Best Brokers For Research 2026

Dig into our top brokers for research – acting like your own trading assistant, offering advanced tools like chart analysis, market insights, timely news, and even social sentiment data – empowering you to spot potential trading opportunities.

-

1Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.3 Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 OANDA is a well-known broker that excels in quick trade executions, a low deposit requirement, and impressive charting and trading platform functions. The highly-regarded brand has over 25 years of expertise and is overseen by reliable authorities like the NFA/CFTC. It provides 24/7 support for traders and offers flexible contract sizes with automated trade executions. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Firstrade is a US-based discount broker-dealer authorized by the SEC and a member of FINRA/SIPC. It offers welcome bonuses, advanced tools and apps, and commission-free trading. Firstrade Securities is a popular top online brokerage, and opening a new account is fast and simple. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 NinjaTrader is a US-based brokerage regulated for trading futures. It offers three different pricing plans for varied needs and budgets, along with extremely low margins on popular contracts. The company's renowned charting software and trading platform provides extensive customization options and excellent technical analysis features.

Compare Brokers

Safety Comparison

Compare how safe the Best Brokers For Research 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Brokers For Research 2026.

Comparison for Beginners

Compare how suitable the Best Brokers For Research 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Brokers For Research 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Brokers For Research 2026.

Detailed Rating Comparison

Compare how we rated the Best Brokers For Research 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Brokers For Research 2026.

Broker Popularity

See how popular the Best Brokers For Research [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Interactive Brokers |

|

| NinjaTrader |

|

| FOREX.com |

|

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

Cons

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

- FOREX.com has expanded their trading offerings, but these remain limited to forex and CFDs. Unfortunately, they don't provide options to invest in actual stocks, ETFs, or cryptocurrencies.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- IBKR, primarily designed for skilled traders, has expanded its appeal recently by eliminating its initial $10,000 deposit requirement.

- Interactive Brokers was named Best US Broker for 2025 by DayTrading.com for its dedication to US traders, ultra-low margin rates, and affordable global market access.

- IBKR provides a cost-effective platform for traders by offering low fees, narrow spreads, and clear pricing.

Cons

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

Why Trade With OANDA US?

OANDA is a reputable broker for US traders. It offers user-friendly tools for analysis and a simple sign-up process. It is very trustworthy due to heavy regulation.

Pros

- You can start trading as a beginner with no minimum initial deposit required.

- Experienced traders can use top-notch tools like an MT4 premium upgrade and advanced charting from MotiveWave.

- Traders can experience quick and dependable order execution.

Cons

- Customer support is not accessible during weekends.

- Few payment options are available and e-wallets are not supported.

- The trading markets are limited to only forex and cryptocurrencies.

Why Trade With Firstrade?

Firstrade is ideal for beginners wanting to trade US stocks without commission fees. It offers plenty of free educational resources and high-quality research, including its new FirstradeGPT tool. Users also get trading ideas from Morningstar, Briefing.com, Zacks, and Benzinga.

Pros

- Great broker for cost-conscious traders with low OTC fees

- Trusted US-regulated broker, member of SIPC

- Improved stock trading features now include overnight trading and fractional shares.

Cons

- Over 90% of the evaluated options lack a demo or paper trading account.

- Visa card deposits and withdrawals are not accepted.

- Customer support needs improvement after testing, with no 24/7 help available.

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- Low costs, with $50 trading margins and commissions starting at $.09 per micro contract.

- You can access thousands of applications and add-ons from developers worldwide for trading.

- NinjaTrader is a well-regarded and acclaimed futures broker, approved by the NFA and CFTC.

Cons

- You need to register with partner brokers to trade in securities other than forex and futures.

- The advanced trading tools require an additional fee.

- Some payment methods require a withdrawal fee.

Filters

How We Chose The Best Brokers For Research

We ran a hands-on research tools test for every broker in our growing directory — no assumptions, real platform use.

Each broker was rated 1 to 5 based on:

- Research Depth: From fundamental analysis and market reports to technical tools and screeners.

- Insight Quality: Are the insights actionable or just noise? We tested them in various scenarios.

- Tool Usability: We looked at how intuitive, flexible, and genuinely helpful the research features were.

Only brokers that delivered across the board earned top marks.

What To Look For In A Top Broker With Market Research Tools

The online trading market is extremely competitive, and brokers don’t only fight it out in areas like pricing and asset range to win customers. They’re also investing huge sums of money to produce research and team with third parties to help their clients make the best returns possible.

However, brokers that provide detailed and valuable research tools may be more expensive to employ, for instance through higher transaction costs or management fees.

So it’s important to consider the boost that its research offering is giving your trading strategy (and potential returns), and whether the extra cost makes this worthwhile.

Here are the most important things to consider when choosing a broker:

Depth Of Market Insights

Our tests show that the range of research resources differs greatly among brokers, as does the quality of information on offer. While some service providers offer basic news and trading aids, others can offer institutional-grade analysis, advanced charting tools and the like.

Certain brokers also provide backtesting systems, where individuals can put their trading strategies through their paces using historical data. Examples include Interactive Brokers’ incorporation of the ORATS Backtester, which “includes more than 180 million back tests for more than 100 symbols.”

Pro tip: Given the breadth of information out there, it can be useful to use a broker that provides customization tools and alerts. As well as helping traders avoid being swamped with irrelevant research, these devices can help them stay on top of important information in a timely manner.

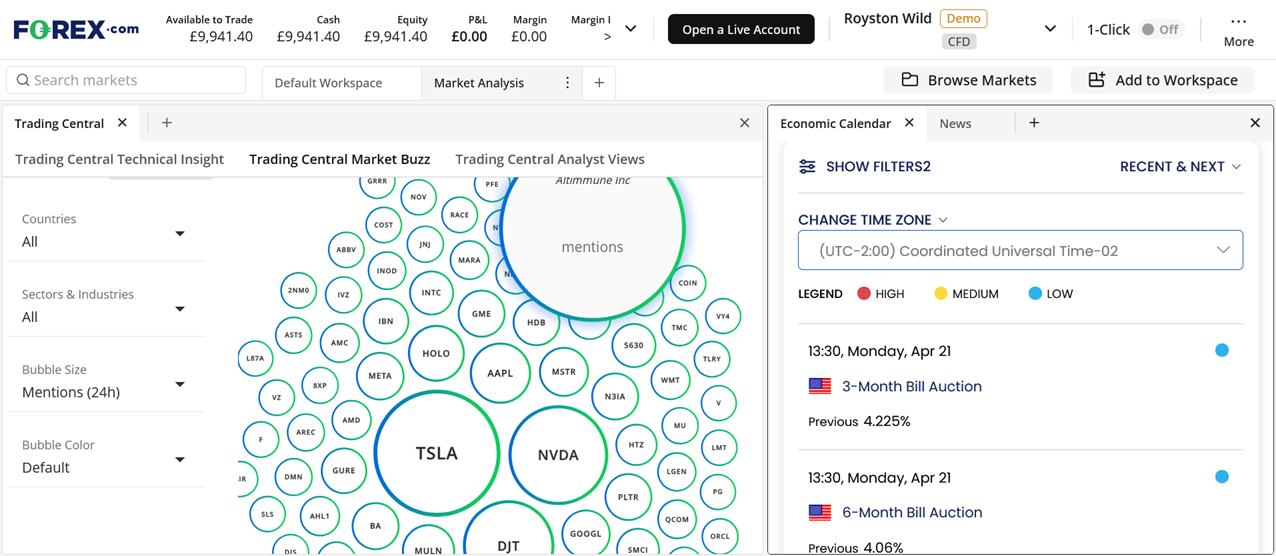

Top broker for depth of market insights: FOREX.com’s trading platform stood out during testing, featuring a Reuters news feed, market analysis, an economic calendar, and its intuitive ‘Market 360’ tool that provides a wealth of information on specific markets.

FOREX.com’s research features are easily accessible straight from the platform

Use Of Third Parties

Brokers often partner with other market research companies to both inform traders and provide an enhanced trading experience.

Many top companies have their own in-house analyst teams, while others employ the services of a bank or financial services company that provides exclusive insights. For instance, AJ Bell allows clients to utilize data and research provided by Morningstar.

Some brokers also integrate their trading platforms with third-party tools, a common example of which is a news feed function populated by the likes of Bloomberg or Reuters.

That said, Trading Central and Autochartist are the most widely available third party tools available at online brokers in our experience.

Top broker for use of third parties: IG blew us away during testing with its powerful research tools — from advanced market screeners and real-time client sentiment to deep technical analysis, live shows, and social trading insights. With DailyFX, alongside insights from partners including Reuters and TipRanks, IG delivers a research experience packed with expert analysis, actionable data, and on-demand content you’ll struggle to find anywhere else.

Artificial Intelligence (AI)

The use of artificial intelligence (AI) in online trading is one of the biggest industry shifts for years. Whether it’s for analyzing market movements, establishing risk management strategies or executing trades, machine assistance can give traders a huge edge.

AI is also being leveraged to provide traders with detailed research; generate customized recommendations based on one’s trading goals and risk tolerance; deliver real-time, data-driven research; provide advanced data analytics; and detect market sentiment via news and social media.

Brokers are investing huge sums to capitalize on the potential of this new technology, as illustrated by Robinhood’s decision to acquire AI investment research platform Pluto in 2024.

Pro tip: Whilst potentially providing a valuable edge, AI research tools can also be prone to outages and errors. Furthermore, in some areas they may not be as effective in interpreting macroeconomic events, for instance, or market psychology as an actual human trader.

Traders should therefore ensure that they don’t become dependent on AI to drive their decisions. The timeless advice that traders “do their own research” is more relevant today than ever!

Top broker for AI-powered market research: Interactive Brokers‘ TrendSpider platform automates the technical analysis process, helping traders to quickly identify trends and chart patterns. This is a powerful weapon in the market research arsenal for active traders who rely heavily on technical summaries to influence their investing decisions.

Regulatory Status

A key thing on anyone’s checklist should be to ensure the company they choose is authorized to trade. This should be with a widely respected regulator (or regulators) that operate inside regions with well-developed financial markets.

Technological advancements, the growth of social media, and the rise of influencers have all contributed to the rise in fraud. In one year, the UK’s Financial Conduct Authority (FCA) removed 10,008 financial promotion ads, representing a 17% year-on-year increase.

Brokers offering eye-popping returns and pursuing aggressive sales tactics are just a couple of red flags to be aware of.

Top broker for regulatory status: IG has been given the green light from around a dozen global regulators, including the UK’s Financial Conduct Authority (FCA), the Monetary Authority of Singapore (MAS) and the US Commodity Futures Trading Commission (CFTC). The result? A broker with terrific financial market research that you can use with confidence.

Article Sources

Financial watchdog stops thousands of misleading ads and promotions – Financial Times

Robinhood Acquires Pluto, AI Investment Research Platform – Robinhood