Best Spot Trading Brokers 2025

Explore the best brokers for spot trading, carefully tested and analyzed to help you capitalize on real-time market opportunities with straightforward transactions.

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 NinjaTrader is a US-based brokerage regulated for trading futures. It offers three different pricing plans for varied needs and budgets, along with extremely low margins on popular contracts. The company's renowned charting software and trading platform provides extensive customization options and excellent technical analysis features. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 OANDA is a well-known broker that excels in quick trade executions, a low deposit requirement, and impressive charting and trading platform functions. The highly-regarded brand has over 25 years of expertise and is overseen by reliable authorities like the NFA/CFTC. It provides 24/7 support for traders and offers flexible contract sizes with automated trade executions. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.4 Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.3 Moomoo is a regulated trading platform which is controlled by SEC. It provides a simple, cost-effective method to trade in stocks, ETFs, and various assets from China, Hong Kong, Singapore, the US, and Australia. They provide the option for margin trading, along with no deposit account and several bonus options.

Best Spot Trading Brokers Comparison

Safety Comparison

Compare how safe the Best Spot Trading Brokers 2025 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Spot Trading Brokers 2025.

Comparison for Beginners

Compare how suitable the Best Spot Trading Brokers 2025 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Spot Trading Brokers 2025 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Spot Trading Brokers 2025.

Detailed Rating Comparison

Compare how we rated the Best Spot Trading Brokers 2025 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Spot Trading Brokers 2025.

Broker Popularity

See how popular the Best Spot Trading Brokers 2025 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Moomoo |

|

| Interactive Brokers |

|

| NinjaTrader |

|

| FOREX.com |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- IBKR offers exceptional access to global stocks, with thousands of equities available from over 100 market centers in 24 countries, including the recent addition of the Saudi Stock Exchange.

- IBKR provides a cost-effective platform for traders by offering low fees, narrow spreads, and clear pricing.

- IBKR is a highly regarded brokerage, regulated by prime authorities. This ensures the safety and reliability of your trading account.

Cons

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- Low costs, with $50 trading margins and commissions starting at $.09 per micro contract.

- NinjaTrader is a well-regarded and acclaimed futures broker, approved by the NFA and CFTC.

- Traders can access a free platform and trade simulation capabilities with the unlimited demo.

Cons

- The advanced trading tools require an additional fee.

- You need to register with partner brokers to trade in securities other than forex and futures.

- Some payment methods require a withdrawal fee.

Why Trade With OANDA US?

OANDA is a reputable broker for US traders. It offers user-friendly tools for analysis and a simple sign-up process. It is very trustworthy due to heavy regulation.

Pros

- The broker provides clear pricing without any concealed fees.

- Traders can experience quick and dependable order execution.

- There's a robust selection of 68 currency pairs for committed forex traders focusing on short-term trades.

Cons

- Customer support is not accessible during weekends.

- Few payment options are available and e-wallets are not supported.

- The trading markets are limited to only forex and cryptocurrencies.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

Cons

- The funding options are not as extensive as those of top competitors such as IC Markets and lack several widely-used e-wallets, particularly UnionPay and POLi.

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

Why Trade With Moomoo?

Moomoo is a great option for beginner and intermediate traders aiming to diversify their investment portfolio. The brokerage's app is easily navigable and the trading fees are significantly low.

Pros

- Moomoo's insights and analytics are more comprehensive and detailed than other brands.

- The broker provides early access to trading hours before the market opens.

- Moomoo is a licensed entity with the US Securities and Exchange Commission (SEC) and the Monetary Authority of Singapore (MAS).

Cons

- The broker doesn't offer phone or live chat support, options typically provided by other brokers.

- The protection against negative balance, a standard security measure at highly regulated brokers, is not available here.

- Regrettably, even with its existing security features, this platform still lacks 2 factor authentication (2FA).

Filters

How We Chose the Best Spot Brokers

To identify the top brokers for spot trading, we recorded and evaluated over 200 key factors for each provider across our extensive broker directory.

Through in-depth hands-on testing of each platform, we assessed overall reliability. We then assigned total scores and ranked the top spot trading brokers to help traders find the most efficient and trustworthy options.

What to Consider When Searching for a Top Spot Trading Broker

The key things you should check when choosing a brokerage for spot trading include:

Speed and Accuracy

Being able to execute transactions quickly and with up-to-date pricing is essential when spot trading.

Look for brokers whose trading platforms provide real-time prices, and which are optimized for the fast and straightforward placing of deals.

Pepperstone is renowned for its quick execution speeds. At the other end of the scale, Vantage‘s sluggish trading platform may make it unsuitable for spot traders to use.

Pro tip: Rapid execution is especially important in the fast-moving currency market. Find a broker where trades are typically executed in fewer than 100 milliseconds.

Liquidity

Having a dynamic platform is important. But this counts for little if a broker suffers from poor liquidity and order fulfilment issues can spring up.

So select a company that partners with multiple liquidity providers to ensure swift execution with minimal slippage, even during periods of market volatility.

Its access to deep pools of liquidity makes CMC Markets a popular choice with spot traders.

Customer Support

As spot trading requires rapid action, it’s important to find a broker that can quickly solve any problems or questions that may arise.

XTB‘s impressive client support has seen it sweep up multiple awards down the years. Its customer service team is available 24 hours a day, seven days a week via live chat, telephone and email. And traders enjoy a dedicated account manager for specific account-related issues.

Source: XTB

Regulatory Status

Traders should seek brokers who are licenced to do business by a reputable financial regulatory authority.

This ensures that you aren’t handing your personal information or money over to a ‘fly by night’ operator, and lessens your chances of falling victim to poor business practices (like price manipulation and account mismanagement).

Pro tip: Check a broker’s regulatory status on the websites of regulatory bodies. For maximum protection, try to find a company that’s authorised to deal by one or more regulators in countries with well-developed financial markets (such as the Financial Conduct Authority (FCA) in the UK).

IC Markets has earned our confidence as a trusted spot trading broker, with authorization from the ASIC and CySEC. Some of our team also personally use it for real money trading.

Trading Costs

Low dealing costs are one of the big attractions of spot trading.

When choosing a brokerage, you need to consider a wide range of factors – like the size of bid and offer spreads, dealing commissions and management fees – as elevated costs can seriously the profits of high-frequency traders.

Pepperstone‘s Active Trader scheme and Razor accounts are popular with traders who are looking to keep costs to a minimum. The former provides rebates of 25% and above on trading commissions, while the latter offers ultra-tight spreads beginning at 0.0.

Asset Range

Not all traders will be bothered by the range of financial markets their broker offers access to. But those who may wish to trade multiple types of assets now or in the future should check the extensiveness of the intermediaries’ market range.

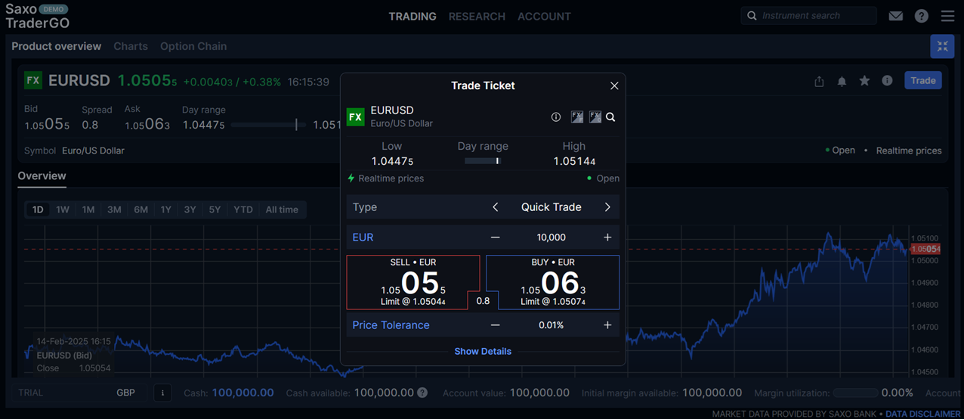

Saxo Bank offers by far the largest selection of assets we’ve seen (it offers trading on more than 70,000 markets and trading vehicles). Blackbull Markets is also rated highly for its product range.

Saxo Bank

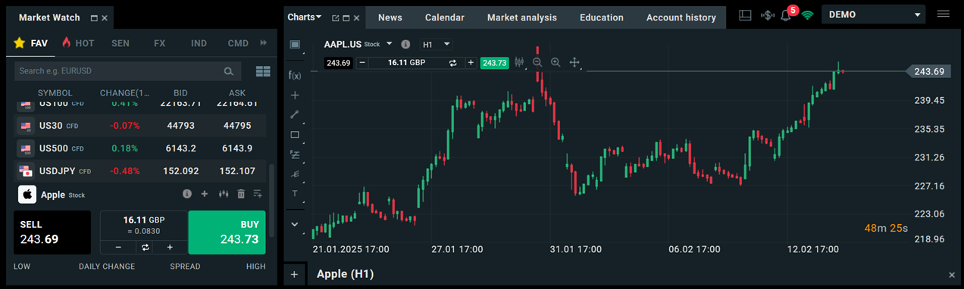

Trading Platform

As well as speed of trade execution and ease of use, consider other aspects of the broker’s trading platform.

Does it offer risk management tools (like stop loss orders), for instance, advanced charting capabilities for technical analysis, or instruments for algorithmic trading?

For those who like to exploit trading opportunities at a moment’s notice, it’s also worth seeing if the brokerage offers a great app for trading on the go.

Vantage is well respected for the quality of its trading platform and mobile app, offering impressive research tools and live charts. Traders can also use third-party plugins like MetaTrader 5 to execute their trades.

FAQ

What Is Spot Trading?

A spot market is one where transactions tend to be completed straight away, either on centralized financial exchanges or over the counter (OTC).

This differs from derivatives markets (such as futures or options contracts), in which a trade is agreed to be carried out at a later date.

What Is a Spot Trading Broker?

These financial services providers focus on trades that complete immediately (or within two business days (‘T+2’)) at current market prices. They sometimes offer a different proposition from brokers that handle longer-term trading contracts.

Spot brokerages can provide services in multiple markets including shares, commodities and cryptocurrencies. The vast majority of spot trading takes place in the forex market.