core services like spot trading and crypto staking are available to both account types, business accounts benefit from more robust tools and personalized service.

I find it straightforward to deposit and withdraw funds. I can choose between crypto and fiat options. Funding my account with Bitcoin transactions or Ethereum payments is quick, and there’s also support for debit card and credit card.

That said, I have to monitor the $5,000 deposit limit over a 7-day period, which can be a constraint if I’m trying to move larger amounts.

The minimum deposit and withdrawal requirements vary depending on the token, so I always double-check Kraken’s website before transferring to avoid hiccups.

Regarding leverage, Kraken offers a reasonably conservative approach to spot trading. There’s 1:5 leverage on major pairs like BTC/USD, which gives some flexibility without exposing you to the extreme risks you’ll find on platforms like OKX, where spot leverage isn’t capped as tightly.

On less liquid pairs—like XMR/EUR—I’ve noticed the leverage drops to 1:2, which makes sense given the added volatility and lower trading volume.

For futures trading, Kraken is more aggressive. I can access up to 1:50 leverage on most contracts, which opens up opportunities for higher returns—but also demands tighter risk management.

Demo Accounts

The Kraken demo account is helpful, but it’s limited to the derivatives platform and does not support spot trading.

The interface closely mirrors the real environment, so it should give you a good feel for how the platform works under live market conditions.

I like that I can test out advanced order types like Post Only, Stop Limit, and Trailing Stop—something not all exchanges we’ve tested include in demo environments.

Kraken also provides an API testing environment, which I use to simulate automated trading and test integrations. It’s a separate tool—not a traditional demo account—but still valuable if you’re into building bots or automated trading.

While Kraken’s demo offering is limited compared to brokers like OKX, which gives full-featured practice accounts for both spot and derivatives trading, it’s still helpful to get comfortable with futures contracts and test order functionality in a realistic, risk-free setting.

Accounts & Banking Details

- Minimum Deposit: $10

- Payment Methods: Bitcoin Payments, Etana, Ethereum Payments, PayID, Silvergate Bank Transfer, Wire Transfer

- Account Currencies: USD, EUR, GBP, CAD, AUD, JPY, CHF

- Islamic Account: No

Assets & Markets

Kraken provides a solid variety of over 100 cryptocurrencies, including major names like Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP).

It also supports seven fiat currencies, including USD, CAD, EUR, GBP, JPY, CHF and AUD, which makes fiat-to-crypto trading straightforward. Compared to some exchanges, this is especially convenient, where fiat support can be more limited or require third-party integrations.

Kraken also offers crypto futures and indices, which I use to hedge risk when I expect a dip in one asset. These tools give more flexibility than buying and holding, especially in volatile markets.

Kraken supports a select number of cryptocurrencies for margin trading. I’ve tested this with pairs like BTC/USD and ETH/USD, and the experience has been smooth.

The margin limits aren’t as high as some other platforms we’ve evaluated, but Kraken’s more conservative approach feels safer—especially if you’re not into high-risk leverage trading.

Assets & Markets Details

- Instruments: Cryptos

- Margin Trading: Yes

- Crypto Coins: AAVE, ALGO, ANT, REP, REPV2, BAT, BAL, XBT, BCH, ADA, LINK, COMP, ATOM, CRV, DAI, DASH, MANA, XDG, EWT, EOS, ETH, ETC, FIL, FLOW, GNO, ICX, KAVA, KEEP, KSM, KNC, LSK, LTC, MLN, XMR, NANO, OCEAN, OMG, OXT, PAXG, DOT, QTUM, XRP, SC, XLM, STORJ, SNX, TBTC, USDT, XTZ, GRT, TRX, UNI, USDC, WAVES, YFI, ZEC, BNB

Fees & Costs

Kraken is one of the more cost-effective crypto exchanges, especially when you’re using Kraken Pro.

From what I’ve seen using Kraken, the fees depend on which part of the platform you use.

If you’re using the Instant Buy feature for convenience, you’ll pay 0.9% for stablecoin purchases and 1.5% for other crypto assets.

In addition, there are extra charges depending on the payment method you choose, such as bank cards or bank transfers.

When you switch to Kraken Pro, the fee structure is more flexible and rewards higher trading volumes. It follows a maker-taker model: maker fees range from 0.00% to 0.16%, and taker fees range from 0.10% to 0.26%, depending on how much you trade over 30 days.

I like that Kraken doesn’t nickel-and-dime users. You don’t pay anything for futures wallet transfers, staking, storing funds, or maintaining your account. And while it doesn’t offer flashy sign-up bonuses, its lower fees for high-volume trading feel like a fair reward.

Fees & Costs Details

- Crypto Spread: 0-0.26% average

Platforms & Tools

Kraken lets you choose between two distinct trading platforms: Standard and Pro. Each caters to a different experience level, and I find both valuable, depending on my goals.

Kraken’s Standard platform best suits beginners or anyone wanting to buy or sell crypto quickly. Its interface is clean and straightforward—I can place market orders, fund my account with fiat or crypto, and even stake assets without digging through complex menus.

It’s great when I need to make a quick purchase or send crypto without overthinking it. That said, it comes with higher fees.

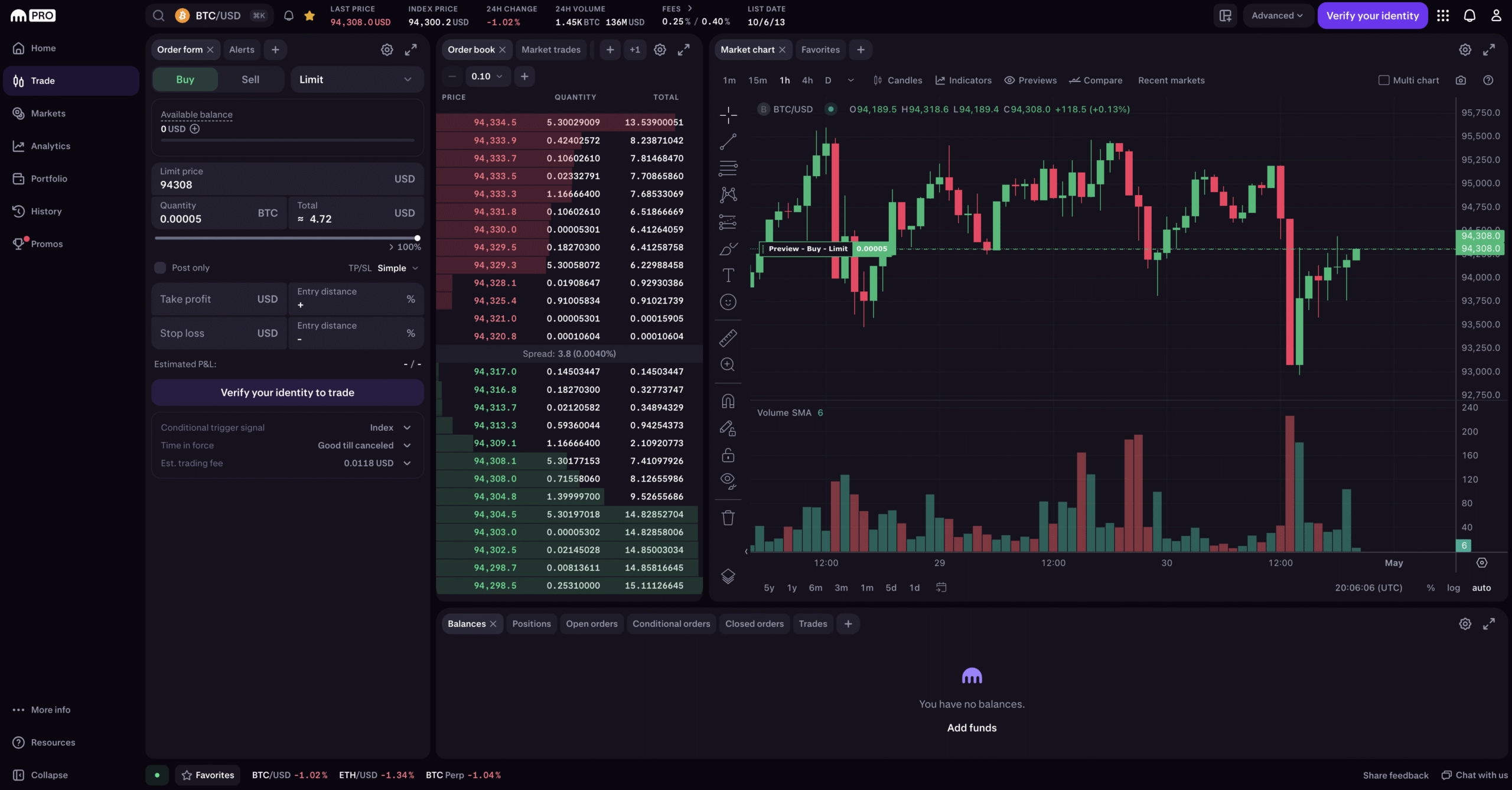

Kraken Pro is a powerful, low-fee trading platform designed for active crypto traders

When I want more control, I switch to the Pro platform, which is geared toward active traders. Its more advanced interface includes real-time charts, order book depth, and multiple order types, such as limit, stop-loss, and post-only.

It also supports margin and futures trading directly from the dashboard. I like that the fee structure is based on a maker-taker model, with much lower rates than the Standard platform and dropping further if I trade more frequently.

Kraken Pro feels solid and dependable compared to other platforms. However, it’s not quite as customizable or fast-paced as some other crypto trading dashboards which offers more altcoins and sometimes deeper liquidity, especially for newer tokens.

Still, Kraken shines in clarity and regulatory trust—two things I value when trading larger amounts.

Platforms & Tools Details

- Platforms: AlgoTrader, Quantower

- Android App Rating:

- iOS App Rating:

- Copy Trading: No

- VPS: No

- Automated Trading: Kraken Futures is integrated in other platforms which have bots: Bookmap, Caspian, FMZ Quant, Gunbot, HaasOnline, Hyndor, Margin

- AI Trading: No

Research

Kraken’s research resources are genuinely insightful—especially if you want to deepen your understanding of crypto markets beyond trading.

The Kraken Intelligence secton on its website features detailed reports on macroeconomic trends, market volatility, and on-chain activity. I find these to be well-written and grounded in data, not just hype or marketing.

One major downside is that the last published monthly report was in October 2022, which feels noticeably outdated for a platform of Kraken’s size.

Kraken’s Intelligence reports deliver expert research and market analysis

As someone who values regular market analysis, I expect more consistent updates. Compared to exchanges like Coinbase, which publish new research and insights far more frequently, it’s disappointing.

When Kraken published regularly, I found the market recaps and deep dives into crypto-specific themes—like stablecoins or DeFi—to be genuinely useful.

Suppose you’re looking for timely, actionable research. In that case, you might supplement Kraken’s older reports with real-time tools from platforms like Messari, Glassnode, or even competitor exchanges that still update their research hubs.

Education

Kraken does a solid job with its educational resources, especially if you’re just getting started or want to deepen your understanding of crypto beyond just buying and selling.

I’ve spent a lot of time on the Learn Center, and it’s well-organized. It covers everything from blockchain basics and DeFi concepts to more technical topics like staking and security.

Kraken’s Learn Center offers clear, in-depth guides and educational resources

The content is written clearly and straightforwardly—there’s not a lot of jargon, making it approachable even to non-seasoned traders.

Kraken also publishes market insights, explainers, and how-to guides, which should help beginners feel more confident when trying new features like margin trading or futures.

Compared to other exchanges we’ve tested, Kraken focuses more on educational depth than flashy presentation. For example, Coinbase‘s “Learn and Earn” program is more interactive and gamified.

Kraken doesn’t lean as heavily into that style—it’s more straightforward, almost like a crypto textbook rather than a training course. That works for me, but I can see how someone who prefers video content or quizzes might find it a bit dry.

Customer Support

Kraken’s customer support is among the most accessible and dependable in the crypto world. One feature differentiating it from other exchanges is that it offers phone support, with dedicated numbers for the US, EU, and UK.

Speaking to someone directly when needed—not just typing into a chat box—gives me extra confidence, especially when dealing with account or funding issues.

Beyond that, Kraken also offers 24/7 live chat, which has come in handy for quick questions or troubleshooting. I usually get connected to a real person within a few minutes.

I’ve used email for more in-depth support, and responses typically arrive within a few hours—not something I can always say about other platforms.

What I appreciate, though, is how active Kraken is across multiple social media channels, including Twitter, Reddit, LinkedIn, and Facebook, and even on Telegram, where there are official communities and updates.

It makes it easy to stay informed about platform updates, maintenance, or new features without always needing to log in or check the website.

The exchange’s Support Center is another excellent resource—clear and well-organized, with articles on everything from staking rewards to API integrations.

This level of access and transparency adds to the platform’s credibility in a space where user support often falls short.

Should You Trade With Kraken?

Kraken is a strong choice if you value security, regulatory transparency, and a solid selection of crypto assets without overwhelming complexity.

Kraken stands out for its reputation—it’s one of the oldest and most respected crypto exchanges, with a strong focus on compliance and user protection.

The platform is user-friendly for spot trading, and Kraken Pro offers low fees that get even better with higher trading volume. While the fee structure isn’t as aggressive as some exchanges at the highest levels, it’s still competitive and easy to understand.

One area where Kraken could improve is its rewards and bonuses—it doesn’t offer many promotions compared to competitors. And while there is a demo account, it’s limited to derivatives, not spot trading.

Article Sources

Alternatives To Kraken

These similar brokers are the highest rated alternatives to Kraken.

-

1

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.3 Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading. -

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.4 Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.6 Founded in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage offering trading on over 1,200 instruments, including binary options. It provides various accounts (JForex, MT4/5, Binary Options) and advanced platforms (JForex, MT4/MT5) with strong tools and market data for active traders.