Brokers With Most Profitable Traders 2026

Jump into our top brokers with the most profitable traders, or the fewest losing traders, indicating a reliable platform, excellent tools, and efficient execution.

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

Profitable Traders

At Interactive Brokers 38% of traders are profitable.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 eToro is a platform for social investing that provides options for both short and long-term trading on stocks, ETFs, options, and crypto. The platform is recognized for its easy-to-use, community-oriented interface and reasonable fees. With oversight from FINRA and SIPC, and used by millions globally, eToro is a reputed name in the industry. Trading on eToro is facilitated by eToro USA Securities, Inc.Profitable Traders

At eToro USA 26% of traders are profitable.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms.Profitable Traders

At FOREX.com 26% of traders are profitable.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 Established in 2008, Exness is a respected broker known for offering over 40 account currencies, a wide choice of CFD instruments, and an intuitive web platform with features like currency converters and trading calculators.Profitable Traders

At Exness 46% of traders are profitable.

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 Skilling is a broker established in 2016, located in Cyprus. It provides a wide range of trading instruments with competitive spreads from 0.1 pips. The platform is beginner-friendly and is regulated in Europe and other regions with clear pricing. Registering and starting trading involves three simple steps.Profitable Traders

At Skilling 44% of traders are profitable.

Compare The Best Brokers With The Most Profitable Traders Across Key Features

How Safe Are The Platforms Trusted By Profitable Traders?

Security is a must—especially when you're beating the market. Here's how top brokers used by successful traders protect your funds:

Best Mobile Apps Used By Profitable Traders – Reviewed

Want to trade like the pros? These mobile platforms are favored by some of the most profitable traders:

Do These Brokers With The Fewest Losing Traders Deliver What Beginners Need?

Starting out? These brokers offer a great blend of education, tools, and support—many are also home to successful traders:

Do These Brokers With The Fewest Losing Traders Deliver What Advanced Traders Need?

Experienced trader? See why these brokers are popular among pros and how they support high-performance strategies:

Accounts Comparison

Compare the trading accounts offered by Brokers With Most Profitable Traders 2026.

Full Ratings: Brokers With The Most Profitable Traders

Explore our comprehensive ratings based on expert testing of brokers with the fewest losing traders:

Fees & Spreads Comparison – Most Profitable Trader Brokers

We broke down the costs to see if low fees contribute to profitability—here’s what the top brokers charge:

Which Brokers Attract The Most Successful Traders?

Curious where the most profitable traders are trading? Discover the platforms drawing in the most users:

| Broker | Popularity |

|---|---|

| Interactive Brokers |

|

| eToro USA |

|

| Exness |

|

| FOREX.com |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- IBKR, primarily designed for skilled traders, has expanded its appeal recently by eliminating its initial $10,000 deposit requirement.

- There's a large selection of free or paid research subscriptions available to all traders. If you subscribe to Toggle AI, you will also receive commission refunds from IBKR.

- The new IBKR Desktop platform combines the advantages of TWS and adds unique tools like Option Lattice and Screeners with MultiSort to make trading accessible and impressive for traders of all levels.

Cons

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

Why Trade With eToro USA?

eToro is a top choice for traders due to its top-notch social investing and copy trading services. The broker caters well to new traders with its low deposit requirement, commission-free trading, and user-friendly platform.

Pros

- Traders can use Smart Portfolios for a simpler approach, covering multiple sectors and markets like renewable energy and artificial intelligence.

- The online broker provides a user-friendly social investment network for easy crypto trading replication.

- The low minimum deposit and simple account setup allow beginners to start trading quickly.

Cons

- There are fewer trading options available, including only stocks, ETFs, and cryptos, compared to competitors.

- Traders used to third-party charting tools won't find MetaTrader 4 platform integration.

- Average fees can reduce the profits of traders.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

Cons

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

- The funding options are not as extensive as those of top competitors such as IC Markets and lack several widely-used e-wallets, particularly UnionPay and POLi.

- FOREX.com has expanded their trading offerings, but these remain limited to forex and CFDs. Unfortunately, they don't provide options to invest in actual stocks, ETFs, or cryptocurrencies.

Why Trade With Exness?

Exness is an excellent choice for active forex traders aiming to reduce costs after lowering spreads, enhancing execution speeds, and offering trading on over 100 currency pairs with more than 40 account currencies.

Pros

- Competitive spreads for USOIL and BTCUSD in 2024 start from 0 pips, with low commissions from $2 per side.

- Fast and reliable 24/7 multilingual customer support through phone, email, and live chat, validated by practical tests.

- Exness Terminal provides an easy experience for beginners with interactive charts, and creating watchlists is simple.

Cons

- Retail trading services are not available in some areas, including the US, UK, and EU, making them less accessible compared to leading brokers like Interactive Brokers.

- Exness has increased its variety of CFDs and introduced a copy trading feature, but it still lacks real assets like ETFs, cryptocurrencies, or bonds.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader are not available yet, despite increasing demand from traders and their integration with other platforms like Pepperstone.

Why Trade With Skilling?

Skilling is a great option for beginners wanting a competitive commission-free account with a copy trading feature. It's also suitable for seasoned strategy providers who want to earn commissions, or anyone interested in trading forex outside regular hours.

Pros

- The Standard account, with its $100 deposit and no commission charges, is ideal for beginner traders.

- Third-party charting tools exist for committed traders, offering numerous technical indicators and advanced order types.

- The broker is well-regarded worldwide and is overseen by leading regulators including the CySEC.

Cons

- Skilling falls behind competitors such as IG in providing research tools that assist traders in making educated decisions.

- Access to stocks on the Skilling Trader platform is limited, and the MT4 accounts offer a reduced selection of instruments.

Filters

How We Chose The Brokers With The Most Profitable Traders

To identify the top brokers with the most profitable traders, we developed a data-driven methodology based on publicly reported trader performance statistics.

Under EU law, all regulated brokers must disclose the percentage of retail traders who lose money on their platforms. We record this figure across every broker in our database, where the law applies, and update it regularly to reflect the most current data.

We then reverse-engineered the figures, highlighting the brokers with the lowest percentage of losing traders.

Whether it’s due to better tools, tighter spreads, superior execution, or smarter clientele, this allowed us to list the brokers that stand out for the percentage of their clients that are profitable.

What To Consider When Picking A Broker Based On Their Ratio Of Winning/Losing Traders

A broker’s percentage of losing traders can reveal a lot – but it’s not the whole story. While we track and rank this data meticulously, we’ve also spent years testing platforms firsthand to understand what else really helps traders succeed.

These are the key factors to consider:

Regulatory Status

The first thing to check is that the broker you’re considering is licensed by a reputable financial regulator in the European Economic Area (EEA), the UK, the US, Australia, or another well-regulated region.

Winning/losing trader disclosure rules are laid down by some of these legal entities, notably in the EU and UK, so it’s important to verify that the company complies with them, and that the company you’re considering hasn’t ‘cooked the books’ to artificially inflate the number of winning traders.

Besides this, using a fully regulated broker is essential to ensure that you receive the best customer service possible, and that you’re not putting your money or your personal data in jeopardy.

Top broker for regulatory status: Interactive Brokers is regulated by approximately a dozen regulators across Europe, North America and Asia. It’s one of the most established, well-trusted names that gets discussed between our testing panel.

Depth Of Information

In the course of our investigations, we’ve found that certain brokers provide more comprehensive client performance data and other trading statistics than others. This can be communicated via standalone educational material or via additional analytical tools, for instance.

Unsurprisingly, brokerages are especially happy to do this when the number of profitable traders on their books beats the market average/is higher than key competitors. The marketing potential of doing this is obvious!

However, such statistics are highly variable and can – for instance – be skewed one way or another by periods of market volatility. It’s important, therefore, to compare data over the same timeframe so as to get a true ‘like-for-like’ comparison.

Pro tip: Figures can also be distorted by the growth of ‘copy trading,’ where clients replicate the trades of more successful investors.

Top broker for depth of information: Alongside providing mandatory disclosures, eToro provides the ‘Popular Investor’ tool where traders can follow investors based on their success rate, risk tolerance, trading frequency and other variables. It’s a breeze to use in our experience.

FAQ

Why Do Brokers Publish Their Clients’ Success Rates?

You may have noticed that many brokers publish the percentage of profitable trades that their customers enjoy. You may have also wondered why companies communicate this information when the numbers are often unflattering.

The truth is that, in some jurisdictions, financial intermediaries are required to display such information to help clients better understand the risk they’re undertaking.

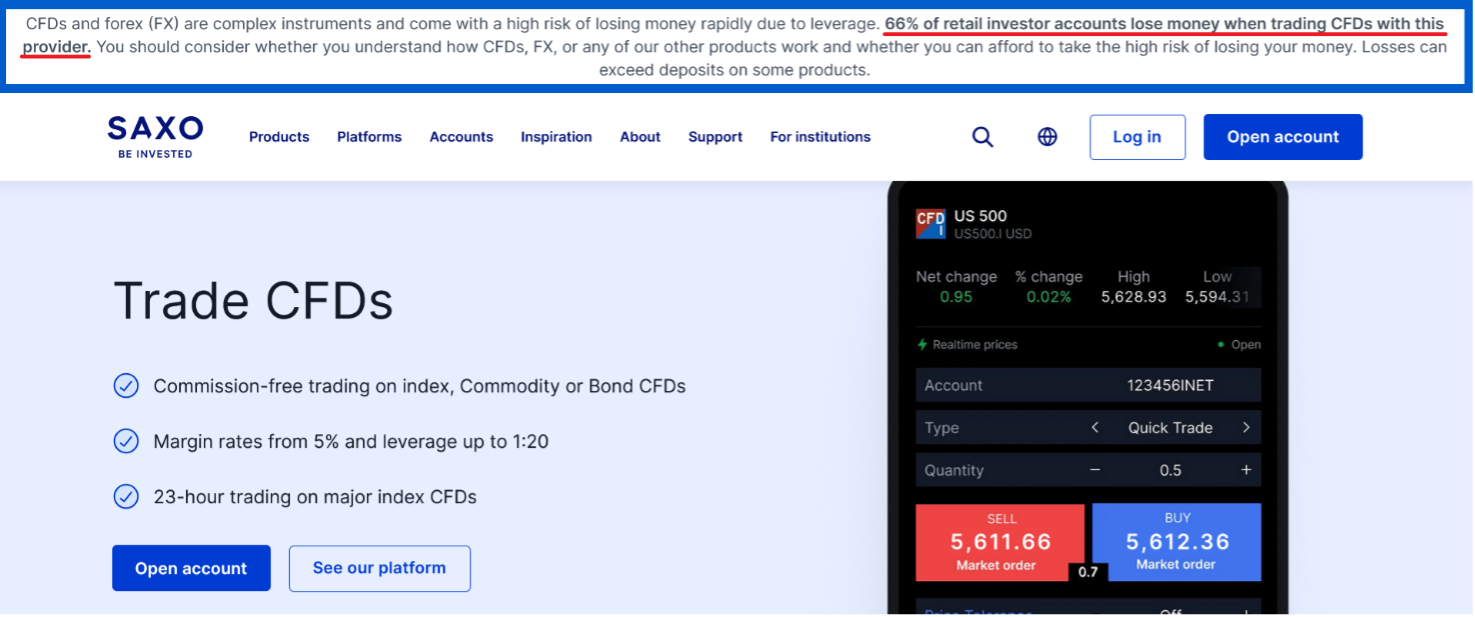

More specifically, brokerages must publish the percentage of their retail clients that lose money. You can see this in the example below, which we took from forex and CFD broker, Saxo.

Saxo, like most compliant brokers we’ve evaluated, displays the percentage of losing traders at the top of their website

Where Can I Find Information About How Many Traders Win At A Broker?

In line with regulations, this information must be clearly communicated on:

- The broker’s website

- Any marketing and promotional materials

- The documents customers sign to open an account

- The brokerage’s trading platform

- Risk disclosure documents

Crucially, these risk warnings must be displayed prominently and written using a standardised format that’s clear and easy to understand for all investors.

In Which Countries Are Brokers Required to Publish Trader Win/Loss Rates?

These regulations were introduced in 2019 by the European Securities and Markets Authority (ESMA), which oversees financial market regulation across the EEA. This bloc of countries comprises the 27 European Union (EU) nations along with Norway, Iceland and Liechtenstein.

While the UK is no longer part of the EEA, its regulator (the Financial Conduct Authority, or FCA) carried over the rules following Brexit, meaning brokers listed there must also publish such information.

Which Trading Products Require Online Brokers to Disclose Win/Loss Rates?

The rules were introduced to protect clients who use highly speculative products like contracts for difference (CFDs) and binary options.

These financial vehicles can be used to trade a wide range of markets, including forex, shares, commodities and cryptocurrencies.