Best Bitcoin Brokers 2026

Discover the best Bitcoin brokers and exchanges based on our tests: providers that make buying, selling, and trading Bitcoin easy while offering low fees, robust security, and user-friendly platforms.

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 NinjaTrader is a US-based brokerage regulated for trading futures. It offers three different pricing plans for varied needs and budgets, along with extremely low margins on popular contracts. The company's renowned charting software and trading platform provides extensive customization options and excellent technical analysis features. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 eToro is a platform for social investing that provides options for both short and long-term trading on stocks, ETFs, options, and crypto. The platform is recognized for its easy-to-use, community-oriented interface and reasonable fees. With oversight from FINRA and SIPC, and used by millions globally, eToro is a reputed name in the industry. Trading on eToro is facilitated by eToro USA Securities, Inc. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 OANDA is a well-known broker that excels in quick trade executions, a low deposit requirement, and impressive charting and trading platform functions. The highly-regarded brand has over 25 years of expertise and is overseen by reliable authorities like the NFA/CFTC. It provides 24/7 support for traders and offers flexible contract sizes with automated trade executions. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms.

Best Bitcoin Brokers Comparison

Broker Details Comparison

Safety Comparison

Compare how safe the Best Bitcoin Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Bitcoin Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Bitcoin Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Bitcoin Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Bitcoin Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Bitcoin Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Bitcoin Brokers 2026.

Broker Popularity

See how popular the Best Bitcoin Brokers [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Interactive Brokers |

|

| eToro USA |

|

| NinjaTrader |

|

| FOREX.com |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- The TWS platform is designed for intermediate to advanced traders. It includes over 100 order types and a dependable real-time market data feed that rarely experiences downtime.

- IBKR, primarily designed for skilled traders, has expanded its appeal recently by eliminating its initial $10,000 deposit requirement.

- IBKR provides a cost-effective platform for traders by offering low fees, narrow spreads, and clear pricing.

Cons

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- NinjaTrader provides detailed charting software for active traders, complete with custom technical indicators and widgets.

- Low costs, with $50 trading margins and commissions starting at $.09 per micro contract.

- Traders can access a free platform and trade simulation capabilities with the unlimited demo.

Cons

- The advanced trading tools require an additional fee.

- Some payment methods require a withdrawal fee.

- You need to register with partner brokers to trade in securities other than forex and futures.

Why Trade With eToro USA?

eToro is a top choice for traders due to its top-notch social investing and copy trading services. The broker caters well to new traders with its low deposit requirement, commission-free trading, and user-friendly platform.

Pros

- The low minimum deposit and simple account setup allow beginners to start trading quickly.

- A free demo account enables new users and potential traders to test the broker without risk.

- Traders can use Smart Portfolios for a simpler approach, covering multiple sectors and markets like renewable energy and artificial intelligence.

Cons

- Traders used to third-party charting tools won't find MetaTrader 4 platform integration.

- There are fewer trading options available, including only stocks, ETFs, and cryptos, compared to competitors.

- Average fees can reduce the profits of traders.

Why Trade With OANDA US?

OANDA is a reputable broker for US traders. It offers user-friendly tools for analysis and a simple sign-up process. It is very trustworthy due to heavy regulation.

Pros

- The OANDA web platform offers an exceptional charting environment with over 65 technical indicators provided by TradingView.

- OANDA is a credible and safe trading brand, approved by top regulators such as the CFTC.

- There's a robust selection of 68 currency pairs for committed forex traders focusing on short-term trades.

Cons

- The trading markets are limited to only forex and cryptocurrencies.

- Customer support is not accessible during weekends.

- Few payment options are available and e-wallets are not supported.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

Cons

- The funding options are not as extensive as those of top competitors such as IC Markets and lack several widely-used e-wallets, particularly UnionPay and POLi.

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

Filters

How We Chose the Best Bitcoin Brokers

We reviewed a range of Bitcoin brokers, evaluating their features, trading options, and performance.

After assessing each, we assigned a total score and used that to compile a ranking of the best brokers for trading Bitcoin in 2026.

What To Look For in a Top Bitcoin Broker

Picking the right broker for Bitcoin trading is a make-or-break decision for your crypto journey. Here’s what to keep in mind when choosing the best platform:

Regulation and Security

Bitcoin trading can be risky, especially with unregulated brokers. Look for brokers that are licensed by reputable regulatory bodies.

Depending on your region, verify their licenses with recognized bodies such as the FCA (UK), CySEC Cyprus), or ASIC (Australia).

Additionally, ensure the platform uses top-notch security features like two-factor authentication (2FA), encryption, and cold storage for funds.

Fees and Costs

From trading fees to withdrawal charges, understanding a broker’s cost structure is essential.

Some brokers offer competitive spreads or charge flat fees, while others might hide hidden costs.

Study your options to ensure you get the best value for your trades.

Ease of Use

Whether you’re a beginner or a pro, the platform should be intuitive and easy to navigate.

A well-designed interface, accessible mobile app, and seamless deposit/withdrawal processes can make a huge difference in your trading experience – I know from my years of trading.

Trading Tools and Features

For active traders, advanced charting tools, technical indicators, and market analysis can enhance decision-making.

If you’re new, look for platforms offering educational resources, demo accounts, or beginner-friendly features like copy trading.

Range of Cryptocurrencies

While your focus might be on Bitcoin, it’s worth considering a broker that supports a wide range of cryptocurrencies.

This allows you to diversify your portfolio or explore trading opportunities with altcoins in the future.

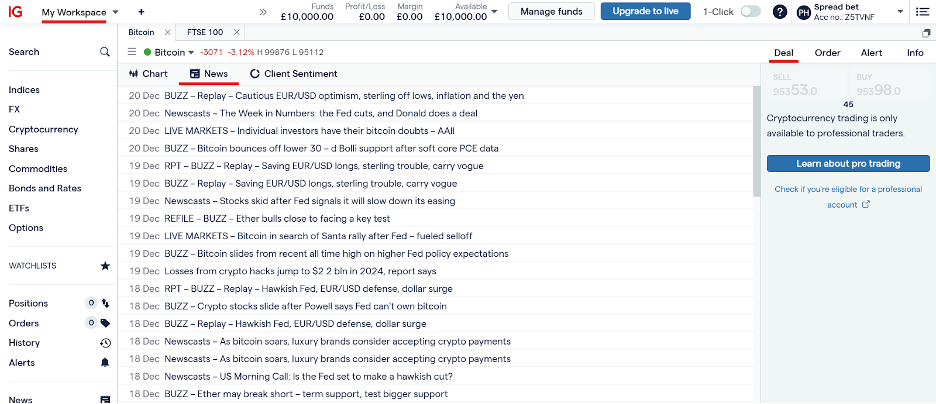

IG – Bitcoin and altcoins

Deposit and Withdrawal Options

A broker with flexible funding options – like credit/debit cards, bank transfers, or increasingly crypto deposits – can make your life easier.

Leverage and Margin

Some brokers allow leveraged trading, enabling you to control larger positions with less capital. Although due to its high volatility, Bitcoin is usually available with limited leverage, such as 1:2 in tightly regulated jurisdictions.

While leverage can amplify gains, it also increases risks, so it’s important to choose a broker with leverage options that match your risk tolerance.

Customer Support

Reliable customer support – available 24/7 or during key trading hours – can be a lifesaver when you need assistance.

Given the always-on nature of the crypto market, choosing a provider with weekend customer support may be particularly important.

Geographic Considerations

Ensure the broker operates legally in your country and complies with local cryptocurrency regulations.

Some brokers may offer specific perks or restrictions based on your location. For instance, the UK does not permit the trading of crypto derivatives.

Tips for Choosing the Right Broker for Your Bitcoin Trading Needs

Here are some actionable tips to help you make the best choice:

- Define Your Trading Goals: Are you planning to trade Bitcoin actively, or do you want to keep it as a long-term investment? Day traders may need brokers with advanced tools, while long-term investors might prioritize low fees and secure storage.

- Research Broker Reputation: Read reviews, forums, and expert opinions to assess a broker’s credibility. Look for platforms with a strong track record of customer satisfaction and prompt issue resolution.

- Test the Platform First: Most brokers we’ve evaluated offer demo accounts – take advantage of these to get a feel for the platform. Ensure the user interface is intuitive and suits your level of expertise.

- Compare Fees Across Platforms: Review the broker’s fee structure, including trading fees, deposit/withdrawal charges, and potential inactivity fees. Choose a platform that aligns with your budget and trading volume.

- Look for Additional Features: If you want to maximize your trading potential, opt for brokers that offer added perks such as market analysis, educational resources, and customizable tools for tracking Bitcoin prices.

- Keep Scalability in Mind: Choose a broker that can grow with you. If you’re a beginner, look for a platform that supports advanced features like leverage or altcoin trading when you’re ready to expand.

IG – Bitcoin news feed

Choosing the right Bitcoin broker means balancing features, costs, and trustworthiness. By keeping these factors in mind, you’ll be well-equipped to trade confidently and securely.

If you combine careful research with these practical tips, you can select a Bitcoin broker that aligns perfectly with your goals, trading style, and level of expertise.

FAQ

What Is Bitcoin?

Bitcoin is a decentralized digital currency created in 2009 by an anonymous entity known as Satoshi Nakamoto.

Unlike traditional currencies governments issue, Bitcoin operates on a peer-to-peer network and uses blockchain technology to ensure secure and transparent transactions.

What Makes Bitcoin Unique?

It’s deflationary, meaning only 21 million Bitcoins will ever be created. This scarcity, combined with its independence from central authorities, has made Bitcoin a popular choice for investors looking for an alternative asset to hedge against traditional markets.

Whether you’re interested in trading Bitcoin for short-term gains or holding it for long-term investment, understanding the basics and choosing the right broker is key to a successful Bitcoin experience.

Do I Need A Bitcoin Broker Or A Bitcoin Exchange?

A Bitcoin Exchange is like a marketplace where you can exchange your money for Bitcoin. You own the Bitcoin and need a digital wallet to store it.

A Bitcoin Broker serves as a middle person between buyers and sellers. They often offer trading on products like CFDs (Contracts for Difference). This means you can profit from Bitcoin’s price changes without owning it. Brokers also allow using borrowed money (leverage) to potentially increase your earnings.

How Do Bitcoin Brokers Make Money?

Brokers earn through transaction fees, spreads (the difference between buying and selling prices), or a combination of both.